Stripe, a leading global payment infrastructure company, is entering the stablecoin market as this sector continues to develop.

On April 25th, CEO Patrick Collison confirmed that the company is actively developing a stablecoin-based product, marking an important milestone after nearly a decade of internal discussions.

Stripe launches stablecoin product supported by Bridge acquisition

Collison revealed that Stripe had long envisioned this project but only recently found a suitable environment to proceed.

The company has not yet shared deep details about its moves. However, the plan indicates that the initial deployment will target businesses outside the United States, European Union, and United Kingdom.

Stripe entered the stablecoins market shortly after acquiring Bridge for $1.1 billion in February, a company specializing in stablecoin infrastructure. Bridge's technology is expected to be the foundation for Stripe's upcoming digital currency initiatives.

This confirmation follows increasing speculation about Stripe's interest in blockchain technology. Stripe, a company processing transactions in over 135 currencies and supporting billions of dollars in global trade annually, views stablecoins as a natural extension of its services.

Adding a stablecoin product could provide businesses with faster, cheaper, and more efficient cross-border transaction processing.

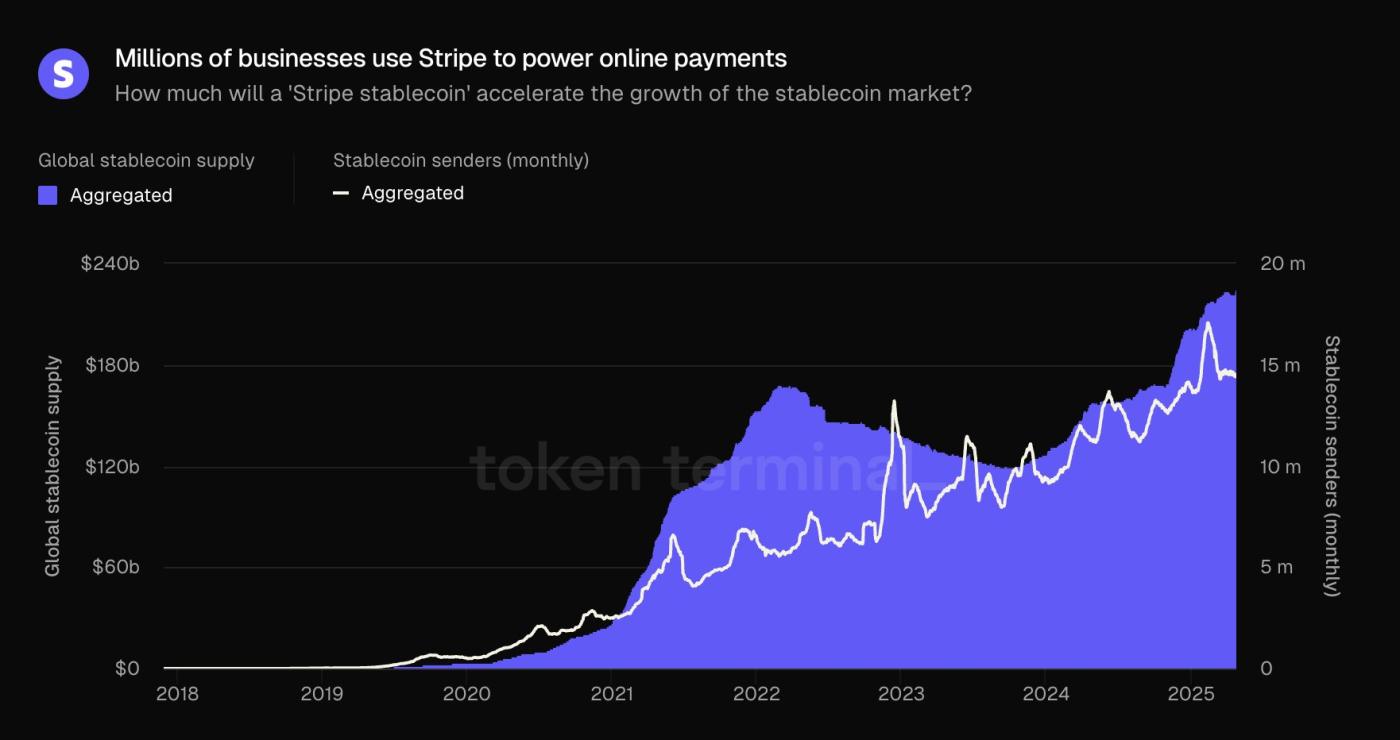

Over 15 million businesses use Stripe's payment solutions. Source: X/Token Terminal

Over 15 million businesses use Stripe's payment solutions. Source: X/Token TerminalThis move by the payment giant occurs as other large fintech companies are also exploring stablecoins. Major traditional financial institutions like PayPal have interacted with this sector, highlighting its growing momentum.

Currently, the stablecoin market is dominated by major players like Tether (USDT) and Circle (USDC).

However, industry analysts, including those at Standard Chartered, believe stablecoin circulation could exceed $2 trillion by 2028, driven by greater regulatory clarity.

In Washington, legislators are advancing bills to provide oversight and structure for the stablecoin industry.

Two important bills — the Transparency and Accountability for a Better Ledger Economy (STABLE) Act and the Guiding and Establishing Innovations Nationally for Stablecoins (GENIUS) Act — propose more robust liquidation requirements and anti-money laundering standards.

These efforts aim to promote greater trust in US-issued stablecoins and maintain the dollar's dominance in global finance.