I. DePIN+AI: Building the Robotic Paradigm in the AI Era

On February 27th, Messari hosted a podcast about "Building Decentralized Physical Artificial Intelligence", inviting Michael Cho, co-founder of FrodoBot Lab. During the podcast, Michael Cho focused on discussing the opportunities and challenges of DePIN+AI in the robotics field.

After Messari's fermentation, the concept of DePIN robots quickly gained popularity, and discussions about DePIN robots began to proliferate.

Our industry observation this week will focus on analyzing and discussing this track.

Before expanding our discussion, let's first look at the development of artificial intelligence in its own track:

- In the computing power domain, Nvidia's quarterly revenue has grown fivefold in the past three years;

- In the bandwidth domain, North American data center construction has also grown fivefold in the past three years;

- In the energy domain, OKLO alone requires 12.0GW, and TerraPower requires 4.0GW;

- In the data domain, large companies invest over $500 million annually to purchase wholesale data for training AI models.

Against the backdrop of overall global economic downturn, AI, as the primary technological revolution for the next ten to twenty years, is leading all players (computing power, energy, data) to accelerate at a growth rate of several times per year.

[The translation continues in the same manner, maintaining the original structure and translating all text while preserving technical terms and proper nouns as specified.]This model demonstrates how AI robots driven by DePIN can sustain their financial operations through decentralized ownership and token incentives. In the future, these AI agents could even pay human operators with tokens, rent additional robot assets, or bid on real-world tasks, creating an economic cycle beneficial to both AI development and DePIN participants.

Expectations

The development of embodied intelligent AI depends not only on algorithms but also on hardware upgrades, data accumulation, funding support, and human participation.

In the past, the robotics industry's development was limited by high costs and the dominance of large enterprises, hindering innovation speed. However, the establishment of DePIN robot networks means that robot data collection, computing resources, and capital investment can be coordinated globally through decentralized networks, not only accelerating AI training and hardware optimization but also lowering the development threshold, allowing more researchers, entrepreneurs, and individual users to participate.

We also expect that the robotics industry will no longer rely on a few tech giants but will be driven by the global community, moving towards a truly open and sustainable technological ecosystem.

II. DePIN Track Data and Observations

1. DePIN's Total Share is Only 0.1% of the Trillion-Dollar AI Market

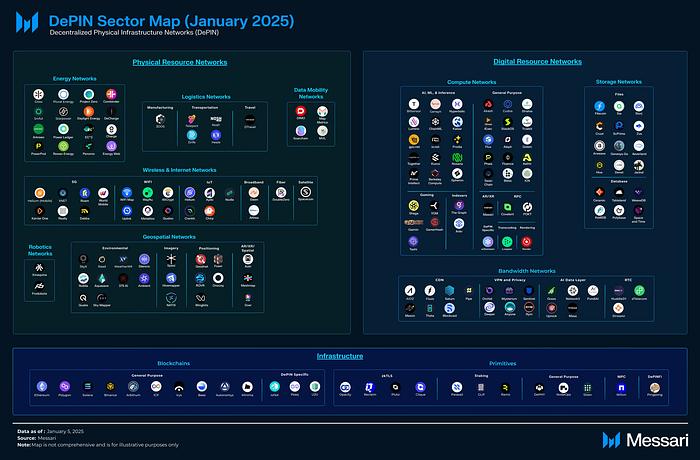

The number of DePIN projects grew from 100 in 2022 to 1,170 in 2024, with market capitalization soaring from $5 billion to $50 billion, and active node rates increasing from 2% to over 50%. However, DePIN's total share is only 0.1% of the trillion-dollar AI market, and it is not an exaggeration to say that this track has 100-1000 times growth potential.

2. DePIN Financing Amount Increases, but Number of Financings Decreases

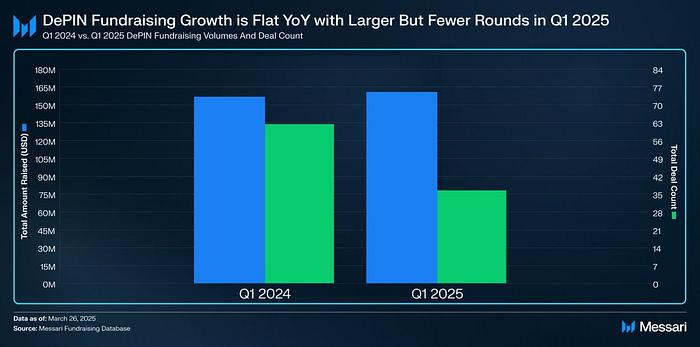

According to Messari data, DePIN financing growth remained year-on-year, with more financing amount in the first quarter of 2025 but fewer financing rounds.

First Quarter of 2024: 62 financing rounds totaling $156 million.

First Quarter of 2025: 36 financing rounds totaling $159 million.

The data indicates: fewer emerging early-stage startup projects, but mature DePIN projects are expanding in scale.

Currently, the global market share of leading DePIN projects in each field is still very small, at the absolute early stage of the track.

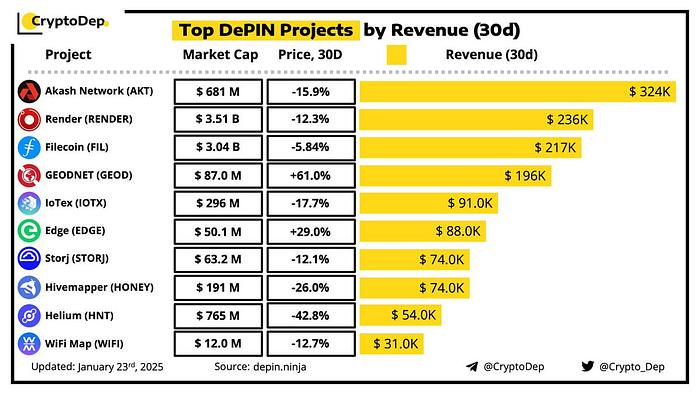

Wireless transmission market share: 0.002% (leading project Helium), computing market share: 0.03% (leading project Filecoin), energy market share: 0.001% (leading project Daylight), identity verification market share: 0.2% (leading projects Worldcoin and Anymal).

In the AI track's agency artificial intelligence market, significant growth is expected in the next decade, from $520 million in 2024 to $196.6 billion in 2034, with a compound annual growth rate of 43.8%.

3. Grayscale Releases Q2 Quarterly Report, Focusing on RWA, DePIN, and IP Tokenization

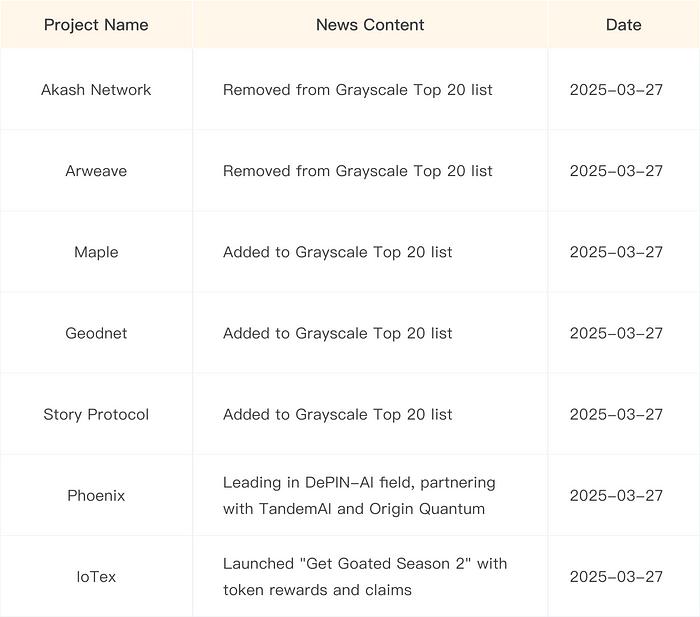

Grayscale released its 2025 Q2 quarterly report this week, focusing on RWA, DePIN, and IP tokenization, thus adding three tokens to the Top 20: IP, SYRUP, and GEOD, while removing Akash Network, Arweave, and Jupiter.

The report shows that this quarter, Grayscale will focus on tokens reflecting non-speculative applications of blockchain technology in the real world, categorized into: RWA (Real World Assets), DePIN (Decentralized Physical Infrastructure), and IP (Intellectual Property Tokenization).

Among the three assets added to the Top 20 list for the second quarter of 2025 - Maple (SYRUP), Geodnet (GEOD), and Story (IP) - two are DePIN projects.

- Geodnet (GEOD): Geodnet is a DePIN project for collecting real-time positioning data. As the world's largest real-time dynamic positioning (RTK) provider, Geodnet offers geospatial data with accuracy up to 1 cm, providing cost-effective solutions for users like farmers. In the future, Geodnet may provide value for self-driving cars and robots. The network has expanded to over 14,000 devices across 130 countries, with annualized network fee income in the past 30 days growing to over $3 million (approximately 500% year-on-year growth). Notably, compared to other top 20 assets, GEOD has a lower market cap and fewer listed exchanges, thus considered higher risk.

- Story Protocol: Focused on intellectual property management on the blockchain, more of a decentralized application than physical infrastructure, potentially marginal to DePIN. Story Protocol is attempting to tokenize the $70 trillion intellectual property (IP) market. In the AI era, proprietary IP used for training AI models has led to copyright infringement claims and massive lawsuits, such as the previous dispute between The New York Times and OpenAI. By bringing IP on-chain, Story will enable companies to use their IP for AI model training while allowing individuals to invest, trade, and earn IP royalties. Story has already brought Justin Bieber and BTS songs on-chain and launched an IP-centric blockchain and token in February.

4. DePIN Track Income Ranking in the Past Thirty Days

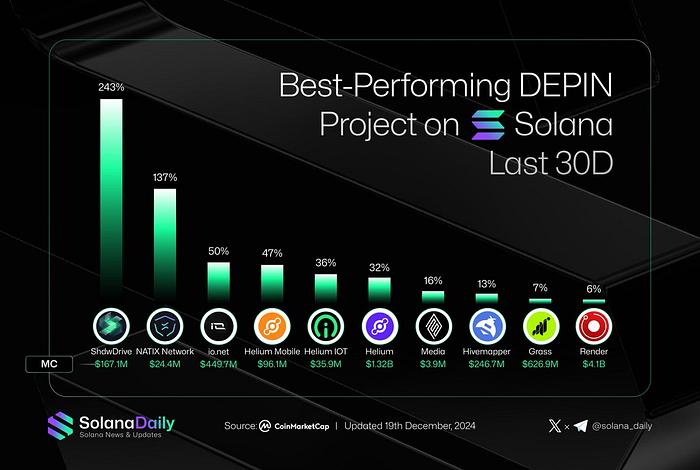

Best Performing DePIN Projects on Solana in the Past 30 Days

5. Industry Event Tracking

- Roam, a global Web3 online network service essential for conferences, has reached 280 million global nodes, allowing users to achieve seamless international roaming at 30% of traditional carrier costs. Roam plans to launch a similar incentive mechanism in the second half of 2025, with spatiotemporal data collected by distributed nodes becoming fuel for training vertical AI models.

- Phoenix is collaborating with TandemAI and Origin Quantum to promote the integration of AI and decentralized physical infrastructure, helping Phoenix lead in the DePIN-AI field.

- IoTeX launched "Get Goated Season 2", involving token rewards and claiming process. The $IOTX claiming window closed on March 27, with unclaimed tokens to enter the IoTeX treasury pool. Sponsors include Geodnet, Uprock, Drop Wireless, and Network 3. The claiming window will start on April 7, with a review period from March 28 to March 31, using zkPass verification. This move may enhance community engagement and attract more users to the IoTeX ecosystem.

- According to Messari's Helium Q4 report, Helium Network's operational data grew significantly, with operator data offloading increasing 555% to 576 TB quarter-on-quarter, mobile hotspots growing 14% to 24,800, and daily mobile paid traffic increasing 99%, demonstrating its disruptive potential in the telecommunications industry. Helium unified $HNT as the sole token through HIP 138, optimized its economic model, and announced a partnership with Telefónica to enter the Mexican market, covering 2 million Movistar users. Additionally, Helium was included in Grayscale's top 20 watched tokens and Coinbase's COIN 50 index, attracting institutional investor attention. In smart city applications, the network has been used for flood monitoring and forest fire warnings in the US. Helium is expanding through the DePIN model, consolidating its leadership in the Web3 telecommunications market.

6. Financing Information

- Filecoin's largest DeFi protocol GLIF released its $GLF governance token, airdropping 94 million tokens, representing 9.4% of total supply. $GLF will expand to new functions like loyalty rewards. GLIF is expanding towards decentralized physical infrastructure networks (DePIN) beyond the Filecoin ecosystem. Currently, GLIF has over $102 million locked on Filecoin and will support more DePIN networks in the future.

- Decentralized business network Domin Network announced strategic investments from Animoca Brands, KuCoin Labs, Web3 Labs.club, IBC Group Official, DWF Ventures, Presto, Outlier Ventures, KnightFury, ThreeDAO, Awakening Ventures, and AB DAO. Domin Network is a decentralized business network that uses Non-Fungible Token and DePIN Rollup technology to connect software, hardware, and consumer behavior data on-chain, enabling users to earn crypto rewards by sharing their consumption data.