1/ New dashboard on Morpho, one of DeFi's hottest lending protocols.

Built by @JackMandin, the dashboard takes a deep dive into Morpho's Lending Markets, Vaults, Financials, and their MORPHO token.

Here is a quick overview:

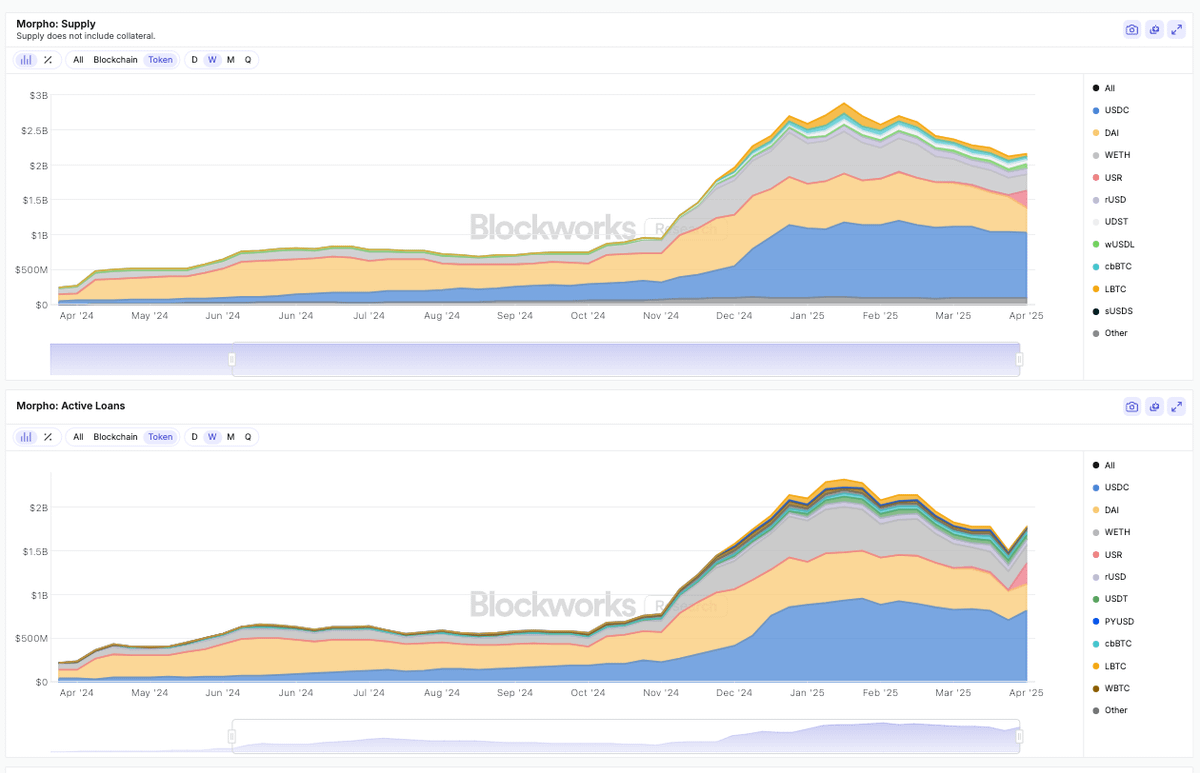

2/ Morpho markets saw sizeable growth in both supply and outstanding loans starting in November 2024, largely driven by USDC and WETH.

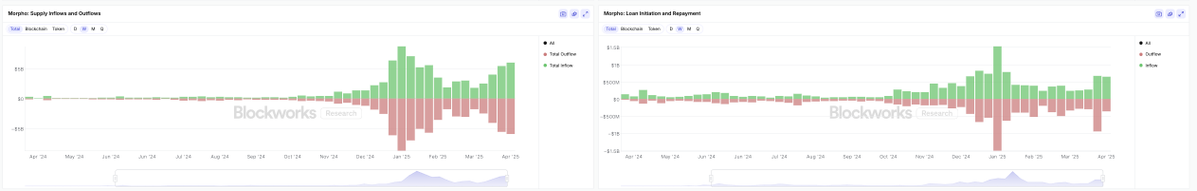

3/ Weekly value flowing in and out of Morpho Lending Markets peaked in January 2025, each measure reaching over $8 billion in the highest week.

For reference, total supply over this period was under $3 billion, suggesting significant rebalancing between markets over this period.

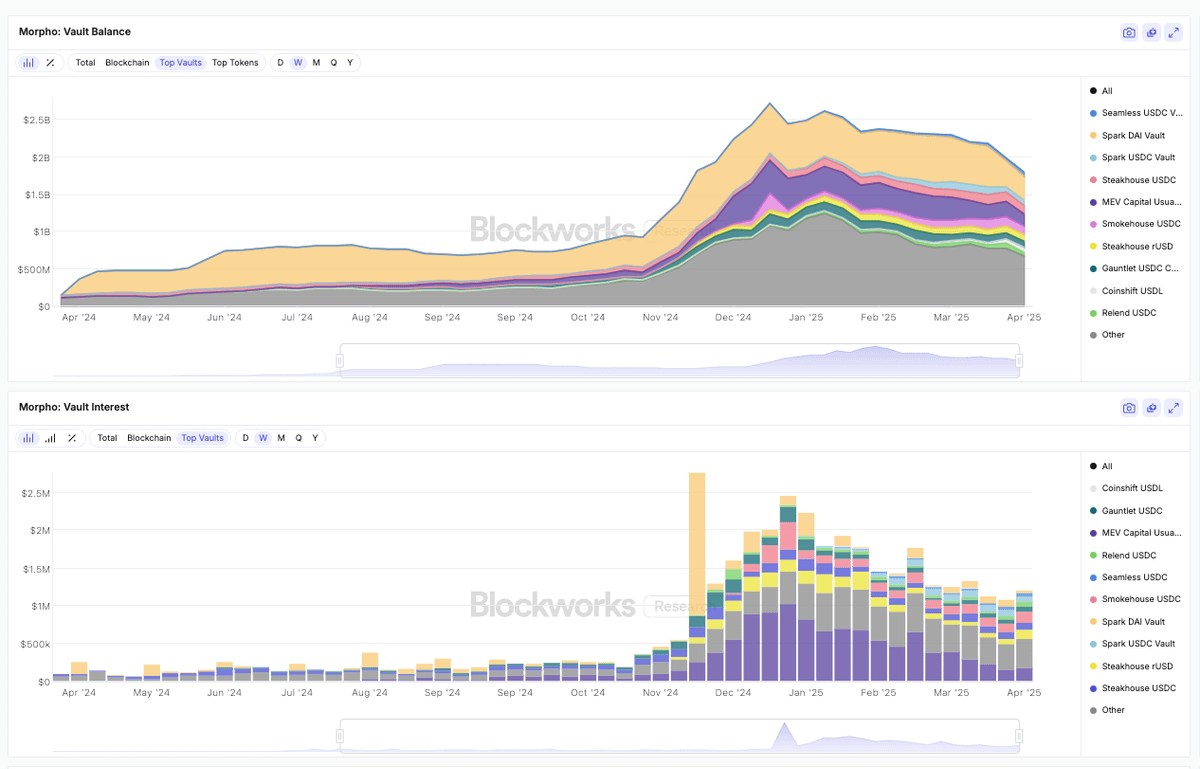

4/ Over 80% of the liquidity supplied to markets is managed through curated Morpho Vaults.

Top curators include @MEVCapital, @SteakhouseFi, and @gauntlet_xyz.

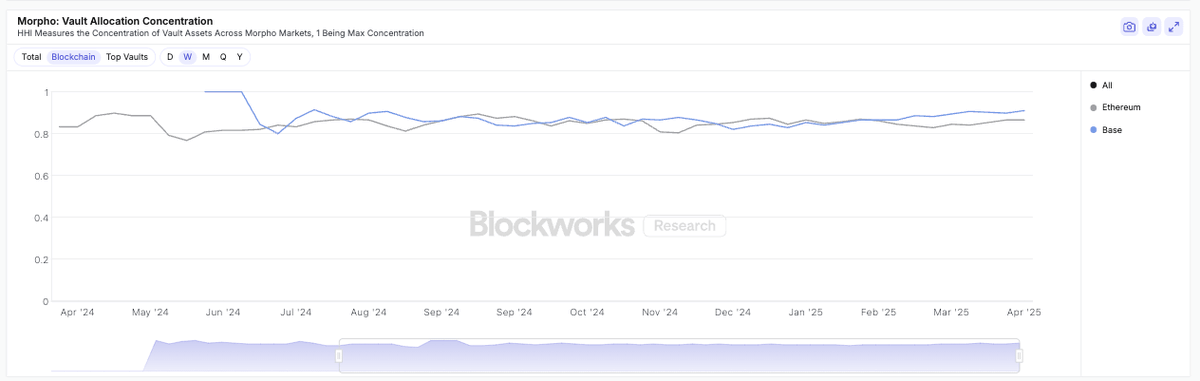

5/ Not all vaults are created equal.

The data shows meaningful variation in the concentration of funds allocated across lending markets, frequency of rebalancing transactions, performance fees, and most importantly, yield!

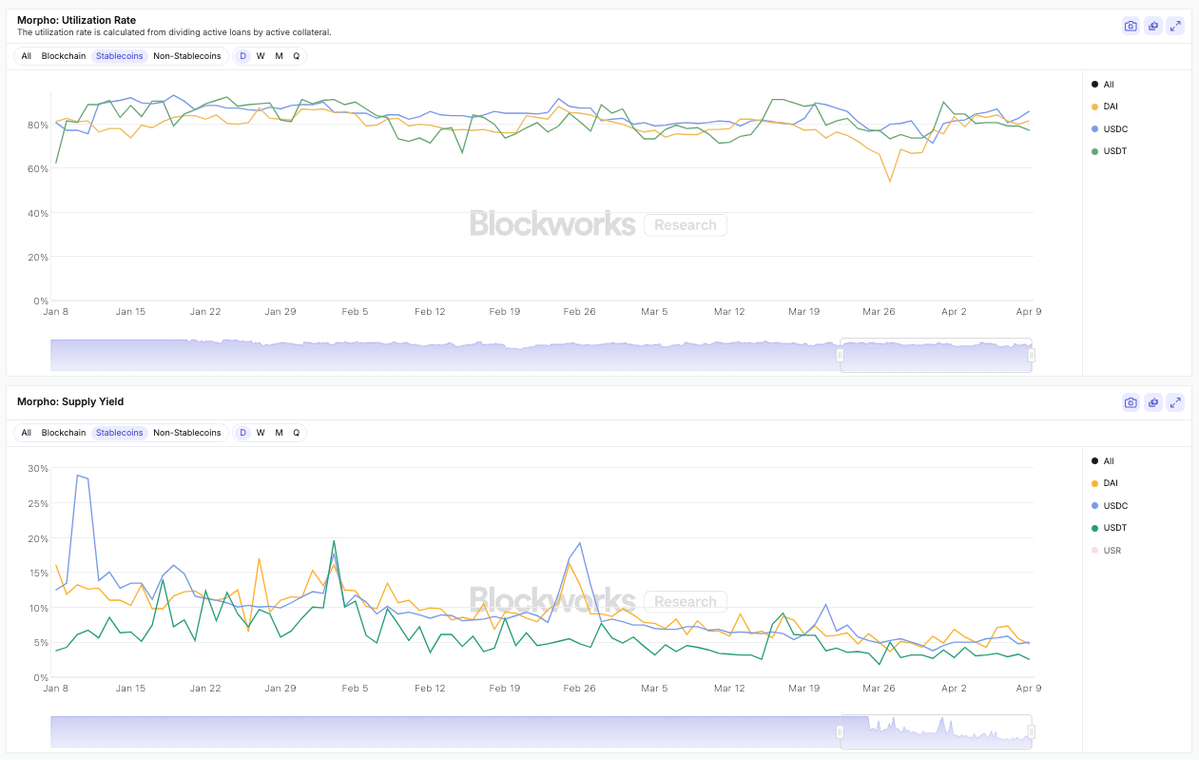

6/ Morpho markets show a clear demand for USD-pegged stablecoins, with current annualized yields between 2.5% and 5% and utilization rates at 80%.

7/ All of these valuable insights and more are available to @blockworksres subscribers. For everyone else, a sneak peek is available on our public analytics tab

blockworks.co/analytics/morpho

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content