Editor: Yoyo

As the crypto market bids farewell to its frenzy and enters a sustained adjustment period with low volatility, market focus has gradually shifted from chasing short-term meme coins to assets with stronger fundamental support - platform tokens. As the core carrier of centralized exchange value, they are not only a barometer of exchange ecosystems but also key assets for holders to obtain platform development dividends and earn diversified returns.

However, in the current sluggish market, different platform tokens show significant differences in performance and actual revenue strategies for holders. Who can provide a better risk-return ratio? This article will comprehensively compare mainstream platform tokens from different tiers, including Binance (BNB), MEXC (MX), Gate.io (GT), and WEEX (WXT), exploring platform token value capture strategies during the bear market.

I. Ecosystem Empowerment of Platform Token Holding

Various cryptocurrency exchanges incentivize users to participate in ecosystem construction through diversified platform token activities, enhancing the holding value and market attractiveness of platform tokens.

- Token Holding Airdrops: Low-Risk + High-Flexibility Earnings Model

Token holding airdrops are a common incentive method in the crypto market, where project parties freely distribute new tokens to known token holders, rewarding long-term support and promotion of new projects. Centralized exchanges have adopted this model by airdropping newly listed project tokens to platform token holders, incentivizing long-term holders and enhancing platform token value.

Compared to locked-in subscriptions, token holding airdrops do not require fund freezing, keeping funds immediately available and reducing price volatility risk, suitable for low-risk preference investors. This low-risk, high-flexibility approach allows users to participate in airdrops of multiple different projects by holding a single platform token, sharing new project growth potential. For example, users holding 100 MX can freely obtain dozens of new tokens, easily accumulating returns.

[The translation continues in the same professional and accurate manner, maintaining the original structure and meaning while translating to English.]MEXC Launchpool allows users to stake MX to obtain new coins for free. From March 3 to April 13, three Launchpool events were held, with an average annual yield of 31.25%. By strictly screening high-potential projects, improving new coin performance, and providing substantial short-term returns for MX holders. At the same time, the low number of participants (around 5,000) optimizes reward distribution, enhancing per capita returns for MX stakers, creating a value depression.

II. Platform Currency Fee Advantages: Key Variables for Transaction Cost Control

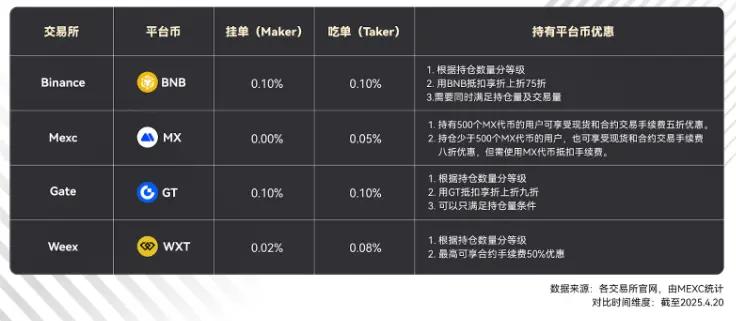

Almost all centralized exchanges inevitably bind fee discounts deeply with their platform currencies, forming an important means of attracting and retaining users, especially active traders. However, behind the word "discount", the specific rules of each platform differ, as shown in the comparison below:

- CEX Fee Basic Structure: Maker/Taker and VIP Level System

Usually, transaction fees are divided into two roles: Maker and Taker:

- Maker: Refers to orders that provide liquidity, where your limit order does not immediately match with current market orders but enters the Order Book waiting for counterparty matching. Exchanges usually encourage this behavior, so Maker rates are often lower than Taker rates, and may even be zero or negative (rebate).

- Taker: Refers to orders that consume liquidity, where your order (usually a market order or an immediately executable limit order) directly matches with existing orders in the Order Book, taking away market liquidity. Taker rates are usually higher.

In addition to the basic Maker/Taker rates, most exchanges also have a VIP level system. Users' VIP levels are typically determined by their trading volume in the past 30 days, total account assets, or platform currency holdings. The higher the level, the lower the Maker and Taker rates enjoyed. This is a common mechanism to encourage large and high-frequency traders.

- Basic Rates and Platform Currency Holding Discount Mechanism

- Binance (BNB): Maker 0.10% / Taker 0.10%

- MEXC (MX): Maker 0.00% / Taker 0.05%

- Gate.io (GT): Maker 0.10% / Taker 0.10%

- Weex (WXT): Maker 0.02% / Taker 0.08%

At the starting line without any discounts, MEXC's 0.00% Maker rate is extremely competitive, with almost zero cost for order placing traders. Its 0.05% Taker rate is also lower than the other three. Weex's Maker rate (0.02%) is better than Binance/Gate.io, but its Taker rate (0.08%) is higher than MEXC. Binance and Gate.io use the industry-common 0.10% as the basic rate.

In terms of platform currency holding discount mechanism, Binance directly links its main benchmark discount to BNB token consumption. Although the discount percentage is considerable, it naturally means that BNB assets will decrease with trading frequency. To obtain rates beyond this basic discount, one needs to enter its VIP system, which has entry conditions based on both trading volume and holdings, with relatively strict thresholds, favoring high-net-worth or high-frequency traders.

MEXC's fee structure is already extremely friendly to order placers at the basic level. Its incentives for MX holders are designed through two clear paths. The core advantage is reflected in a holdings-driven high discount mechanism: reaching a specific holding threshold (500 MX) enables significant rate reductions for spot and contract trading. The most critical differentiating factor is that this core discount can be obtained without users consuming MX tokens for payment. This design greatly improves capital efficiency, allowing users to enjoy low-cost trading while completely retaining MX assets for other ecosystem participation or value investment. Another tier provides basic discounts for small holders, but requires token payment.

Gate.io's advantage lies in the more flexible VIP promotion conditions, allowing users to qualify through either holdings or trading volume. The direct token payment discount is relatively limited. Weex's incentive model is entirely based on WXT holding levels, with 10,000 WXT providing only a 10% discount, and reaching the maximum 50% discount requiring 3,000,000 WXT holdings.

- Comparative Insights: MX's Competitiveness in Cost Savings

In summary, holding MX has more significant advantages in reducing transaction costs:

- Low rate starting point: 0% Maker rate advantage is huge.

- High and easily obtainable core discount: 50% universal discount with 500 MX holdings, with a relatively accessible threshold.

- Non-consumptive holding: Core discount can be enjoyed without consuming MX, perfectly matching the "holding is value" logic.

In comparison, Binance discounts require BNB consumption and have strict VIP requirements; Gate.io and Weex's VIP systems have low discount cost-effectiveness. For users who want to strictly control transaction costs while hoping to fully hold platform currencies to capture other values (such as ecosystem participation or token appreciation), the path provided by MX is obviously superior.

III. Token Market Performance: Value Support and Growth Potential

The market performance of platform currencies, including price fluctuations and liquidity levels, jointly constitute key dimensions for assessing investment potential.

1. Price Resilience Analysis: Safe Haven Effect in Bear Market?

Platform currencies are often considered to have certain anti-fall properties during market corrections, possibly due to their holder structure (more focused on platform functions and new token earnings rather than pure speculation) and continuous buyback and burn mechanisms providing value support. The following chart selects a significant market downturn from January 1, 2025, to April 15, analyzing the price performance of various platform currencies, especially the maximum decline from the highest to lowest point during the period of April 5-8, 2025:

Data shows that during the sharp decline from April 5 to 8, MX demonstrated the strongest resilience. BNB and GT had similar maximum declines, both experiencing around 12.5% downward pressure. WXT experienced the largest intraday decline (about 15.9%). Overall, in this specific market correction, MX's anti-fall ability was most prominent. It's worth considering whether this relative resilience is indeed related to the holder structure. For MX, many holders might be more focused on obtaining new token earnings from MEXC's Launchpool and Kickstarter activities. This holding motivation aimed at platform benefits, compared to pure price speculation, might lead to lower selling willingness during market downturns, forming a certain demand floor and constituting the basis of its price resilience.

2. Trading Volume: Market Attention and Liquidity Depth

High trading volume usually means high market attention, good liquidity, and lower trading slippage, which is especially important for large traders. We analyzed the average daily trading volume (ADV) of various platform currencies from March 1, 2025, to April 15, 2025, and calculated the trading volume/market value ratio (understandable as relative trading volume) to evaluate their relative activity:

The unique aspect of MX lies in its combination of "medium market capitalization + high trading volume", which from a traditional financial perspective might indicate potential undervaluation and greater growth space.As shown in the figure, MX's trading volume/market value ratio (approximately 7.27%) is far higher than other tokens, which means that relative to its market value scale, MX has a very active turnover rate. The potential reasons may include: on one hand, MEXC platform's frequent Launchpool and Kickstarter activities directly drive user acquisition and holding of MX, forming a unique "new project economy" moat, meaning users hold and possibly frequently trade MX to meet participation thresholds, constituting strong utility demand and trading momentum. On the other hand, trading activities are highly concentrated on MEXC itself, amplifying its liquidity performance on its home ground. At the same time, the possibility of medium market capitalization more easily attracting speculative funds seeking high volatility cannot be ruled out.

Regardless of the reason, high relative trading volume is usually a positive signal, reflecting higher market attention and good liquidity, reducing the risk of slippage and inability to trade for large transactions.

IV. Summary

In the bear market downturn, platform tokens as the core assets of exchange ecosystems provide investors with diversified revenue paths and value capture opportunities. This article, by comparing BNB, MX, GT, and WXT across dimensions of airdrops, Launchpool, fee discounts, and market performance, reveals the unique positioning of each platform token.

MEXC's MX demonstrates excellent risk-return ratio and capital efficiency through high-frequency airdrops (43 events, 9.22% yield rate, -9.4% decline), high-yield Launchpool (31.25% yield rate, ≈5000 participants), 0% Maker fee, and 7.27% trading volume/market value ratio. Its carefully selected project strategy and low participation number optimization of reward distribution significantly enhance token stability and user returns. In comparison, BNB benefits from Binance's scale effect, while GT and WXT focus on flexibility and fees respectively. In the future, the long-term value of platform tokens will increasingly depend on ecosystem empowerment and market resilience. MX provides investors with an efficient value anchor during the bear market through its new project economy and trading cost advantages, making it worthy of attention.