Crypto inflows last week were modest at $6 million, as US economic indicators wiped out significant profits mid-week.

However, the modest inflows indicate a changing market sentiment.

US Retail Sales Caused $146 Million Outflow from Crypto Market

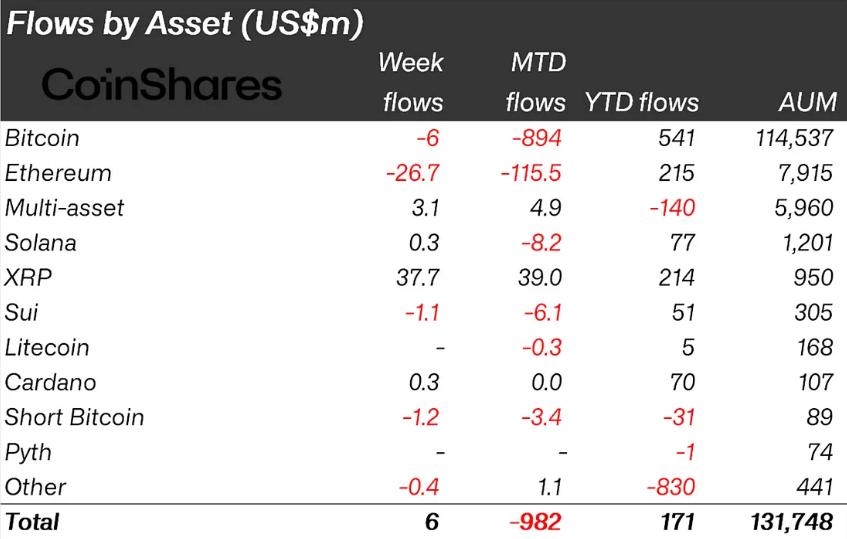

The latest CoinShares report shows crypto inflows of only $6 million last week, amid mixed investor sentiment. While the week started with small inflows, stronger-than-expected US retail sales data the previous Wednesday triggered a $146 million outflow.

"Digital asset investment products saw net inflows of $6 million, with US retail data mid-week triggering $146 million in outflows," James Butterfill, CoinShares' head of research, said.

In fact, US retail sales increased in March due to increased car purchases. Beyond inflation adjustment, retail purchase values rose the most in over two years.

This economic indicator, measuring annual consumer spending, also showed households increased motor vehicle and other goods purchases. According to Reuters Business, the goal was to avoid higher prices from Trump's tariffs.

"The US Commerce Department reported retail sales increased 1.4% last month, significantly higher than February's 0.2% increase, the largest increase in over two years, as households increased shopping to avoid higher prices from President Trump's tariffs," the report said.

In this context, the US continued to see outflows, totaling $71 million last week. This contrasts with other markets, with Europe and Canada, among others, recording positive inflows.

Meanwhile, Ethereum led negative outflows, recording nearly $27 million in outflows, followed by Bitcoin with $6 million in outflows.

Crypto inflows last week. Source: CoinShares

Crypto inflows last week. Source: CoinSharesIn fact, the data reflects mixed sentiment, with investors shifting towards altcoins like XRP, Solana, and Cardano, which are US-produced tokens.

XRP's nearly $38 million inflow is unsurprising. Recent data shows network activity increased, nearly 70% by the end of last week. As BeInCrypto reported, this is likely due to excitement about Coinbase launching XRP Futures through its derivative branch.

"XRP continues to break patterns with $37.7 million inflows last week, making it the third most successful currency this year with YTD inflows of $214 million," Butterfill explained.

Institutions See Crypto as More Than Just a Risk Bet

Meanwhile, as Trump's tariffs impact consumer spending, Wall Street seems to be struggling more than expected.

Nexo Dispatch Editor Stella Zlatarev recently told BeInCrypto that the relative stability of Bitcoin and other blue-chip cryptocurrencies signals that crypto may be entering a new market maturity phase.

"Bitcoin's ability to withstand macro volatility without significant fluctuations like in previous years shows institutional investors are seeing it less as speculation and more as a strategic asset," Zlatarev said.

Instead, Bitcoin is emerging as a risk momentum asset that doesn't collapse like high-growth stocks but also doesn't attract safe-haven flows like traditional safe havens.