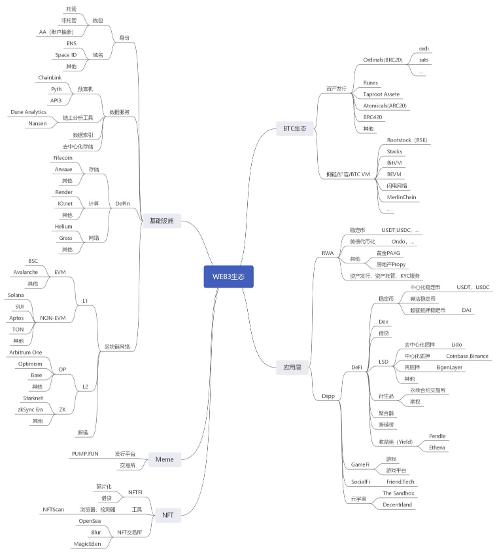

1. Introduction to BTC Ecosystem

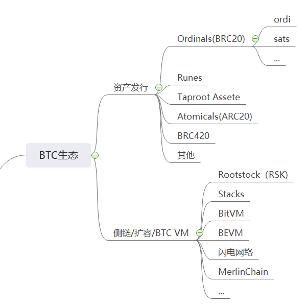

The Bitcoin ecosystem is centered around asset issuance protocols and expansion plans, forming a diversified competitive landscape. In the field of asset issuance, BRC20 dominates with its first-mover advantage, but faces dust attacks and high gas fees; Runes solves technical bottlenecks through UTXO model innovation and quickly rises to become the underlying infrastructure of DeFi; Taproot Assets is deeply integrated with the Lightning Network, opening up a new scenario for off-chain asset issuance; BRC420 promotes innovation in the metaverse and chain games with its modular recursive features.

The expansion plan shows a trend of "technical route differentiation" and "ecological synergy" in parallel: the Lightning Network is firmly in the leading position in payment, and is expected to break through functional boundaries after integrating asset protocols; Merlin Chain achieves explosive growth in TVL with community-driven and dual-mining mechanisms; BEVM and BitVM lead technological breakthroughs with fully decentralized cross-chain and trustless interaction respectively.

The competition landscape revolves around two major technical camps: UTXO native faction (such as Runes, Lightning Network) emphasizes security and native compatibility with Bitcoin, but faces the challenge of insufficient development tools; EVM compatible faction (such as BEVM, Stacks) borrows the potential of Ethereum ecosystem, but is constrained by cross-chain centralization disputes. In the future, modular protocols, cross-chain interoperability and regulatory variables will dominate the evolution of the ecosystem - BRC420 may usher in the era of Bitcoin application chains, BitVM is expected to promote multi-chain DeFi integration, and SEC regulatory rulings and the entry of Layer2 exchanges may reshape the industry landscape. In terms of risks, technical maturity, liquidity fragmentation and geopolitics are still key constraints on ecological development.

(I) Asset Issuance Agreement

1. Ordinals ( BRC20 )

• Technical features : By numbering the smallest unit of Bitcoin, “Satoshi”, and attaching arbitrary content (inscription), the issuance of native digital assets is achieved, which has the characteristics of pure on-chain storage and non-tamperability.

• Representative projects :

▪ ordi : The first BRC20 token, with more experimental symbolic significance than functionality, and its market capitalization accounts for more than 50% of the total BRC20 market capitalization.

▪ sats : Tokens denominated in “satoshi” that promote small payment scenarios of Bitcoin.

• Limitations : Dependence on off-chain indexers, UTXO dust problem causes network congestion.

2. Runes

• Innovative value : Proposed by Casey, the founder of Ordinals, it combines the OP_RETURN opcode and the UTXO model to solve the dust problem of BRC20 and support asset splitting and unified on-chain management.

• Technological breakthroughs :

▪ Asset transfer is automatically completed through UTXO splitting, avoiding the risk of ARC20 “burning”;

▪ Compatible with the Ordinals protocol to achieve a unified FT/NFT issuance framework.

• Market impact : Market impact: The mainnet will be launched after the halving in 2024, absorbing the liquidity of protocols such as BRC20, but not completely replacing other standards. For example, RunesLend, a lending platform based on Runes, allows users to use Runes assets as collateral for lending, automatically matches borrowers and lenders through smart contracts, sets interest and repayment periods, and effectively utilizes Runes' asset splitting and on-chain management functions, promoting the development of Bitcoin DeFi.

3. Taproot Assets

• Positioning : The asset issuance layer of the Lightning Network, which supports the issuance of stablecoins and other assets within the Lightning Network channel to improve the efficiency of off-chain transactions.

• Progress : The mainnet has been opened and is gradually deepening its integration with the Lightning Network to jointly build a closed loop of 'payment + asset circulation'.

4. Atomicals ( ARC20 )

• Technical features : Based on the UTXO colored coin model, decentralized minting is achieved through POW mining, and it is highly recognized by the technical community.

• Problem : Relying on Segregated Witness to store data, the token splitting function has defects, and some assets are permanently lost due to operational errors.

5. BRC420

• Innovation direction : Modular recursive combination of inscriptions, support for metaverse asset formats and on-chain royalty agreements, and expansion of the functional boundaries of Ordinals.

• Case : The RCMS protocol implements multi-inscription nesting and promotes complex on-chain applications (such as game props synthesis).

2. Expansion Scheme and Computing Layer

1. Sidechain & Expansion Technology

• Rootstock ( RSK )

▪ The old EVM-compatible sidechain shares Bitcoin computing power through merged mining, but the centralized bridging mechanism (sBTC) is controversial.

▪ The current TVL is approximately US$300 million, focusing on DeFi scenarios.

• Stacks

▪ The introduction of sBTC enables cross-chain Bitcoin assets. After the Nakamoto upgrade, it supports the final settlement of Bitcoin, and the ecosystem covers DEX and lending protocols.

▪ The market value will increase by more than 300% in 2024, becoming the representative of the smart contract layer.

• BitVM

▪ A Rollup-like solution based on fraud proof, which realizes off-chain computing through logic gate verification. The technology is still in the early verification stage.

▪ Potential scenarios: cross-chain bridge and state channel optimization.

▪ Future development trends: If BitVM's fraud proof technology is successfully verified, it will promote trustless cross-chain interaction between Bitcoin and other blockchains (such as Ethereum and Solana). This will usher in a new era of multi-chain DeFi ecological integration. For example, Bitcoin native assets can directly participate in liquidity mining on Ethereum or conduct high-speed transactions on Solana, thereby improving asset utilization and market liquidity.

• BEVM

▪ Fully decentralized Layer2, using Taproot multi-signature and MAST scripts to achieve BTC cross-chain, compatible with the EVM ecosystem.

▪ Technical highlights: Greatly reduce third-party custody risks, and on-chain applications initially cover DEX, stablecoins and other fields.

• Lightning Network

▪ The orthodox Layer2 solution will support asset issuance after integrating Taproot Assets in 2024, with the number of nodes exceeding 50,000 and daily transaction volume reaching tens of millions of US dollars.

▪ Bottleneck: Insufficient complex asset management capabilities and reliance on channel liquidity.

• Merlin Chain

▪ Community-driven Layer2, relying on native assets such as BRC420 and Bitmap to accumulate users, ranks first with a TVL of over US$2 billion.

▪ Innovative model: The dual mining mechanism attracts miners, and joint activities of exchanges boost the popularity.

(III) Competition landscape and trends

1. Market structure: " multi-dimensional game " between protocol standards and extension solutions

( 1 ) Asset Issuance Agreement: Technology iteration is accelerating, BRC20 and Runes compete for supremacy

• BRC20 : Still dominant due to first-mover advantage, but facing technical bottlenecks:

▪ The market share is about 55%, and the leading tokens represented by ordi and sats contribute more than 70% of liquidity;

▪ The problems of dust attacks and high gas fees have not been fundamentally solved, and some developers have turned to the Runes ecosystem.

• Runes : Rapid rise driven by technological innovation:

▪ Within 3 months after the mainnet launch, the market value of the protocol increased to 30%, and the number of ecological projects increased by 300%;

▪ The asset splitting function based on the UTXO model has become the preferred underlying protocol for Bitcoin DeFi (such as lending, DEX).

• Other protocols differentiate and develop :

▪ Taproot Assets is deeply integrated with the Lightning Network and supports stablecoin issuance testing;

▪ BRC420 has become the core of blockchain games and metaverse infrastructure due to its modular characteristics, with TVL exceeding US$800 million.

( 2 ) Expansion plan: Ecosystem synergy and technological originality are the key to success

• Lightning Network : The absolute king in payment scenarios, but faces functional limitations:

▪ The number of nodes exceeded 60,000, and the daily transaction volume reached 120 million US dollars;

▪ After the integration of Taproot Assets in 2025, a new cycle of “payment + asset circulation” may be launched.

• Merlin Chain : An outbreak sample of community-driven Layer2:

▪ TVL exceeds 2.5 billion US dollars, attracting miners through the dual mining mechanism, and the cross-chain pledge of BRC420 assets accounts for 40%;

▪ Jointly launched the “Inscription Mining + Transaction Rebate” campaign with the exchange, with over 2 million new addresses added in a single week.

• BEVM and BitVM : Technical originality leads developer migration:

▪ BEVM’s fully decentralized cross-chain solution has attracted over 500 DApp deployments;

▪ BitVM is verifying the network test. If successful, trustless cross-chain will be achieved.

2. Technical route: " Paradigm conflict " between UTXO native faction and EVM compatible faction

( 1 ) UTXO native party ( Runes , Lightning Network)

• Advantages :

▪ Deeply bound to the underlying Bitcoin, with the highest level of security in the industry;

▪ Asset issuance does not require reliance on external protocols, which is in line with Bitcoin’s minimalist philosophy.

• challenge :

▪ Lack of development tools and limited smart contract functionality;

▪ The ecosystem is severely fragmented and the cost of cross-protocol interaction is high.

( 2 ) EVM -compatible faction ( BEVM , Stacks )

• Advantages :

▪ Reusing the mature Ethereum ecosystem, leading DeFi protocols such as Uniswap and Aave have completed adaptation;

▪ Low learning cost for developers and supports rapid deployment of complex DApps.

• challenge :

▪ Cross-chain bridge centralization controversy;

▪ Dependence on Bitcoin mainnet settlement, transaction confirmation delays affect user experience.

3. Future trends: Ecological integration and regulatory variables reshape the landscape

( 1 ) Modular protocols usher in the era of “ Bitcoin application chains ”

• BRC420 recursive inscriptions support multi-chain nesting, and 3 blockchain games have realized the cross-chain synthesis function of props;

• Taproot Assets may be combined with the Lightning Network to create the first Bitcoin off-chain stablecoin.

( 2 ) Cross-chain technology breakthroughs promote " Bitcoin DeFi 2.0"

• After successful BitVM verification, Bitcoin L1 can directly call Solana and Ethereum smart contracts;

• The TVL of Bitcoin staking derivatives (LST) exceeded US$5 billion, and the annualized yield of the leading protocol reached 18%.

( 3 ) Regulatory and market variables are the biggest uncertainties

• The U.S. SEC may make a ruling on the securities attributes of BRC20 tokens in the first half of 2025;

• After the Bitcoin halving, miners’ income has declined, and the top mining pools are accelerating the layout of Layer2 node hosting business;

• Binance, OKX and others plan to launch their own Bitcoin Layer2, which may disrupt the existing ecological balance.

4. Risk Warning

• Technical risks: Frontier solutions are still in their early stages and there is a possibility of code vulnerabilities leading to asset losses;

• Liquidity risk: The differentiation of protocol standards leads to the dispersion of funds, making it difficult for long-tail projects to survive;

• Geopolitical risk: If crypto regulation is strengthened after the US election, the process of Bitcoin ecosystem compliance may be hindered.

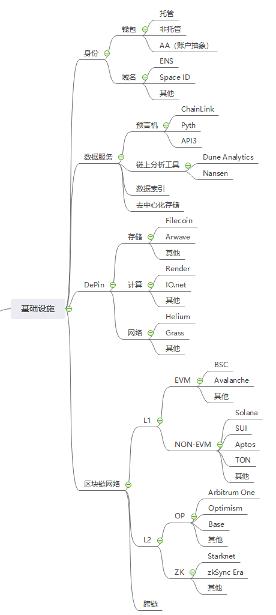

2. Panoramic Analysis of Infrastructure

The current blockchain infrastructure presents three main lines: "security upgrade, performance iteration, and ecological differentiation". In the field of identity management, custodial wallets are driven by compliance to turn to institutional-level multi-signature solutions, and non-custodial wallets reconstruct user experience through MPC technology and account abstraction (AA). ENS and Space ID are competing for the entrance to the identity ecosystem with multi-chain domain names + credit systems. Data services are developing in depth towards vertical scenarios: ChainLink and Pyth form a "general data-high-frequency finance" duopoly in the oracle track, Filecoin and Arweave build a storage layered ecosystem, and FVM smart contracts activate storage financialization scenarios.

The competition of blockchain network performance has entered a new stage: Layer1 presents a triangular game of "Solana performance breakthrough, TON traffic crushing, and EVM chain compatibility counterattack", while Layer2 faces the confrontation between the maturity of ZK Rollup technology and the first-mover advantage of the OP ecosystem. The cross-chain bridge solves the contradiction between security and efficiency through zero-knowledge proof and intention matching mechanism. The competition landscape highlights three major trends: wallets are upgraded from asset tools to DApp aggregation entrances, data services build barriers around real-time and vertical integration capabilities, and the infrastructure layer competes for the developer ecosystem through modular design. We need to be vigilant about the compliance pressure of cross-chain protocols, the hidden dangers of ZK technology centralization, and the risk of ecological resource dissipation caused by the homogenization of EVM chains.

1. Identity management

1. Wallet

• Custodial wallet

▪Current situation : Exchange built-in wallets (such as Binance and Coinbase) account for 70% of new user entrances, but the CEX hacking incident in 2024 caused a loss of more than US$1.2 billion.

▪Trend : The rise of compliant custody solutions (such as Fireblocks institutional-grade custody), supporting multi-signature and insurance compensation mechanisms.

• Non-custodial wallet

▪Top projects : MetaMask (45 million monthly active users), Phantom (dominated by the Solana ecosystem, accounting for 65% of daily trading volume).

▪Technological breakthrough : MPC wallet (ZenGo) realizes private key sharding, and the penetration rate of social recovery function reaches 40%.

• Account Abstraction ( AA )

▪Core value : Gas payment, batch transactions, and seamless interaction reconstruct the user experience.

▪Ecological progress :

– The Ethereum mainnet ERC-4337 standard is being gradually promoted, and middleware service providers such as Stackup and Biconomy are actively exploring cross-chain AA solutions.

– Middleware service providers such as Stackup and Biconomy lead cross-chain AA solutions.

2. Domain Name Service

• ENS ( Ethereum Name Service )

▪Market position : The number of registrations has exceeded 8 million, and it is compatible with 12 chains including Solana and BNB Chain;

▪Innovation : Launched the “.eth” subdomain auction function, with the highest transaction price for a single domain name reaching 50 ETH.

• Space ID

▪Differentiation : One-stop multi-chain domain name (.bnb, .arb), integrated DID identity authentication and on-chain credit scoring;

▪Data : In Q4 2024, transaction volume increased by 320% month-on-month, and the BSC ecosystem accounted for more than 60%.

• SNS ( Solana Name Service )

▪Positioning : High-performance chain-exclusive domain name, transaction confirmation speed reaches millisecond level;

▪Bottleneck : The Solana network downtime caused domain name resolution delays and a user churn rate of 15%.

2. Data Services

1. Oracle

• ChainLink

▪Market share : 65%, supporting over 1,500 smart contracts;

▪Technical barriers : The DECO protocol ensures that data is tamper-resistant, and the node stake volume exceeds US$4 billion.

• Python

▪Features : Institutional-level high-frequency data (real-time quotes for US stocks and cryptocurrencies), with a latency of less than 300ms;

▪Partner : Jump Trading’s exclusive data source, DeFi protocol adoption rate increased by 30% month-on-month.

• API3

▪Innovative model : First-party oracle (data source directly operates nodes), reducing middle-layer costs;

▪Use case : Deep integration of derivative protocols such as UMA and Synthetix, reducing data call fees by 50%.

2. On-chain analysis tools

• Dune Analytics

▪Core advantages : user-defined dashboards and SQL queries, indexing over 30 public chains;

▪Data volume : There are more than 150,000 active developers per day, and the number of reports generated exceeds 2 million.

• Nansen

▪ Positioning : Institutional-level monitoring, the whale address label system covers 98% of the top 1,000 ETH holding addresses;

▪New features : MEV transaction tracking and NFT liquidity heat map, with over 100,000 paying users.

3. Data Index

• The Graph

▪Ecological status : 90% of EVM chain DApps rely on its services;

▪Technology upgrade : The Firehose protocol increases data throughput by 10 times and reduces indexing latency to less than 1 second.

4. Decentralized Storage

• Filecoin

Current status : Storage capacity reaches 30 EiB, and utilization rate increases to 8% (mainly due to Solana historical data storage cooperation);

▪Breakthrough : FVM smart contract supports storage rental auctions, with annual revenue growth of 200%.

• Arweave

▪Technical features : permanent storage protocol, single-payment model;

▪Adoption rate : The first choice for cold data storage of NFT projects, with a cumulative storage capacity of over 500TB.

3. Depin (Decentralized Physical Infrastructure Network)

1. Storage

• Filecoin

▪Technical features : Based on the IPFS distributed storage protocol, the storage capacity exceeds 30 EiB and the utilization rate is increased to 12%;

▪Innovation : FVM smart contracts support storage rental auctions, with annual revenue growth of 300%;

▪Challenges : The retrieval market is inefficient, with cold data accounting for over 90%.

• Arweave

▪Technical features : permanent storage protocol, single-payment model;

▪Application scenario : The first choice for cold data storage of NFT projects, with a cumulative storage capacity of over 800TB;

▪Bottleneck : Storage costs are higher than Filecoin, and the adoption rate of small and medium-sized projects is low.

2. Calculation

• Render

▪Technical architecture : Distributed GPU computing network, supporting 3D rendering and AI model training;

▪Market performance : The adoption rate of Hollywood studios exceeds 20%, and computing power rental revenue has increased by 150% year-on-year.

• IO.net

▪Core value : Aggregate idle CPU/GPU resources to provide low-cost AI inference services;

▪Use case : The inference cost of the Stable Diffusion model is reduced by 70%, and the average daily call volume exceeds 100 million times.

3. Network

• Helium

▪Transformation direction : From LoRaWAN to 5G network coverage, with over 500,000 base stations deployed;

▪Challenges : Cooperation with operators is progressing slowly and user acceptance of the paid subscription model is low.

• Grass

▪Technical model : Building a decentralized IP proxy network through user-shared bandwidth;

▪Data : The number of nodes exceeded 2 million, and the average daily data throughput reached 100TB.

4. Blockchain Network

1. Layer 1

• EVM compatible chain

BSC :

– TVL is stable at $8 billion, and gas fee is as low as $0.05;

– Problem : Highly centralized (21 verification nodes), and DeFi protocols are highly homogenized.

Avalanche

– Subnet architecture supports game chain ecology (such as DeFi Kingdoms), with TPS exceeding 8,000;

– Challenge : The staking rate of the native token AVAX is less than 30%, and the ecological incentive effect is limited.

• Non- EVM chain

Solana

– Performance benchmark : average daily transaction volume exceeds 800 million, and the fee cost is 0.05% of Ethereum;

– Breakthrough : Firedancer client is launched, aiming to achieve one million TPS.

▪ SUI :

– Technical features : Object storage model supports high-concurrency interaction of GameFi assets;

– Ecological shortcomings : DeFi protocol TVL is less than $1 billion, and developer tools are scarce

TON :

– Traffic entry : Relying on Telegram’s 900 million users, the number of monthly active wallet addresses exceeded 50 million;

– Killer application : Telegram Bot trading robot accounts for 80% of on-chain interactions.

2. Layer2

• OP Rollup system

Arbitrum One :

– TVL is $15 billion, accounting for 55% of the Rollup market;

– Bottleneck : The delay in fraud proof is still up to 7 days, and the security risks during the dispute period have not been resolved.

Blast :

– Native income model : ETH staking + US Treasury income, TVL exceeded US$5 billion in 6 months after launch;

– Dispute : The team has multiple signatures to control contract permissions, and the decentralization process is lagging behind.

• ZK Rollup System

zkSync Era :

– Technical advantages : LLVM compiler supports Rust development, and ZK-Prover efficiency is increased by 3 times;

– Ecosystem incentives : A $350 million fund supports GameFi and SocialFi projects.

▪ Scroll :

– Compatibility : fully compatible with EVM bytecode, and the migration cost for developers is close to zero;

– Data : 9 months after the mainnet was launched, the number of DApps exceeded 800.

3. Cross-chain bridge

• status quo :

▪Head solutions : LayerZero (full-chain interoperability), Wormhole (messaging protocol);

▪Security dilemma : Cross-chain bridge attacks will cost more than $1 billion in 2024 (Ronin Bridge accounts for 40%).

• Innovation direction :

▪Zero -knowledge proof : zkBridge realizes trustless verification, and the verification speed is increased to within 5 seconds;

▪Intent -centric : Socket Protocol matches the optimal cross-chain path based on user intent.

( V ) Competition landscape and trends

1. Identity management: From tools to ecosystem entry points

• Wallet battlefield : The proportion of AA wallet users will jump from 15% to 45% in 2023, while the share of custodial wallets will continue to decline;

• Domain name service : ENS faces the impact of Space ID’s multi-chain strategy, and .eth’s market share has dropped to 50%.

2. Data services: verticalization and real-time upgrade

• Oracle : Pyth seizes the financial derivatives market, and ChainLink turns to AI data oracles (such as LLM training data verification);

• Storage protocol : Filecoin Virtual Machine (FVM) promotes smart storage contracts and forms a “hot data-cold data” layered ecosystem with Arweave.

3. DePIN : Resource integration and vertical scene breakthrough

· Storage : Filecoin and Arweave form a “hot data-cold data” layered ecosystem;

Computing : AI computing power demand drives Render and IO.net’s annual revenue growth to over 200%;

Network : Helium 5G and Grass proxy network explore the enterprise-level B-end market.

3. Blockchain network: performance, compatibility and user experience game

• Layer1 : Solana and TON squeeze the EVM chain space with performance and traffic entry, and BSC maintains its basic market with low gas fees;

• Layer2 : The maturity of ZK Rollup technology has been improved, and the OP Stack camp faces challenges such as Starknet and Scroll.

4. Risk Warning

• Regulatory risks : The US SEC intends to include cross-chain bridges in the regulation of “securities trading platforms”, which will increase compliance costs;

• Technical risks : ZK Rollup’s Prover centralization problem may lead to a crisis of trust;

• Ecological risks : Homogeneous competition among EVM-compatible chains leads to the dispersion of developer resources, making it difficult for long-tail chains to survive.

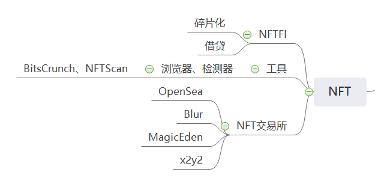

3. Panoramic Analysis of NFT Ecosystem

The NFT ecosystem has formed a diversified system with parallel financial innovation, tool empowerment, transaction competition and regulatory game, and continues to evolve with technology-driven and market iteration.

In the field of NFT finance ( NFTFi ) , fragmentation technology lowers the asset threshold through standards such as ERC-721E. Unicly dominates the pool segmentation market with a TVL of over US$500 million, while Floor Protocol focuses on blue-chip NFT fragmentation and expands the pledge income scenario. However, the structural contradiction of liquidity concentration in the top projects and the SEC's securitization review pose a double challenge. In the lending track, BendDAO has remained the leader in ETH mortgage with a low bad debt rate. NFTfi has achieved a quarterly growth of 200% through the P2P model, but the lack of liquidity of long-tail assets and the deviation of oracle valuation still limit the development ceiling.

The tool service layer focuses on data transparency. BitsCrunch relies on AI detection technology to process more than 100 million API calls per day, effectively suppressing wash trading. NFTScan reduces the exposure rate of counterfeit projects by 50% through multi-chain data aggregation and copyright tracing, becoming the infrastructure pillar of platforms such as OpenSea and Blur.

The trading market landscape is highly dynamic: OpenSea maintains an average monthly trading volume of US$800 million with its professional version aggregator and mandatory royalty collection, but its market share has been eroded by Blur; Blur has risen rapidly with zero fees and token incentives, but has caused controversy because of the fact that wash trading account for more than 40%; MagicEden has established a cross-chain advantage with a 60% transaction share on the Solana chain and millisecond-level speeds, while x2y2's DAO governance and leasing functions explore differentiated paths, but face liquidity difficulties.

Future trends focus on technology integration and compliance breakthroughs: Dynamic NFT annual adoption rate surges 300%, LayerZero cross-chain protocol reduces 60% of Gas costs, promotes asset multi-chain interoperability; DeFi integration spawns NFT pledge derivatives (TVL exceeds $2 billion) and option hedging tools. However, regulation has become a key variable - the EU MiCA framework requires NFT platforms to comply with KYC, and the US SEC's securities recognition of fragmented NFTs may squeeze the space for small and medium-sized creators, while risks such as liquidity depletion and contract loopholes continue to threaten the health of the ecosystem.

The evolutionary logic of this ecosystem is clearly presented: technological innovation expands the application boundaries, market competition reshapes the competitive landscape, and the compliance process will determine the value distribution and survival space in the next stage.

1. NFT Finance ( NFTFi )

1. Fragmentation

• Technical features : Split a single NFT into multiple ERC-20 tokens (such as ERC-721E standard) through smart contracts, lowering the investment threshold and improving liquidity.

• Representative Agreement :

▪ Unicly : Supports multi-NFT pool fragmentation, with a TVL of over $500 million and a 40% market share;

▪ Floor Protocol : Mainly focuses on the fragmentation of blue-chip NFTs (such as BAYC), while expanding other NFT businesses, with an annualized staking return of 12%.

• Market impact :

▪ Fragmented NFT trading volume accounts for 15% of total NFT trading volume, but liquidity is concentrated in top projects;

▪ Regulatory risk: The U.S. SEC is tightening its review of whether fragmented NFTs are securities.

2. Borrowing

• Operation model : Use NFT as collateral for on-chain lending, supporting fixed interest rates and Dutch auction rates.

• Head platform :

▪ BendDAO : ETH lending accounts for more than 60%, supports blue-chip NFTs such as BAYC and CryptoPunks, and the bad debt rate is controlled within 3%;

▪ NFTfi : Decentralized P2P model, loan issuance volume in Q4 2024 increased by 200% month-on-month.

• challenge :

▪ Long-tail NFT collateral has poor liquidity and a long liquidation cycle (72 hours on average);

▪ Valuation relies on oracles, and extreme market fluctuations cause collateral value deviations of more than 30%.

2. Tool services

1. Browser / Detector

• BitsCrunch :

▪Core functions : AI-driven NFT wash trade detection, rarity scoring and price prediction;

▪Data coverage : Supports 12 chains including Ethereum and Solana, with an average daily API call volume of over 100 million times.

• NFTScan :

▪Positioning : Multi-chain NFT data aggregator, providing batch transaction analysis and copyright traceability services;

▪Partners : Leading platforms such as OpenSea and Blur integrate their data APIs.

• Industry value : Increased tool usage has increased transparency in the NFT market and reduced the exposure of counterfeit projects by 50%.

(III) Trading Market

1. OpenSea

• Market position : Still the largest overall market, but share drops from 80% to 45% in 2023;

• Innovation strategy :

▪ Launched the professional version of "OpenSea Pro", with the aggregator function supporting price comparison and cross-platform orders;

▪ Integrate the ERC-721C on-chain royalty standard to enforce royalties on creators.

• Data : Monthly transaction volume remains stable at $800 million, but users are being lost to emerging platforms such as Blur.

2. Blur

• Disruption model :

▪ Zero platform fees, incentivizing market makers through token airdrops (accounting for 70% of trading volume);

▪ The first “Bid Pool” batch quotation system, supporting one-click purchase of floor-price NFTs.

• Market impact :

▪ In Q1 2024, the transaction volume will surpass OpenSea and occupy 35% of the market share;

▪ Controversy: Over-reliance on token incentives has resulted in wash trading accounting for over 40%.

3. MagicEden

• Positioning : Solana ecosystem dominates the market, expanding to Ethereum and Bitcoin Ordinals;

• Core advantages :

▪ The transaction speed is at the millisecond level, and the gas fee is 1/100 of Ethereum;

▪ Launched the “Diamond Hand” reward program, where long-term holders will receive airdrops of platform tokens.

• Data : NFT transaction volume on the Solana chain accounts for more than 60%, with 3 million monthly active users.

(IV) Competition landscape and trends

1. Market structure

• Trading Platform :

▪ Blur and OpenSea compete for overall market dominance, with a combined share of over 70%;

▪ MagicEden remains the leader in the Solana ecosystem and is actively expanding its multi-chain strategy.

• NFTFi :

▪ Lending protocols are centralized, with BendDAO and NFTfi accounting for 80% of the market share;

▪ Fragmented protocols penetrate into vertical fields (such as game assets, music copyrights).

2. Technical route

• Dynamic NFT :

▪ Real-time update of metadata based on on-chain data (such as changes in game item attributes), with an adoption rate of 300% year-over-year;

▪ Chainlink VRF and IPFS dynamic storage become technical standards.

• Cross-chain NFT :

▪ LayerZero full-chain communication protocol supports seamless cross-chain NFT, reducing gas costs by 60%;

▪ The two-way mapping protocol between Bitcoin Ordinals and Ethereum NFT is under testing.

3. Future Trends

• Deepening DeFi integration:

▪ TVL of NFT-collateralized derivatives (such as NFT-LST) exceeded US$2 billion;

▪ NFT option protocols (such as Hook Protocol) are launched to hedge against price volatility risks.

• Regulatory compliance :

▪ The EU MiCA regulations incorporate NFTs into the regulatory framework and require trading platforms to implement KYC;

▪ The U.S. IRS plans to impose capital gains tax on NFT transactions, triggering user demand for anonymity.

4. Risk Warning

• Liquidity risk : Long-tail NFT liquidity dries up, and 90% of project transaction volumes return to zero;

• Technical risks : Dynamic NFT smart contract vulnerabilities lead to frequent metadata tampering incidents;

• Policy risk : Differences in the recognition of NFT securitization attributes among countries have led to a surge in compliance costs.

• Regulatory risks : In addition to the US SEC's review of fragmented NFTs, the EU also plans to include NFTs in the MiCA regulatory framework, requiring issuers to conduct KYC and transparent disclosure. This may cause some NFT projects to exit the market due to excessive compliance costs. For example, some small artists' NFT works may not meet complex compliance requirements, thus affecting the diversity of the NFT market.

4. Panoramic Analysis of the Meme Track

The Meme track presents the ecological characteristics of " high explosion and high volatility coexisting " . Its core has shifted from disordered speculation to a dual-track parallel of technology-driven and compliance exploration. The Meme track takes the issuance platform - trading market - community consensus as the core chain, forming a market structure with both explosive power and fragility. The leading issuance platform PUMP.FUN has an absolute advantage in the Solana chain with its low cost and "one-click coin issuance" mechanism. Its innovative mechanisms such as "social graph detection" effectively filter out robot volume, but the extremely short life cycle of tokens and high Rug Pull rate still expose the cruelty of speculative bubbles. Emerging competitors try to break through through DAO governance and cross-chain collaboration, but Gas cost and liquidity depth are still key bottlenecks.

The trading market shows a liquidity stratification of CEX and DEX : centralized exchanges dominate high-liquidity tokens through strategic innovation, while Solana-based DEXs undertake long-tail assets with low slippage and aggregated trading functions. Decentralized exchanges, with their anti-censorship features and cross-chain support, are gradually becoming a new hub for the game between Meme coins and institutional funds.

In terms of technological evolution, AI -driven has become a key variable: AI tools have greatly improved issuance efficiency, and risk control systems have strengthened real-time monitoring of risks; cross-chain protocols have attempted to break the limitations of a single chain, but regulatory compliance pressures have constrained their progress. Future trends focus on compliance survival and community economic revolution : anonymous projects turn to privacy chains, the DAO model promotes the democratization of token parameters, and SocialFi integrates fan economy to reshape the governance framework.

1. Meme Distribution Platform

1. PUMP.FUN

• Technical features:

▪ One-click coin issuance protocol based on Solana chain, completing token creation, liquidity pool injection and contract locking within 5 minutes;

▪ Innovation mechanism:

– Social graph detection : verify real users by binding Twitter/X accounts and filter out robot-generated traffic;

– Token destruction : If the preset liquidity threshold is not reached within 24 hours, the tokens will be automatically destroyed and the funds will be returned.

• Market performance:

▪ More than 800,000 tokens will be issued in total by 2024, with the daily trading volume peaking at over US$350 million;

▪ Successful Cases:

– BOOM : Dogecoin imitation, with a peak market value of $150 million and more than 100,000 community holding addresses;

– SOLANA - Trump : Political Meme Coin, with trading volume soaring 500% during the US election cycle.

• Disputes and risks :

▪ More than 95% of tokens have a life cycle of less than 48 hours, and Rug Pull events account for 30%;

▪ The platform charges 2% transaction fee + 10% liquidity pool fee, with annual revenue estimated to exceed US$600 million.

2. Emerging competitors

• PooCoin (Ethereum chain) :

▪ Supports multi-chain deployment and integrates token market value prediction AI tools, but the Gas cost is 5 times higher than the Solana chain;

▪ The market share is less than 8%, and the liquidity depth is far inferior to PUMP.FUN.

• Memeland (cross-chain protocol) :

▪ The first “community governance coin issuance” model, where token parameters are determined by DAO voting;

▪ TVL exceeded 50 million USD during the testing phase and has not yet been fully opened.

2. Meme Exchange

1. Centralized Exchange ( CEX )

• Head platform strategy:

▪Binance:

- Set up a "Meme Innovation Zone" where listing of coins must pass community voting (such as PEOPLE and FLOKI);

– Launched Meme Index futures, allowing 3x leverage to hedge volatility risk.

▪ Bybit :

– “Zero Fee Meme Season” attracted retail investors, with a peak daily trading volume of $1.8 billion;

– Robots’ manipulation of trading volume has caused drastic price fluctuations, with some tokens experiencing daily increases and decreases of more than 1,000%.

• Data Insights :

▪ The Meme coin trading volume of the top five CEXs accounts for more than 70%, with Binance, Bybit, and OKX dominating;

▪ Listing fee tiers: Blue-chip Meme projects (such as DOGE and SHIB) are free of charge, while new coins must pay a maximum of US$2 million.

2. Decentralized Exchange ( DEX )

• Solana Series :

▪ Raydium : The core trading market for PUMP.FUN tokens, supporting instant liquidity pool creation with slippage of less than 0.5%;

▪ Jupiter : The aggregator integrates cross-DEX prices, and Meme coin trading volume accounts for 80% of the platform’s total trading volume.

• Ethereum system :

▪ Uniswap V4 : Launched the “Meme Liquidity Mining Plug-in”, LPs can receive protocol token airdrops;

▪ ShibaSwap : Focuses on Meme coin Swap and supports staking SHIB to earn income, but the TVL is less than US$100 million.

• Innovation tools :

▪ PumpBot : Telegram robot integrated with DEX trading, users can automatically complete on-chain purchases through the command “/buy token name”;

▪ Meme sniping tool : real-time monitoring of PUMP.FUN new coins, supporting millisecond-level front-running transactions.

(III) Competition landscape and trends

1. Market structure

• Issuing side :

▪ PUMP.FUN monopolizes the Solana chain market (85% share), and Ethereum chain competitors have difficulty breaking through due to high gas fees;

▪ Cross-chain protocols such as Memeland attempt to break the single-chain monopoly, but the ecological synergy effect has not yet emerged.

• Trading side:

▪Differentiation between CEX and DEX:

– CEX dominates high-liquidity tokens (such as DOGE, SHIB), accounting for 65% of trading volume;

– DEX takes over long-tail assets, and Solana chain DEX occupies 60% of the market share.

2. Technological evolution

• AI -driven publishing :

▪ The platform integrates AI to generate token names, icons and marketing copy, increasing issuance efficiency by 10 times;

▪ The AI risk control system monitors the Rug Pull mode in real time, with an early warning accuracy rate of over 80%.

• Cross-chain issuance protocol :

▪ PUMP.FUN plans to support multi-chain deployment of Ethereum and Aptos, and Gas cost may become a key bottleneck;

▪ LayerZero full-chain communication protocol tests seamless cross-chain transfer of Meme coins.

3. Future Trends

• Compliance attempts :

▪ The EU requires Meme coin issuers to submit KYC, and anonymous projects turn to privacy chains (such as Monero);

▪ The U.S. SEC sued PUMP.FUN for some tokens involving securities issuance, and the platform may introduce mandatory information disclosure.

• Community Economic Revolution :

▪ The MemeDAO model is emerging, and token parameters are determined by community proposal voting (such as destruction mechanism, tax distribution);

▪ Social token (SocialFi) is integrated with Meme coin, and fan economy drives market value growth.

4. Risk Warning

• Technical risks :

▪ Smart contract vulnerabilities lead to theft of funds (the Solana chain Meme project lost more than $200 million in 2024);

▪ Front-running trading robots cause transaction prices for ordinary users to deviate by more than 30%.

• Market risks :

▪ High volatility caused leverage liquidation, and a Bybit user lost $5 million in a single day;

▪ Liquidity depletion causes tokens to return to zero, and the average survival period of long-tail projects is less than 72 hours.

• Regulatory risks :

▪ India, South Korea and other countries prohibit CEX from listing Meme coins, and geopolitical fragmentation is exacerbated;

▪ The U.S. IRS has included Meme coin income in its tax audit priorities, and the number of tax evasion and penalty cases has surged.

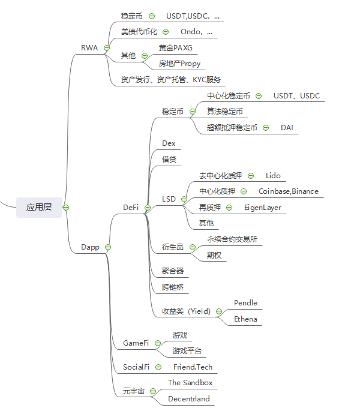

5. Panoramic Analysis of the Application Layer

The application layer takes RWA asset tokenization and DApp scenario innovation as its core pillars, presenting a pattern of parallel technological breakthroughs and compliance exploration.

In the RWA track, stablecoins (USDT/USDC) are firmly at the core of payment with a market value of US$160 billion, but the US Payment Stablecoin Act has increased compliance pressure. The TVL of Ondo, the leader in US debt tokenization, exceeded US$5 billion, and the low threshold attracted 70% of institutional funds; the real estate tokenization platform Propy has a cumulative transaction volume of US$800 million, but cross-jurisdictional title confirmation is still a bottleneck. In terms of supporting services, compliant issuance platforms such as Securitize and Polymesh dominate the market, institutional-level custody solutions such as Fireblocks improve asset security, and zero-knowledge proof technology is gradually integrated into the on-chain identity authentication process.

DApp ecosystem is clearly differentiated:

DeFi track : Uniswap V4 dominates with an average daily trading volume of US$5 billion. Aave V4 reduces the bad debt rate to below 0.5% through isolated pools and cross-chain liquidation. LSDFI (such as Pendle) pushes the ETH pledge derivatives market size to exceed US$50 billion.

GameFi field : After Axie Infinity transformed into a free-to-play and earn-earn model, its daily active users rebounded to 500,000, but the users’ stay time on the Metaverse platform was less than 30 minutes, and the problem of land liquidity depletion has not been solved (for example, the average price of Decentraland fell 85% from its peak).

SocialFi Exploration : Friend.Tech’s social tokenization model has been unpopular, with token prices falling 90% from their peak. Decentralized social protocols (such as Lens and Farcaster) are trying to integrate NFT functions to regain users.

Future trends focus on AI integration and regulatory breakthroughs:

Technology-driven: AI agents promote DeFi automated liquidation and strategy optimization, and ZK-Rollup technology significantly improves Layer2 privacy and transaction efficiency; if the Bitcoin OP_CAT upgrade is passed, the potential of native smart contracts may be released and the BTCFi market size may exceed 10 billion US dollars.

Compliance challenges: The U.S. SEC has tightened its review of the securitization attributes of the RWA platform, and the EU MiCA framework requires 100% reserves for stablecoin issuers, resulting in a surge in compliance costs for small and medium-sized projects.

1. RWA ( Real World Asset Tokenization)

1. Stablecoins

• USDT/USDC

▪Market position : The total market value exceeds 160 billion US dollars, accounting for 90% of the stablecoin market;

▪Regulatory dynamics : The U.S. Payment Stablecoin Act requires 100% cash reserves, and Circle has obtained a New York State license.

2. Tokenization of U.S. Treasury Bonds

• Ondo

▪Product structure : Short-term U.S. Treasury bond token (OUSG) has an annualized return of 4.8%, with a minimum investment threshold of $1;

▪Scale : TVL exceeded US$5 billion, with institutional investors accounting for over 70%.

3. Other assets

• Gold ( PAXG )

▪Mechanism : 1:1 anchored to physical gold in the London Vault, with a market value of US$3 billion;

▪Liquidity : The average daily trading volume of CEX is less than US$100 million, and the arbitrage efficiency is low.

• Real Estate ( Propy )

▪Use case : Use NFT to achieve property division and on-chain transactions, with cumulative transaction volume exceeding US$800 million;

▪Limitations : Legal title confirmation relies on offline processes and is limited to specific jurisdictions.

4. Supporting Services

• Asset issuance : led by compliance platforms such as Securitize and Polymesh;

• Asset custody : Anchorage and Fireblocks provide institutional-grade custody solutions;

• KYC : Circle Verite and iden3 support on-chain identity authentication, and privacy computing technologies (such as zero-knowledge proof) are gradually integrated.

2. DApp Ecosystem

1. DeFi

• Stablecoins

▪Centralized stablecoins : USDT/USDC dominates payment and transaction scenarios;

▪Algorithmic stablecoin : Frax v3 introduced a partial collateral mechanism, and its market value rebounded to US$1.5 billion;

▪Overcollateralized stablecoin : MakerDao’s DAI maintains a 1:1 value peg with the U.S. dollar by overcollateralizing crypto assets and dynamically adjusting parameters through a community governance mechanism.

• DEX

▪Head protocol : Uniswap V4’s average daily trading volume is US$5 billion, and the share of Solana chain DEX (Orca) has increased to 25%;

▪Innovation : Intent trading (UniswapX) reduces MEV and reduces transaction costs by 30%.

• Loans

▪ Aave V4 : Introducing isolated pools and cross-chain liquidation, the bad debt rate dropped to below 0.5%;

▪ Compound : Turning to the institutional lending market, corporate loans account for more than 40%.

• LSD (Liquidity Staking Derivatives)

▪Decentralized staking : Lido, which implements non-custodial staking through multi-node operators, supports users to stake ETH to obtain stETH tokens, with a staking market share of approximately 65% and a TVL of over US$35 billion;

▪Centralized staking : Staking services provided by centralized exchanges such as Coinbase and Binance. Centralized services usually provide a simpler and more direct user experience, but users have less control over their assets than decentralized services.

▪Re -staking : The representative protocol Eigenlayer allows users to re-stake the staked ETH and earn multiple returns;

• Derivatives

▪Perpetual Contracts : dYdX on-chain derivatives trading volume accounts for more than 60%, and the V4 version supports custom trading pairs;

▪Options : Hegic v2 launches zero-slippage options trading, and the proportion of institutional market makers increases to 50%.

• Aggregators

▪ 1inch : Integrates 200+ DEXs, and the Gas optimization algorithm saves users 15% of costs;

• Cross-chain bridge : LayerZero accounts for more than 70% of all chain transactions, but security disputes remain unresolved.

• Income

▪ Pendle : Allows users to flexibly trade by splitting the principal (PT) and the right to income (YT) of an asset, supporting income strategy optimization and forward income hedging;

▪ Ethena : A synthetic dollar protocol that generates yield-generating stablecoin USDe by pledging ETH and short futures contracts, providing on-chain risk-free interest rates and high-leverage derivative strategies.

2. GameFi

• Chain Games

▪Head project:

– Axie Infinity : Transformed to a free-to-play model, with daily active users rising to 500,000;

– Parallel : TCG card game, NFT card secondary market transaction volume exceeds US$300 million.

• Gaming platform

▪ Immutable : Ethereum ZK-Rollup game chain, with more than 300 projects;

▪ Gala Games : The node sales model was unpopular, and it transformed into a subscription-based membership service.

3. SocialFi

• Friend.Tech

▪Model : Combination of social tokenization (Key) and content subscription, with creators taking 95% of the profits;

▪Bottleneck : User churn rate exceeds 80%, and token price falls 90% from the peak.

4. Metaverse

• The Sandbox

▪Ecological progress : Land airdrops attracted brands such as Gucci and HSBC to settle in, with less than 100,000 daily active users;

▪Challenges : There is a lack of 3A-level content, and the average user stay time is less than 30 minutes.

• Decentraland

▪Transformation strategy : Focus on virtual conference and exhibition scenarios and host more than 500 corporate events in 2024;

▪Data : The average land price has fallen 85% from its 2022 peak, and liquidity has dried up.

( III ) Competition landscape and trends

1. RWA : Compliance and scalability in parallel

• Tokenization of U.S. debt : Ondo and Maple Finance compete for institutional funding portals;

• Real Estate : Propy works with Chainlink to achieve off-chain and on-chain property rights confirmation and verification.

2. DApp Ecosystem: User Experience and Compliance Reconstruction

• DeFi : LSDFI and ReStaking push the ETH staking derivatives market to over $50 billion;

• GameFi : The launch of 3A game “Illuvium” may become a turning point for the industry;

• SocialFi : Decentralized social protocol (Lens, Farcaster) integrates Meme and NFT functions.

3. Risk Warning

• Regulatory risks : The US SEC sued the RWA platform for allegedly issuing unregistered securities;

• Market risk : The Metaverse land bubble bursts and the liquidity crisis spreads to related DeFi protocols.

• Credit risk : The credit status of the asset issuer and the quality of the asset itself. Assets must undergo strict offline title confirmation and evaluation to ensure the authenticity and legality of the assets.