On Good Friday, over $2.2 billion in Bitcoin and Ethereum option contracts will expire today.

This occurs as the cryptocurrency market continues to be affected by macroeconomic uncertainty. President Donald Trump is pressuring the Federal Reserve (Fed) to cut rates, but Chairman Jerome Powell is not yielding.

Over $2.2 Billion in Call Options Expiring Today

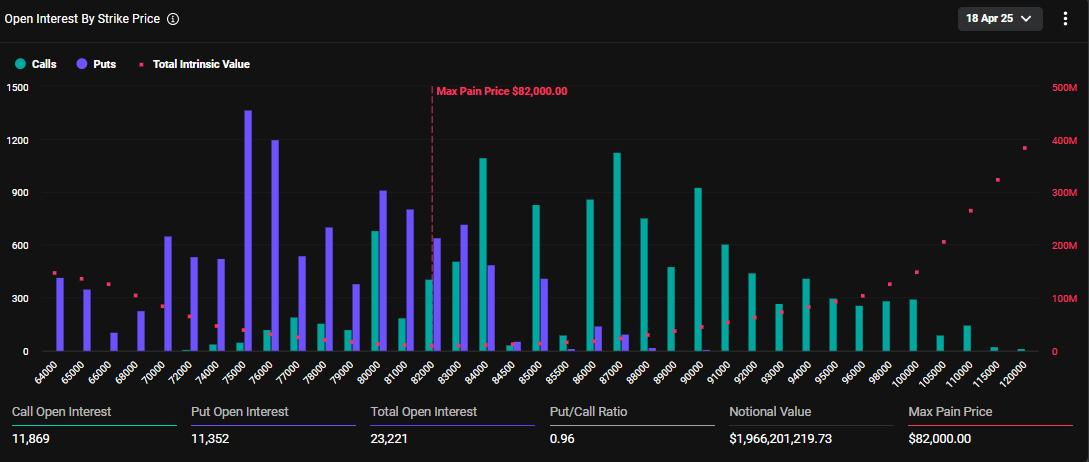

Today, on 04/18, during Good Friday celebrations, 23,221 Bitcoin (BTC) option contracts will expire. The nominal value of the Bitcoin option contracts expiring this Friday is $1.966 billion, according to data from Deribit.

The put/call ratio is 0.96, indicating the prevalence of call options compared to put options.

When Bitcoin options expire, they have a maximum pain price or strike price of $82,000; at this point, the asset will cause the greatest financial loss to investors.

Bitcoin Options Expiring. Source: Deribit

Bitcoin Options Expiring. Source: DeribitSimilarly, the cryptocurrency market will witness the expiration of 177,130 Ethereum contracts, with a nominal value of $279.789 million. The put-to-call ratio for these expiring Ethereum options is 0.84, with a maximum pain price of $1,600.

This week's option expiration event is slightly smaller than what the cryptocurrency market experienced last Friday. As BeInCrypto reported, approximately $2.5 billion in BTC and ETH option values expired then, with short-term declines increasing put demand.

Expiring Ethereum Options. Source: Deribit

Expiring Ethereum Options. Source: DeribitTraders and investors need to closely monitor today's developments as option expiration can lead to price volatility. However, the put-to-call ratio below 1 for Bitcoin and Ethereum in option trading indicates market optimism. This suggests many traders are betting on price increases.

Meanwhile, analysts at Deribit emphasize low volatility and flat skew. Although this indicates a calm market, historical data from CoinGlass suggests that price volatilities after expiration are common, potentially signaling an upcoming movement.

"With compressed volatility and flat skew, is the market preparing for a post-expiration move?" they asked.

Black Swan Event Likely, According to Greeks.live Analysts

Analysts at Greeks.live clarified the current market sentiment, reflecting a quiet outlook. However, they note that the market is primarily bearish to neutral. Traders predict continued oscillating action before potentially returning to the $80,000 to $82,000 range.

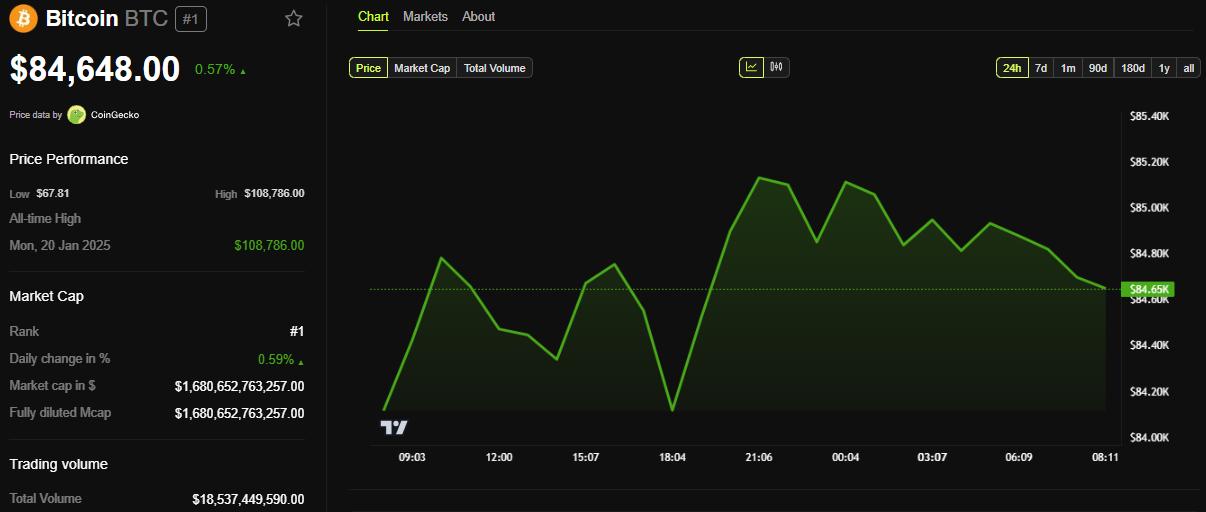

At the time of writing, Bitcoin is trading at $84,648, slightly higher than the strike price of $82,000. Based on Max Pain theory, the price is likely to move towards this strike price as options near expiration.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCryptoCiting a gentle sentiment, Greeks.live analysts attribute the calmness to Trump not generating much news this week. However, they predict further trade wars, increasing uncertainty, and volatility.

"We predict trade and tariff wars are far from over, and market uncertainty will continue for a long time, as will market volatility," Greeks.live wrote.

They also suggest this outlook is due to Powell's comments, creating downward pressure as expectations of a 100 basis point rate cut this year have decreased. This leads to cryptocurrency's correlation with traditional markets.

In this context, Greeks.live indicates a higher probability of a black swan event, where a rare, unexpected event with significant impact and typically market-disrupting consequences occurs.

"...currently is a painful phase where speculators completely shift from bullish to bearish, and investor sentiment is relatively low. In this poor market when speculators shift from bullish to bearish, the likelihood of a black swan event will be significantly higher," they explained.

They encourage traders to buy out-of-the-money (OTM) put options. An option is considered out of the money when its strike price is less favorable compared to the current market price of the underlying asset. This means it has no intrinsic value, only time value (the potential to become valuable before expiration).