Written by: Bright, Foresight News

Wearing a BNB Chain cultural shirt from the Hong Kong Web3 Festival, I was walking up the school stairs when a stranger pointed at the bright yellow-gold "BNB" embroidery on my chest and excitedly said to me, "Life is BNB."

I was stunned, having never heard this reference before. He excitedly grabbed me and began describing BNB and PancakeSwap. I suddenly realized that new entrants might not have bought BTC and ETH, but would likely be excited to switch to BNB after the upcoming Binance wallet TGE announcement, nervously pressing "Deposit" on the PancakeSwap page, silently calculating the oversubscription earnings shared by group members.

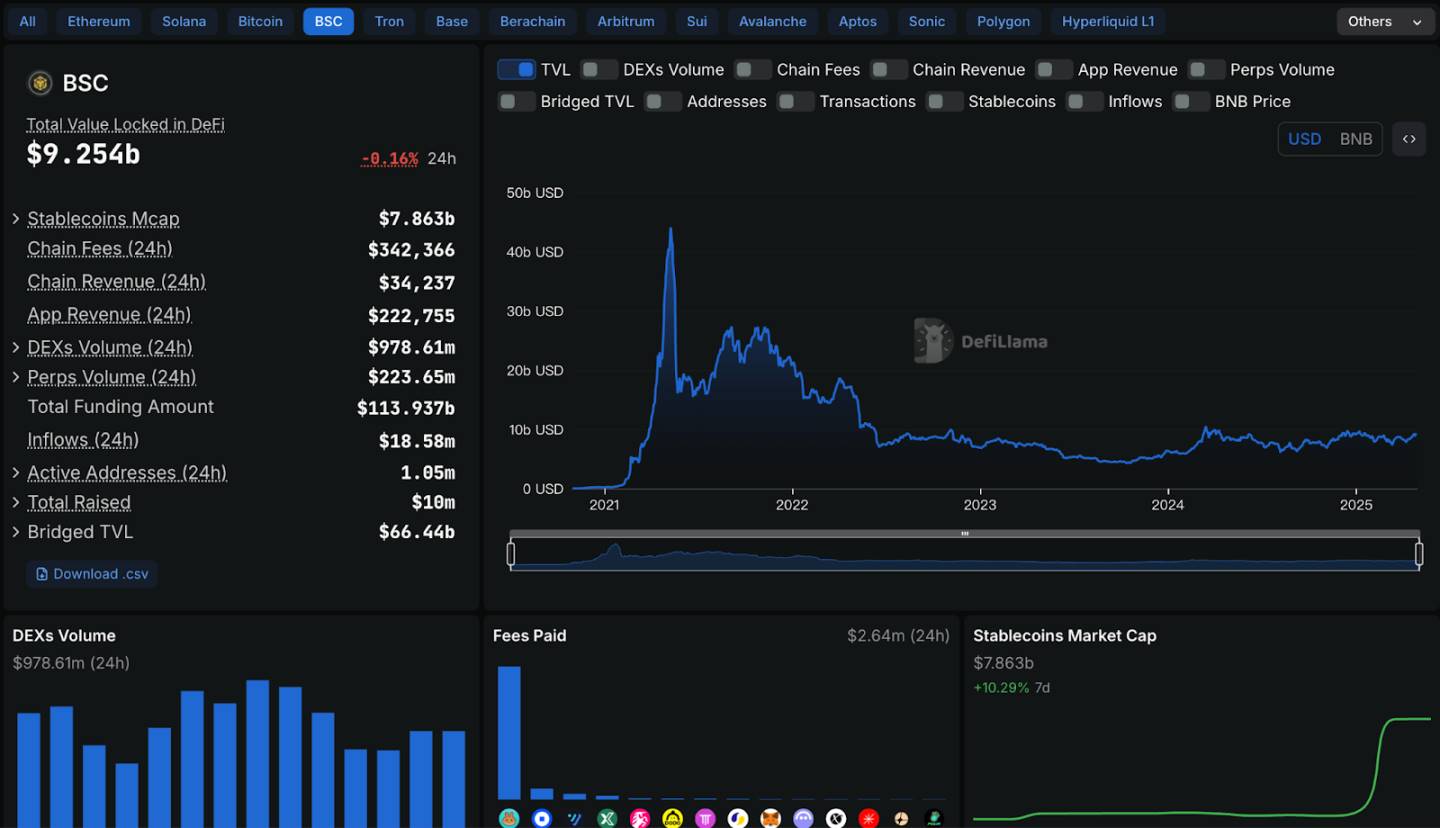

A Messari report shows that in the first quarter of 2025, BNB Chain's average daily active addresses grew by 26.4% quarter-on-quarter, breaking through from 94,160 to 1.2 million. During the same period, BNB Chain's network revenue jumped to $70.8 million, a quarter-on-quarter increase of 58.1%. The number of validators decreased by 90% after the launch of the Goodwill Alliance. In these three months as the FOMO fever subsided, this vibrant "health report" became the best proof that BNB Chain remains "HOT".

On April 29, BNB Chain announced the completion of the BSC and opBNB mainnet hard fork upgrade, reducing BSC's block time to 1.5 seconds and opBNB's block time to 0.5 seconds. BNB is racing forward, breaking free from the impression of an "old" public chain. While we discuss or even complain about ETH's "mid-life crisis", BNB Chain actually emerged only two years after ETH, launching in 2019 and now six years old, yet no one has publicly discussed a "mid-life crisis" for BNB.

Growth: BNB Riding the Waves

How a public chain defines innovation and inclusiveness in the decentralized world is key to measuring its regenerative capacity. One of the underlying logics of BNB Chain's wild growth in DEX is its strong support for new quality projects. These projects not only enhance user experience but also expand the boundaries of tracks like DeFi and DeFAI.

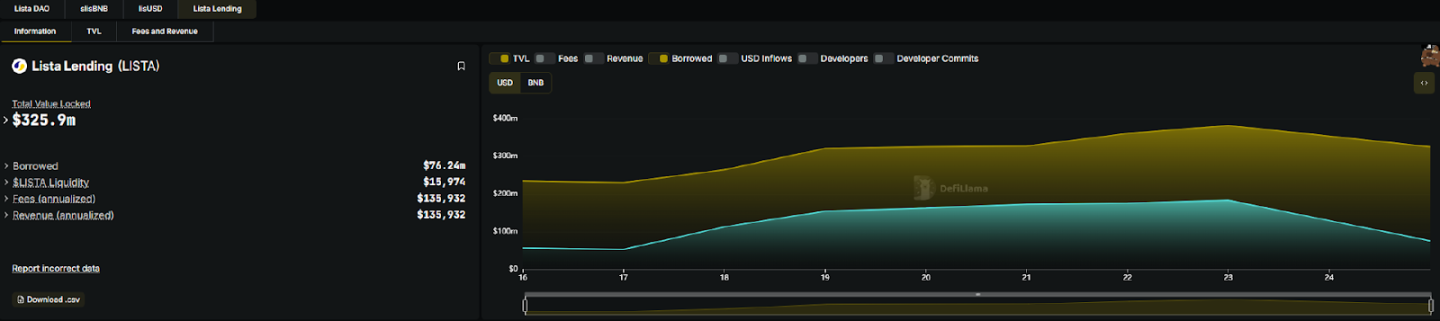

Lista DAO is a DeFi platform running on BNB Chain that combines liquidity staking, CDP system, and lending. On April 11, Lista DAO officially launched Lista Lending, using an innovative P2P Lending model to fuel the BNB chain ecosystem. Within an hour of launch, BNB vaults worth over $10 million were "swept". According to defillama, Lista Lending's TVL has exceeded $389 million, with peak borrowing reaching $183 million. The BNB Chain Blog also mentioned that by dynamically allocating BNB to validators offering high annual yields (28% APR), it enhanced DeFi users' earning potential.

Lista Lending focuses on vaults and markets, supporting BNB and USD1 vaults. Users can collateralize BTCB, PT-clisBNB, solvBTC and more to borrow BNB, meeting short-term liquidity needs for Binance Launchpool and Binance wallet TGE. As the third-largest TVL on the BNB chain, Lista DAO has innovatively created a growth flywheel with a "user-first" concept.

The BNB Most Valuable Builder (MVB) series is another key to maintaining BNB's youthful vitality. CZ stated at a closed-door MVB ninth season gathering in Hong Kong: "A truly sustainable project must have real users, revenue, and profits, so users can continuously benefit and token prices can remain stable."

Since its launch in 2021, BNB MVB has built a reputation as the "Web3 Y Combinator". The first eight seasons incubated about 150 projects, comprehensively covering mainstream tracks like DeFi, Non-Fungible Token, gaming, AI, and infrastructure. By the ninth season, 147 projects were incubated. Incomplete statistics show that from the first eight seasons, 75 projects received top-tier venture capital, and 163 projects successfully issued tokens, with most listed on mainstream exchanges.

On April 23, the MVB plan underwent a major upgrade, transitioning from a traditional quarterly application system to a rolling application system, allowing global entrepreneurs to transform their ideas into reality with BNB Chain's support at the first moment of inspiration.

The upgraded MVB, with its mission of "full-stage empowerment", allows joining at any time, providing comprehensive support from product development to market landing and potential financing through customized courses, one-on-one mentor guidance, and a resource package of up to $300,000 "Launch-as-a-Service" (LaaS).

Maturity: BNB Chain in Full Swing

On April 16, 2025, the BNB Foundation announced the completion of its 31st quarterly BNB token burn, destroying 1.579 million BNB tokens worth approximately $916 million, gradually reducing the total supply to 100 million. BNB Chain continues to Burn & Cook, reaching maturity over time.

In the first quarter of 2025, BNB Chain's income was $70.8 million, a quarter-on-quarter increase of 58.1%, with DEX trading volume surging 79.3%. BNB Chain experienced a massive ecosystem explosion in February 2025, quickly taking over from Solana as a leader in on-chain ecosystem competition, backed by CZ and Binance's massive resources. BSC daily active addresses stabilized above 1 million, with on-chain contract deployments mushrooming to 250,000, creating a multi-quarter new high. In the first quarter, BNB Chain topped the trading volume chart for multiple weeks. On February 13, stimulated by TST, PancakeSwap's 24-hour trading volume reached $3 billion, with a weekly trading volume of $20 billion. BNB Chain's TVL grew from $6.26 billion in September 2024 to $9.25 billion on April 29, 2025, an increase of 31.8%.

BNB Chain's maturity is not just about data accumulation, but also strategic planning. From meme coin traffic engines to AI and DeFi protocol value anchoring, BNB Chain has launched a $4.4 million meme coin liquidity support plan and a direct token purchase support "100 million dollar support plan".

Stablecoin activity is like BNB Chain's lifeline, continuously supplying nutrients. Driven by new tracks like Payfi and RWA, the global stablecoin market is growing rapidly, with various forces wanting to take the stage. From September 2024 to April 2025, the stablecoin market value on BNB Chain rose from $4.916 billion to approximately $9.258 billion, an increase of about 88%, reflecting its core position in stablecoin trading and DeFi applications. The World Liberty Financial (WLFI) project, backed by the Trump family, chose to issue the USD1 stablecoin on BNB Chain. So far, WLFI's USD1 has issued over 2.1 billion tokens on BNB Chain, representing over 99.32% of circulation. USD1 has become the seventh-largest stablecoin by market value.

Following the 2025 roadmap, BNB Chain moves forward clearly. BSC and opBNB mainnet continue to upgrade as scheduled, with block generation time accelerating by over 50% while maintaining the capacity to process 100 million daily transactions. Additionally, introducing EIP-7702 smart contract wallet upgrades significantly reduces user experience friction. The "barrier-free" efficiency further advances mass adoption of Web3 applications like stablecoins.

Running: BNB Trading Flows Like Water

As the undisputed platform token from the TOP1 exchange, BNB is thriving in the CEX field. On April 22, the mainstream US exchange Kraken officially launched BNB, which may represent BNB gradually emerging from regulatory shadows. Previously, the special administrative region of Bhutan's Gelephu Mindfulness City's innovative move to incorporate BNB alongside BTC and ETH into national strategic reserves, coupled with CZ's recent appearance as a strategic advisor to the Pakistan Crypto Committee, inevitably leads one to speculate how far BNB's "Silk Road" has expanded in the real world.

As of mid-April 2025, according to CoinMarketCap data, BNB's price remains stable around $610, with a 24-hour trading volume reaching $1.69 billion. During the overall market correction in the first quarter of 2025, BNB demonstrated exceptional resilience. Its historical high was $793.86 on December 4, 2024, while the current correction low is $500, representing a 37.1% decline. Among mainstream cryptocurrencies, it performed second only to BTC (-32.1%), significantly outperforming ETH (-66.3%), SOL (-67.8%), and XRP (-52.6%).

BNB's utility on Binance further enhanced its attractiveness. Users can use BNB to pay transaction fees (enjoying a 10% discount on contract fees), participate in launchpools, and engage in Binance Wallet exclusive TGEs. Recent frequent exclusive TGE launches have provided warmth to users during market downturns. Notably, tokens from BNB Chain projects have shown impressive performance. Statistics reveal that over 30% of the 12 exclusive TGE projects on Binance Wallet are BNB Chain projects, including decentralized exchange KiloEx and Bitcoin L2 infrastructure Lorenzo Network, both star members of early BNB MVB seasons.

Behind hundreds of "comfort meals" lies the powerful synergy of Binance Alpha and Binance's non-custodial wallet. Binance Alpha focuses on early project showcases, attracting users through airdrop activities and convenient trading features. Since April 21, 2025, Binance Alpha's transaction count has doubled, repeatedly setting daily trading records. On April 28, Binance Wallet's total transaction volume reached $92 million, exceeding the combined volume of all other wallets. Binance Alpha 2.0's quick purchase function, with automatic slippage adjustment and anti-MEV mechanisms, bridges CEX and DEX trading channels, providing users with more investment categories and lowering entry barriers for new users investing in on-chain tokens.

Starting from an exchange, BNB has expanded its lines across public chains, exchanges, wallets, and accelerators, seemingly touching every corner of Web3. However, achieving a "billion-user" milestone remains a long journey. The hope is that this young pump in the Web3 ecosystem will continue to roar, realizing the true ideal of "life is BNB" mass adoption.