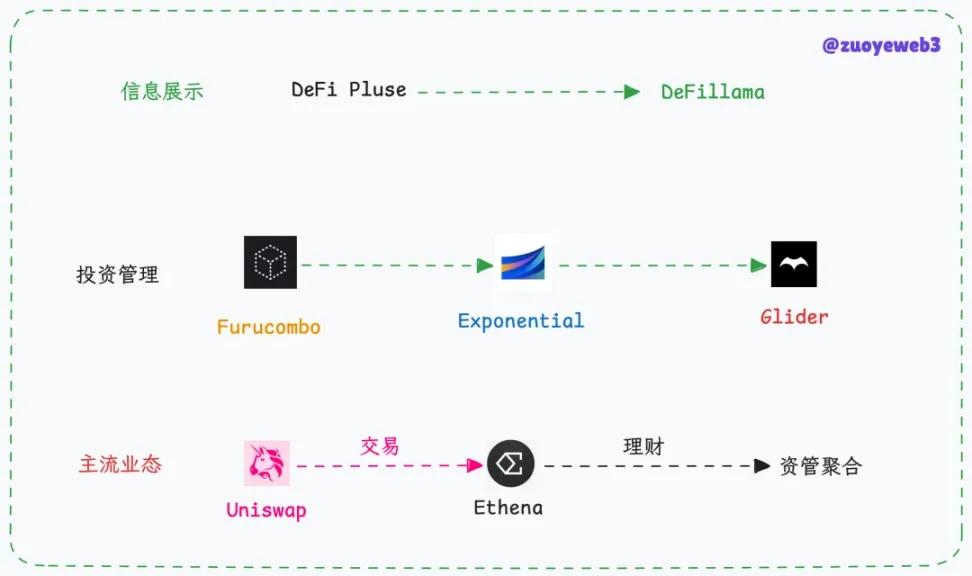

- Complex on-chain activities are being simplified, with technical infrastructure already mature;

- Everything old faces a historical opportunity to be reshaped, and new opportunities have emerged;

- Intent, TG/Onchain Bots, and AI Agents all need to solve authorization issues.

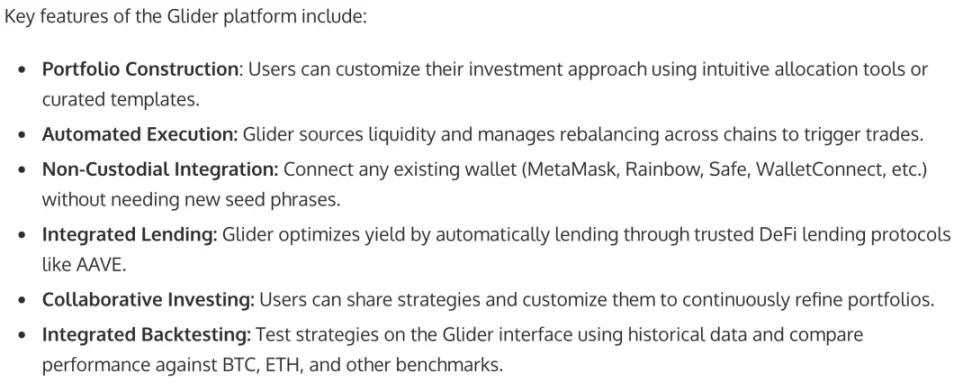

On April 16, Glider completed a $4 million financing round led by a16z CSX (startup accelerator), able to position itself in the seemingly simple but complex on-chain investment field, benefiting from technological trends like Intent and LLM, but DeFi indeed needs to be recombined to simplify investment thresholds.

Image description: DeFi tool development history, image source: @zuoyeweb3

The DeFi Lego era is over, and the era of securely coupled financial management has arrived.

Past: Furucombo Failed Before Getting Started

Glider started in late 2023 as an internal startup at Anagram, initially in the form of Onchain Bots, combining different operational steps to facilitate user investment and usage.

Image description: Glider function preview, image source: businesswire

But this is not a novel business model. Helping users with financial management is a long-term business, both in TradFi and DeFi Summer. Currently, Glider is still in the internal R&D stage. From the PR draft, its rough outline can be described as:

- Connecting existing DeFi tools, including industry leaders and emerging protocols, building a B2B2C customer acquisition logic through API integration;

- Allowing users to build investment strategies and support sharing, facilitating co-investment, copy trading, or collective investment for higher returns.

With the cooperation of AI Agent, LLM, intent, and chain abstraction, building such a stack is not technically difficult. The real challenge lies in traffic operations and trust mechanisms.

Involving user fund transfers is always sensitive, which is the most important reason why on-chain products have not defeated CEX. Most users can accept decentralization in exchange for fund safety but basically do not accept decentralization increasing security risks.

In 2020, Furucombo received investment from institutions like 1kx, focusing on helping users reduce confusion when facing DeFi strategies. If forced to compare, it's most similar to today's MEME Coin tools like GMGN, except that the DeFi era was about combining yield strategies, while GMGN is about discovering high-potential, low-value memes.

However, most people did not remain on Furucombo. On-chain yield strategies are an open market where retail investors cannot compete with whales in terms of servers and capital volume, meaning most yield opportunities cannot be captured by retail investors.

Compared to the unsustainability of yields, safety issues and strategy optimization are secondary, and there was no space for stable financial management in the high-return era.

Now: The Democratization of Asset Management

ETF for the rich, ETS for retail investors.

ETF tools not only run in stock markets but were also tested by exchanges like Binance in 2021. From a technical perspective, asset tokenization ultimately gave birth to the RWA paradigm.

Image description: Exponential page, image source: Exponential

Further, how to complete the on-chain transformation of ETF tools has become a startup focus. From defillama's APY calculation and display to Exponential's continuous operation, all indicate market demand.

Exponential is strictly a strategy sales and display market. With massive professional and precise calculations, human and AI-assisted strategy decisions, but on-chain transparency means no one can truly hide an efficient strategy from imitation and modification, leading to an arms race that ultimately flattens yields.

Ultimately, it becomes a boring game of big fish eating small fish.

However, it has never been standardized to develop into projects that redefine markets like Uniswap, Hyperliquid, or Polymarket.

I've been thinking recently, after the MEME Supercycle ends, the old DeFi form will be hard to revive. Is the industry's peak temporary or permanent?

This relates to whether Web3 is the next step of the internet or FinTech 2.0. If it's the former, human information and capital flow operations will be reshaped. If it's the latter, Stripe + Futu will be the ultimate endpoint.

From Glider's strategy, on-chain yields are about to transform into a democratized asset management era, similar to how index funds and 401(k) created a long bull market in US stocks. With absolute capital volume and a massive number of retail investors, the market will have enormous demand for stable income.

This is the meaning of the next DeFi. Beyond Ethereum, there's Solana. Public chains still need to bear the innovation of Internet 3.0, and DeFi should be FinTech 2.0.

Glider adds AI assistance, but from DeFi Pulse's information display to Furucombo's first attempt and Exponential's stable operation, stable on-chain yields of around 5% will still attract the basic population beyond CEX.

Future: Generating Assets On-chain

Crypto products have developed to a point where only a few truly gain market acceptance:

- Exchanges

- Stablecoins

- DeFi

- Public chains

All other product types, including Non-Fungible Tokens and MEME coins, are just periodic asset issuance models without sustainable self-maintenance capabilities.

However, RWA has been taking root since 2022, especially after the FTX/UST-Luna collapse. As AC said, people don't truly care about decentralization but care more about returns and stability.

Even without the Trump administration actively embracing Bitcoin and blockchain, RWA's productization and practicality are accelerating. If traditional finance can embrace electronization and informatization, there's no reason to abandon blockchain-ization.

In this cycle, whether complex asset types and sources or overwhelming on-chain DeFi strategies, they severely hinder CEX users' migration on-chain. Regardless of Mass Adaptation's authenticity, at least the massive exchange liquidity can be drawn away:

- Ethena converts fee income to on-chain yields through interest alliances;

- Hyperliquid pumps exchange perpetual contracts to on-chain through LP Tokens.

These two cases prove that liquidity can go on-chain, and RWA proves that assets can go on-chain. Now is an industry spectacle moment. ETH is considered lifeless, but everyone is actually going on-chain. In a sense, fat protocols are not conducive to fat applications' development. Perhaps this is also the last dark night before public chains return to infrastructure and application scenarios shine brightly.

Image description: Yield calculation tool, image source: @cshift_io

Beyond these products, vfat Tools as an open-source APY calculation tool has been running for years. De.Fi, Beefy, RWA.xyz all have different focuses, displaying project APYs. The focus of yield tools has increasingly concentrated on generating assets like YBS over time.

Currently, increasing AI trust requires addressing responsibility allocation. Enhancing human intervention would reduce user experience, making it difficult.

Possibly separating information and capital flows, creating a UGC strategy community that makes project parties compete internally and benefits retail investors might be a better way out.

Conclusion

Glider gained market attention due to a16z, but long-term track issues will persist. Authorization and risk issues exist - here, authorization doesn't refer to wallets and funds, but whether AI can satisfy humans. If AI investment results in severe losses, how will responsibility be allocated?

This world is still worth exploring the unknown. Crypto, as a public space in a fractured world, will continue to thrive.