Author: Frank, PANews

Over the past year, stablecoin market capitalization has grown significantly, with increasingly diverse application scenarios. Beyond serving as "hard currency" in crypto-native environments like DeFi, its role is continuously expanding, with a broader trend of penetrating Web2 payment, cross-border settlement, and value storage domains.

The massive market and potential of stablecoins have made them a key resource that all public chains are competing for. To support these larger-scale real-world application scenarios, higher requirements are placed on the basic performance and ecosystem preferences of public chains.

In this silent financial pipeline revolution, BNB Chain has constructed a three-dimensional infrastructure system with "performance axis-ecosystem axis-scenario axis", quietly paving the highway for future finance.

Data provides the most direct evidence, with more users, projects, and institutions choosing to conduct stablecoin-related activities on BNB Chain. Recently, the Trump family's WLFI-launched USD1 stablecoin also chose BNB Chain as its primary issuance battlefield, with the chain accounting for nearly 90% of its total circulation. The market cap of USD1 on BNB Chain has already exceeded $110 million.

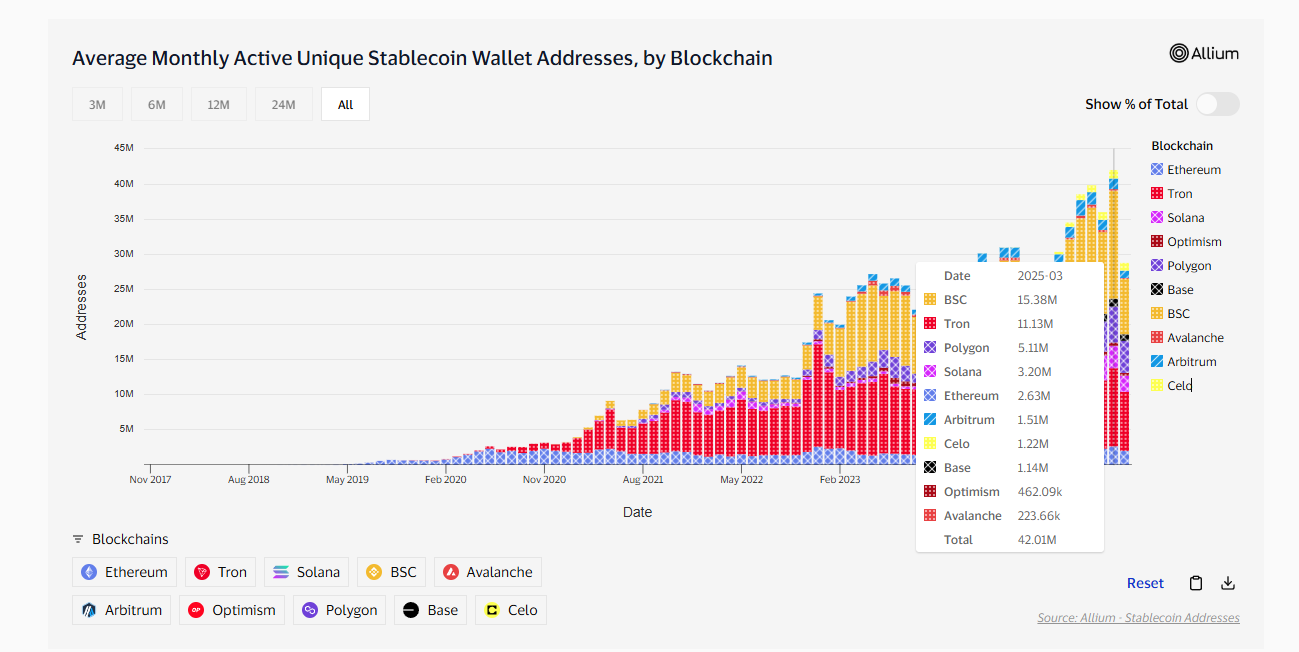

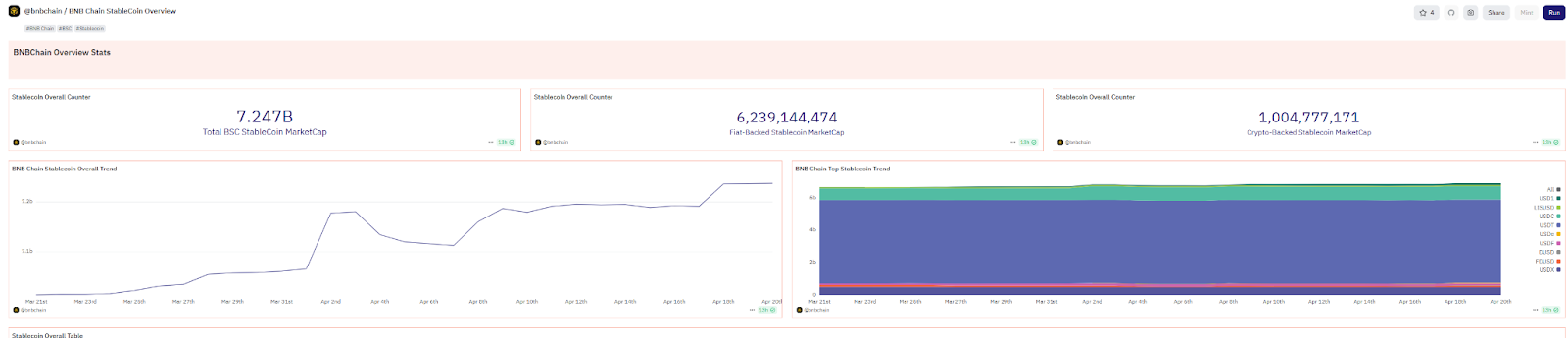

In March 2025, BNB Chain's active stablecoin independent wallet addresses reached a historical high, surpassing 15.38 million, leading other public chains. In the past month, the number of active USDT addresses on BNB Chain reached 12 million, ranking first. Over the past year, the stablecoin market value on BNB Chain grew by approximately 75%, demonstrating strong capital attraction.

Forging the "Three-Pole Engine" of Financial Highway

In the process of stablecoin penetration into the real economy, BNB Chain builds value transfer infrastructure through a three-level power system: a high-speed transmission shaft with 3-second block confirmation + 5000 TPS processing capacity; a zero-friction bearing with costs as low as $0.03 and a zero Gas plan; and a modular chassis of BSC mainnet + opBNB expansion layer + Greenfield storage.

In terms of performance, BNB Chain's mainnet BSC has a block time of about 3 seconds, which will drop to 1.5 seconds after the Lorentz upgrade this month, far faster than Ethereum's approximately 12 seconds. In transaction processing capacity (TPS), its theoretical capacity can reach 5000 TPS. In comparison, Ethereum's TPS after merging (PoS) is about 30, with a historical peak test of around 22.7. Powerful performance provides a fundamental guarantee for large-scale, real-time stablecoin applications.

Architecturally, its multi-chain architecture (universal BSC, expansion layer opBNB, storage layer Greenfield) is meeting the needs of different application scenarios, providing a flexible basis for stablecoin integration across various applications. This strategic shift means BNB Chain aims not just to be a stablecoin channel, but the core platform for stablecoin value creation.

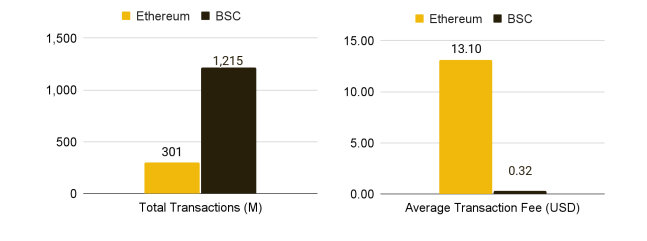

Cost is also a key factor for large-scale stablecoin applications, especially in small payment scenarios. BSC's average transaction fee is extremely low, between $0.03 and $0.11, about 1/30 of Ethereum's fee. This means that even if a user makes 100 stablecoin transfers on BSC daily, the total cost might be only around $3 (calculated at $0.03 per transaction).

[The translation continues in the same professional and accurate manner for the rest of the text.]The emerging ListaDAO represents a new trend in the lending field, combining Liquidity Staking Derivative Finance (LSDFi). Users can mortgage assets such as BNB or liquidity staking tokens like slisBNB, borrowing the protocol's native stablecoin lisUSD or the recently launched USD-pegged stablecoin USD1. As of April 2025, ListaDAO's TVL on BNB Chain has reached $748 million, with total borrowings of approximately $155 million.

These lending protocols greatly expand the use of stablecoins, making them an important tool for obtaining liquidity, leveraging, or implementing yield strategies.

Beyond DeFi, BNB Chain is actively promoting stablecoins in real-world payment scenarios, connecting on-chain value with offline consumption.

On the streets of Bangkok, users have enjoyed first-order free rides and BNB Chain stablecoin payments through the TADA Telegram mini-program; in Singapore malls, dtcpay's Visa card instantly converts stablecoins into fiat currency for consumption—these scenarios are transforming crypto experiments into everyday financial reality.

From DeFi to payments, from on-chain to off-chain, from transaction processing to value circulation. BNB Chain continuously expands the application boundaries of stablecoins and plays a crucial role in promoting their integration into the global payment system, laying a solid foundation for the popularization and mainstreaming of stablecoins.

As stablecoins gradually transition from crypto-native finance to broader real-world scenarios, the underlying blockchain infrastructure is experiencing a profound reshuffling. In this reconstruction of a new order, BNB Chain is quietly becoming the backbone of this transformation with its high performance, low cost, strong ecosystem, security, and top-tier resource integration capabilities.

Here, stablecoins become the highway to future finance, the starting point for reaching the next billion users.