Buyer Strike Moment Arrives: Two-Year US Treasury Overseas Demand Plummets to Two-Year Low

Throughout April (especially after the nauseating surge in 10-year US Treasury yields two weeks ago), the market's most concerned question was whether China is selling its approximately $1 trillion in US debt holdings. Although the April International Capital Flow (TIC) data published in June will only confirm this (and even then, the data will at most provide blurry clues), we have just discovered an equally important signal: Chinese are no longer rushing to buy US bonds - a conclusion drawn from the cliff-like drop in "indirect bidder" (overseas buyers) demand in today's two-year Treasury auction.

Let's trace back the details.

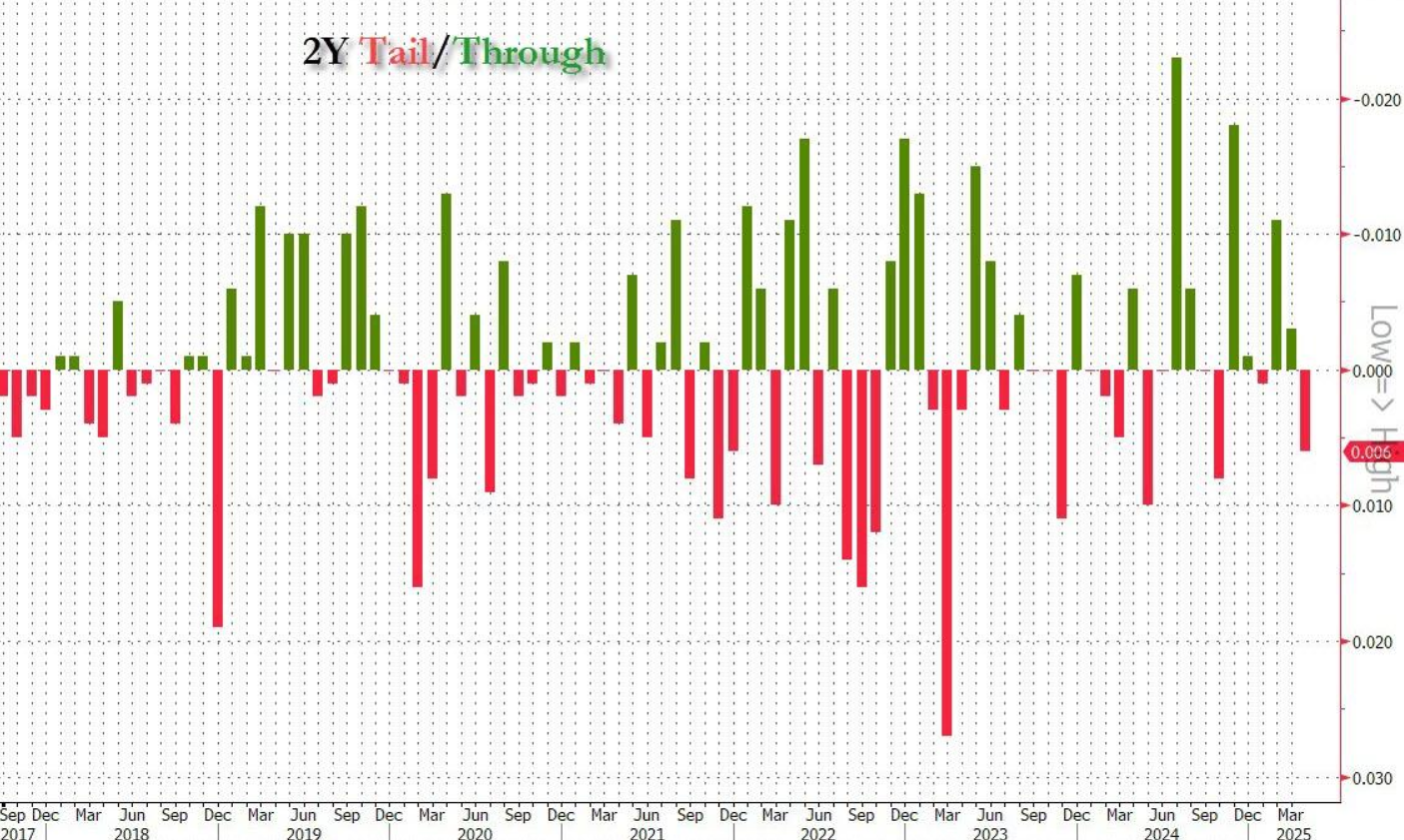

This $69 billion two-year Treasury auction was priced at a high yield of 3.795%, down from last month's 3.984%, reaching the lowest level since September last year. However, it was still 0.6 basis points higher than the pre-issuance trading rate of 3.789%, marking the first "tail" premium since January and the largest premium since October last year.

Although the tiny premium can be ignored, the first danger signal is the bid coverage ratio plummeting from 2.66 to 2.52, a new low since October last year and below the recent six auctions' average of 2.64.

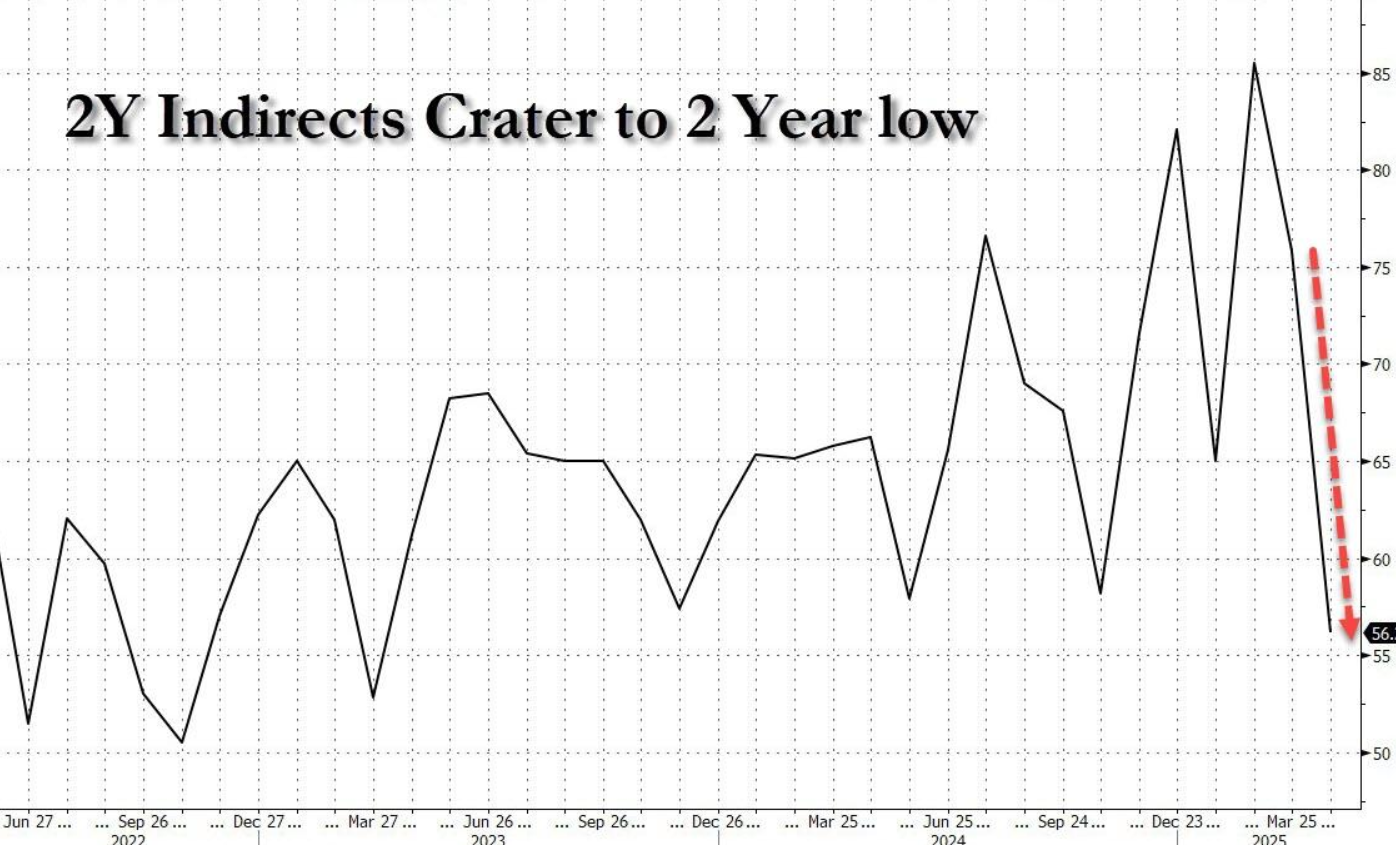

The real chaos lies in the internal structure: Unlike the collapse of "direct bids" in recent 3/10/30-year auctions, this two-year auction's direct bid proportion reached a record-high 30.1%. However, the problem is that the surge in direct bids came at the expense of a dramatic collapse in indirect bids (overseas buyers) - which dropped to a two-year low. As shown in the chart below, the indirect bid proportion in April was only 56.2%, the lowest since the banking rescue crisis in March 2023.

In other words, while overseas demand was still strong two weeks ago, it has now collapsed. If this indicator drops another 10-20%, the Federal Reserve might be forced to restart quantitative easing, fulfilling its explicitly stated ultimate mission: serving as a safety net "last buyer" for the US Treasury.

Finally, under the dual effect of surging direct bids and plummeting indirect bids, dealer takedown rose to 13.7%, higher than last month's 10.7% and slightly above the recent average of 11.6% (though not reaching an abnormal level).

Overall, this is at best a mediocre auction, but the result would have been much worse if direct bidders had not filled the vacuum left by overseas buyers (i.e., China) suddenly going on strike.

Please closely monitor the remaining medium and long-term Treasury auctions this week: Unlike two weeks ago when the market was focused on direct bidders, we have now finally touched the core issue - we must closely watch the only important indicator: whether overseas buyers will ultimately stop financing the US's trillions in debt, forcing the Federal Reserve's quantitative easing to become the only choice.