The U.S. Dollar just posted one of its sharpest drops in months. What does this mean for Bitcoin and broader markets? Let’s break it down 🧵👇

1/ USD's Sharp Drop and BTC – Historical Patterns vs. Current Divergence

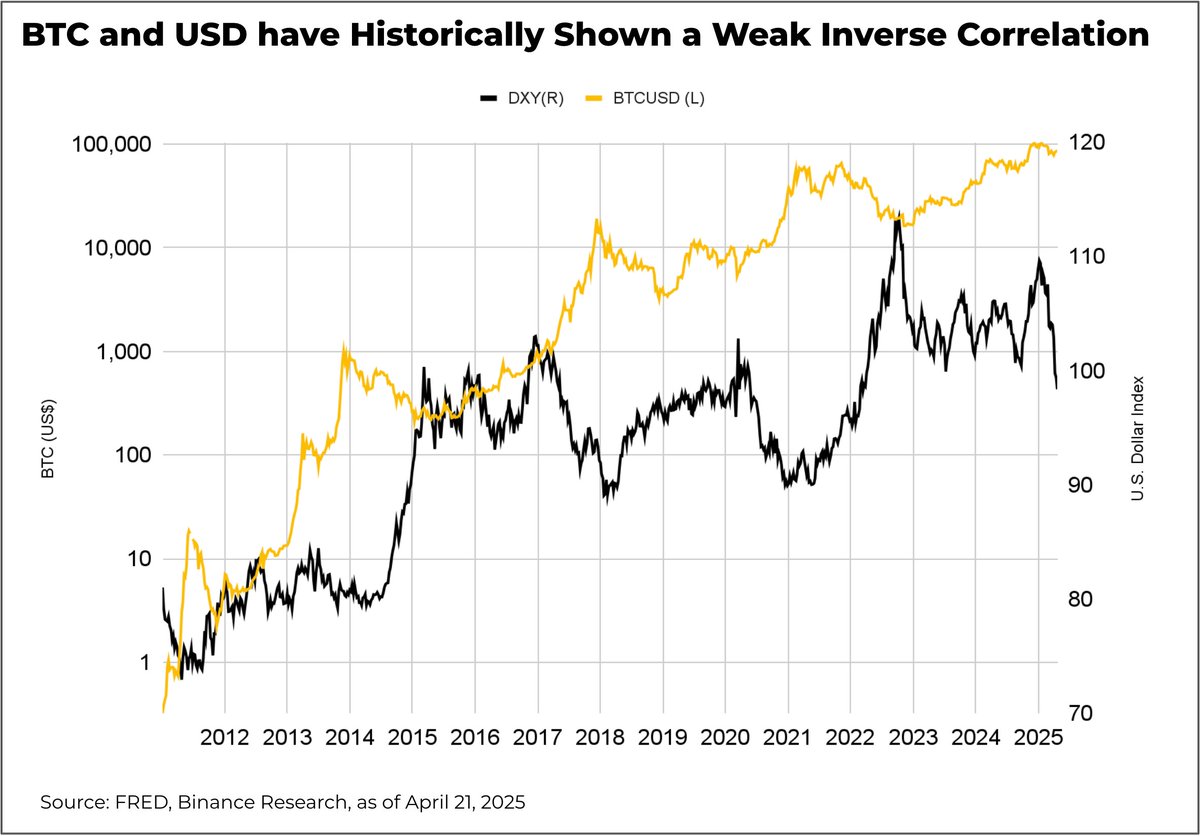

Historically, Bitcoin ($BTC) and the U.S. Dollar Index ($DXY) have shown a weak, but often inverse correlation. The recent decline in $DXY, driven by trade war uncertainty, puts that relationship back in

2/ BTC During Dollar Drops – What the Data Shows

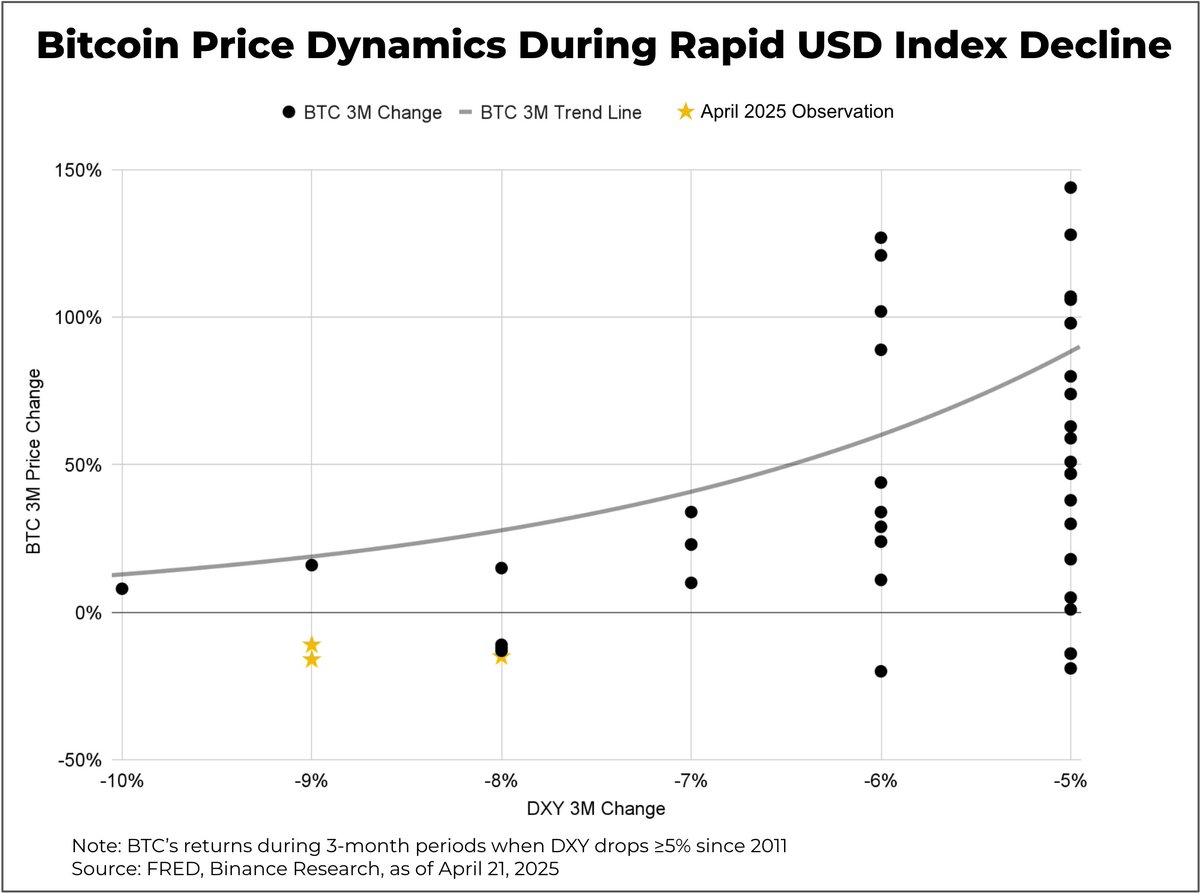

Our scatter plot analysis looks at how $BTC reacted during past sharp $DXY drops (≥5% over 3 months). The results highlight historical patterns and place the current situation in context.

3/ BTC Tends to Rally During Sharp Dollar Drops

During past instances of ≥5% declines in $DXY over 3 months:

🔸 $BTC historically posted positive returns

🔸 Average gain was +43%

🔸 The trend line remained above zero in most cases

4/ Negative Correlation: Deeper $DXY Drops, Softer BTC Performance

Historically, larger $DXY declines were associated with more muted $BTC performance. This suggests an inverse relationship between the depth of dollar weakness and Bitcoin’s response.

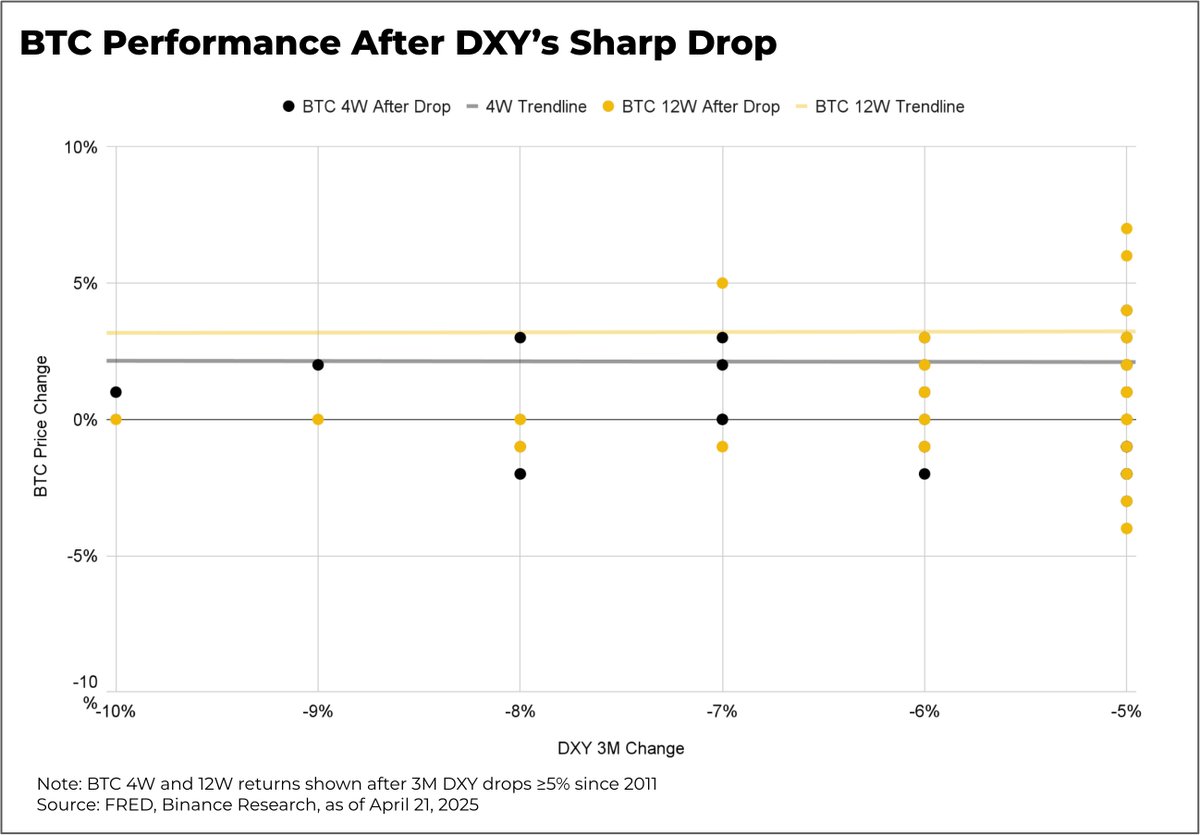

5/ Historical Calm: BTC Performance After DXY’s Sharp Drop

Following 3-month $DXY declines, $BTC’s average price change over the next 4 to 12 weeks was relatively flat (~+0.4%). Historically, these events did not lead to sustained momentum in either direction.

6/ Current Setup: April 2025 Deviation Amid Trade War

In the current setup, $DXY is down ~9% over 3 months, second largest 3-month drop since 2011,driven by trade war uncertainty. Historically, a ~9% drop in $DXY has aligned with positive—but moderate—$BTC performance compared

7/ BTC Divergence: >15% Drop Despite Dollar Weakness

But this time, $BTC is down over 15%—a clear deviation from the norm. This raises key questions:

🔸Does a trade war–driven $DXY drop impact crypto differently?

🔸Could BTC’s response simply be lagging?

🔸Or are we seeing a

Found this helpful? Check out the Binance Research website for more in-depth reports.

www.binance.com/en/research

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content