Bitcoin (BTC) has consolidated its separation from the stock market as it entered the Wall Street trading session on April 21, amid escalating trade tensions between the US and Asian partners.

According to data from TradingView, BTC reached its highest level this month, surpassing the $88,000 threshold.

Bitcoin continued to rise after the weekly close, closely following the upward momentum of gold - a precious metal that recently set a new historical peak at $3,430 per ounce.

In contrast, the stock market faced strong selling pressure. Both the S&P 500 and Nasdaq Composite indexes dropped by more than 2% at the time of writing.

Bitcoin's new strength seems to have ended the period of trading parallel to stocks, as investors react to headlines related to trade wars.

Tensions escalated after both China and Japan warned about deteriorating relations with the US, while President Donald Trump continued to criticize Federal Reserve Chairman Jerome Powell about interest rate policies.

"Tech stocks continue to be sold off this week. Nvidia (NVDA) has dropped more than 15% since last Monday, while many stocks in the 'Magnificent 7' group have lost over 10%," the market analysis account The Kobeissi Letter commented on X.

"Without tech stocks, the market cannot find a dip."

Kobeissi also highlighted the downward pressure on the Dollar Index (DXY), which has fallen to its lowest level since March 2022.

"As DXY falls to new 52-week lows below 99, Bitcoin and gold simultaneously surge," Kobeissi summarized.

"The market urgently needs immediate trade deals."

QCP Capital also expressed a positive view in its latest newsletter sent to its Telegram channel.

According to QCP, Bitcoin is gradually sharing the "safe haven" role with gold in the context of increasing macroeconomic instability - something BTC could not do in the past few months.

"With the stock market closing last week in red and continuing its April decline, the narrative of Bitcoin as an asset hedge against inflation or instability is gradually returning. If this trend continues, BTC may receive additional momentum from institutional investors."

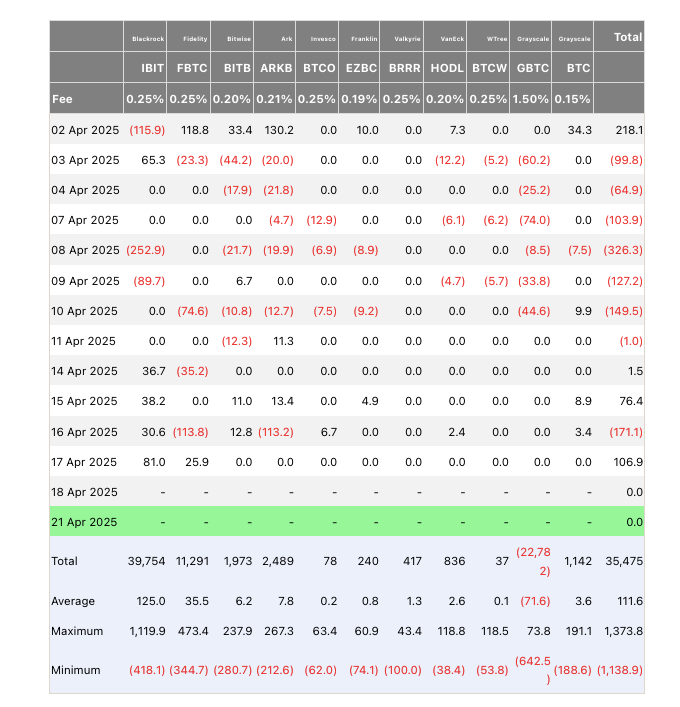

QCP also believes that the capital outflow from US spot Bitcoin ETFs may soon reverse.

"In fact, we have started to see early signals indicating that institutional confidence is returning. Capital flow into spot Bitcoin ETFs turned positive last week, with a total net inflow of $13.4 million - completely opposite to the $708 million withdrawal the previous week."

"In the options market, trading positions are also becoming more balanced. Options contracts are no longer heavily skewed towards short-term put options as before."

Disclaimer: The article is for informational purposes only and is not investment advice. Investors should thoroughly research before making decisions. We are not responsible for your investment decisions.

Join Telegram: https://t.me/tapchibitcoinvn

Twitter (X): https://twitter.com/tapchibtc_io

Tiktok: https://www.tiktok.com/@tapchibitcoin

Youtube: https://www.youtube.com/@tapchibitcoinvn

Vuong Tien