Tether Releases Independent Verification Report, Confirming Over 7.7 Tons of Real Gold Backing XAUT Token, Equivalent to a 1:1 Ratio Between Token and Physical Gold.

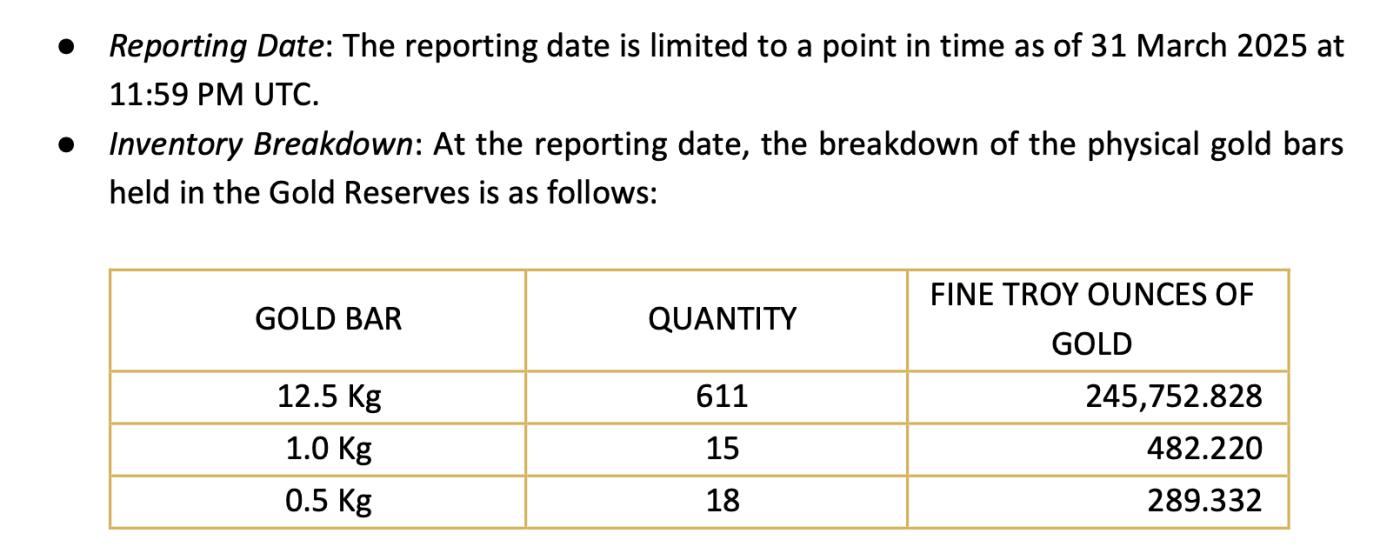

ocTether Holdings has just released the verification report for Q1/2025 for Tether Gold (XAUT), confirming that over 7.7 tons of physical gold are fully backing the circulating token amount. According to the report conducted by BDO Italia S.p.A., as of March 31, 2025, a total of 246,524.33 troy ounces of pure gold are being stored in vaults in Switzerland.

The verification confirms that that each XAUT continues to be backed 1:1 with an equivalent ounce of gold. At the quarter end of the the cumulative market value of Tether Gold reached 770 million USD, with each token priced at 3,123.57 USD. 180,777.07 XAUT tokens have been sold, while 65,747.26 tokens remain available for sale>

Changes in Legal Regulations and Asset Management

TG Commodities S.A. de C.V., the ississuer of XAUT, has now transitioned to operating under El Salvador's Digital Asset Issuance Law, after relocating from the British Virgin Islands (BVI) in January. The, the company has registered as a Money Services Business with the Financial Crimes Network of the US Treasury Department (FinCEN).

The report emphasizes that Tether's gold reserves include gold bars certified by the London Bullion Market Association (LBMA), with periodic quality checks by independent third parties. According to management policy, gold is valued at fair market price and assumes continuous operation.

Tether also points out macmacro-gold's role as a Store of Value (including Sincluding strong gold purchasing by increasing inflation pressures. specifically, in024banks purchased more than 1,044 tons of gold to their reserves,, from Council.

This independent report confirms that Tether Gold (XAUT) provides users with a digital asset backed by verifiable physical gold, creating a difference from non-compliant tokenized products that often rely on "paper gold" or face significant legal uncertainties.