At the current adjustment period of Web3, the Token Generation Event (TGE) is no longer just a simple financing method, but has become a venue for projects to compete with the market. Especially under the current environment of shrinking liquidity and insufficient investor confidence, how to launch and in what manner has become a topic that project parties must carefully consider.

IDO is a common TGE method. From early platforms like Coinlist, many top-tier projects were born through IDO. However, as the number of projects increased, the wealth effect of IDO has diminished. Binance's every move also constantly stimulates the market's nerves. Since 2025, Binance Wallet IDO has become a choice for many projects to launch. Its characteristics of "low threshold, high heat, and strong traffic" quickly became the market focus, attracting numerous startups and community attention, but it also exposed a series of fundamental changes in the new coin market structure, valuation system, and project logic.

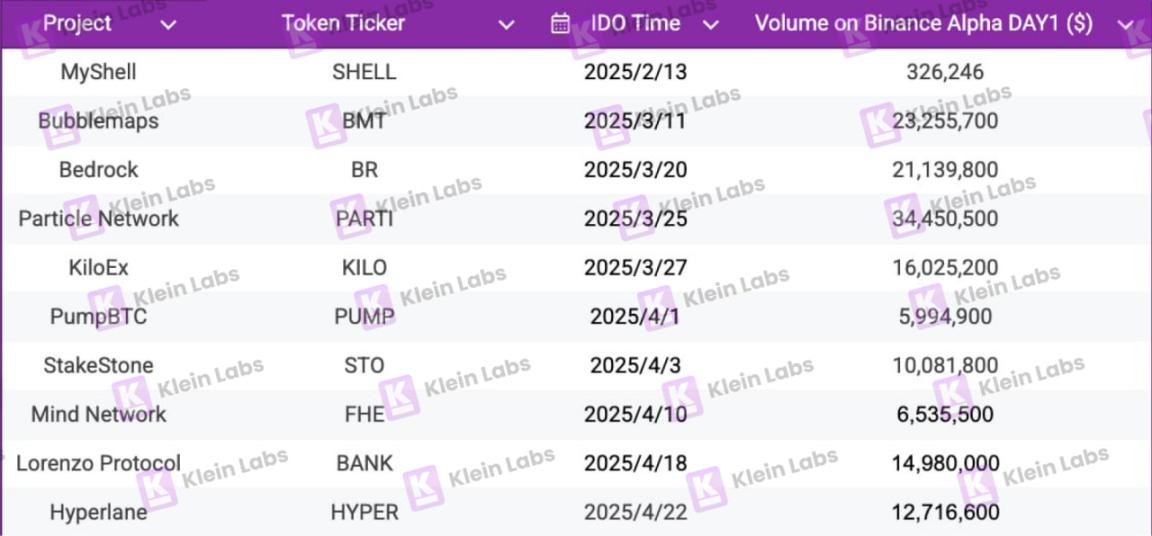

However, is this model truly suitable for every project? Which projects can quickly amplify their narrative and complete a cold start, and which projects might encounter the dilemma of "high opening and low walking" after market hype? The Klein Labs Research team conducted a systematic data research and structural breakdown of 10 already-launched Binance Wallet IDO projects, attempting to help project parties make smarter decisions from a strategic perspective.

I. Background: What Market Cycle Are We In?

We can clearly observe the evolution of market investment preferences over the past few months:

Early preference: High valuation + Low circulation model (VC-led, short-term speculation)

Mid-term frenzy: Fully circulated MEME Coin model (zero-threshold hype)

Current turning point: The market is returning to focus on projects with strong fundamentals and sustainability

Meanwhile, the TGE model is also experiencing a three-stage evolution:

Early model: Low valuation issuance + Market value discovery mechanism (narrative-driven)

Mid-term model: High valuation issuance + Insider arbitrage (through OTC or immediate selling after release)

Current state: Returning to low valuation opening (lack of buying, no one willing to "take over")

The most intuitive manifestation of this market state is the low-valuation launch of Binance Wallet IDO projects. Project parties must exchange a slight market attention with extremely low valuation and release ratio. Behind this is an important logic:

The TGE valuation is not a reflection of the "project's future value", but a current comprehensive mapping of market liquidity, listing expectations, narrative intensity, and market-making system.

(Translation continues in the same manner for the rest of the text, maintaining the specified translation rules for specific terms)

PARTI, BMT, and BR projects stand out, with first-day trading volumes exceeding $20 million each

High trading volumes are not only related to initial traffic but are closely linked to the project's narrative strength, token economic design, and market expectation management;

IDO is just the "ignition point" of enthusiasm, and whether the heat can be maintained and the secondary market can be ignited depends on the project's execution and operational rhythm control. Many underperforming projects quickly become silent after TGE, either due to lack of continuous content output to maintain topic heat or because of market management losing control, leading to rapid confidence decline.

Summary: Binance Wallet IDO is a "Value Filter" and a Narrative Verification

Binance Wallet IDO is a structured, high-leverage cold start method for Web3 projects to launch narratives, build consensus, and amplify attention. It provides project teams with a set of "opening scripts" to leverage large volumes at a small cost, but also places extremely high demands on team execution, operational planning, and market management capabilities.

The performance data of Binance Wallet IDO reflects the profound evolution of the entire market's valuation logic and issuance model. It is neither an endpoint nor a pass, but a window for low-cost validation of product vision and market mechanism trial and error.

Precisely because the current market is in the late stage of low confidence + low liquidity + high vigilance, it is more necessary for projects truly willing to build long-term to come forward and use Binance Wallet IDO to showcase their product value, narrative rhythm, and operational capabilities.

It is not suitable for everyone, but for teams with clear stories, definite rhythm, and long-term construction intentions, it is an important springboard to enter the Binance ecosystem and mainstream market vision. In the window period of bubble burst, the market returns to the value source. For teams truly wanting to do something and having a long-term vision, this is actually a positive signal.

Like all platform-type IDOs, after the brief pleasure, how can the feast continue? This is also a question Binance Wallet needs to consider. Simply put, if Binance Wallet IDO can continue to be the preferred launch platform for high-quality assets, its life cycle can be extended as much as possible. Behind this is the understanding of "high-quality assets". What projects does the industry need? Which projects are suitable for development in this world? Each of us needs to think deeply.