Mastercard announced on the 28th that it plans to allow consumers to pay with stablecoins at over 1.5 million merchant stores that accept Mastercard. Mastercard has previously collaborated with other crypto companies, including MetaMask, Baanx, and Ledger. Last July, crypto wallet provider Argent launched a new crypto payment card in partnership with Mastercard and blockchain startup Kulipa, recently collaborated with crypto exchange OKX for card issuance, and closely worked with stablecoin issuers Circle and Paxos to enable merchants to receive payments in stablecoins.

Jorn Lambert, Mastercard's Chief Product Officer, stated in a statement: The benefits of blockchain and digital assets in mainstream use are evident, and we believe stablecoins have the potential to improve payment and business processes.

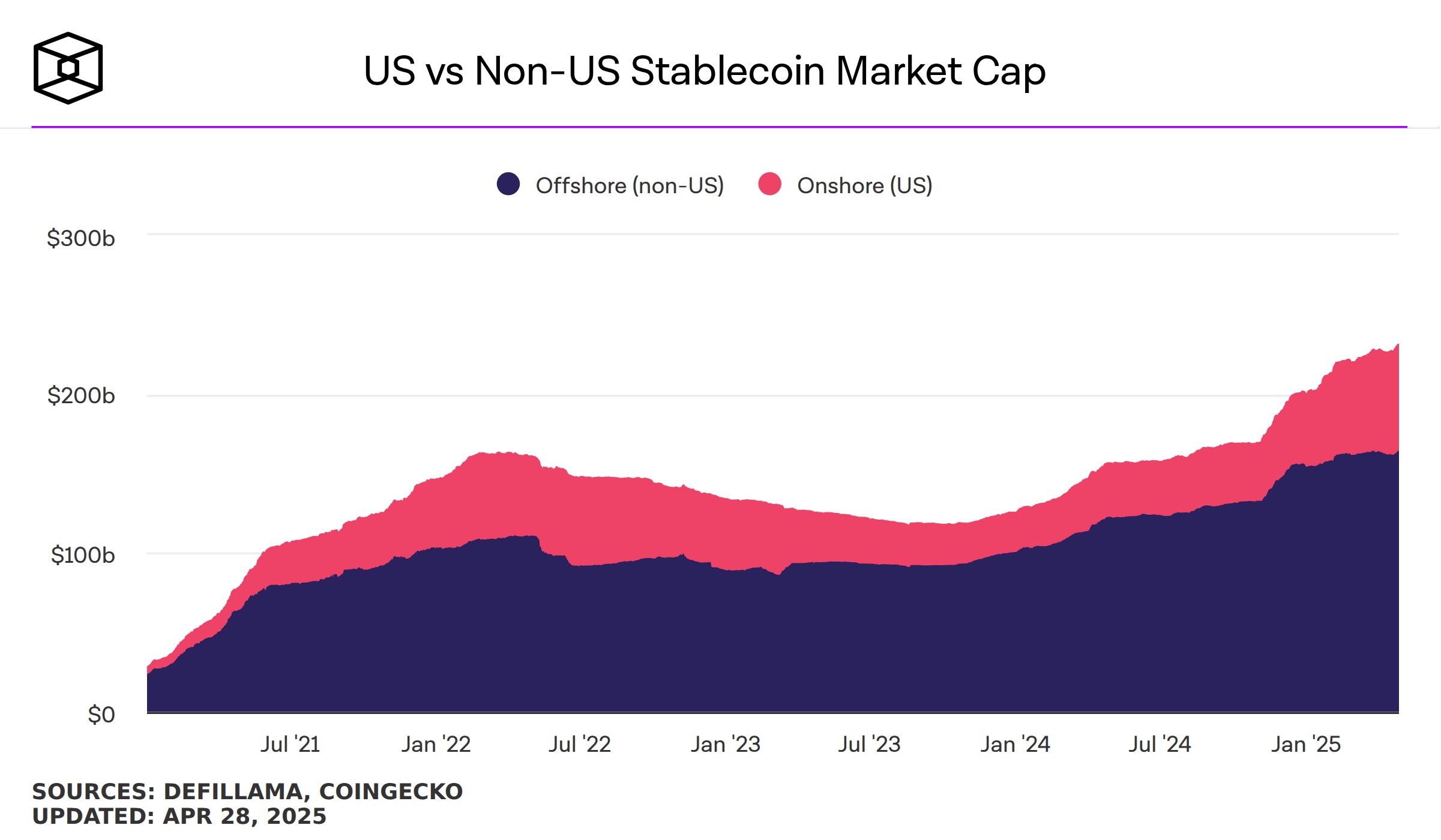

As the US Congress considers legislating stablecoins, major banks are preparing to develop stablecoin businesses pegged to the US dollar. The total supply of USD-pegged stablecoins has recently exceeded $230 billion. The market size is expected to grow to trillions of dollars in the coming years. Bitwise analysts noted that stablecoins generated over $5.1 trillion in global transactions in the first half of 2024.

Table of Contents

ToggleMastercard Integrates Global End-to-End Stablecoin Payment System

According to the press release, Mastercard is integrating a global end-to-end stablecoin payment system. As global stablecoin regulatory policies become increasingly transparent, stablecoins are evolving from crypto trading tools to comprehensive solutions combining payments, consumer spending, and remittances. To enable consumers and businesses to use stablecoins as easily as funds in a bank account, Mastercard provides a complete system supporting crypto wallets, verification, and card issuance.

Merchant Settlement

Mastercard is collaborating with Nuvei and Circle to allow merchants to accept stablecoin payments, such as using USDC issued by Circle. Mastercard has also partnered with Paxos to enable stablecoin payments using Paxos-issued stablecoins.

On-Chain Remittances

Mastercard Crypto Credential allows crypto exchange users to receive and send digital assets for remittances and cross-border payments using simple, trustworthy usernames. Current participants in the Mastercard Crypto Credential ecosystem include Wirex, Bit2Me, Lirium, Notabene, Coins.ph, and Mercado Bitcoin.

MTN Systemized Commercial Application for Processing Bank Settlement Business

The Mastercard Multi-Token Network (MTN) can simplify settlement across global financial markets and currencies, enabling partners like Ondo Finance to use On-Chain Tokenized Assets for Real Time Payments and Redemptions. JPMorgan Chase and Standard Chartered have already collaborated with Mastercard's MTN system to link deposit accounts with digital assets.

Risk Warning

Cryptocurrency investments carry high risk, with potentially significant price volatility. You may lose your entire principal. Please carefully assess the risks.