If you’re thinking of launching your own token on Solana, Raydium LaunchLab could be a name to know. The platform promises simple no-code token creation with real DeFi juice. Whether you’re building a meme coin, a serious utility project, or just experimenting, LaunchLab aims to give you the tools (and curves) to make it happen. So, is it as good as it looks from the outside? Here’s what to know in 2025.

KEY TAKEAWAYS➤ Raydium LaunchLab provides customizable token launches with features like bonding curves, vesting schedules, and integration with Raydium’s AMM.➤ Unlike platforms such as Pump.fun and Pompom, LaunchLab supports multiple quote tokens (SOL, USDC, USDT, jitoSOL).➤ LaunchLab enhances the Solana ecosystem by enabling token creation and liquidity integration.

In this guide:- What is LaunchLab?

- How does LaunchLab work?

- What are LaunchLab’s key features?

- Is there a LaunchLab airdrop?

- How is LaunchLab different from Pump.fun and Pompom?

- Why LaunchLab matters for Solana

What is LaunchLab?

Built into the Raydium ecosystem, LaunchLab is a no-code, permissionless token launchpad that lets anyone create and launch a token in minutes.

Think of it as a vending machine for tokens: you plug in your details, pick your bonding curve, set a few parameters, and your token goes live.

Did you know? A bonding curve is a mathematical pricing formula that determines how a token’s price increases as more of it gets bought. With LaunchLab, you can choose curves like linear, exponential, or logarithmic, meaning you control how price and demand interact right from the start.

It’s not just about launching. Once your token hits certain thresholds, LaunchLab connects it to real liquidity via Raydium’s AMM (automated market maker). That means your token can be bought and sold directly on Raydium, just like any major coin, without manual listings or middlemen.

Why was LaunchLab created?

Before LaunchLab, launching a token meant losing sleep over smart contracts, begging for AMM listings, and hoping your liquidity pool didn’t get drained by snipers. It was technical, slow, and mostly built for developers, not creators.

Raydium built LaunchLab to change that and give every creator a chance to launch with full control, smart liquidity flows, and pricing curves to match their project’s vibe.

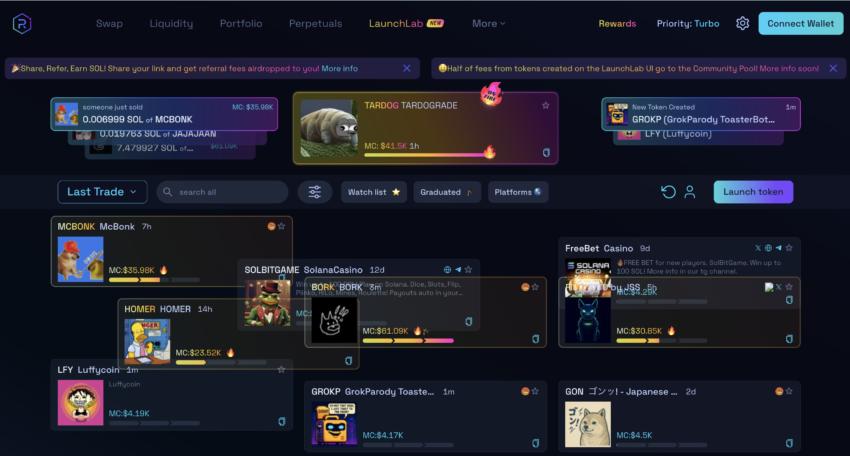

Raydium LaunchLab interface: Raydium

Raydium LaunchLab interface: RaydiumWhether you’re testing an idea or building a movement, Raydium LaunchLab makes it feel native — because that’s what it is.

How does LaunchLab work?

So, how does Raydium LaunchLab actually work behind the scenes? The good news is that you don’t need to be a dev. Here’s a quick example of the token creation process.

To create a token on LaunchLab you must:• Pick a launch mode• Enter token details• Hit launch

Step 1: Pick your launch mode

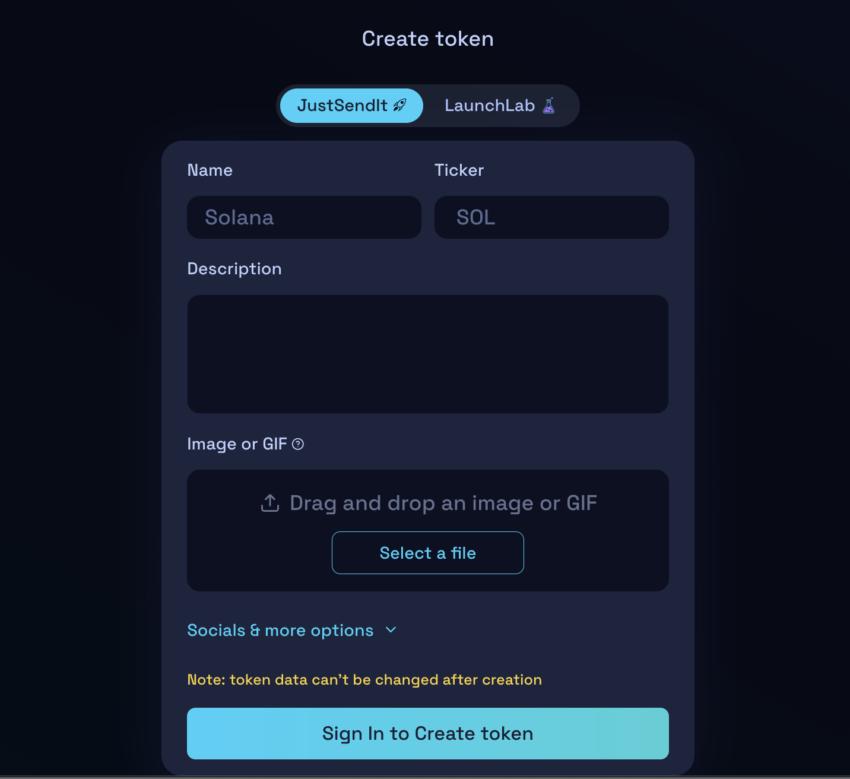

You’ll start by choosing between two modes:

- JustSendIt – for folks who want to go live now, with minimal fuss.

- LaunchLab Mode – for those who want customization: bonding curve shape, token supply, fees, vesting, etc.

Token creation method one: LaunchLab

Token creation method one: LaunchLabStep 2: Enter your token details

This is your token’s bio. You name it, assign a symbol, upload a logo if you like, and set the total supply. Then, you decide what % you want to sell to the public.

There’s a minimum raise target (e.g., 30 SOL), and you decide the bonding curve logic.

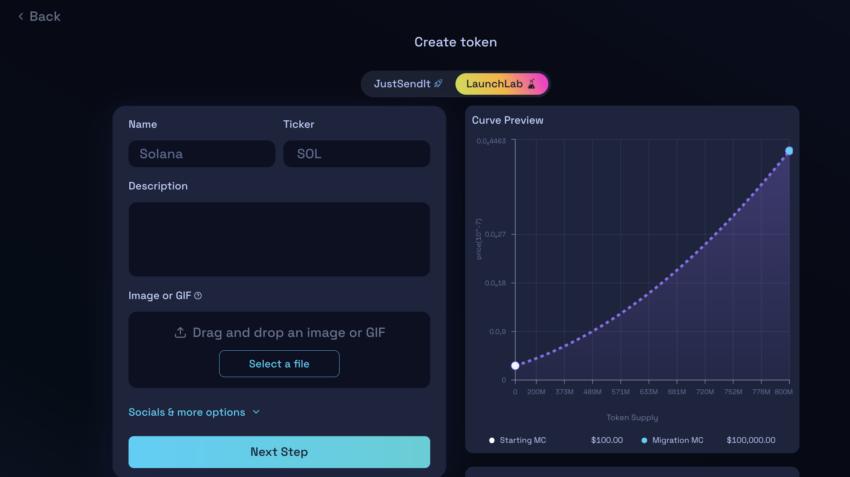

You can choose from the following bonding curve logics:

- Linear: Price rises steadily.

- Exponential: Starts low, then shoots up — great for rewarding early buyers.

- Logarithmic: Price climbs fast early, then slows — good for smoothing late entries

Note: This curve becomes your token’s pricing engine during the launch window.

Token creation method two: LaunchLab

Token creation method two: LaunchLabStep 3: Hit launch, and optionally, be first

Once you hit launch, anyone can start buying tokens along the curve. But LaunchLab gives you a cool option: you can make the first buy yourself. That stops bots and snipers from messing up your initial momentum.

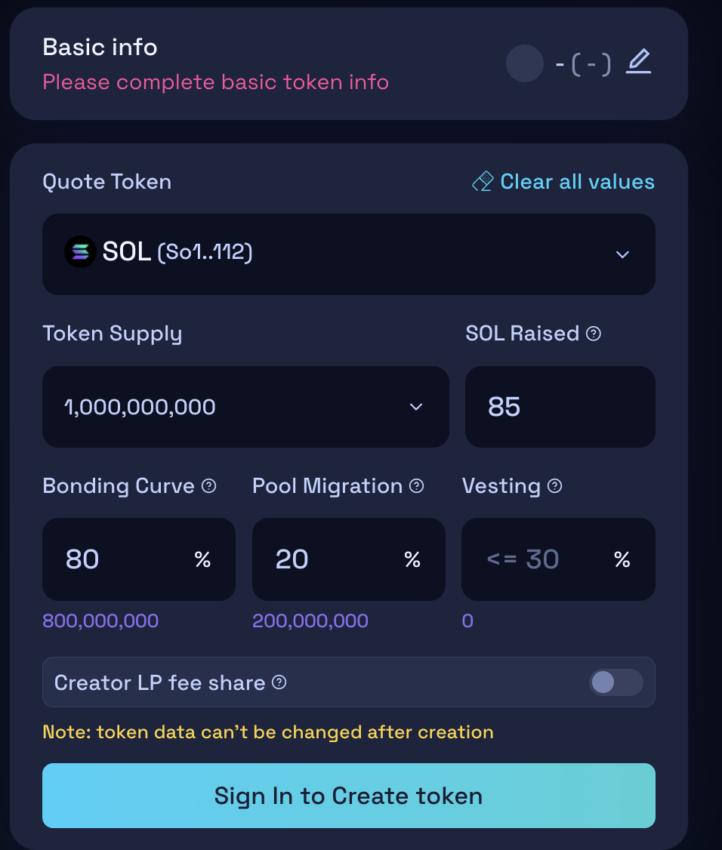

Step 4: Automatic liquidity kick-in

Once the raise hits your predefined goal (let’s say 85 SOL), LaunchLab automatically pushes your token and the collected SOL into a liquidity pool on Raydium’s AMM. It even burns the LP tokens, so the liquidity is locked. You can’t pull it, and neither can anyone else.

Step 5: Earn from trading fees

Here’s the kicker. If you enable creator fee share, you earn 10% of all LP trading fees from that pool. You get an NFT (“fee key”) that proves you’re the creator, and yep, that NFT is the key to claiming those earnings.

That’s it. From token creation to price logic and real, functioning liquidity in one smooth workflow.

Additional token creation details: LaunchLab

Additional token creation details: LaunchLabWhat are LaunchLab’s key features?

You’ve seen the workflow. Now let’s talk about what makes Raydium LaunchLab not just functional, but also powerful.

These features are designed to help you launch like a pro, even if it’s your first time deploying a token.

Full customization with Bonding curves & caps

You’re not locked into one-size-fits-all logic. LaunchLab lets you shape how your token behaves, starting with your bonding curve (linear, exponential, or logarithmic) and ending with your raise cap. So whether you’re rewarding early buyers or trying to maintain price stability, you get to call the shots.

Built-in liquidity via Raydium’s AMM

Once your raise completes, LaunchLab pushes your token and funds into Raydium’s AMM automatically, something we mentioned earlier while discussing the platform’s modus operandi.

Did you know? Many launch platforms rely on manual liquidity adds or third-party DEX listings. LaunchLab skips that entirely by integrating with Raydium, one of Solana’s top AMMs.

Creator fee share with NFT-based access

Enable Creator Fee Share, and you earn 10% of all trading fees from your token’s AMM pool. You’ll receive a unique Fee Key NFT, which acts like a revenue pass. As long as it’s in your wallet, you can earn from every trade your community makes.

Support for multiple quote tokens

You’re not limited to SOL. With Raydium LaunchLab, you can set your raise in SOL, USDC, USDT, or jitoSOL, depending on what fits your strategy or audience best.

Did you know? jitoSOL is a liquid staking token built on Solana by Jito Labs. Jito Labs, the team behind jitoSOL, is one of the key players in Solana’s infrastructure scene. The team is known for building tools that optimize staking, validator performance, and MEV (Maximal Extractable Value) solutions — basically helping Solana run faster, fairer, and more efficiently.

Vesting & token unlock options

If your project isn’t just a meme (and you’re thinking long-term), LaunchLab has you covered. You can set up vesting schedules, delayed unlocks, and custom distribution plans — all without writing a single line of code.

JustSendIt mode for one-click launches

Want to skip all the custom options? Use JustSendIt Mode, set the basics, and go live in minutes. Perfect for meme coins, experiments, or fast-moving trends.

Is there a LaunchLab airdrop?

Be honest; you were hoping for some alpha here, right? So far, there’s no official LaunchLab token, but there have been whispers.

The Raydium team recently dropped a tweet with an airdrop emoji, and the community’s been speculating ever since. So, while there’s nothing confirmed, if you’re interacting with Raydium LaunchLab now, you might be early.

It’s also worth noting that there’s already a referral rewards program tied to LaunchLab launches. Share a project and if someone swaps through your link, you get 0.1% of that volume airdropped directly in SOL. Not a massive bag — but it’s clean, real, and instant. So, no token drop (yet), but definitely a few perks floating around.

How is LaunchLab different from Pump.fun and Pompom?

At first glance, all three might look like token launch platforms riding the same meme wave. But dig a little deeper, and it’s clear that Raydium LaunchLab plays a different game. Here is a quick comparison table to validate that notion.

| Feature | Raydium LaunchLab | Pump.fun | Pompom |

| Customization level | High: bonding curves, vesting, multiple token pairs | Low: one-click, minimal setup | Minima: meme-first, visual-first |

| Liquidity handling | Auto-migrated to Raydium AMM with LP burn | Initially Raydium, now uses PumpSwap | No direct AMM integration |

| Supported quote tokens | SOL, USDC, USDT, jitoSOL | SOL only | Mostly SOL |

| Post-launch tools | Fee share via NFT, locked liquidity | None (highly experimental) | Basic trading, no fee-sharing |

| Ideal for | Builders, long-term projects, serious launches | Fast meme coins, viral drops | Meme vibes, visual discovery, and rapid spin-ups |

Why LaunchLab matters for Solana

Raydium LaunchLab isn’t just another Solana token launch platform; it’s an infrastructure layer that makes token creation, liquidity, and discovery feel native. By combining deep AMM integration with permissionless tools and bonding curve logic, it helps creators and strengthens Solana’s DeFi flywheel. Whether you’re shipping a meme or a serious project, LaunchLab brings long-term mechanics to what used to be short-term hype.

While it might just be the right time to start exploring it in depth, it’s important to proceed with caution, particularly if you’re looking at investing in LaunchLab-made meme coins. Be wary of scams and fishing links and prioritize safety whenever interacting in such new, decentralized spaces.