Some notable cryptocurrency news is being watched this week, spanning multiple ecosystems with the potential to create volatility.

This week, traders want to take advantage of event-driven volatility and are following these developments.

Solana Community Conference

This week, the Solana Community Conference, also known as Breakpoint, is one of the notable cryptocurrency news items. The event begins on 04/25 and is the main gathering for Solana developers, investors, and creators.

Historically, Solana Breakpoint is where important announcements are made, such as new project launches, partnerships, or technological advances. In recent years, significant announcements at similar events have included the Solana Seeker phone or the Firedancer validator.

According to data from Solscan, the Solana ecosystem has nearly 4 million active wallets. Meanwhile, data from defillama shows the TVL reaching $7.37 billion. With these numbers, the Solana community conference could create a positive sentiment for SOL, which is trading at $141.05 at the time of writing.

Solana (SOL) Price Performance. Source: BeInCrypto

Solana (SOL) Price Performance. Source: BeInCryptoTraders should prepare for potential price volatility, as positive news could stimulate short-term price increases. Similarly, any unexpected news or network concerns, such as previous outages, could reduce enthusiasm.

Bitcoin Reserve Hearing in Texas

Another notable news item this week relates to cryptocurrency strategic reserves. On 04/23, Texas will hold a hearing on the strategic Bitcoin reserve, marking an important event for the state's pro-cryptocurrency stance.

This bill, introduced four months ago, was passed by the committee with 9 votes in favor and received Senate approval with 80% support. Similarly, Dan Patrick, Lieutenant Governor of Texas, has listed the Bitcoin Reserve as a top priority for 2025.

"My statement announces the first round of 40 top priority bills for the 2025 legislative session," he shared on X (Twitter) in January.

In this context, Wednesday's hearing could clarify Texas's approach to Bitcoin acceptance at the institutional level. This could set a precedent for other states or federal policy.

A favorable outcome could strengthen Bitcoin's legitimacy, drive demand from institutional investors, and positively impact BTC prices.

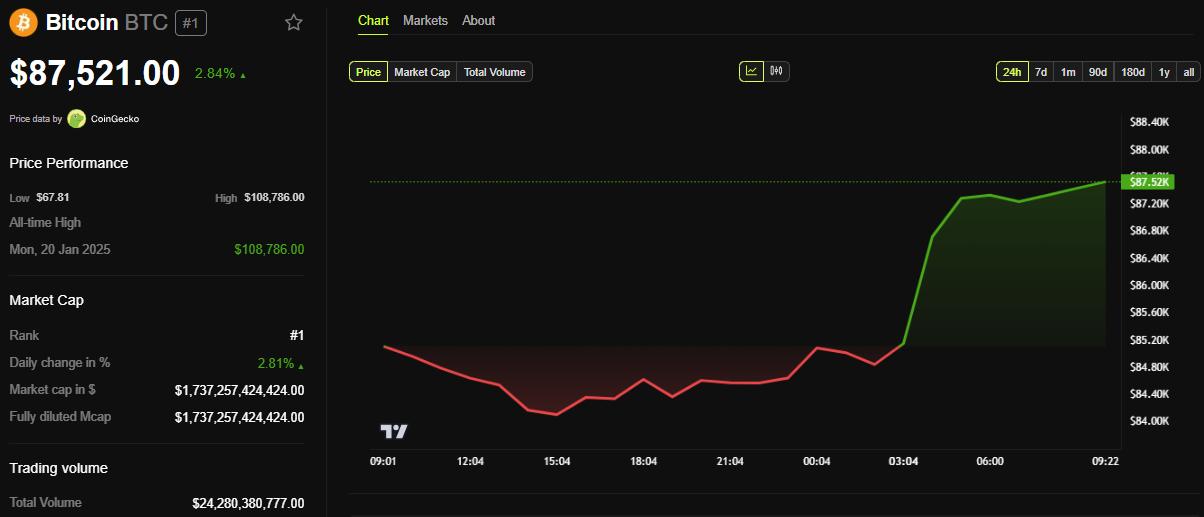

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCryptoInitia Mainnet Launch and INIT Token Release

Also in this week's headlines, Initia will launch its mainnet and INIT token on Thursday, 04/24. This follows the network's announcement of a 50 million token airdrop three weeks ago.

Thursday's event will mark an important milestone for a layer-1 blockchain, focusing on interoperability and user experience. The launch could attract attention from DeFi and cross-chain enthusiasts, as Initia aims to simplify dApp interactions.

For traders, the initial price action of INIT will be crucial, as new token launches often experience high volatility due to speculative trading.

"The Initia INIT listing date on Binance Spot has been announced! Listing on: 04/24/2025. Mainnet will also officially launch on the same day. The exact date and time for airdrop are still not announced," the network recently declared.

Investors should assess Initia's partnerships and developer adoption, as its success depends on ecosystem development.

Injective's Lyora Mainnet Upgrade

Injective's Lyora mainnet upgrade, expected on Tuesday, 04/22, aims to improve network performance and transaction speed. This will reinforce its position as a layer-1 chain focused on DeFi.

"Injective Lyora Mainnet is coming soon! Vote today to significantly improve Injective's infrastructure, performance, and transaction speed. Official launch on 04/22," Injective stated.

This upgrade could improve user experience and attract developers to the Injective ecosystem, especially for trading and derivative platforms.

Traders should monitor INJ prices to capture short-term momentum, as successful upgrades often drive positive sentiment.

Injective (INJ) Price Performance. Source: BeInCrypto

Injective (INJ) Price Performance. Source: BeInCryptoSimultaneously, investors should consider Injective's growing TVL and partnerships, such as collaboration with Sonic for AI agent platforms, as potential long-term indicators.