Original source from Forbes

Compiled | Odaily Moni

Editor's Note:A heavyweight news has emerged in the stablecoin market - Ripple has made a $4-5 billion acquisition offer to Circle Internet Group, a competitor preparing for an IPO and stablecoin provider! Yes, you heard that right, it's Ripple, which just had the SEC drop its appeal and acknowledge that XRP is not a security, but this offer was rejected as being too low. It is reported that Ripple is still very interested in Circle but has not yet decided whether to make another offer.

Why would this well-known crypto company, Ripple, make an attempt to acquire Circle at this point? Will Circle ultimately say "Yes" or "No"? Regarding these questions, Forbes published an article to dig deep into some "inside stories", Odaily will translate the original text as follows, enjoy~

Why would Ripple want to acquire a stablecoin company?

Stablecoins require both scale and speed.

The news of Ripple's potential acquisition of stablecoin company Circle might not seem like a typical acquisition at first glance, but for industry insiders familiar with Ripple's corporate strategic layout, acquiring Circle is both "unexpected and yet understandable".

In early April, Ripple acquired brokerage firm Hidden Road for $1.25 billion and announced that it would use the RLUSD stablecoin as collateral for its primary brokerage products, moving its post-trade activities to the XRP Ledger blockchain. Ripple believes this acquisition has the potential to optimize costs and liquidity for its cross-border payment service Ripple Payments and provide custodial services for Hidden Road's clients.

It's worth noting that Hidden Road has successfully obtained a broker-dealer license, which means this acquisition gives Ripple legal rights to access traditional financial channels as an institution. XRP and RLUSD might evolve into liquidity bridge assets for institutional trading execution, repo financing, and even sovereign debt swaps, opening doors for tokenized government bonds, central bank digital currencies, and RWA.

Clearly, Ripple's "ambition" has exceeded the crypto track, and its power tentacles are beginning to deeply embed into traditional financial infrastructure. Stablecoins pegged to fiat currencies are undoubtedly the best bridge connecting the crypto and traditional financial worlds.

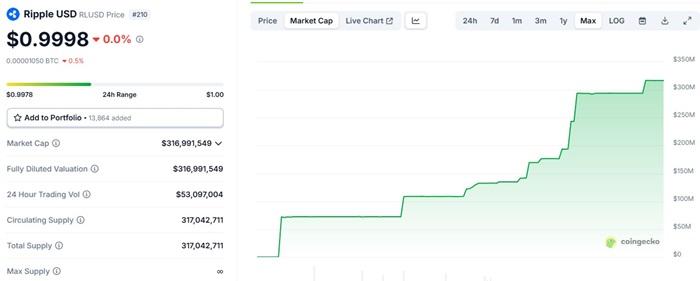

In fact, as early as mid-2024, Ripple CEO Brad Garlinghouse had confirmed the stablecoin strategy and announced the launch of RLUSD at the XRP Ledger community summit. After obtaining approval from the New York Department of Financial Services (NYDFS), RLUSD was officially launched at the end of last year, with a current market cap of around $316.9 million, which can be considered a good start.

However, for the current stablecoin market with a market cap of nearly $245 billion, RLUSD's performance is lukewarm. If it adopts a "steady" strategy, it seems difficult to keep up with rapidly developing competitors. Not to mention the market caps close to $149 billion for USDT, around $61.5 billion for USDC, or even the recently launched USD 1 that has broken through $2 billion in market cap, RLUSD's advantages are extremely insignificant.

Therefore, Ripple's acquisition of Circle is not just about expansion, but more of an acceleration strategy that allows it to overtake competitors and quickly secure a place in the global stablecoin economy.

(Translation continues in the same manner for the rest of the text)Power Game - Bigger Than Circle and Ripple

For leaders in financial technology, digital assets, and global payments: Market share alone cannot win the future, "winning" is about ecosystem coverage, interoperability, and trust. The stablecoin race is far from over, and the true winners will be those who can innovate boldly while maintaining enough flexibility to respond to regulations, market volatility, and global demands. Stablecoins are becoming the core pillar of the crypto ecosystem, and in the coming years, the integration, competition, and regulatory game around "compliant stablecoins + payment networks" will be the main theme.

Ripple's acquisition offer to Circle appears to be an acquisition deal, but it reflects the maturity of the stablecoin ecosystem, the blurred boundaries between crypto-native innovation and institutional adoption, and more importantly, the importance of strategic alignment when traditional finance meets crypto finance.