Original Source: Dune, Slice Analytics

Translated by: Yuliya, PANews

In the numerous innovations of the blockchain industry, Decentralized Physical Infrastructure Networks (DePIN) are rapidly rising, becoming a bridge for real-world assets to be on-chain. Whether it's shared GPU, telecommunications networks, or street map collection, DePIN is reshaping the construction and operation of infrastructure through crypto incentive mechanisms. Solana is gradually becoming the core platform for this trend, with its high-performance network providing ideal expansion soil for DePIN projects.

Based on the latest research report jointly released by Dune and Slice Analytics, this article conducts an in-depth analysis of the development status, market performance, and on-chain data of multiple core DePIN projects on Solana. The report data is as of April 22, 2025, providing us with a clear picture of this emerging ecosystem and revealing its true, verifiable growth trajectory.

[The rest of the translation follows the same professional and accurate approach, maintaining the technical terminology and specific blockchain-related terms.]- 2013: Helium founded

- 2019: Helium hotspots launched, users start earning HNT for coverage

- 2023: Migrated to Solana to improve scalability and speed

- 2024: Public release of Helium Mobile, a decentralized 5G service

- 2025: Launch of Zero Plan, the first free 5G mobile plan in the US

- 2025: SEC withdraws lawsuit against Nova Labs, confirming Helium's token model does not violate securities law

- 2025: Helium partners with AT&T to provide nationwide Wi-Fi coverage

Key Data:

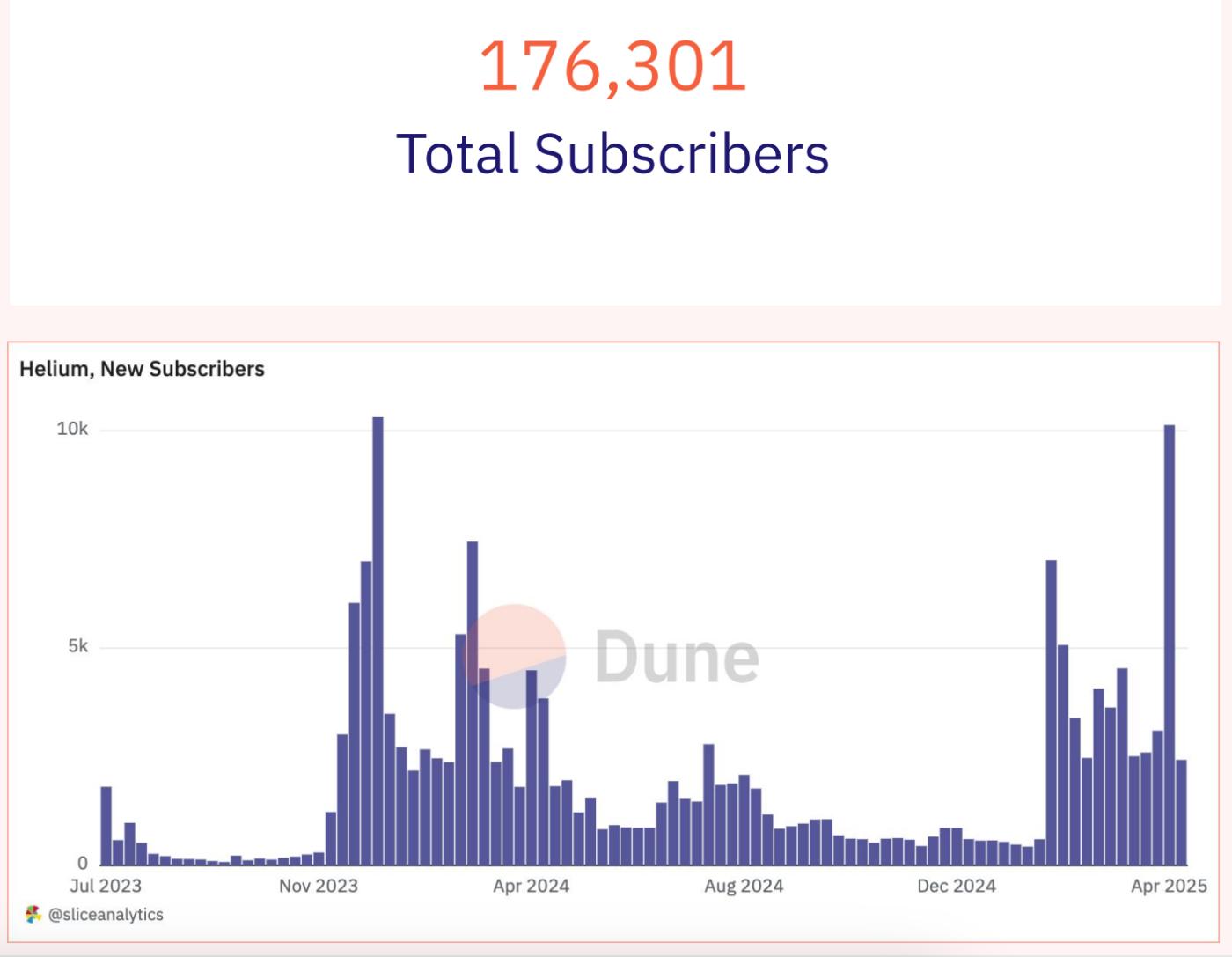

- Total Subscribed Users: 176,301

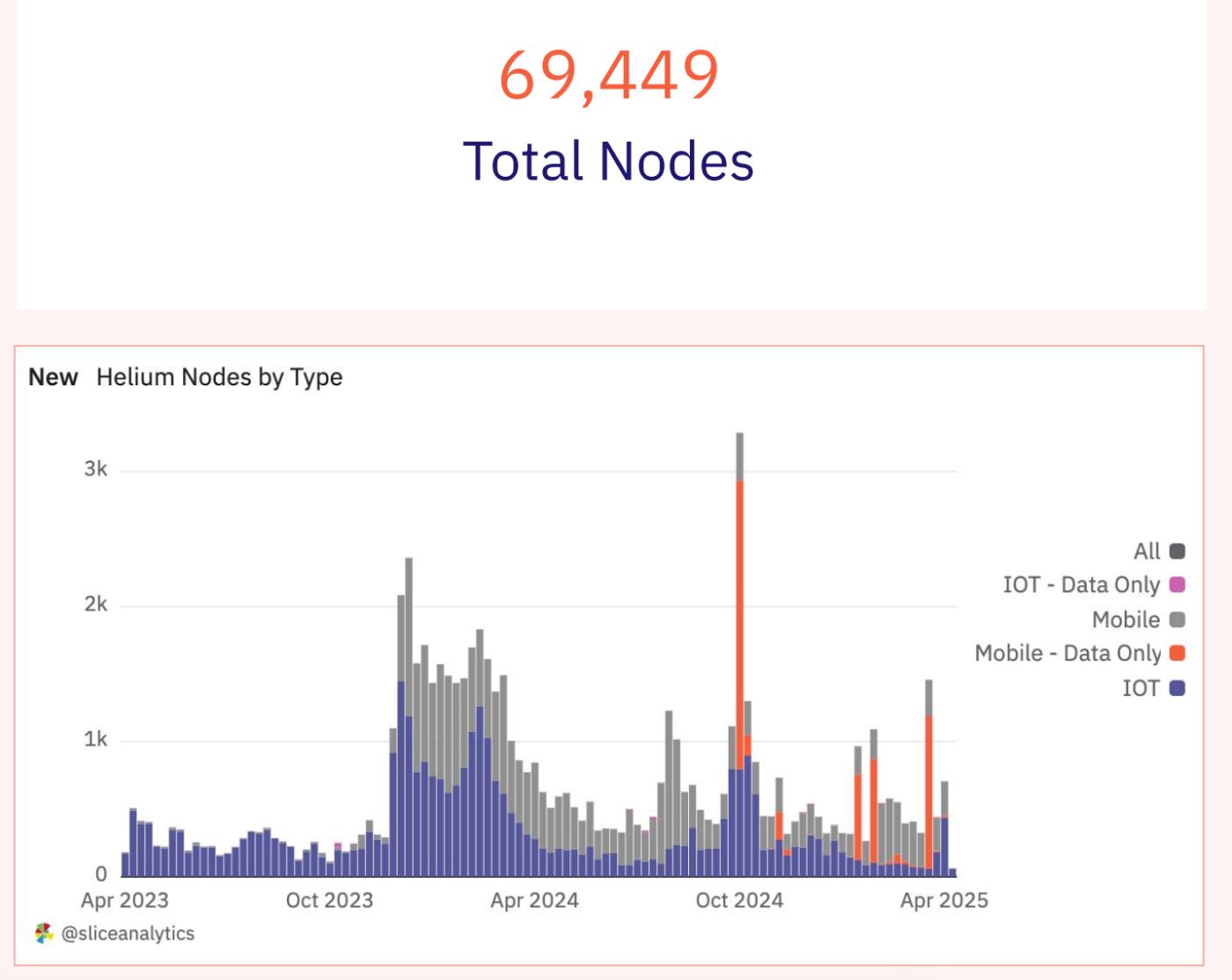

- Total Nodes: 69,449

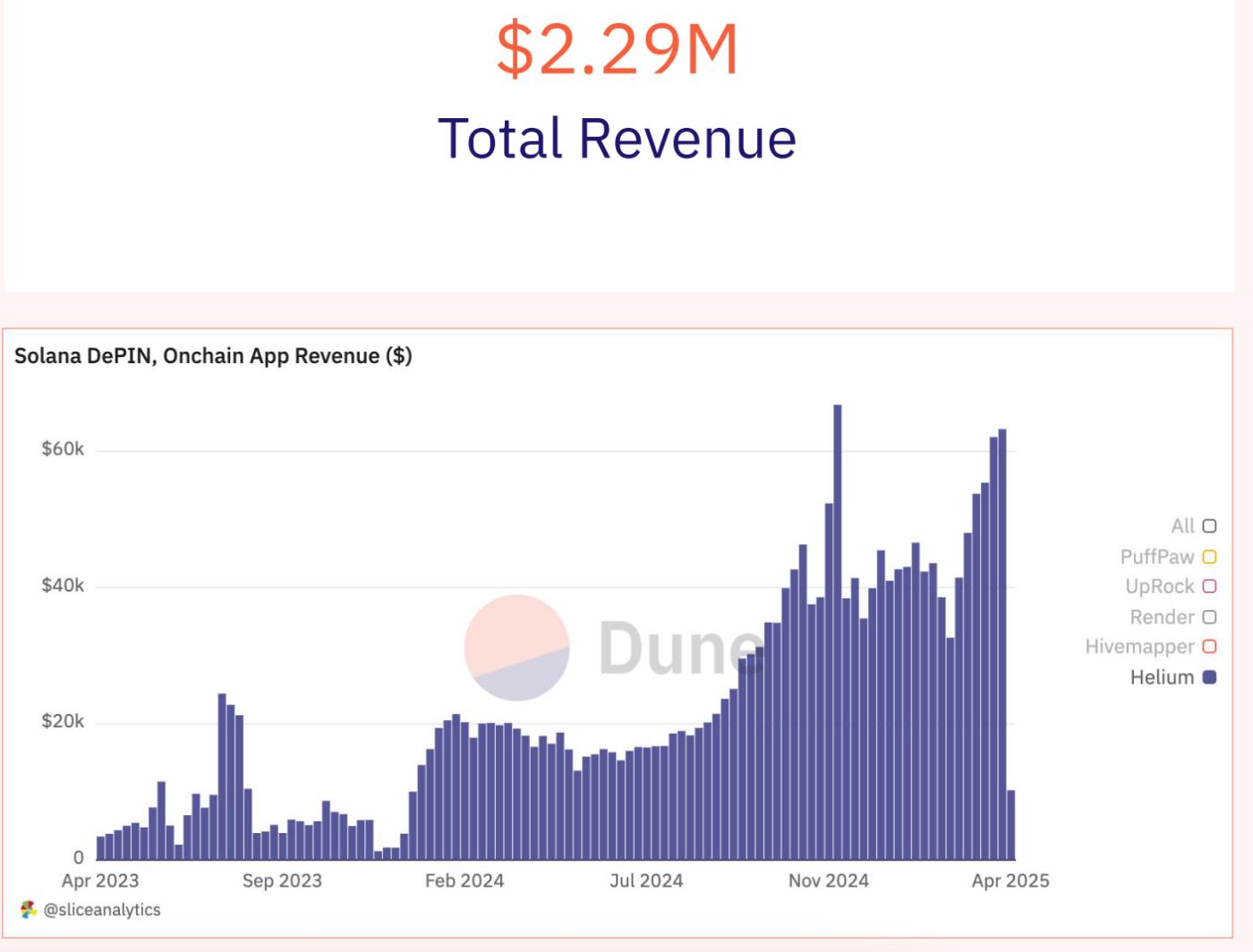

- Total On-chain Revenue: $2.29 million

Helium's subscriber growth was influenced by clear product-driven inflection points. Within a week of Helium Mobile's official launch in January 2024, new subscriptions reached 10,300, promoting more hotspot deployments and network expansion. Subsequently, the Zero Plan launched in February 2025 (the first free 5G mobile plan in the US) triggered a second wave of growth, quickly filling the waiting list. After opening the free plan to everyone in April, user numbers again peaked at 10,000.

As of the reporting period, Helium's total subscribed users reached 176,301, with 69,449 total nodes. Node composition shows a changing trend, with mobile data-specific categories growing particularly strong. The report indicates two key events drove node deployment peaks. First, the October 2024 partnership with Ameriband added over 100,000 data-only hotspots at retail and commercial sites; second, user growth accelerated again after removing the Zero Plan waiting list in April 2025.

Helium generates on-chain revenue through its unique burn-mint model, where users can convert HNT into non-transferable data credits (DCs) to access services on its IoT and mobile networks. Specifically, mobile data is charged at $0.50 per gigabyte (50,000 DCs), while IoT usage is charged per 24-byte message increment. The company's revenue grew steadily, reaching a record of $66,000 per week in December 2024 and again hitting a sustained peak of $63,000 per week in April 2025.

- 2024: Launch Global Testnet Grid

- 2024: Release Node V2, Significantly Improve Performance

- 2025: GPU Market Mainnet Launch

Key Data:

- Global Node Count: Over 4,200

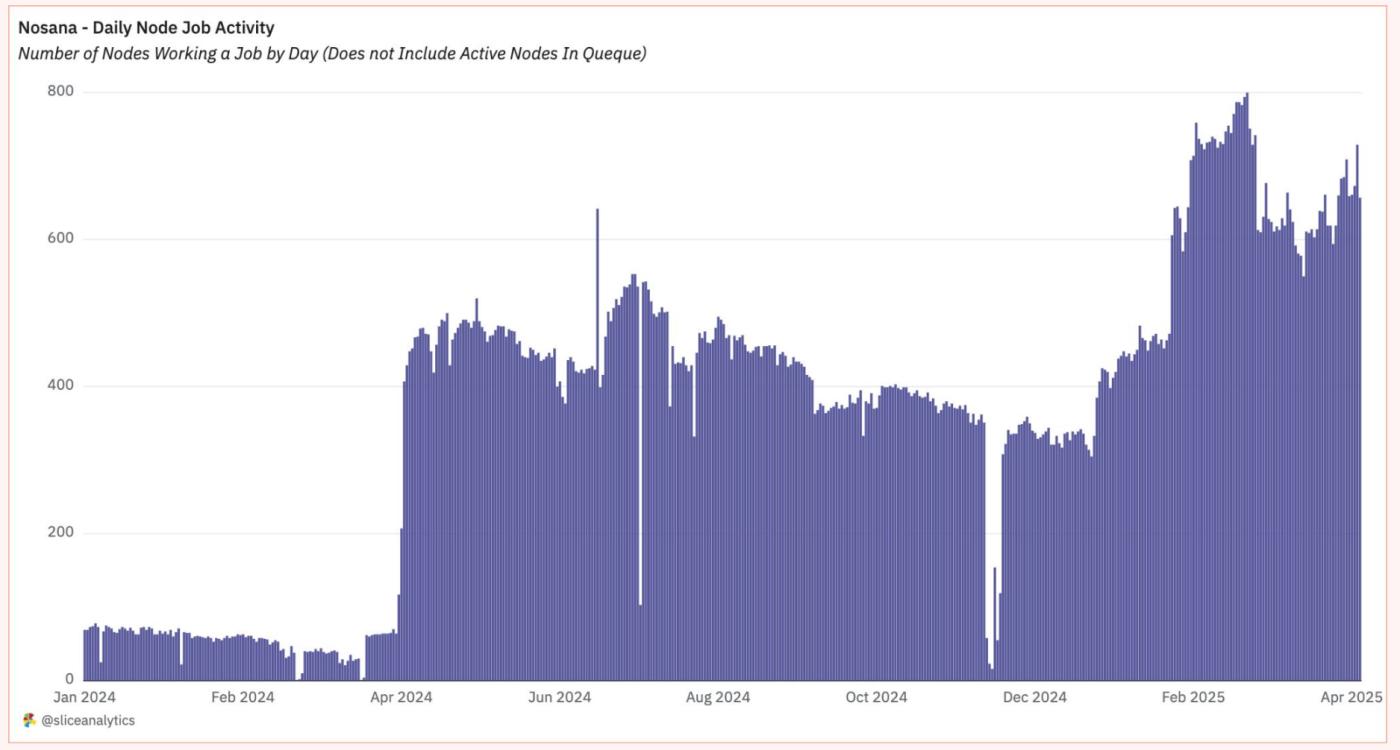

- Daily Active Nodes: Increasing from an Average of 300 in 2024 to Over 600 in 2025

In January 2025, Nosana officially launched its decentralized GPU market to the public. After a year of closed testing, this release triggered significant node activity growth: daily active nodes increased from an average of 300 in 2024 to over 600, with a peak of over 800 in March 2025. This growth indicates increasing adoption by GPU hosts and AI developers.

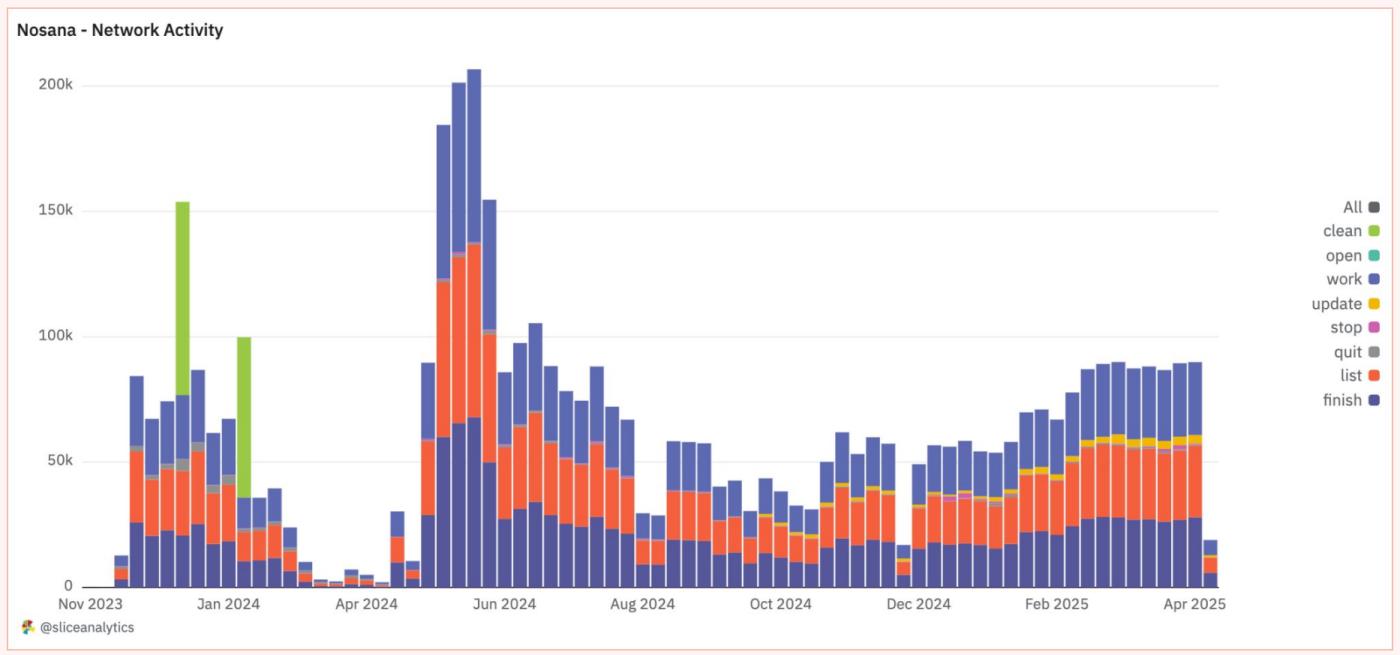

With over 4,200 nodes globally joining, Nosana has demonstrated scalability and continuous activity, becoming a powerful decentralized alternative to traditional computing providers. Its on-chain activity is driven by node operators' interactions with the work market, reflecting the actual usage of its decentralized GPU network. The network reached a historical high of over 200,000 operations per week in May 2024 and stabilized around 80,000 operations, showing a healthy, sustained demand for computing tasks.

Most activity comes from three key instruction types: creating new job positions, nodes queuing to execute tasks, and completing tasks with payment, representing the core work lifecycle on the network and maintaining a relatively stable usage pattern. Less frequent instructions like stop, exit, and cleanup, occurring about 1,000 times per week, indicate a low early task termination or cleanup rate, further demonstrating system stability and well-aligned incentive mechanisms.

5. UpRock: Mobile-First Data Intelligence Network

UpRock is a decentralized data intelligence network driven by a mobile-first DePIN model. Users can share unused internet bandwidth and computing power through the UpRock app, transforming everyday devices into passive data contributors and earning $UPT tokens. These resources provide real-time, geographically diverse, and censorship-resistant data support for AI models.

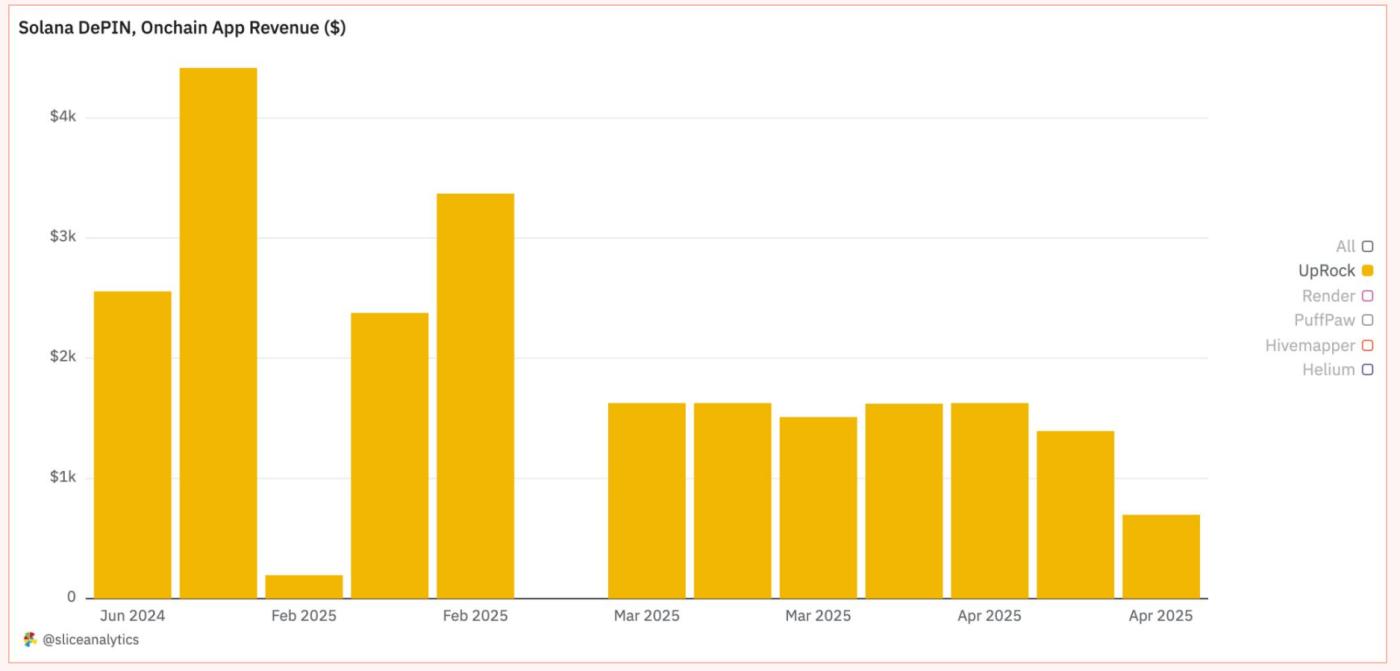

UpRock monetizes through SaaS subscriptions and pay-per-use APIs, with part of the revenue used for on-chain $UPT token buybacks, funding contributor rewards and strengthening the ecosystem. After reaching a peak of over $3,000 in weekly on-chain network revenue in February 2025, income has stabilized at around $1,500 per week.

Conclusion and Key Insights

- Solana's Leadership in DePIN: If protocols choose not to launch their independent L1/blockchain, Solana has become the leading chain for DePIN, with a total market cap of $3.25 billion and an average of $191.3 million per project.

- On-Chain Activity Proves DePIN's Actual Value: DePIN is more than just a narrative. Projects like Helium, Render, and Hivemapper have generated nearly $6 million in on-chain network revenue, a strong signal of real product-market fit.

- Computing and Wireless Categories Dominate the Market: Computing (71.2%) and wireless (22.2%) categories lead market share in the Solana DePIN field (totaling 93.4%).

- Node Growth and Service Adoption Accelerating: Helium has over 176,000 mobile users and 69,000 nodes, while Hivemapper and Render continue to expand their contributor base. Nosana doubled its active nodes after mainnet launch.

- Transparency Challenges Remain: Despite real applications, DePIN remains one of the most difficult crypto areas to track on-chain activity, as it relies on off-chain hardware and third-party integrations. While progress has been made, fully transparent and consistent on-chain measurement is still ongoing.