Tesla's Q1/2025 financial report reveals that despite not meeting revenue expectations, the company still holds over $951 million worth of Bitcoin.

After initial purchase in February 2021 and selling 75% of its Bitcoin holdings in July 2022, Tesla currently holds approximately 11,509 BTC.

Bitcoin Remains Tesla's Strategic Asset

According to a filing with the US Securities and Exchange Commission (SEC) on 04/22/2025, Tesla's Q1 revenue reached $19.34 billion. This figure is significantly lower than the market expectation of $21.37 billion.

The electric vehicle segment, Tesla's primary revenue source, decreased by 20% compared to the same period last year. The main reason is a 13% reduction in deliveries and a 16% decrease in production.

Nevertheless, Tesla's stock price has dropped 41% since the beginning of 2025, under pressure from controversies surrounding CEO Elon Musk related to his government role and ongoing protests against the company.

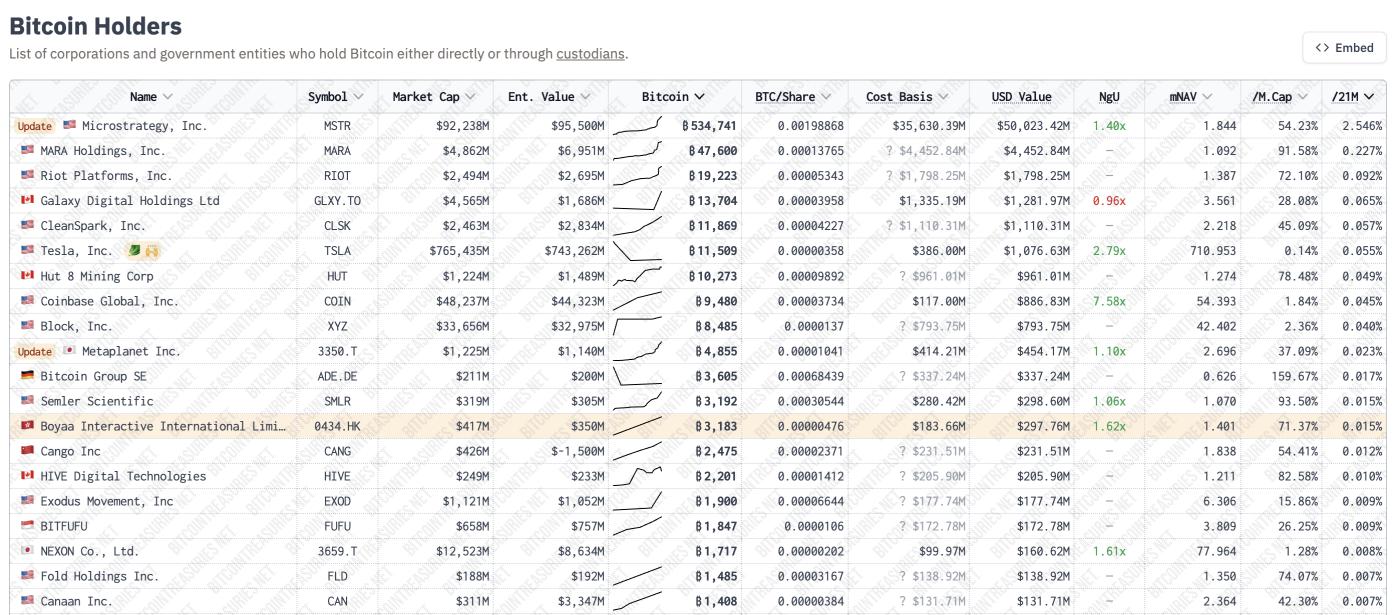

A key point of interest in Tesla's Q1/2025 financial report for the crypto community is the amount of Bitcoin the company holds. As of 03/31/2025, Tesla owns 11,509 Bitcoin, valued at approximately $951 million, according to data from Bitcointreasuries.net.

Tesla's BTC Holdings. Source: Bitcointreasuries.net.

Tesla's BTC Holdings. Source: Bitcointreasuries.net.Bitcoin's 12% decline in Q1/2025 slightly reduced Tesla's BTC value from $1.076 billion at the end of 2024. However, with Bitcoin price increasing 6% to $93,000, the value of Tesla's Bitcoin has once again surpassed $1 billion.

New regulations from the Financial Accounting Standards Board (FASB) require companies to mark digital assets at market value each quarter, impacting Tesla's financial report. Previously, these regulations allowed Tesla to recognize $600 million in profits from Bitcoin in Q4/2024 due to market price increases.

Consequently, Tesla made no Bitcoin-related transactions this quarter. This indicates the company is maintaining a HODL strategy, viewing Bitcoin as part of its strategic investment portfolio. Other large companies, like Strategy and Metaplanet, are also pursuing this long-term holding approach.

Elon Musk Refocuses on Tesla

Tesla's continued Bitcoin holding amid market volatility shows Elon Musk's belief in the cryptocurrency's long-term potential. However, this also raises questions about the fate of Tesla's BTC, especially as Musk plans to reduce focus on DOGE and shift attention back to Tesla starting this May.

"Not resigning, just reducing allocation time as @DOGE is set up," Musk stated.

Currently, Tesla stands at a critical crossroads, with Dan Ives, an analyst at Wedbush, calling this a "red alert situation." If the current situation continues, Musk may be forced to restructure Tesla's financial strategy, including the Bitcoin holdings.

BeInCrypto reports that the cryptocurrency market will be volatile in the short term until mid-May 2025, due to economic pressures and uncertainty about trade policies. The market may stabilize from mid to late Q2, supported by historical trends and loose monetary policies. Strong growth is predicted in Q3, driven by Bitcoin's post-halving cycle, institutional acceptance, and clearer cryptocurrency regulations in the US.