This article is machine translated

Show original

Bitcoin Breaks $93,000, Positive Macroeconomic News Emerges - 0423 Coin Research Weekly Report

🔥 Bitcoin's Safe-Haven Demand Increases: Breaking $93,000, Weak Dollar and Expected Trump Policies Enhance Hedging Appeal

🔥 Positive Macroeconomic News Frequently Reported, Trump Softens Stance on Tariffs with China

🔥 @HyperliquidX Dominates DeFi: TVL Surges 14% in a Week, Daily Trading Volume of $6.4 Billion, Leading DEX

🔥 @Grayscale Enters DeAI: AI

View the full content, welcome to subscribe to the Coin Research Weekly

Let's grasp the weekly macro trend and ambush alpha 💥

Short link: cryptowesearch.substack.com/p/...

📍 @realDonaldTrump said the 145% tariff on China is too high and will be significantly reduced but not returned to zero, emphasizing that the trade negotiations are friendly. The U.S. Treasury Secretary predicts that the easing of the tariff deadlock will boost market growth momentum.

📍Brandon Lutnick, son of the US Secretary of Commerce, joins forces with SoftBank and @Tether_to

, @Bitfinex, builds 21 Capital Bitcoin acquisition platform, receives $3 billion investment, @Tether_to contributes $1.5 billion.

📍

📍Ethereum founder @VitalikButerin suggests replacing Ethereum EVM with RISC-V to improve scalability

📍 @binance co-founder @heyibinance posted on the social platform that he does not participate in any project investment, does not participate in project communication, and does not talk about listing coins.

📍@Bitget observed VOXELUSDT on April 20, 2025, 16:00 to 16:30 (UTC+8) twitter.com/965990932549177344...

📍 @Grayscale announced that its decentralized AI fund is open to investors, focusing on the intersection of AI and crypto, holding NEAR, TAO, etc., with a management fee of 2.5% and an asset size of $1.05 million

📍 @Coinbase launches @Solana asset recovery service, self-service recovery of mistakenly sent SPL tokens, supports thousands of tokens, and will expand to more networks in the future

📍Nasdaq-listed company Upexi receives 1 from @GSR_io

📍 @Circle, @BitGo plan to apply for banking licenses, @coinbase and @Paxos also consider following suit

📍According to @PancakeSwap, $CAKE Token Economics 3.0 will be implemented on April 23, veCAKE and Gauges Voting will be withdrawn, staking will be unlocked, and CAKE can be exchanged 1:1 within 6 months

📍 $USDC Supply increased to $61 billion, up 38.6% year-over-year; $USDT reached 1450 twitter.com/341746855/status/1...

📍 @GalaxyDigital transferred 65,600 ETH (105 million USD) to Binance in two weeks and withdrew 752,240 SOL (98.37 million USD), suspected of converting ETH to SOL

📍 @paradigm transferred 5,500 ETH (8.66 million USD) to @Anchorage at 6:15 (UTC+8) on April 22. In the past year, a total of 96,955 ETH (302 million USD) has been transferred, which is suspected to be in preparation for sale.

📍 @Aave announcement, $RLUSD twitter.com/867100084248469505...

💡 Market Trends

Despite the sharp drop in U.S. stocks, Bitcoin remained above $90,000 on April 22, demonstrating strong resilience. According to data, Bitcoin has outperformed the Nasdaq Index (down 10% year-to-date compared to 16%) amid the trade war and deglobalization, and it is expected that the cryptocurrency regulatory framework to be promoted by the Trump administration will make Bitcoin an important pillar of financial innovation.

The US dollar index has recently fallen to 3.

💡 Release time of important macro events in April (UTC +8)

📍Federal Reserve White Paper on Economic Conditions: April 24

📍Third Crypto Policy Roundtable: April 25

📍University of Michigan Consumer Confidence Index for April: April 25

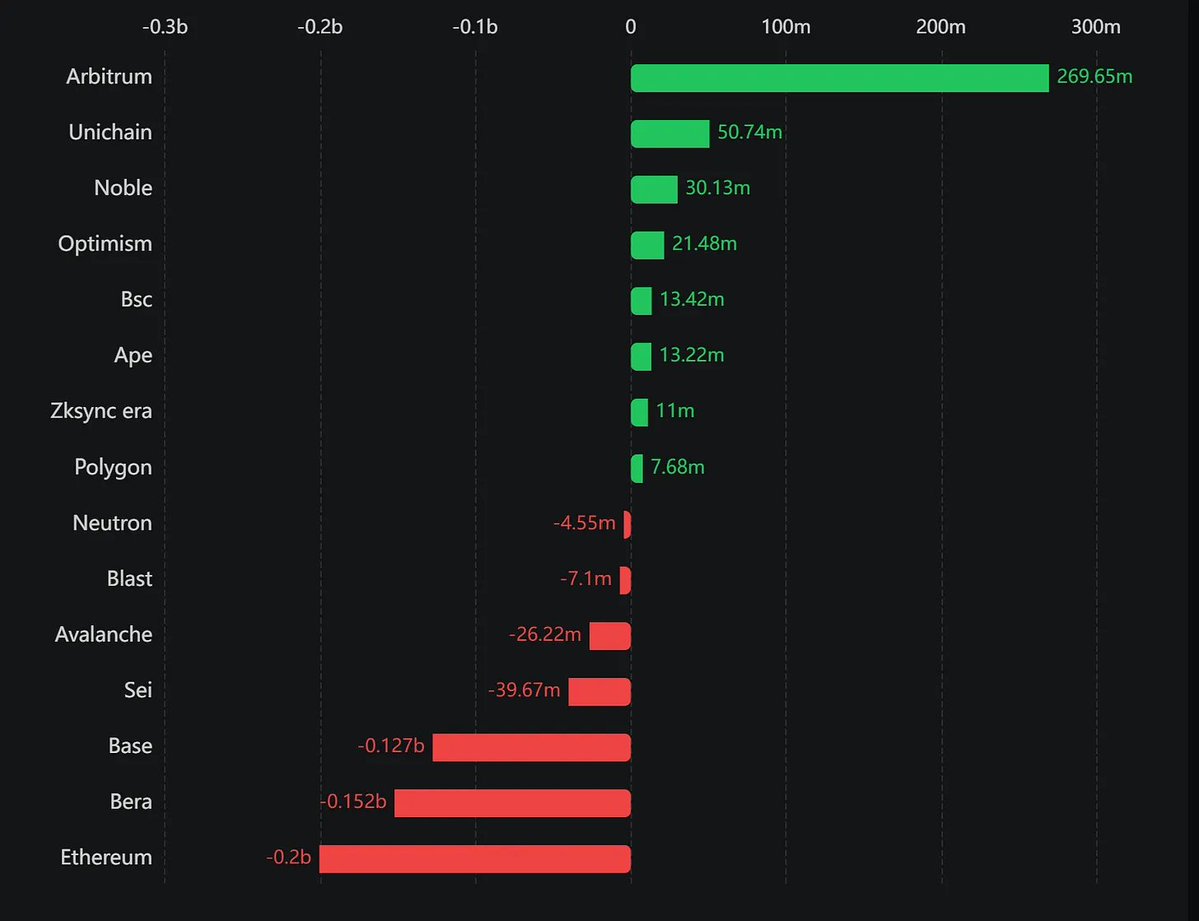

💡Cross-chain net inflow data

📍 @Arbitrum / @HyperliquidX +260 million (previous +290 million) for two consecutive weeks🔥🔥 The @HyperliquidX ecosystem continues to show strong growth, with net inflows exceeding $100 million for multiple weeks in a row. The HyperEVM and perpetual contract markets remain hot, with contract trading volumes increasing significantly.

TVL has increased by 14% in the past 7 days, which is an impressive performance. Recent work with @Cypher_HQ_

📍 @berachain - 152 million (previous - 100 million), consecutive weeks of decline list 💀💀💀 @Berachain has recently faced consecutive weeks of capital outflows. $BERA The price of the coin is currently consolidating in the $3.5 USD range, indicating that this price may be a stage bottom and has certain support. However, affected by the current POL mechanism, the market has seen a continuous phenomenon of "mining, withdrawing and selling", with investors quickly selling after mining, resulting in $BERA

💡TVL Growth List Top 10

📍 @Bitzap_ (57 million, 15 times) is the third-ranked CDP protocol in the @BitlayerLabs ecosystem, with nearly 54 million $wBTC funds flowing into it yesterday

📍 @NapierFinance (33 million, 220%) is a modular yield protocol that supports 13 chains. The recent increase in TVL was boosted by @OpenEden_X's launch on @Napier. The $USDO twitter.com/177442832985425100...

📍 @sandglass_so (10 million, 112%) is a Yield project in the @Solana ecosystem and @Eclipse. It recently attracted US$8 million in capital inflows, with the inflows mainly concentrated on the 18th.

📍 @dropdotmoney (37 million, 109%) is the No. 1 LST project in the @neutron_org ecosystem. Its points program has attracted a total of US$5 million in inflows recently. twitter.com/170656940240424550...

💡 Top 5 Financing List

📍 @Auradine_Inc

(US$153 million) is a US-based bitcoin mining machine manufacturer, led by StepStone Group, with participation from Samsung, Qualcomm, Premji Invest, etc., completing a US$153 million Series C financing, of which US$138 million was equity financing and US$15 million was venture debt.

📍 @LayerZero (5,500

📍 @getoro_xyz ($6 million) is a decentralized AI platform that has completed a $6 million seed round of financing led by a16z Crypto Startup Accelerator (CSX) and Delphi Ventures, with participation from NEAR Protocol, 0G Labs, and others.

📍 @neutrl_labs

($5 million) is a DeFi protocol led by STIX and Accomplice, with participation from Amber Group, Figment twitter.com/189686141418014310...

💡 Featured content - Decentralized AI trends after the AI Agent bubble by @Defi0xJeff

🧾Summary

In the fourth quarter of 2024, the Web3 AI Agent market value surged to $20 billion and then quickly collapsed, exposing its vulnerability to excessive hype. Today, the market is shifting towards infrastructure and decentralized AI (DeAI), emphasizing data sovereignty, transparency, and practical applications.

author

@Defi0xJeff analyzes market transformation, key projects and

The full content is on Biyan Substack, welcome to subscribe🔥

cryptowesearch.substack.com/p/...

🔥 Join the Biyan community to discuss more market opportunities:

📍 Chinese Telegram community: bit.ly/3YmFBrN

📍 Hong Kong Telegram community: bit.ly/HK-TG-Group

📍 Subscribe to the Daily Coin Research Telegram channel:

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content