Project deconstruction: Staking infrastructure for modular ecosystem

(I) Product positioning

MilkyWay is the first dual-track protocol of liquidity pledge + re-pledge in Celestia ecosystem, solving the capital efficiency problem of modular blockchain. By issuing liquidity pledge tokens (LSD) such as milkTIA, users can pledge TIA to obtain basic income (about 12% APY) while investing LSD tokens in DeFi protocols to obtain additional income, or provide security for ecological projects such as Babylon and Initia through re-pledge, achieving triple income superposition.

Its TVL exceeded US$220 million in two months, with over 300,000 users.

(II) Technical architecture innovation

- Modular design: Built with Cosmos SDK, supports seamless interaction with Celestia DA layer and Initia VM layer

- Cross-chain liquidity engine: milkTIA and mainstream asset exchange are realized through Osmosis DEX, with an average daily trading volume of over US$5 million

- Shared Security Pool: Aggregate pledged assets to provide economic security for AVS (Active Verification Service), and have connected to 12 protocols such as light nodes and cross-chain bridges

(III) Team and capital layout

Core Team:

- CEO JayB: Former Chainlink core developer, leading cross-chain oracle architecture

- CTO Joon: Early contributor to Osmosis, proficient in Cosmos ecosystem tool chain development

Funding Milestones:

- A $5 million seed round was completed in April 2024, led by Binance Labs and Polychain Capital

Token Economics

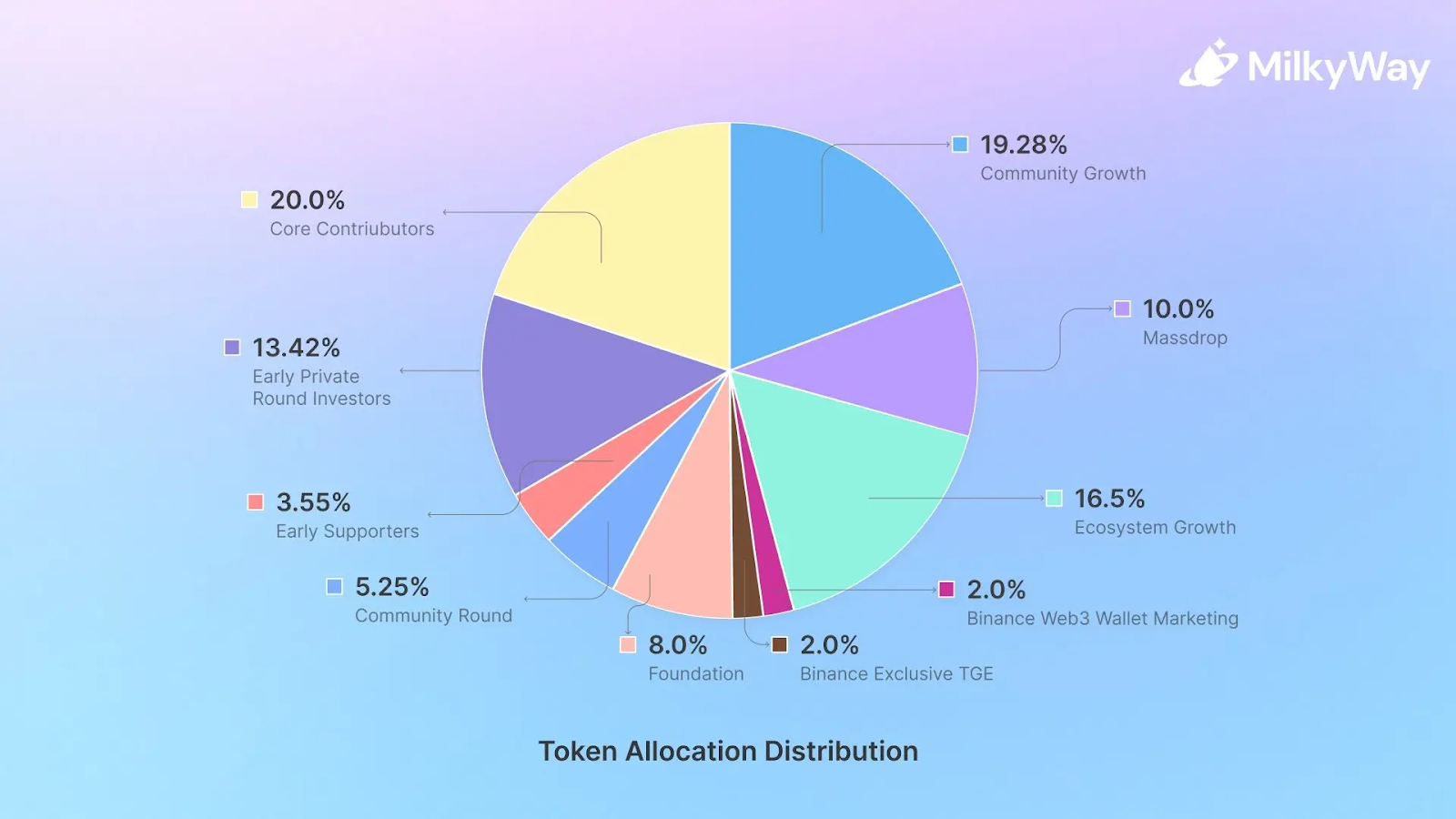

(I) Allocation structure

- Core Contributors – 200 million MILK (20.00%);

- Early private placement investors – 134.2 million MILK (13.42%);

- Early Backers – 35.5 million MILK (3.55%);

- Foundation – 80 million MILK (8.00%);

- Community round – 52.5 million MILK (5.25%);

- Binance exclusive TGE (Token Generation Event) – 20 million MILK (2.00%);

- Binance Web3 Wallet Marketing – 20 million MILK (2.00%): allocated for future Binance Wallet marketing activities, details of which will be announced later;

- Ecosystem growth – 165 million MILK (16.50%);

- Massdrop – 100 million MILK (10.00%): allocated to early users, including mPoint holders, Moolitia NFT holders, and milkINIT testers, released in four phases;

- Community growth – 192.8 million MILK (19.28%).

The functions of the token include governance, protocol fee sharing (15% of staking income), re-staking node margin, etc.

However, as many as 88% of the tokens have not yet been circulated, and the ecological incentive part adopts the "on-demand issuance" mechanism, which has significant long-term inflationary pressure. Referring to similar projects (such as Lido's LDO), the token value capture ability is highly dependent on the protocol revenue growth and destruction mechanism, and MilkyWay has not yet announced a specific deflation model.

Binance Alpha Mechanism Alienation: From Inclusive Entry to "Big Player Club"

1. Points inflation: the "Krypton Gold Formula" with a 75-point threshold

This round of TGE raised the Alpha score threshold to 75 points, a 66% increase from the 12th round (45 points). According to the score rules, retail investors must meet any of the following conditions:

- Balance path: Holding assets of more than $100,000 for 15 consecutive days (3 cents per day x 15 days = 45 cents) + average daily trading volume of $512 (9 cents per day x 15 days = 135 cents) → at least $180,000 in principal required

- Pure trading path: Daily trading volume must reach US$8,192 (13 points/day x 15 days = 195 points) → Cumulative trading volume123,000 US dollars

Compared with the previous low threshold period of "average daily trading of $128 to meet the standard", the cost of participation has increased exponentially. On-chain data shows that among accounts with scores above 75, the balance contribution accounts for more than 80%, proving that the rules have been seriously tilted towards "large holders of currency".

2. The "overt conspiracy" of rule design: data harvesting and ecological closed loop

Binance achieves three goals through the Alpha Points system:

- Screening loyal users: High net worth holders and high frequency traders contribute more on-chain data and optimize the coin listing decision model

- Bound Funds Sedimentation : Forcing users to keep their assets in Binance Exchange and wallets, reducing cross-platform flows

- Creating liquidity siphoning : Alpha token trading volume directly determines the priority of listing on the main site, stimulating project parties to purchase market making services

Although this mechanism increases the value of platform data, it causes retail investors to either "pay to join the game" or be completely eliminated. As the community complained: "Points are like a cut in Pinduoduo, there is always one point short of making you slap orders like crazy."

3. Selling pressure tsunami: How high-frequency TGEs undermine the logic of the copycat season

1. Data calculation: 10 billion new coins impact in half a year

- Current pace: Alpha platform launches 1 project per day on average, with a single project market value of approximately 60 million US dollars (e.g. MilkyWay initially circulated 120 million tokens, assuming a unit price of 0.5 US dollars)

- Half-year selling pressure: 1.5 projects/day × 180 days × 60 million = 16.2 billion US dollars

- Comparison Benchmark: In 2024, the net inflow of Altcoin was about US$24 billion, and the selling pressure of new coins accounted for 67.5%

This does not include the IEO of Binance main site, Launchpool project and the listing volume of external exchanges. When the incremental funds in the market cannot cover the selling pressure, the token price will fall into a death spiral of "listing is the peak".

2. The "Prisoner's Dilemma" of Token Distribution

- Project Party: In exchange for the qualification of listing, accept a high proportion of token dumping (usually 30%-50% is allocated to exchanges and market makers)

- Exchanges: Earn fees and market-making spreads through high-frequency listings, but overdraw platform credit

- Retail investors: forced to choose between "taking over early chips" and "miss the pump the opportunity"

This "listing and liquidation" model completely overturns the previous market perception that "listing is beneficial".

Conclusion: When inclusiveness disappears, how much "real innovation" is left in the crypto market?

The alienation between MilkyWay's technical vision and Binance Alpha's mechanism is like the two mirror images of the current crypto world: on one hand, there is the efficiency revolution brought about by underlying innovations such as modularization and re-staking, and on the other hand, there is the "financial alchemy" conspired by exchanges, VCs, and quantitative institutions. When the project launch becomes a prize for the "points game", and when the community consensus is deconstructed by selling pressure, is this experiment promoting the evolution of the industry or accelerating the dissipation of value? Perhaps as one developer said: "We are repeating the tragedy of Web2's traffic involution in the way of Web3."