On April 29, two Arizona State Strategic Bitcoin Reserve Bills successfully passed the final vote in the House of Representatives and are awaiting signature by Democratic Governor Katie Hobbs, making Arizona the first state in the United States to require public funds to invest in BTC. Among them, Bill SB 1373 proposes establishing a digital asset strategic reserve fund managed by the state treasurer, with up to 10% of funds invested in digital assets such as BTC each fiscal year; Bill SB 1025 allows the state treasury and retirement system to invest up to 10% of available funds in virtual currencies, with a focus on BTC.

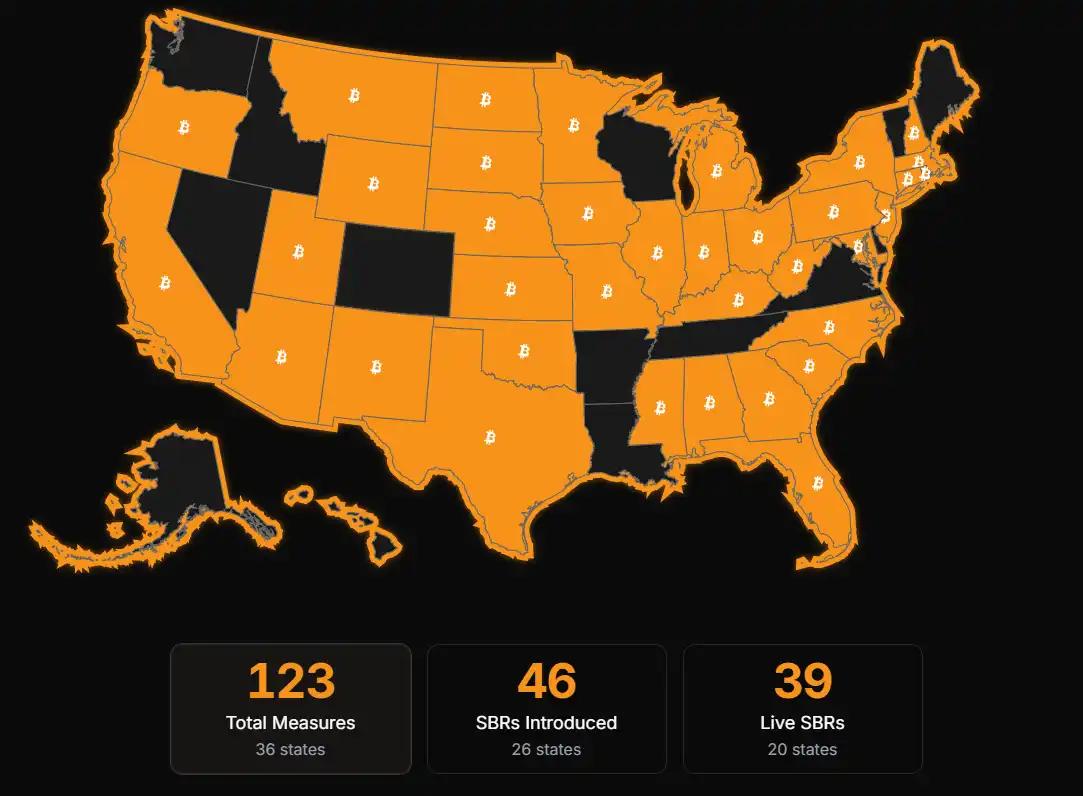

At the federal level, Trump signed an executive order in March requiring the establishment of a strategic BTC reserve and digital asset inventory. The Arizona state government's inclusion of cryptocurrencies in public financial management reflects the growing mainstream acceptance of digital assets. According to data from the Bitcoin Laws tracking website, 26 states in the United States have proposed bills to create BTC reserves, and the following are the bill progress situations for states other than Arizona.

States with Clear Support

(The rest of the translation follows the same professional and precise approach, maintaining the specified translations for technical terms)Montana

On January 31, 2025, Montana legislators proposed HB 429, suggesting allowing the state to invest up to $50 million in BTC, digital assets, stablecoins, and precious metals as a diversified fiscal investment. However, the bill was rejected on February 21 in the House with a vote of 59 to 41, failing to pass the first round of voting, with no indication of revival. Montana's legislative efforts for BTC reserves have come to an end.

Pennsylvania

On November 14, 2024, Pennsylvania Representatives Mike Cabell and Aaron Kaufer introduced HB 2664, allowing the state treasurer to invest up to 10% of Pennsylvania's general fund, rainy day fund, and state investment fund in BTC and crypto-based exchange-traded products, potentially involving investments up to $970 million. However, according to a report on March 2, 2025, the bill was "effectively terminated" in the legislative process, unable to advance further, with no current possibility of revival.

North Dakota

On January 11, 2025, North Dakota Representatives Nathan Toman, Josh Christy, and Senator Jeff Barta jointly proposed a strategic BTC reserve bill, aimed at allowing state fiscal investment in BTC, but with unclear specific investment proportions and details. Currently, the bill has failed to advance, with legislative efforts ending and no indication of restart.

South Dakota

On February 25, 2025, South Dakota legislators postponed a bill that might have allowed the state to adopt BTC as a strategic reserve asset. The bill's specific details were unclear, but aimed to allow state fiscal investment in BTC. The postponement was due to BTC's high price volatility, and the bill has now been terminated with no further possibility of advancement.

Wyoming

On January 18, 2025, a bill was introduced, supported by Wyoming Senator Cynthia Lummis, HB 0201, which would allow the state treasurer to invest in BTC up to 3%, including general fund, permanent mineral trust fund, and permanent land fund. Investments could be made through direct purchases or regulated BTC exchange-traded products, with annual reporting required for transparency. However, the bill currently shows no further progress and is considered a failed legislative effort.

Arizona's breakthrough has set a benchmark for U.S. states, with Texas, Alabama, and others following suit by legislatively incorporating BTC into public financial frameworks, aiming to diversify asset risks and seize digital economic opportunities. States previously rejecting BTC reserves due to crypto volatility risks and regulatory challenges, as well as those in ongoing processes, may shift their stance because of Arizona's first step. Despite multiple challenges, BTC's positioning as "digital gold" is gradually being consolidated through local legislation. Whether it can become a mainstream reserve asset remains to be seen, but it is undeniable that crypto is increasingly being accepted by the mainstream, and its future path will continue to broaden.