Pierre Rochard in El Salvador this morning with a bitcoin masterclass for @cuboplus students.

He kicked off the class with high praise for President Bukele’s bold move to be the very first Bitcoin Country and to establish the world’s first Strategic Bitcoin Reserve.

Now a deep dive into the block size limit.

Related topics:

➡️Scaling bitcoin on Layer 2’s

➡️Bitcoin as a savings technology

➡️Bitcoin capital markets

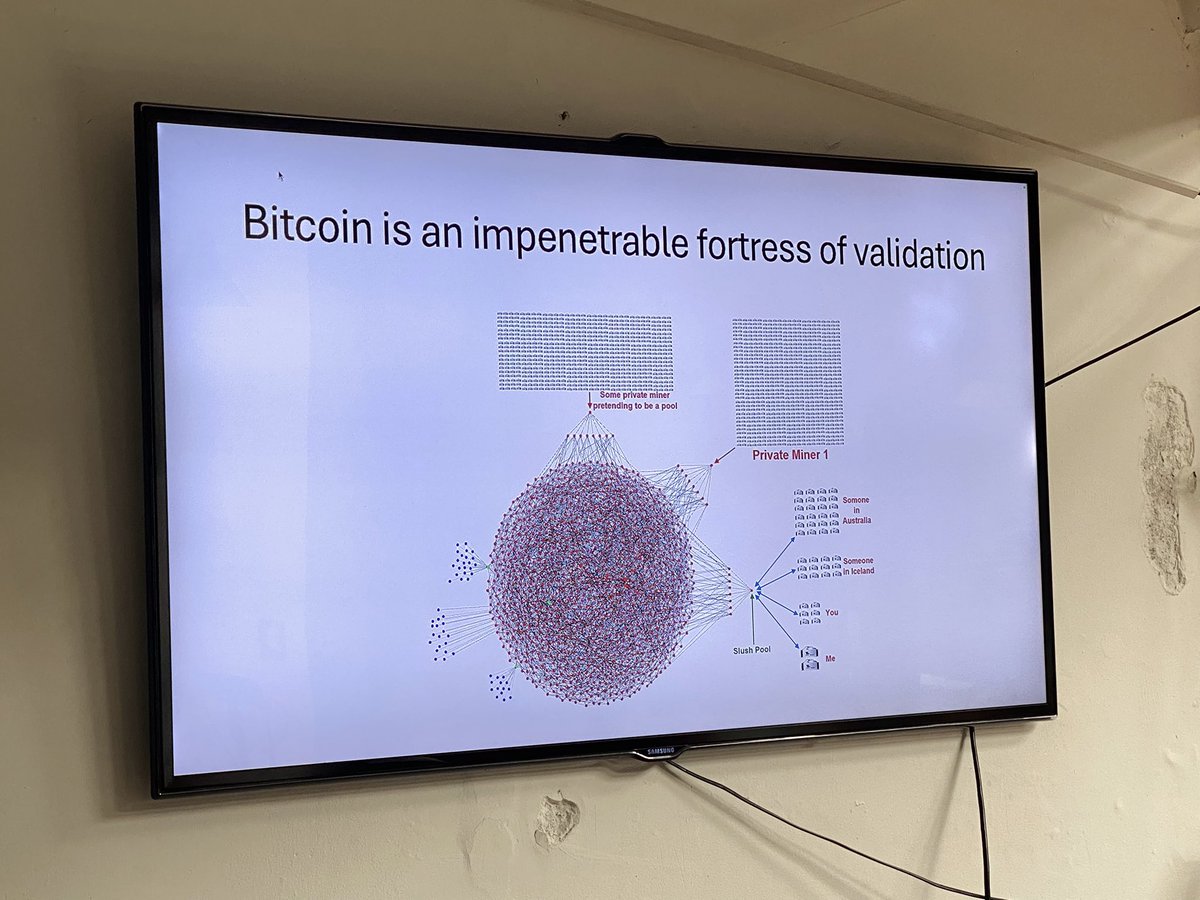

Bitcoin is the most secure structure in cyberspace.

"They'll say that tokenizing equities is a trillion dollar opportunity. No. It's a zero dollar opportunity."

x.com/stacyherbert/status/1916...

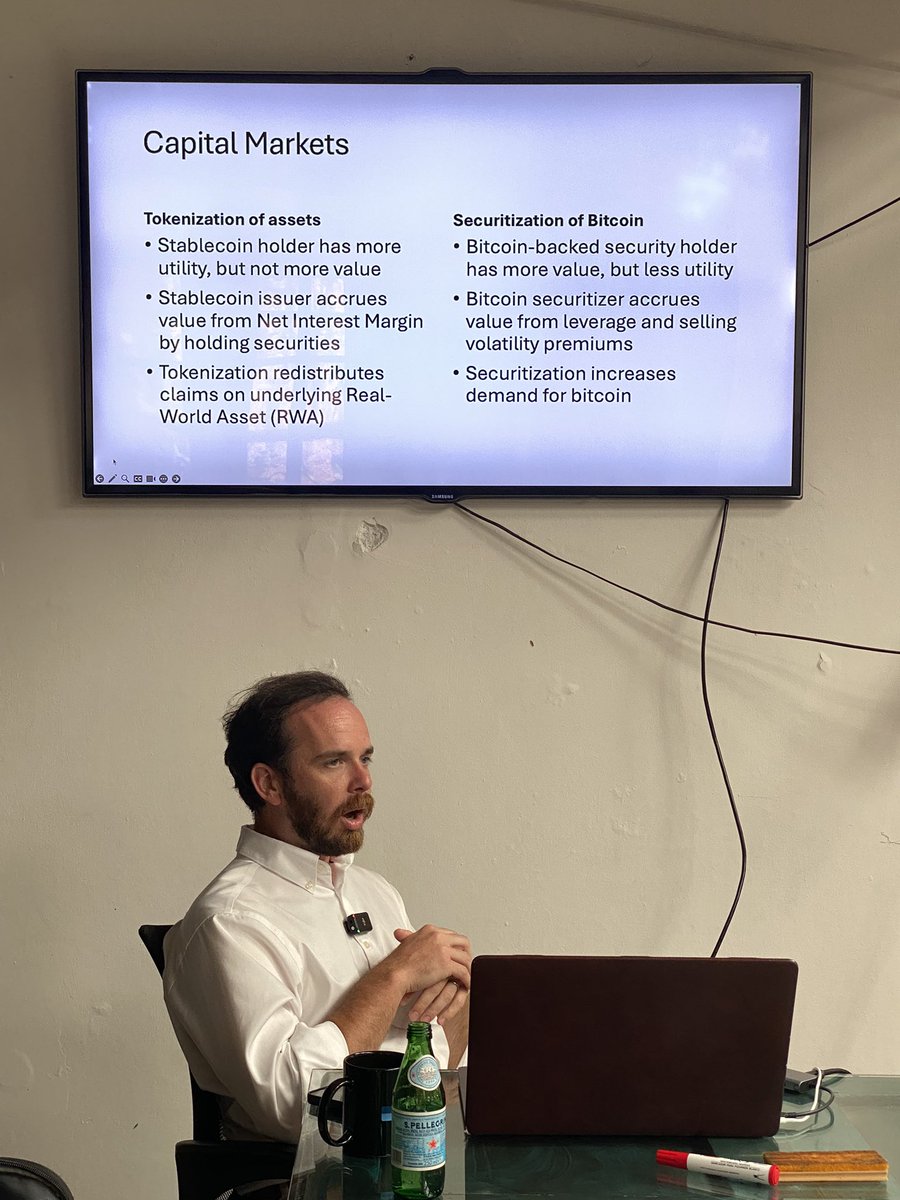

Capital markets on USD vs Bitcoin

Tokenization of Assets vs Securitization of Bitcoin

Tokenization of real world assets may increase liquidity at the margin. And there could be, therefore, a small liquidity premium due to a wider population of investors who can own a share of that real estate.

But real estate

An absurd sleight of hand.

The value already exists in the stock market. Tokenizing it does not add any value to the stocks, other than a small liquidity premium.

Putting a share in a different wrapper does not change the underlying asset.

Ethereum has lost 80% of its value against bitcoin.

The utility on the ethereum network did not add value to the underlying token.

Utility and value are two separate concepts that get conflated and confused.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content