Author: Jack Inabinet

Translated by: TechFlow

The convergence of traditional finance and cryptocurrency is accelerating, and this trend is particularly evident in Twenty One's emergence. Twenty One is a new Bitcoin-focused entity preparing to go public through a SPAC (Special Purpose Acquisition Company) backed by Cantor Fitzgerald.

With notable enterprises like SoftBank involved and plans to hold over $4 billion in Bitcoin as its financial reserve, Twenty One positions itself as the next evolution of MicroStrategy's Bitcoin accumulation strategy. But can it live up to expectations and achieve a high premium?

Some view this as a breakthrough moment for Bitcoin's application on corporate balance sheets, with public markets valuing this opportunity at three times the intended Bitcoin holdings. same time, others express concerns about complex capital structures, asymmetric incentive mechanisms, and profound impacts on retail investors.

Today, we will conduct an in-depth analysis of Twenty One's investment opportunities.

What is Twenty One?

Seemingly led by CEO Jack Mallers, who founded the Bitcoin payment app Strike in Twenty One promotes itself as a "unique Bitcoin-vehicle" carrier" that will conduct ""Bitcoin-supporting advocacy" and "explore future expansions into Bitcoin-native financial products".

Although Twenty One's mission statement might initially seem confusing, the company is extremely similar to Michael Saylor's MicroStrategy, functioning as a Bitcoin accumulation vehicle aimed at increasing the number of Bitcoins attributable to individual shareholders.

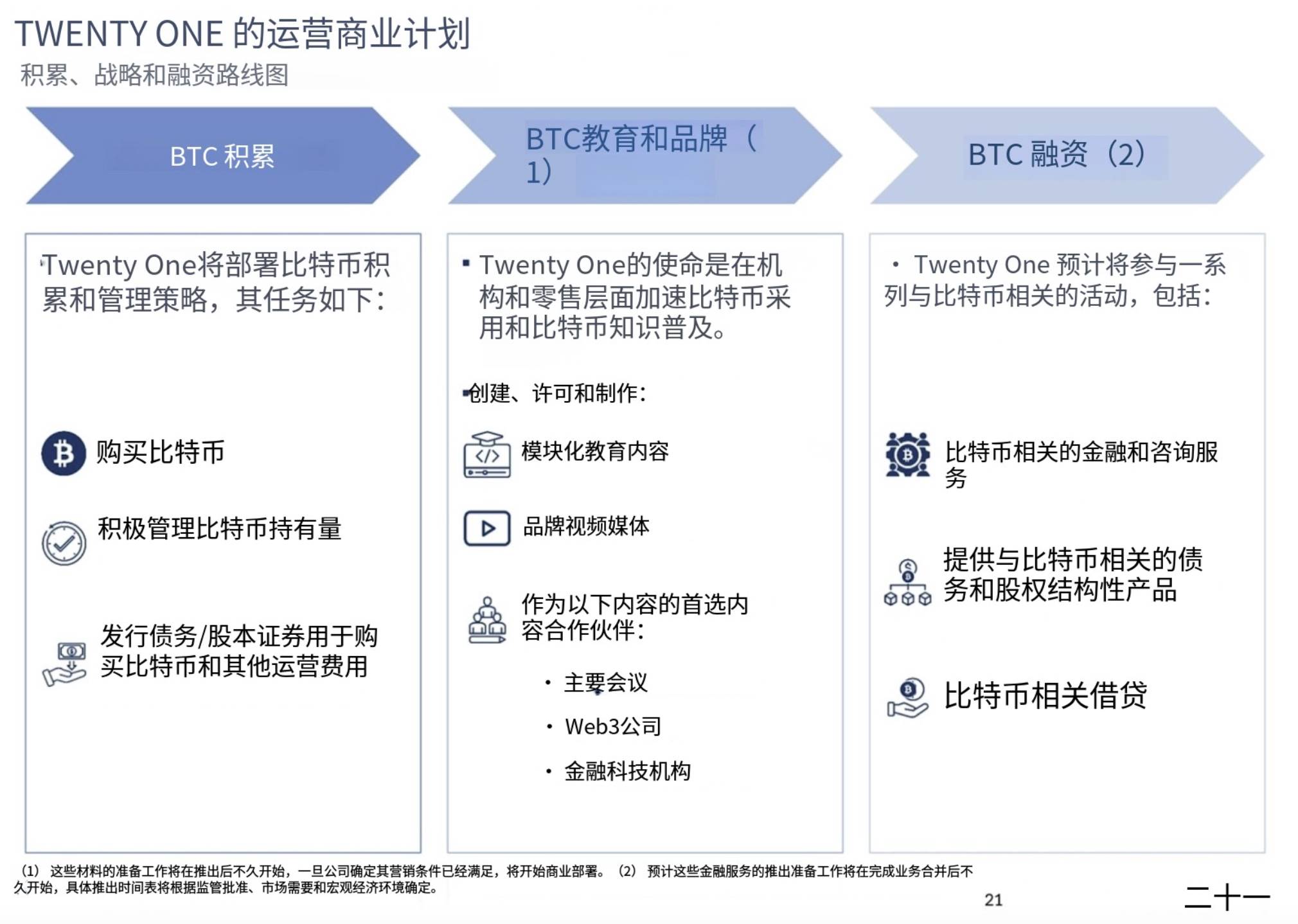

According to the filing submitted to the SEC, like MicroStrategy, Twenty One will acquire Bitcoin by issuing debt and stock. Slightly different from its predecessor, Twenty One also plans to produce Bitcoin educational content (such as YouTube videos) and engage in "various Bitcoin-related activities", including Bitcoin-related financial consulting services and lending its Bitcoin.

Source: SEC

Translated by: TechFlow

According to Twenty One's estimated assumptions, its initial financial reserve will contain 42,000 Bitcoins - valued slightly over $4 billion at current market prices. Although Mallers is the company's leading figure, he is far from alone endeavp>the p>

Currently, this transaction is not yet formally completed, but Twenty Twenty One is expected to be acquired by Cantor Equity Partners. Equity SPAC that will trade trade under the stock code "P" from from mid-August 2024, associated with Howard Lutnick's financial services company Cantor Fitzgerald (which holds 5% of Tether's equity through convertible bonds).

The SPAC process allows Twenty One to reduce SEC regulatory burdens required for listing by merging with an existing listed stock. In exchange, Cantor Equity Partners will inject $100 million cash into the merged balance sheet,, and CEstock holders will obtain 2.7% of Twenty One's One, but without voting rights.

Additionally, investors participating in the initial convertible bond issuance will obtain 7.1% of Twenty One's by equity by contributing $340 million; while investors through PIPE (Private Investment in Placement in Public Equity) will obtain 5.4% of shares under favorable conditions (for example, they can purchase purchase shares at Bitcoin's net asset value, while public SPshareholdersc shareholders must purchase CEP stocks at market market prices). These two sales are expected to raise approximately $500 million in cash, which will flow to Tether to pay for the's Bitcocontributed on behalf of investors.

>p img="" src="https://=".post upload images/20250427/2025042711532917939873...jpg">SEC<2is the?<><>its SEC filing, positions itself Bitcoin accumulation vehicle compared to MicroStrategy. For investors seeking passive Bitcoin accumulation, the smaller Twenty One One One be easier to raise funds to purchase Bitcoin, points directly articulated in Twenty One's investor materials.

As of Thursday, fourth's closing, Cantor Equity Partners (a CEa marketalization $317 million, a balance of $100 million. seeing increased Bitcoin adoption among large financial institutions might be comforting, the preferential terms available to institutional investors at cost price raise suspicions among critics.

Ultimatelyether seems to One be the winner in in this arrangement; this stablecoin issuer can effectively extract funds from institutional players seeking to distribute Bitcoin-backed stocks at a to premium retail investors by injecting Bitcoin into the the SPAC, without selling tokens in the open market.SPACs have gained an unsavory reputation in recent years, considered one of the worst stock market investments of the past decade. While simply going public might be foriders and sponsors, calculations the calculations rarely favor retail investors in secondary markets. Across any industry since 2009, these investments have consistently underunderperformed. For retail investors considering long-term Twenty One investment, their returns may be significantly impacted by majority shareholders attempting to exit their.

在加密密货币市场中,AR的表现相对平稳,仅下跌了0.5%。