Yesterday, Bitcoin Exchange Traded Funds (ETFs) saw significant inflows, marking the third consecutive day of positive cash flow.

With BTC currently trading back above the 90,000 USD mark, there are signs of renewed institutional interest, as major players seem to be returning to the market after several cautious weeks.

BTC ETF Inflows Increase 146% in One Day

On Wednesday, the net inflows of US Bitcoin Spot ETFs surged to 936.43 million USD, a 146% increase from the previous day's 381.40 million USD.

Total net inflows of Bitcoin Spot ETF. Source: SosoValue

Total net inflows of Bitcoin Spot ETF. Source: SosoValueThis also represents the largest single-day inflow since January 17, indicating a significant revival in institutional demand for BTC exposure.

Ark Invest and 21Shares' ARKB ETF led the inflows, recording the highest daily net inflow of 267.10 million USD, bringing the cumulative net inflow to 2.87 billion USD.

Fidelity's FBTC ETF followed with a net inflow of 253.82 million USD. The total historical net inflow of this ETF currently stands at 11.62 billion USD.

BTC Price Rises Strongly, but Derivative Traders Bet on Decline

On the derivatives side, the open interest in BTC futures also increased, reflecting increased trading activity and speculative positions as the coin attempts to stabilize above 90,000 USD.

BTC was trading at 93,548 USD at the time of writing, showing a 6% price increase over the past day. During the same period, the open interest of futures contracts also increased by 16%. At this point, it stands at 67.19 billion USD, the highest since January 24.

Open interest of BTC futures contracts. Source: Coinglass

Open interest of BTC futures contracts. Source: CoinglassWhen an asset's price and open interest rise simultaneously, it indicates strong confidence in this movement. This means more Capital is flowing into the market to support the upward trend.

However, not all indicators point to optimism.

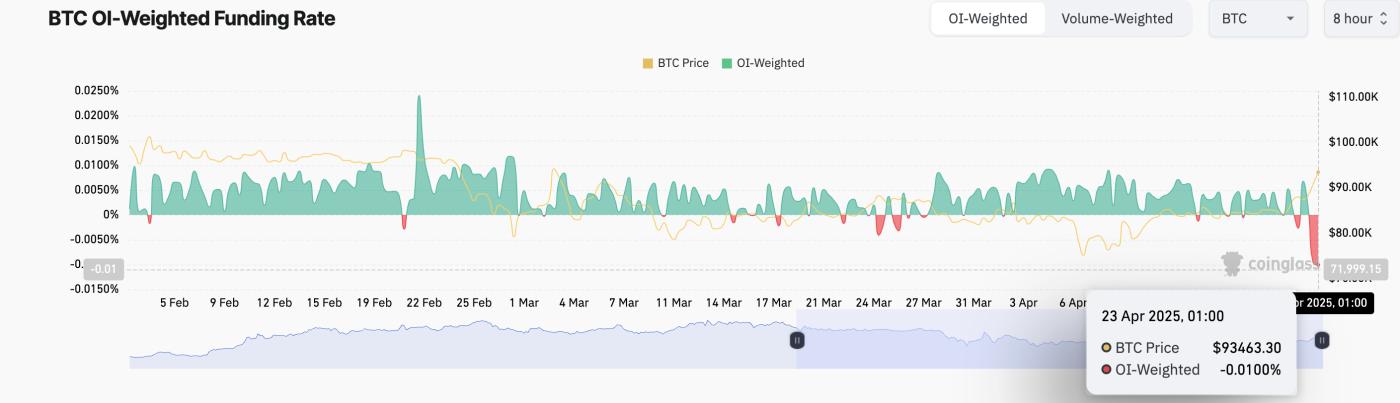

Despite BTC's price increase, the funding rate remains negative, suggesting that traders are paying to short the coin in the futures market. The current funding rate is -0.01%.

BTC funding rate. Source: Coinglass

BTC funding rate. Source: CoinglassThe negative funding rate for BTC means that short sellers are paying long-term buyers to maintain their positions. This indicates that many traders are betting against the current BTC price increase and anticipating a downward reversal.

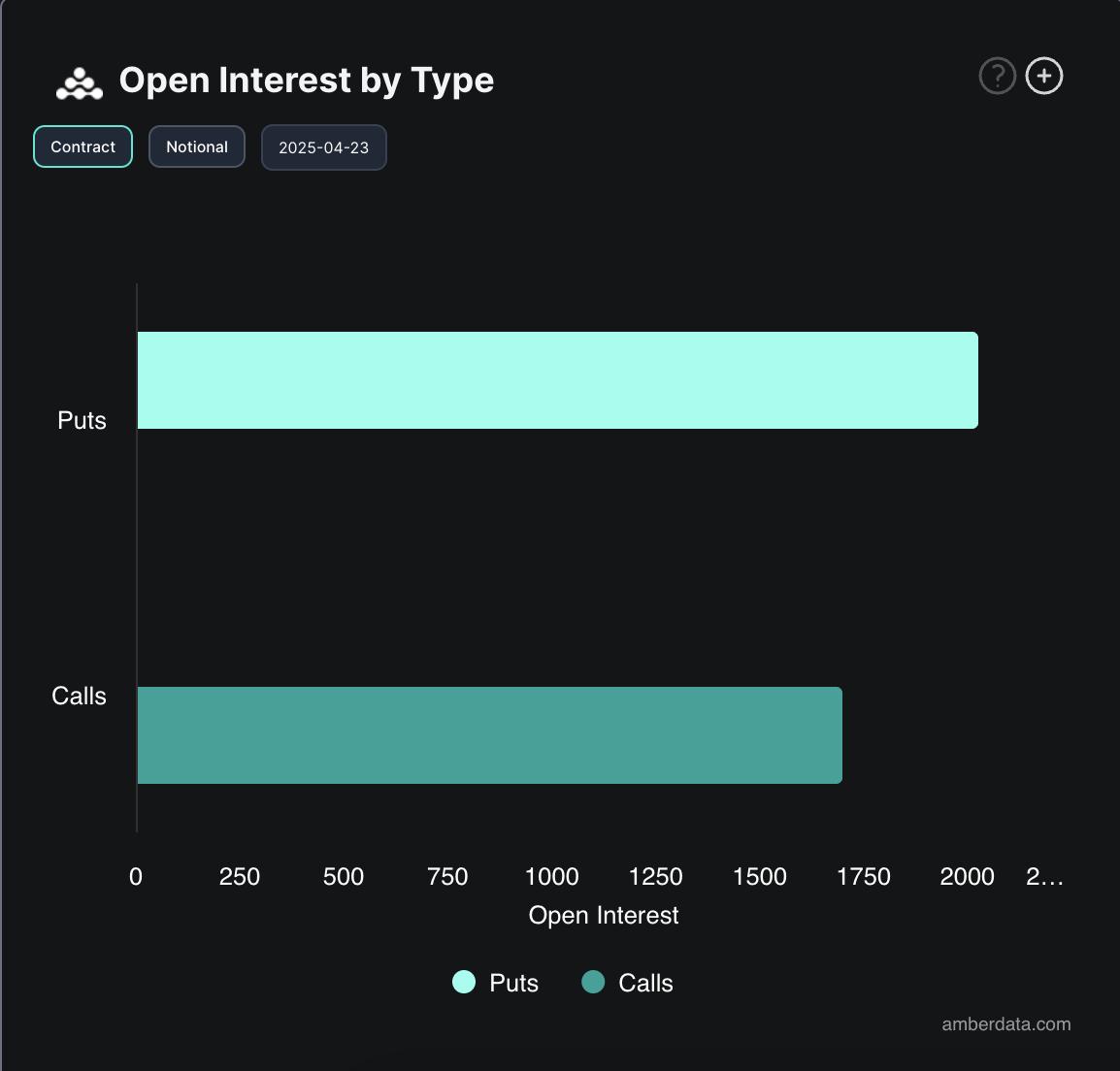

Additionally, the put-to-call ratio leans towards a price decline. This confirms the decrease in investor confidence and expectations of price reduction among BTC options traders.

Open interest of Bitcoin options. Source: Deribit

Open interest of Bitcoin options. Source: DeribitWith BTC fluctuating above an important psychological level and institutional inflows increasing, the coming days may reveal whether this momentum will be maintained.