According to the latest report from Financial Times, Cantor Fitzgerald, a financial services company led by Brandon Lutnick, son of US Commerce Secretary Howard Lutnick, is collaborating with SoftBank, Tether, and Bitfinex to establish a Bitcoin (BTC) Investment Vehicles with a scale of over 3 billion USD.

This initiative emerges in a context where BTC is recovering, with notable increases in the past day.

Is Cantor Fitzgerald trying to recreate Strategy's success with Bitcoin?

Financial Times, citing sources close to the matter, reveals that Lutnick's special purpose acquisition company (SPAC), Cantor Equity Partner, raised 200 million USD in January. This amount will be used to fund the establishment of a new company called 21 Capital.

The cryptocurrency companies participating in this initiative are contributing large amounts of Bitcoin to 21 Capital. The stablecoin giant Tether will contribute 1.5 billion USD worth of BTC. Meanwhile, Bitfinex exchange will contribute 600 million USD, and SoftBank, the Japanese multinational investment company, will provide 900 million USD.

This brings the total Bitcoin contributions from partners to 3 billion USD. Moreover, this move also emphasizes SoftBank's growing interest in the cryptocurrency sector.

"Masayoshi Son's biggest bet on Bitcoin so far," Matthew Sigel of VanEck commented on X.

The cryptocurrency investments will be converted into 21 Capital shares at 10 USD per share, with Bitcoin valued at 85,000 USD per coin. In addition to partner contributions, the SPAC also plans to raise additional capital through 350 million USD convertible bonds and a 200 million USD private share issuance to purchase more Bitcoin.

"Although the deal is likely to be announced in the coming weeks, it may still not materialize and the numbers may change," FT wrote.

This initiative aims to emulate the success of the largest BTC holding company, Strategy (formerly MicroStrategy). The company has been buying BTC since 2020, accumulating a total of 538,200 coins valued at 50.14 billion USD at the time of writing, according to SaylorTracker. The company is holding unrealized profits of approximately 39.8%.

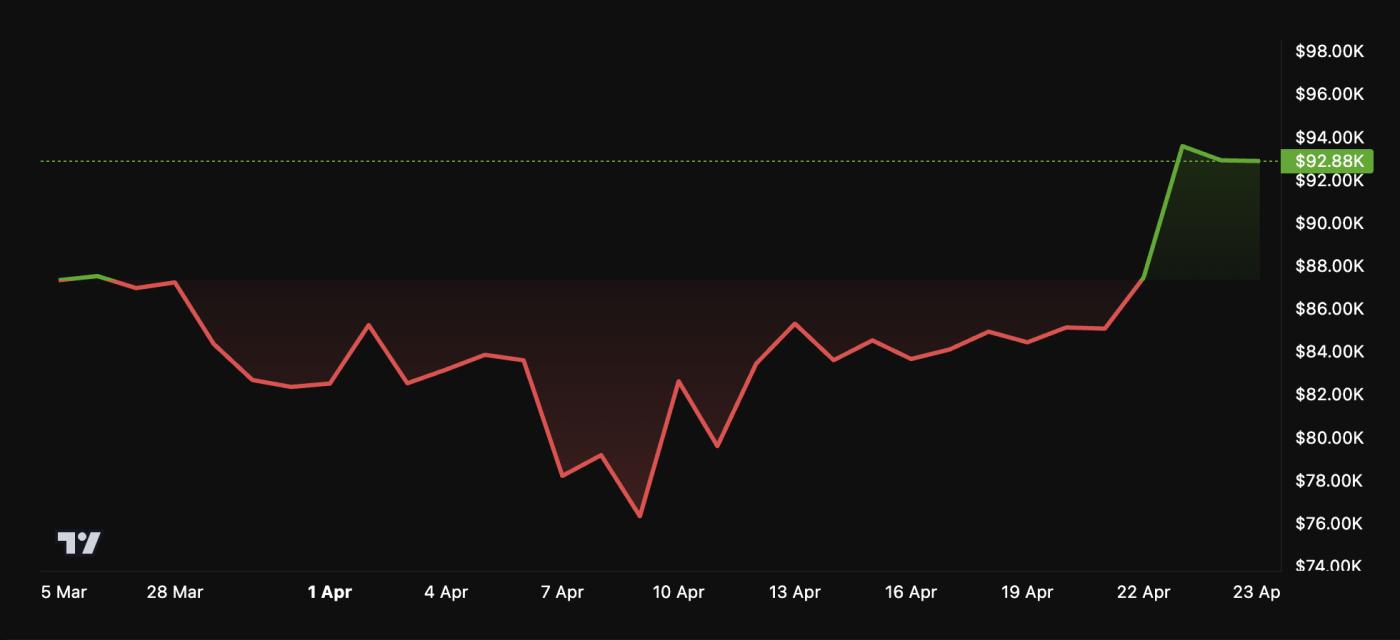

Meanwhile, Bitcoin, the center of this initiative, has seen a significant recovery recently. As BeInCrypto previously reported, the largest cryptocurrency has surpassed the 90,000 USD mark for the first time in seven weeks. In the past day, it increased by 5.3% to trade at 92,862 USD.

BTC Price Performance. Source: BeInCrypto

BTC Price Performance. Source: BeInCrypto"You start to think Bitcoin is rising like a sound monetary value storage against inflation, but the market gods have a sick sense of humor and it turns out it's just a Cantor/SoftBank/Tether MSTR 2.0 from start to finish," an analyst posted on X.

As this alliance moves forward, its success will likely depend on Bitcoin's long-term performance and broader cryptocurrency regulatory prospects.