Andreessen Horowitz (a16z) Urges SEC to Modernize Cryptocurrency Asset Custody Regulations

This cryptocurrency venture capital firm supports a principle-based framework that allows registered investment advisors (RIAs) to self-custody digital assets under defined conditions.

A16Z Requests SEC to Grant RIAs Authority

The cryptocurrency venture capital firm wrote a detailed article responding to the SEC's information request on investment advisor custody. This provides a balanced approach to managing blockchain-based assets while protecting investors.

"We submitted our response to the SEC's information request on IA custody. We are pleased to see the SEC taking steps to provide guidance on cryptocurrency. Advisory clients deserve to have their assets safely protected, and we welcome the commission's specific advice." – Scott Walker, Chief Compliance Officer of a16z, announced the company's submission on X (Twitter).

He noted that cryptocurrency custody presents unique risks, and clear guidelines are needed to help RIAs responsibly address these challenges.

From a16z's perspective, existing custody rules designed for traditional securities are insufficient when applied to cryptocurrency. RIAs often find that third-party custodians do not support or cannot access the full functionality of digital assets.

This forces advisors to balance legal uncertainty and fiduciary duties. This is especially true when preserving economic and governance rights inherent in many tokens. These rights include protocol voting, Staking, and yield farming.

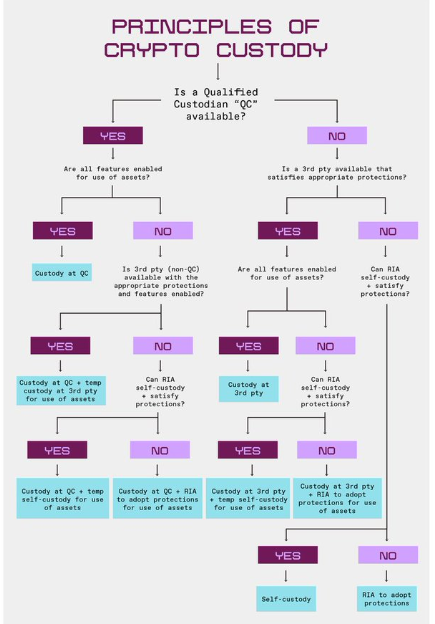

The company proposed a framework solution with five principles that reflect the unique characteristics of cryptocurrency.

Principles Empowering RIAs... A16Z Shares

The core of this approach is the idea that custody rules should focus on the protection provided rather than the provider.

- Qualification Based on Protection, Not Legal Status

a16z argues that legal status, such as federally chartered banks, should not determine cryptocurrency asset custody qualifications. Instead, the SEC should recognize all custodians, including state-chartered trust companies and unregistered institutions that can meet strict protection requirements.

These requirements include annual technical and financial audits, proper asset segregation, encrypted key management, disaster recovery plans, and robust disclosure practices.

The company emphasizes that cryptocurrency custodians must be able to prevent unauthorized transfers. Additionally, they must avoid jurisdictions where assets could be swept into bankruptcy and maintain verifiable ownership records.

- Practical Protection for Custodians

Another key principle is that RIAs should not be forced to choose between asset security and client value. Currently, custodians often restrict access to Staking or governance functions due to technical constraints or compliance issues.

- Exercisable Cryptocurrency Rights

a16z argues that RIAs should have the authority to exercise these rights on behalf of clients. If a custodian cannot support this, temporarily self-custodying assets to unlock these functions should not be considered a regulatory violation.

- Optimal Execution Flexibility

The company demands greater flexibility for RIAs in pursuing optimal execution. Transferring cryptocurrency to exchanges for the best price should not be considered a withdrawal from custody. However, this is only if the advisor takes appropriate measures to verify the platform's security and integrity.

- Self-Custody as a Last Resort

a16z maintains that third-party custody should remain the default. However, the cryptocurrency venture capital firm believes RIAs should self-custody when no viable alternatives exist or are necessary to fulfill fiduciary responsibilities.

Such arrangements must follow the same audit and disclosure standards as third-party custodians.

"Registered investment advisors investing in cryptocurrency assets have suffered from a lack of regulatory clarity and limited executable custody options. What the industry needs is a principle-based approach to addressing this critical issue for professional investors." – The company wrote in a post.

As the SEC contemplates cryptocurrency's place in the regulatory landscape, a16z's comprehensive proposal could provide a roadmap for reform that protects investors while maximizing the potential of tokenized finance.

Meanwhile, this report comes months after the U.S. SEC issued Staff Accounting Bulletin (SAB) No. 122, which effectively canceled the previous SAB 121 guidance that made banks hesitant to hold Bitcoin.

This action allowed banks and traditional finance (TradFi) institutions to offer cryptocurrency services without significant regulatory barriers.

Similarly, a groundbreaking decision a month ago simplified digital asset integration by allowing banks to provide cryptocurrency custody and stablecoin services without prior approval.

However, even as banks and RIAs seek more cryptocurrency flexibility, robust risk management controls remain essential and must align with the Office of the Comptroller of the Currency (OCC) regulatory guidance.

"The OCC expects banks to have the same robust risk management controls to support new banking activities as they do for traditional activities." – Rodney E. Hood, Acting Comptroller of the Currency