Key Points

- Kyros is a liquidity restaking protocol built on Solana, utilizing Jito's restaking infrastructure, offering kySOL and kyJTO vault products.

- As of April 1st, Kyros vault's Total Value Locked (TVL) reached $36.3 million, with 84% in kySOL and 16% in kyJTO. The two token types have a total of 15,000 holders, including 10,800 on-chain holders and 4,200 users through CeFi asset management company SwissBorg.

- kySOL has been integrated into multiple Solana ecosystem DeFi platforms, including Kamino, Exponent, Sandglass, and RateX, supporting lending, liquidity provision, and yield trading functions.

- Kyros plans to expand supported Node Consensus Networks (including Squads and Ping Network), while exploring new vault products pegged to stablecoins.

Introduction

Kyros

Kyros is a liquidity restaking protocol built on Solana's Jito restaking infrastructure. Users can obtain kySOL—a liquidity restaking token—by staking SOL or JitoSOL, with its yield combining Solana staking rewards, MEV rewards (via JitoSOL), and additional restaking rewards generated by Node Operators (NOs) providing security for Node Consensus Networks (NCNs). Node Consensus Networks (NCNs) are services that provide network security for blockchain infrastructures such as validators, oracles, cross-chain bridges, and L2. kySOL represents users depositing SOL or JitoSOL into the vault, with assets delegated to Node Operators responsible for maintaining NCNs security. In return for economic security, NCNs provide potential additional rewards to the Kyros vault (for example, 0.15% of Jito tips on TipRouter are distributed to all JitoSOL restakers).

kySOL has been integrated with DeFi protocols like Kamino Finance, Sandglass, and Exponent Finance, allowing users to employ kySOL in liquidity provision, lending, and yield trading strategies.

In addition to kySOL, Kyros offers a second vault product, kyJTO. This token is issued to users staking JTO (Jito DAO governance token), with Jito DAO overseeing Jito network operations.

Jito does not provide a user interface but supports protocols like Kyros in restaking functionality through underlying infrastructure (particularly restaking and vault programs). In this framework, staked assets are tokenized into Vault Receipt Tokens (VRTs) (i.e., kySOL and kyJTO), which maintain liquidity and can be used in DeFi. Kyros is responsible for managing VRTs minting and burning, delegating vault assets to NCNs to optimize users' restaking risk-reward ratio. Jito's infrastructure also supports flexible validator reallocation, customizable slashing conditions, and operator management functions, helping restaking protocols optimize validator performance while maintaining liquidity.

kySOL has been integrated into multiple Solana-based DeFi platforms such as Kamino, Exponent, Sandglass, and RateX, supporting lending, liquidity provision, and yield trading.

Kyros plans to support more Node Consensus Networks (including Squads and Ping Network), while exploring new vault products pegged to stablecoins.

[The rest of the translation follows the same professional and accurate approach]- kySOL Vault: Users deposit SOL or JitoSOL to obtain kySOL (current exchange rate: 1 SOL=0.84 kySOL, 1 JitoSOL=0.99 kySOL). SOL deposits are internally staked to generate JitoSOL and then deposited into the vault for restaking. kySOL uses a non-rebasing design, continuously accumulating staking rewards, MEV income, and NCN additional rewards, with all rewards automatically compounding to continuously increase its value relative to SOL while maintaining full liquidity for DeFi use.

- kyJTO Vault: Users stake JTO to obtain kyJTO and share in the income generated by TipRouter NCN. kyJTO also uses a non-rebasing design, with its value increasing relative to JTO over time.

Performance Data

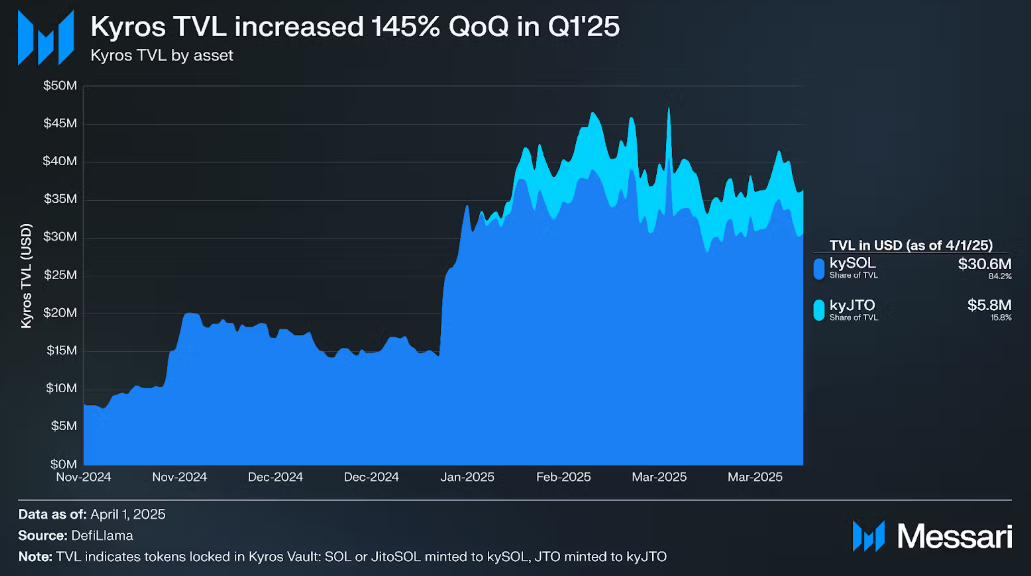

Since the launch of the kySOL vault in late October 2024, both Kyros vaults have shown significant capital inflows. In the first quarter of 2025, Kyros' Total Value Locked (TVL) increased by 145% quarter-on-quarter, from $14.8 million to $36.3 million. As of April 1st, the kySOL vault accounts for 84% of the TVL ($30.6 million), while the kyJTO vault, launched in early January 2025, has grown to 16% of the TVL ($5.8 million).

Ecosystem Composition

Node Operators (NOs)

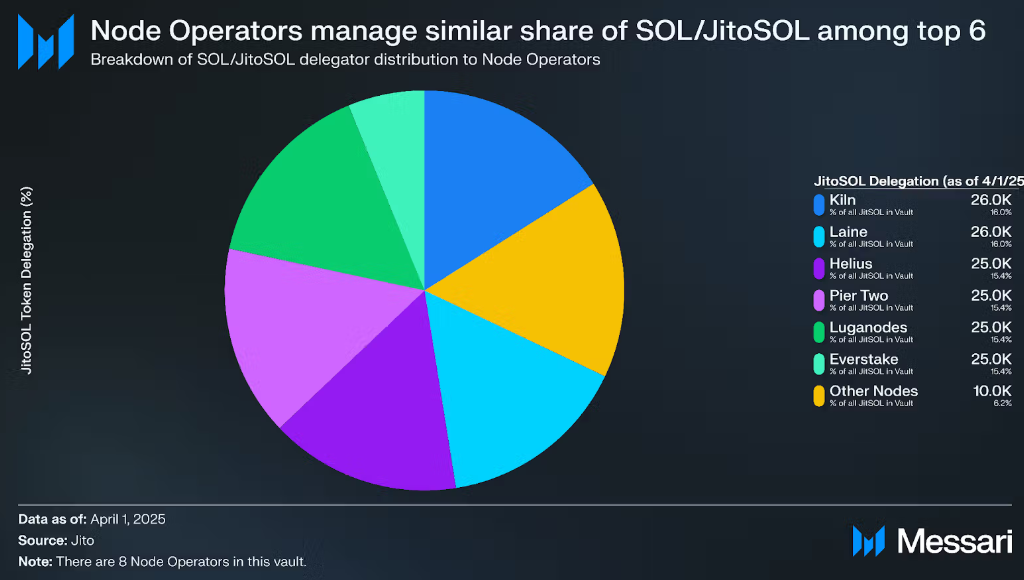

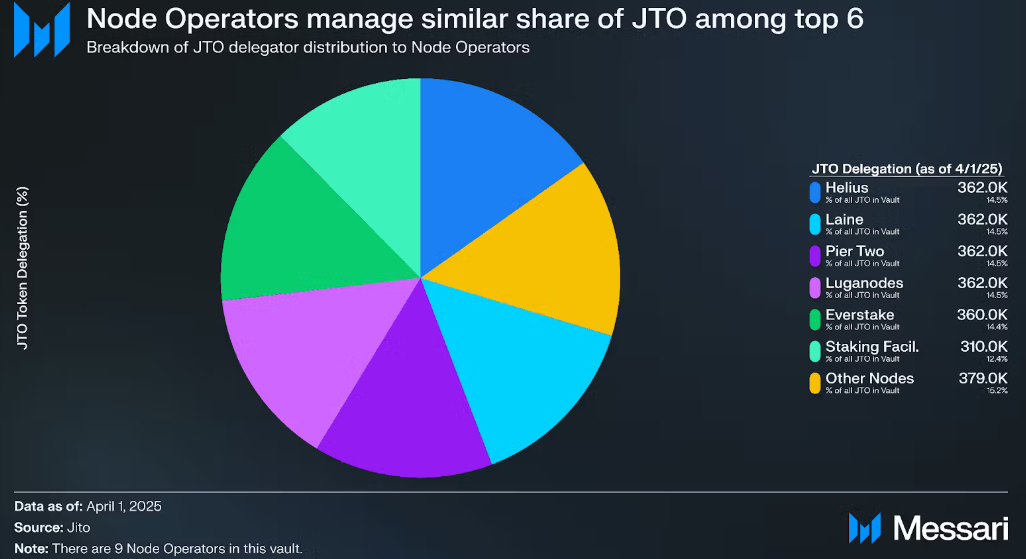

Currently, 9 active NOs are collaborating with Kyros. Eight of them provide security for NCNs in the kySOL vault, and 9 (including Staking Facilities specifically for kyJTO) provide security for the kyJTO vault. The complete list includes: Kiln, Luganodes, Helius, Temporal, Laine, Pier Two, Everstake, InfStones, and Staking Facilities (kyJTO only). Kyros strategically delegates assets based on the performance and historical reliability of NOs to maximize user returns.

In the kySOL vault, the two NOs with the highest underlying asset (JitoSOL) allocation are Kiln and Laine, each receiving 26,000 JitoSOL delegations (16% of the total 162,000). The next four in order of delegation are Helius, Pier Two, Luganodes, and Everstake.

In the kyJTO vault, Helius, Laine, Pier Two, and Luganodes each receive 362,000 JTO delegations (14.5% of the total 2.5 million).

DeFi Applications

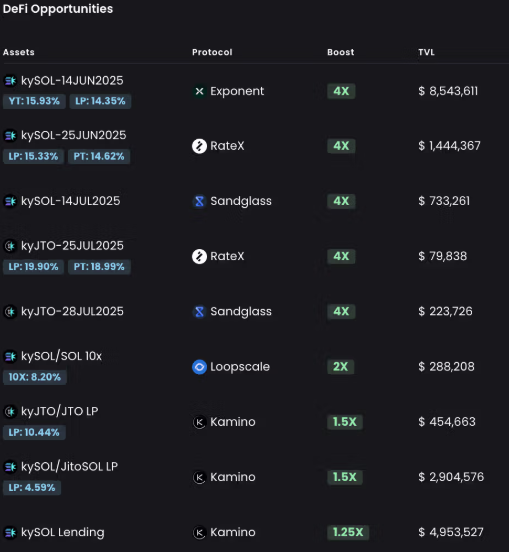

Source: Kyros DeFi

Kyros has integrated kySOL and kyJTO into multiple protocols in the Solana ecosystem, breaking through the limitations of passive income accumulation:

- Lending: Users can collateralize kySOL on the Kamino lending market to borrow JitoSOL, implementing basic leverage strategies

- Liquidity Provision: Collaborating with Jito and Raydium to develop kySOL-JitoSOL and kyJTO-JTO liquidity pools

- Structured Yields:

- Exponent supports buying and selling future income streams by minting/trading YT-kySOL and other yield tokens, providing fixed income or leveraged exposure

- Sandglass, developed by the Lifinity team, enables fixed income trading through a points system based on SOL/kySOL positions

- RateX supports leveraged exposure and fixed APY strategies with kySOL as the underlying asset

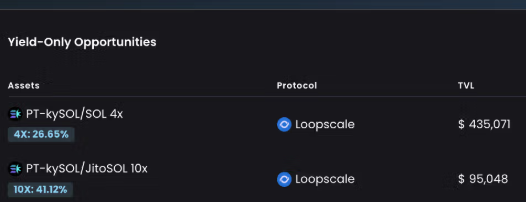

Example explanation: On the Exponent platform, PT-kySOL represents the principal token certificate of the underlying kySOL. Users can exchange kySOL for PT-kySOL expiring on June 14th at an implied 15.9% APY, and then deposit it in Loopscale to obtain up to 4x leverage.

Beyond DeFi, Kyros has partnered with the CeFi asset management platform SwissBorg to provide custodial restaking services for kySOL and kyJTO to retail users. According to SwissBorg's internal data, they have 3,900 kySOL wallet holders and 300 kyJTO wallet holders.

Community Incentives and Token Holding

Kyros has established two programs, "Village" and "Warchest", to encourage continuous user participation in the platform and related DeFi ecosystem.

Village is a task-based participation system where users earn experience points (XP) by completing on-chain or community tasks and advance through a tiered ranking system. These tasks (called "quests") are categorized into three types based on complexity: offensive (strategic actions), defensive (ecosystem support), and loyalty (long-term commitment). Accumulated XP can improve user levels, and although current rewards are non-monetary, higher levels may potentially enjoy additional benefits in the future.

Warchest is a points reward program based on token holding duration, where holding kySOL allows linear point accumulation (calculated by position size and duration). Using kySOL in integrated DeFi protocols provides a points multiplier effect. This program uses a non-custodial mode, with points automatically tracked and displayed on the Kyros interface without active claiming. These two programs aim to guide user long-term behavior in sync with protocol development while strengthening kySOL's adoption in Solana DeFi.

As of April 1st:

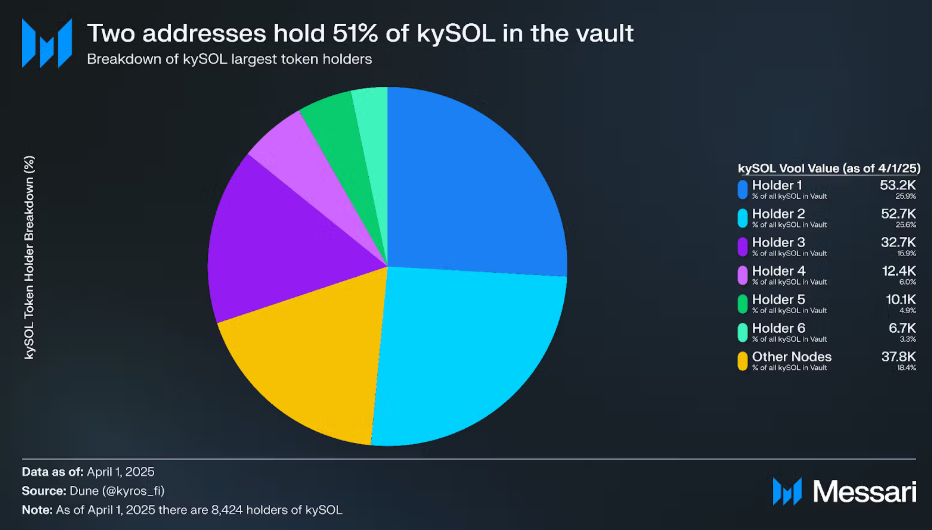

8,400 on-chain kySOL holders, with the top two addresses holding 51% of the total (105,900 kySOL). SwissBorg, a CeFi asset management platform, is the largest holding address, with internal data showing 3,900 managed users.

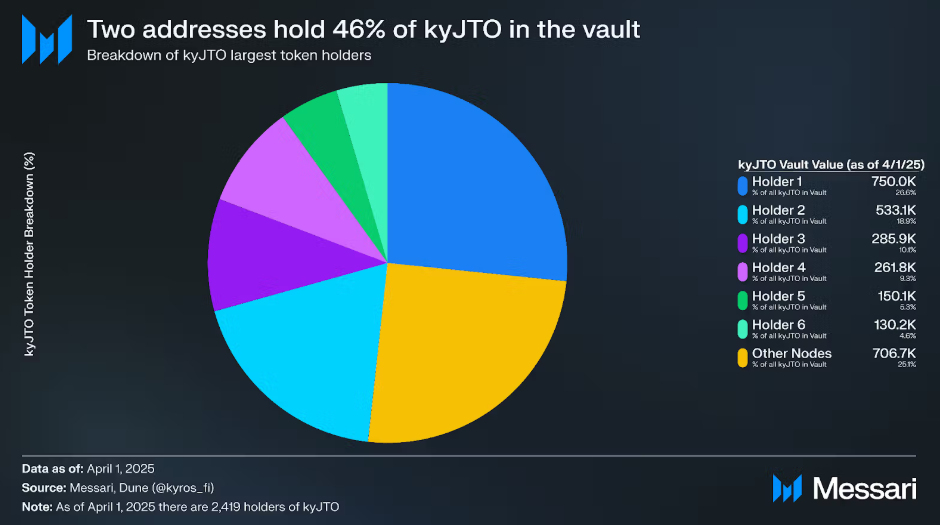

2,400 on-chain kyJTO holders, with the top two addresses holding 46% of the total (1.3 million kyJTO). SwissBorg's kyJTO wallet manages 300 users.

Competitors

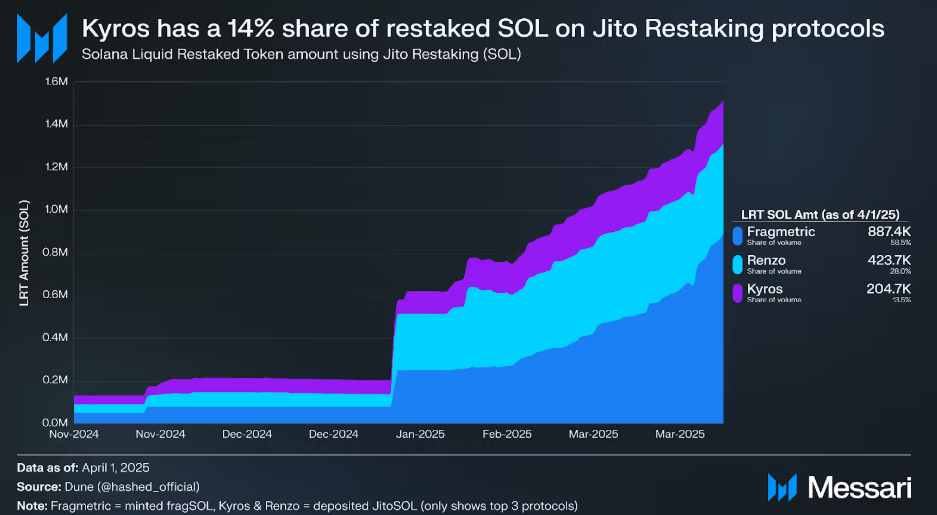

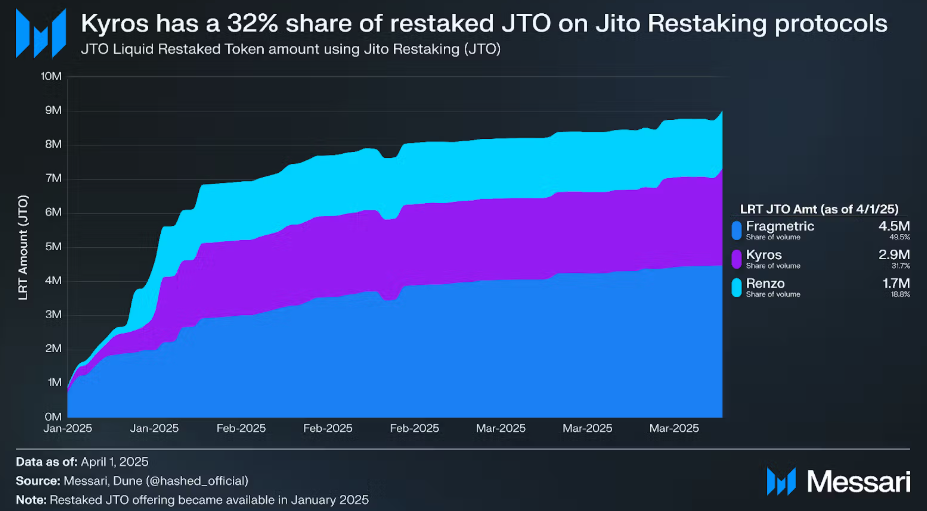

Besides Kyros, active protocols based on Jito's restaking infrastructure include Renzo and Fragmentic, which offer Solana restaking vault services similar to Kyros.

Kyros holds a 14% market share in the Jito ecosystem's SOL restaking market (204,700 out of 1.5 million)

In the Jito JTO restaking market, Kyros holds a 32% market share (2.9 million out of 9 million)

Development Roadmap

In the coming year, Kyros plans to expand its business through the following directions:

- New NCN Integration: Currently connecting with Squads, Ping Network, and Nozomi NCNs to create more yield opportunities for vault assets

- Expand DeFi Support: Will integrate with protocols like MarginFi (lending) and Astrol (lending) to enhance kySOL utility

- Develop New Vault Products: Including restaking services for stablecoins and other assets

Summary

As one of the first liquidity restaking protocols on Solana, Kyros' kySOL/kyJTO vaults built on Jito infrastructure enable users to capture Solana staking rewards, MEV, and restaking incentives while maintaining asset liquidity. Integration with DeFi protocols like Kamino and Exponent further enriches yield strategy options.

Since launching in late 2024, Kyros' TVL has exceeded $36 million (primarily kySOL), currently delegating to 9 node operators and supporting one active NCN, TipRouter. With a 14% market share in the Jito ecosystem's SOL restaking market and 32% in the JTO market, Kyros demonstrates strong development momentum. As the Solana restaking ecosystem evolves, Kyros is poised to play a crucial role in connecting user funds with decentralized infrastructure and expanding market share in the liquidity restaking domain.