Original Title: Mind-shifts Amidst The Chaos

Original Author: The Learning Pill (@thelearningpill)

Translated by: Asher (@Asher_0210)

In the uncertain world of the crypto market, technical analysis and token economics provide limited support. The real competitive advantage stems from the mindset: the psychological models that influence decision-making under complex market conditions. In other words, successful crypto investment depends not only on fundamental analysis or market trends, but also on mastering probabilistic thinking, profoundly understanding second-order effects, seeking asymmetric investment opportunities with returns far greater than risks, building anti-fragile strategies that become more resilient in turbulence, clearly assessing the opportunity cost of each investment, identifying and following emerging market narratives, effectively managing one's attention to avoid noise, maintaining a long-term investment perspective, avoiding linking personal identity with investment performance, and focusing on optimizing the investment process rather than single trade outcomes.

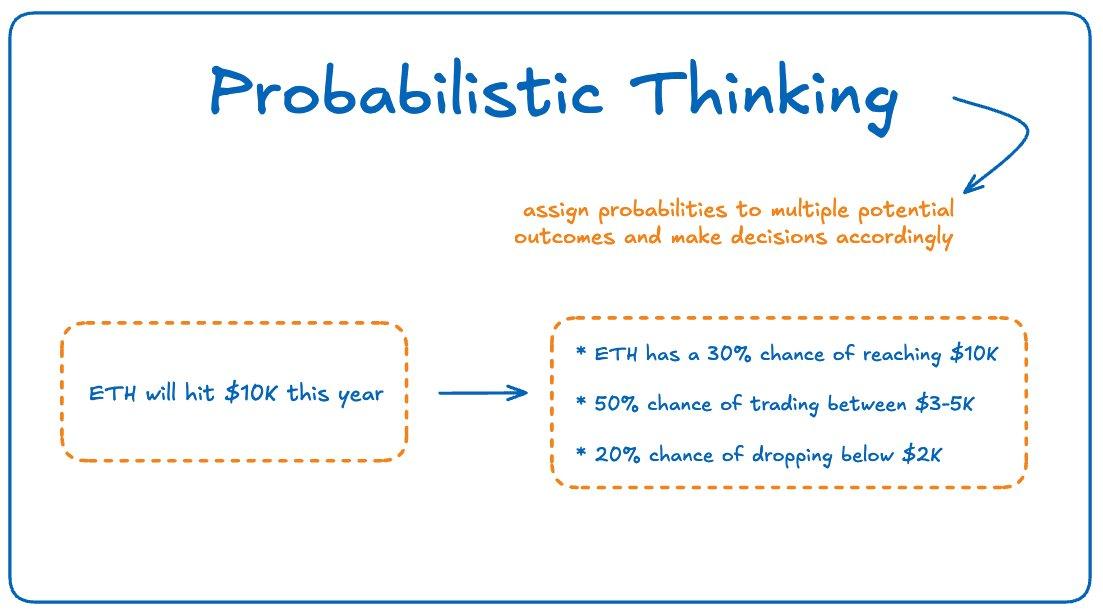

I. Probabilistic Thinking: Replacing Certainty with Odds

Most crypto investors fall into binary thinking: "This project will definitely rise 10x" or "The market will certainly crash". This absolutist mindset leads to overconfidence, incorrect position sizing, and emotional collapse when predictions fail. Efficient crypto investors are different; they assign probabilities to multiple possible outcomes and make decisions accordingly. Instead of saying "ETH will definitely rise to $10,000 this year", they would say "ETH has a 30% probability of rising to $10,000, a 50% probability of fluctuating between $3,000 and $5,000, and a 20% probability of falling below $2,000".

Probabilistic thinking enables one to:

Reasonably allocate positions based on risk;

Prepare response plans for multiple possible scenarios;

Make rational decisions in uncertainty;

Maintain emotional stability during extreme market volatility.

When using probabilistic thinking, investors are never completely wrong, but merely adjust probability distributions as new information arrives.

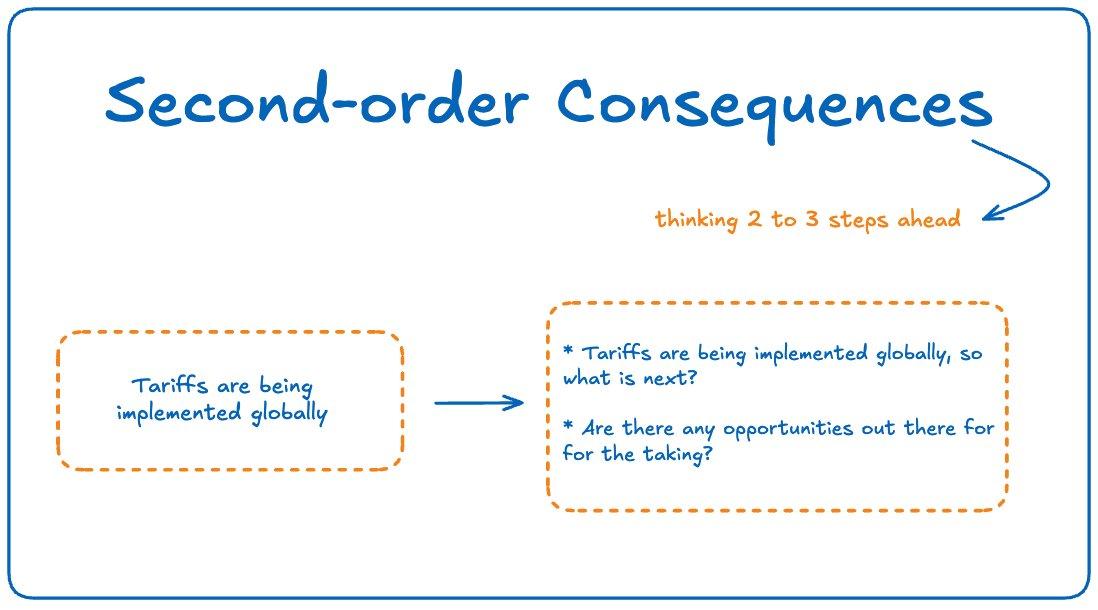

II. Second-Order Effects: Insights Beyond the Surface

Ordinary investors often react intuitively to news, while efficient crypto investors ask: "What will happen next?" For example, when China banned crypto mining, many panic-sold. However, those thinking from a second-order effect perspective realized this would lead to mining decentralization, potentially enhancing Bitcoin's long-term risk resistance, and thus made corresponding layouts.

Second-order effects can train automatic thinking two or three steps ahead, helping to:

Predict market trends in advance;

Identify hidden risks behind seemingly positive news;

Discover masked opportunities in seemingly negative news;

Layout in advance before mass reactions.

The most profitable insights often exist in these second or third-order effects, which many investors completely overlook.

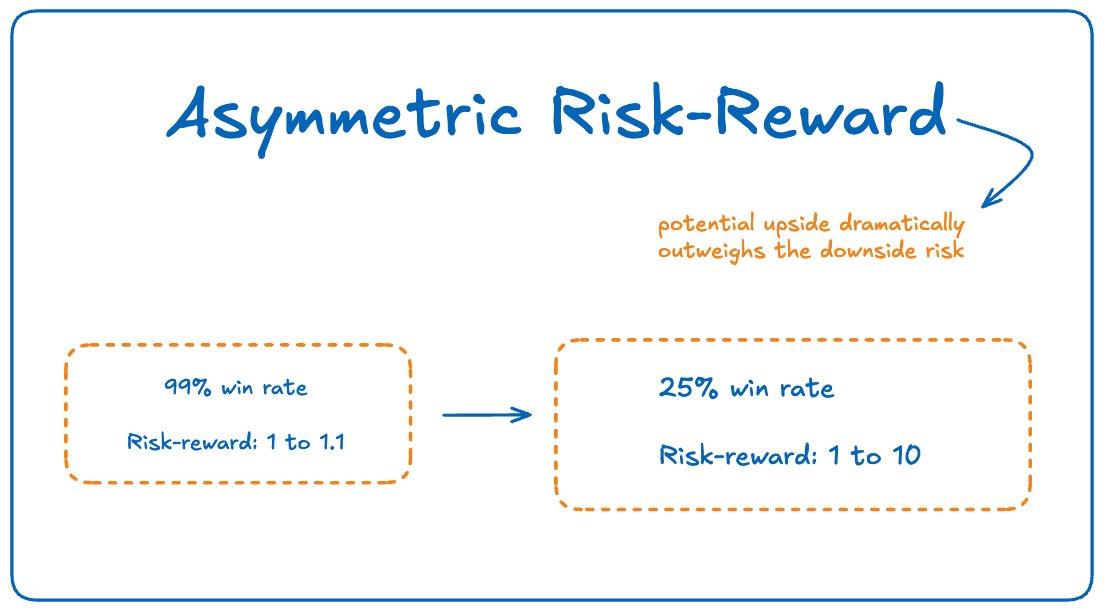

III. Asymmetric Risk-Reward: The Only Game Worth Playing

Traditional wisdom tells you to seek "good investments", but efficient crypto investors seek asymmetric investment opportunities where potential returns significantly exceed downside risks. Asymmetric risk-reward means the investment portfolio should be able to withstand numerous small losses while capturing occasional massive gains, including:

Adjusting position sizes so that even complete failure won't cause major damage to your portfolio;

Seeking opportunities where you might lose 1x but can earn 10x, 50x, or even 100x;

Exchanging lower success rates for greater returns;

Avoiding situations with moderate returns accompanied by catastrophic downside risks.

Especially in the crypto field, returns follow a power law distribution, where a life-changing winner can surpass decades of "safe" traditional investments.

(The translation continues in the same manner for the remaining sections.)Build a system to help investors identify true signals from noise;

Arrange dedicated deep work time for research and analysis.

The highest returns come from deep thinking on a few things, rather than shallow attention to everything.

Eight, Expectation Value Oriented: Focus on Process, Not Results

Most investors always focus too much on a single trading result, while efficient crypto investors focus on the positive expected value of their decision system through multiple iterations, shifting from result-oriented to process-oriented means:

Not discouraged by inevitable losses;

Evaluate decisions based on available information at the time, not in hindsight;

Continuously improve the decision process, rather than dwelling on individual trades;

Understand that even good decisions may lead to undesirable results in the short term.

By focusing on the expected value across multiple decisions, rather than the result of a single trade, a sustainable approach can be built over time.

True Alpha Lies in Personal Thinking Approach

As the crypto market matures, investors' biggest competitive advantage will be their way of thinking. The above thinking models are not just abstract concepts, but practical thinking tools that can help investors distinguish themselves from those wavering in FOMO and panic.

The good news is that while the market is difficult to predict, thinking approaches can be controlled. By consciously cultivating these mindset shifts, investors can maintain clarity and confidence even in the most turbulent markets, which most participants lack. Do not update trading strategies and mindsets just to cope with the current market cycle.