📝 Editor’s Note:

Welcome to the second issue in OurNetwork’s two part series on lending protocols. After covering some of the largest players in the DeFi subsector in the first issue, we’re trending slightly down the stack to up-and-comers.

These projects were born in the wake of DeFi mainstays like Aave and Compound, and are exploring alternative models around isolated lending pools, token buyback strategies, order book-based lending, among other initiatives. While it may not be as easy to keep up in DeFi as it once was, we hope this issue serves to show a little bit about what’s happening in the space, enough to follow your own proverbial rabbitholes.

Let’s get into it.

– ON Editorial Team

Lending Pt. 2 🏦

Fluid | Silo | Yei Finance | Moonwell | Gearbox | Loopscale

Fluid 🌊

👥 Nikita Ovchinnik | Website | Dashboard

📈 Fluid is Rapidly Growing in the DeFi Space, with a Unique Liquidity Layer Allowing Efficient Use of Collateral and Debt as Liquidity for Decentralized Exchanges

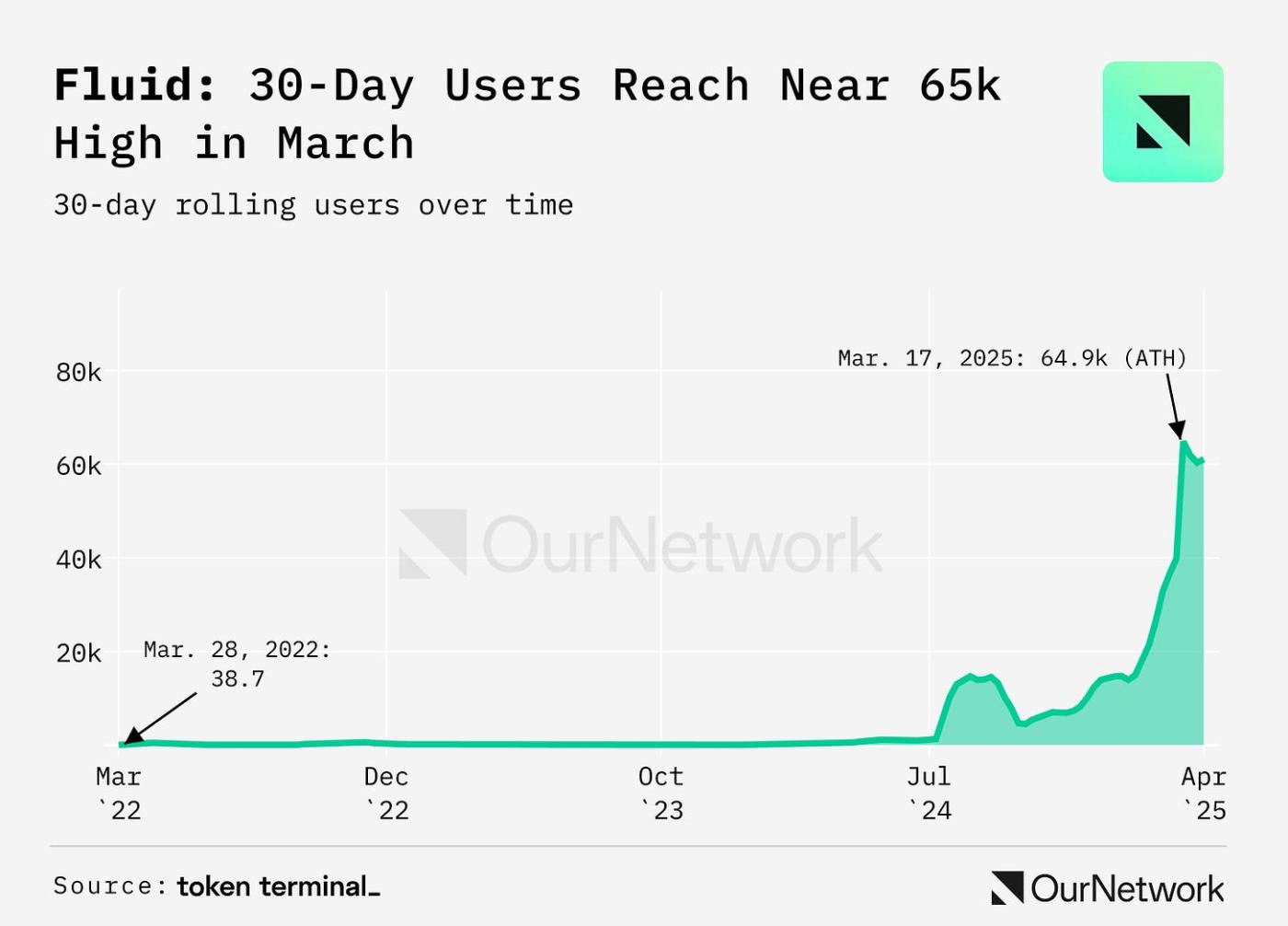

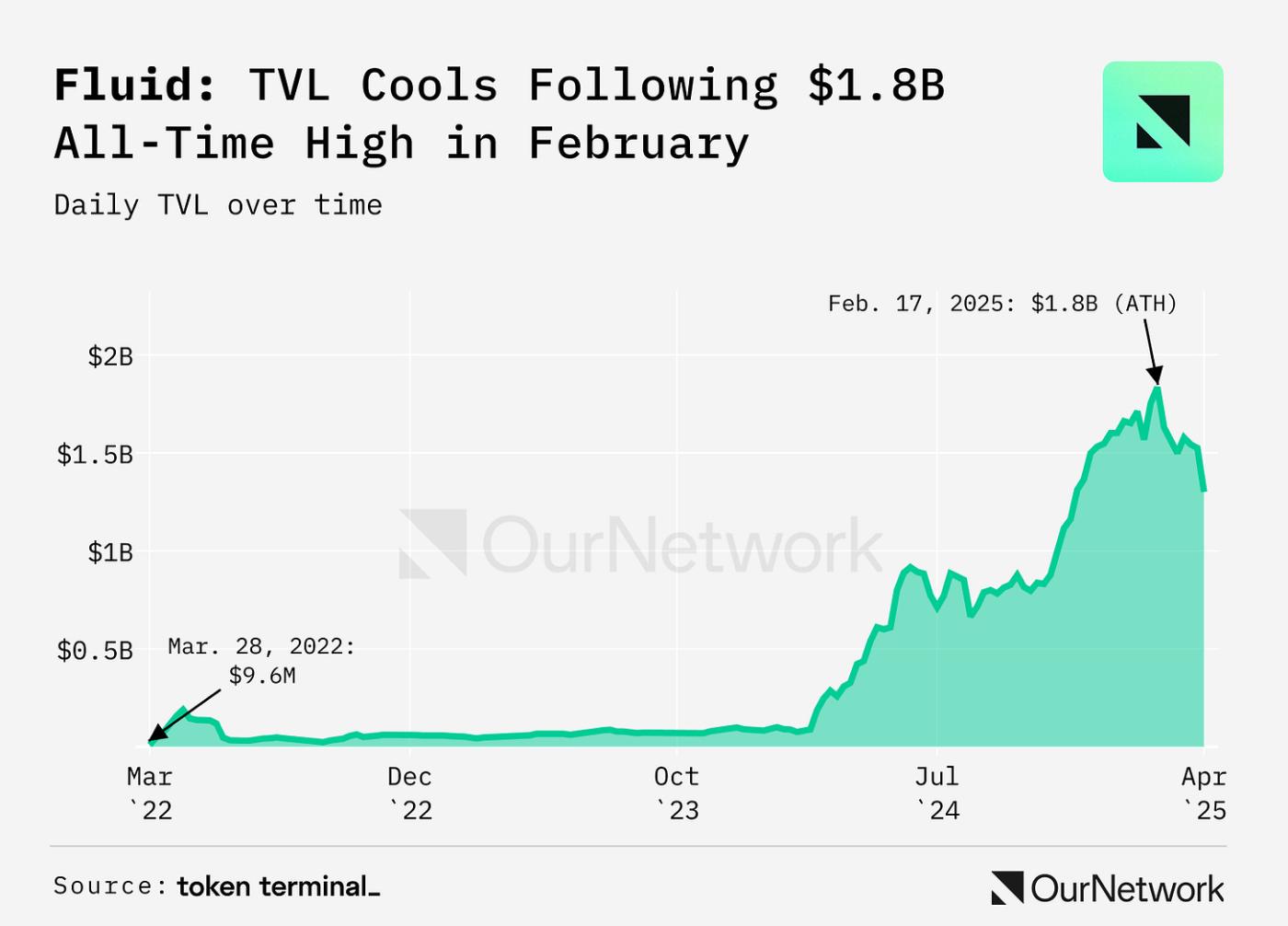

Fluid is a non-custodial lending, vaults, and decentralized exchange protocol developed by Instadapp, the DeFi platform. Since the launch of its decentralized exchange in late 2024, the protocol has experienced a significant surge in key performance metrics. Over the past months, Fluid has seen its monthly active users grow exponentially, reaching a peak of over 60,000 users in March 2025. This growth aligns with the sharp increase in total value locked (TVL), which surpassed $1.8B.

✏️ Editor's Note:

While the chart shows Fluid's TVL dropping in dollar terms, in ETH terms, it's steadily close to its high. This indicates the drop-off since February is due to crypto price fluctuations, rather than an exodus from the protocol.

Quick Links: Disclosures

ork! Subscribe for free to receive new posts and support our work.