After a relatively stable month of April with reduced network demand and sideways pricing, the second-largest cryptocurrency, Ethereum (ETH), may be preparing for a change.

ETH holders are optimistic about May. This optimism is driven by strong fundamentals, the upcoming Pectra upgrade, and renewed interest from institutional investors through spot ETH exchange-traded funds (ETFs).

ETH faced challenges in April, but May brings a ray of hope

In April, on-chain data showed a decrease in user activity on the Ethereum network, while broader market stagnation kept ETH trading below important resistance levels.

According to Artemis, over a 30-day period, Ethereum's user demand significantly dropped, leading to a decline in active addresses, daily transaction volume, and consequently, network fees and revenue.

This, along with the broader market downturn, affected ETH's performance, keeping the top altcoin's price below $2,000 throughout April.

However, in an interview with BeInCrypto, Gabriel Halm, a research analyst at IntoTheBlock, suggested that ETH's price could surpass $2,000 in May and stabilize above that level.

For Halm, improved capital inflows into ETH spot ETFs, Ethereum's dominance in the DeFi sector, and the upcoming Pectra upgrade could help make this a reality.

ETF Inflows, DeFi Dominance, and Pectra: Three Drivers for Ethereum in May

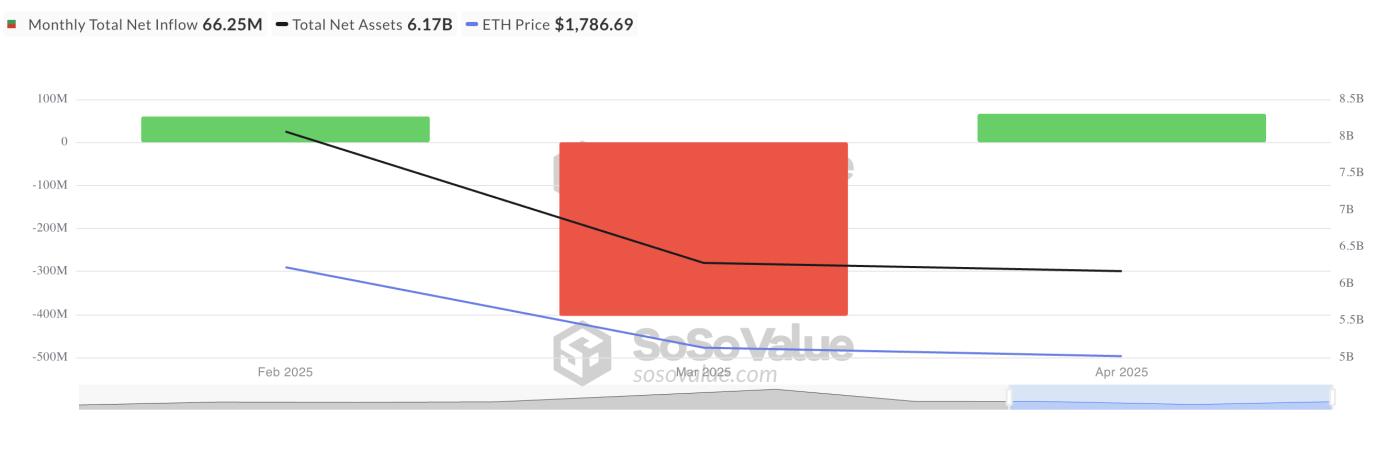

According to SosoValue, the monthly net capital flow into ETH ETFs totaled $66.25 million in April, indicating a shift in market sentiment compared to the $403.37 million net outflow recorded in March.

Total net inflow of Ethereum spot ETFs. Source: SosoValue

Total net inflow of Ethereum spot ETFs. Source: SosoValueThe reversal from strong outflows to modest inflows suggests investor confidence in the altcoin is gradually returning. This indicates institutional investors may be preparing for a long-term recovery, especially as Ethereum's network fundamentals begin to improve, one of which is its increasing dominance in the DeFi sector.

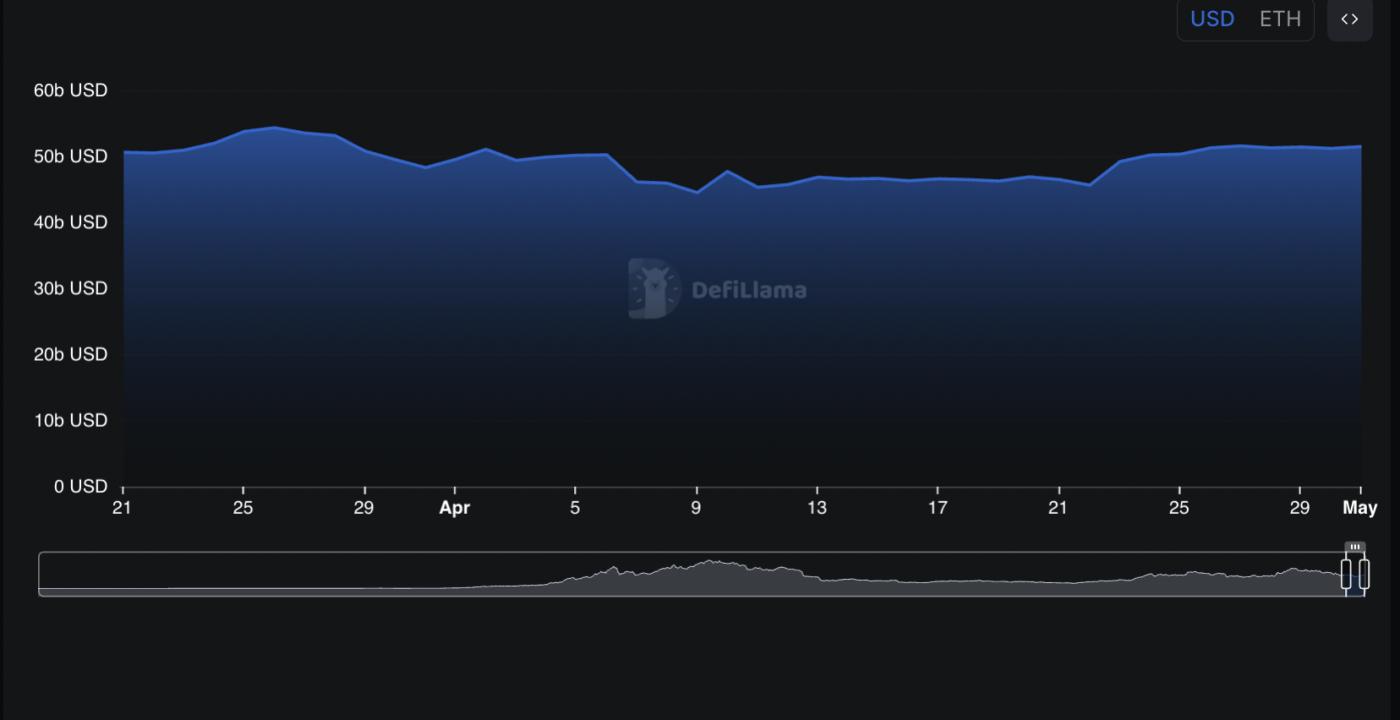

Over 50% of the Total Value Locked (TVL) in DeFi protocols remains on the Ethereum blockchain. This means Layer-1 (L1) is still the preferred payment layer for various financial applications, including lending, staking, yield farming, and decentralized exchanges.

Ethereum's DeFi TVL. Source: defillama

Ethereum's DeFi TVL. Source: defillamaTherefore, in May, if broader market conditions begin to improve, new capital inflows into Ethereum's DeFi sector could, in turn, drive demand for ETH and support its price momentum.

Moreover, according to Halm, Ethereum's upcoming Pectra upgrade, expected to launch on 07/05/2025, could continue to support ETH's price performance this month. This upgrade promises to improve network scalability, reduce transaction fees, enhance security, and introduce smart account functionality.

These improvements could drive increased user demand throughout May, potentially lifting ETH's price, provided macroeconomic conditions remain favorable.

ETH's Development Depends on Broader Market Stability

However, broader economic pressures pose a significant risk to ETH in May. Halm notes that the upcoming CPI report on 13/05 will be particularly important, likely influencing market sentiment and contributing to volatility.

This is because inflation or hawkish signals from the Federal Reserve could worsen risk-averse sentiment in the cryptocurrency market, putting pressure on ETH's price.

Halm also points out that ETH remains highly correlated with US stocks. Therefore, if the stock market faces new tensions this month due to inflation concerns or interest rate expectations, the altcoin could face similar pressures.

Historical correlation of ETH with S&P 500. Source: IntoTheBlock

Historical correlation of ETH with S&P 500. Source: IntoTheBlock"Looking ahead in May, if this high correlation continues, it implies that Ethereum's vulnerability to market downturns and inflation-related pressures could be similar to traditional risky assets like those in the S&P 500. A downturn in the general market or increasing inflation concerns affecting stocks could therefore negatively impact ETH's price," said Gabriel Halm, research analyst at IntoTheBlock.

Although a sustainable price increase above $2,000 remains possible, any price surge likely depends on inflation trends, risk sentiment in traditional markets, and the extent to which ETH remains tied to stocks.