1/ Markets are green and risk is back on the menu.

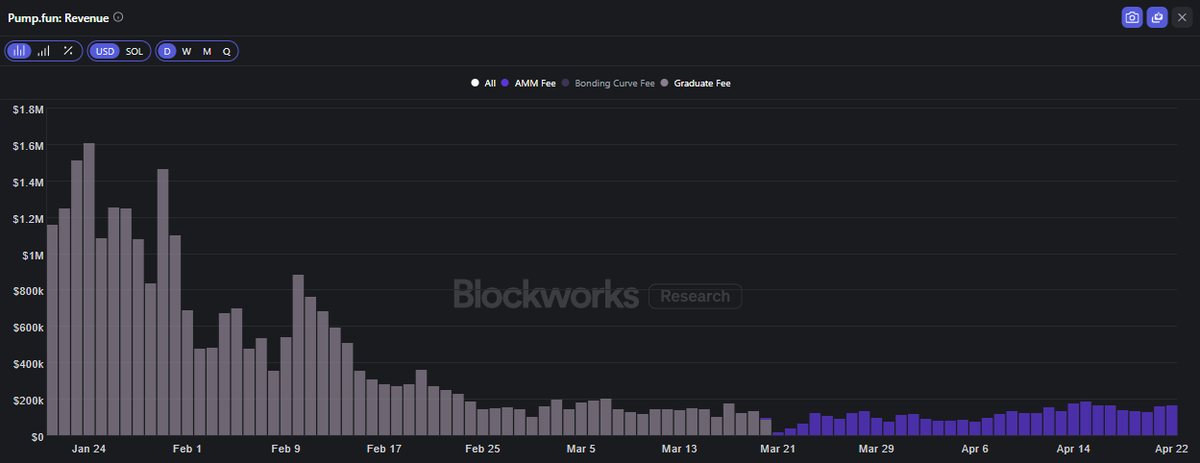

It's been a month since @pumpdotfun introduced their native AMM and removed graduation fees.

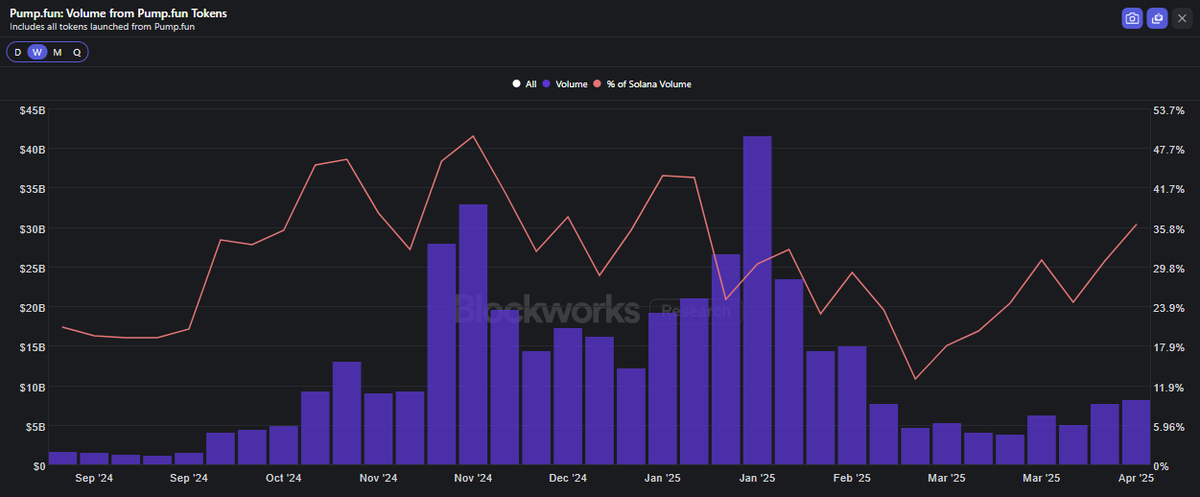

Daily AMM volume has quickly risen to more than $400M, while bonding curve volume has quietly doubled since early March.

2/ While the AMM volumes appear significant, AMM revenues have only just started to reach parity with prior graduation fee revenue.

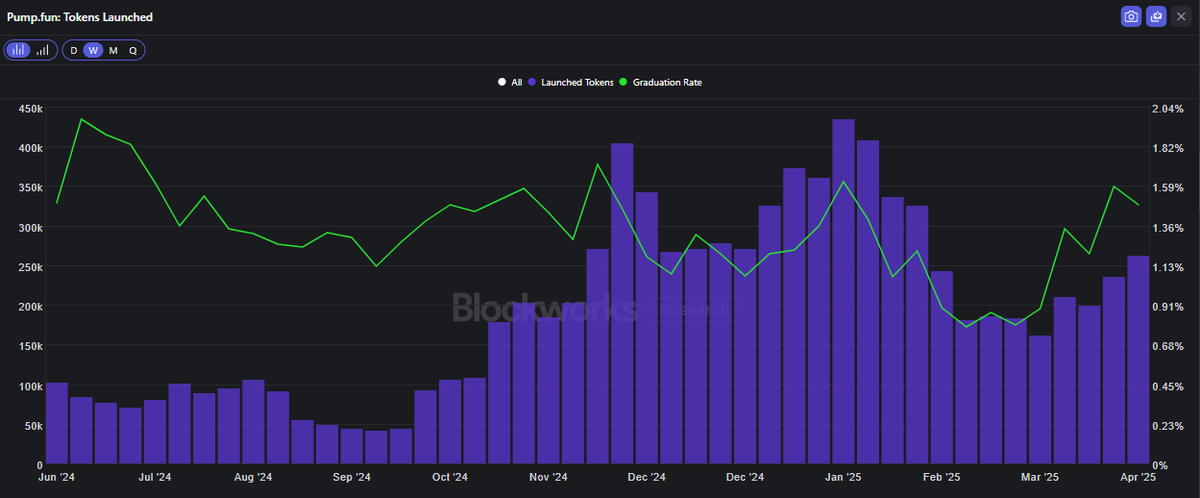

3/ The change to instant graduations in March and the recent bounce in the market have contributed to a sharp increase in token graduation rates.

Launched tokens briefly fell to November '24 levels before bouncing back and are now ticking back towards the highs of January.

4/ While volumes declined 80-90% from peak to trough, pumpfun token volumes have started to dominate overall Solana DEX volume again.

From a low of 12% back in late February, pumpfun token volume as a % of total Solana DEX volume has eclipsed 35% again.

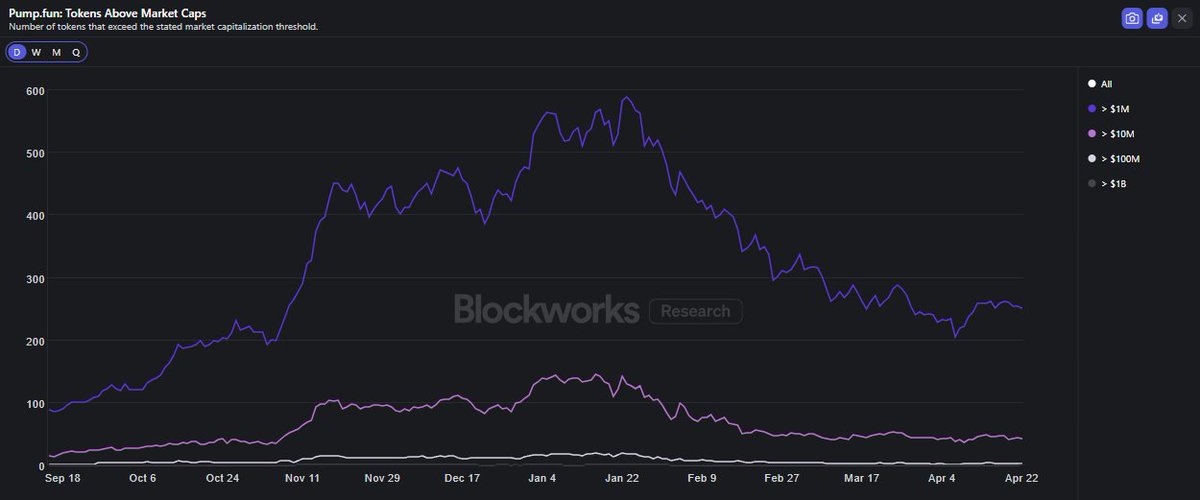

5/ Even though it seems that the memecoin rotation games have become increasingly short-lived,

pumpfun tokens above $1M market cap appear to be making higher lows compared to pre-election levels.

6/ Overall, pumpfun seems very much alive and well.

Many metrics are making higher lows on a long-term basis, and token launches and relative volume are grinding back towards their Q1 highs.

Subscribe to Blockworks Research for direct access to our full pumpfun dashboard.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content