Cryptocurrency traders and investors will witness the expiration of Bitcoin (BTC) and Ethereum (ETH) options worth approximately $3 billion today.

Option expiration primarily causes price volatility. Therefore, cryptocurrency market participants should carefully observe today's changes and adjust their trading strategies based on 8:00 UTC.

$2.95 Billion Bitcoin Ethereum Option Expiration

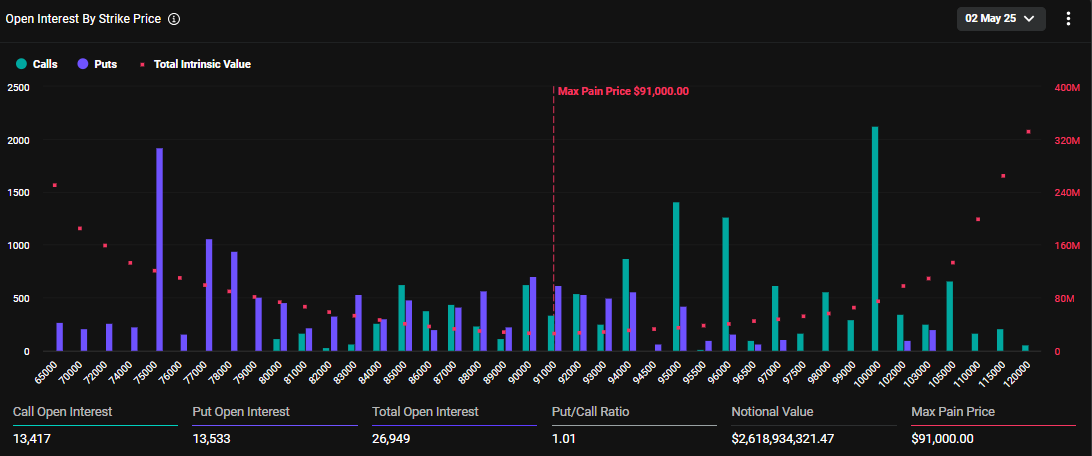

According to data from cryptocurrency derivatives exchange Deribit, 26,949 Bitcoin contracts will expire today. The nominal value of the expiring options is approximately $2.6 billion.

The maximum pain point that could cause financial losses to the largest asset holders is $91,000. At this point, most contracts will expire worthless.

Bitcoin's put-call ratio is 1.01, indicating that investors are making more sell (put) orders than buy (call) orders, suggesting a bearish sentiment.

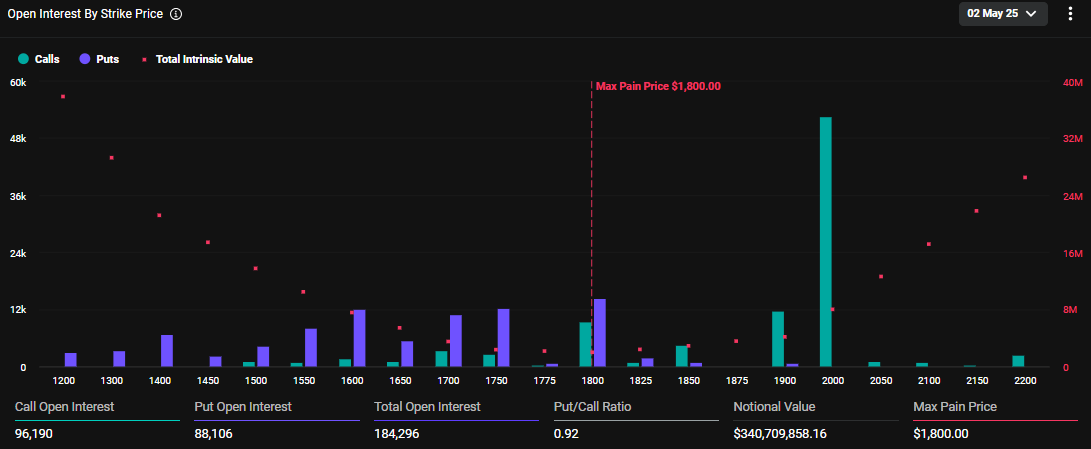

In contrast, Ethereum's put-call ratio is 0.92, representing a generally bullish market outlook. According to Deribit data, 184,296 Ethereum contracts will expire today. The nominal value of these expiring contracts is approximately $340.7 million, with a maximum pain point of $1,800.

Ethereum has shown a slight increase of 2.27% since the start of Friday's session and is currently trading at $1,848.

Despite Bitcoin sell orders exceeding buy orders, analysts from Greeks.live mention a primarily bullish sentiment in the market. They also note that many traders are expecting a rise towards $100,000, citing low volatility and market structure.

"Notable key levels are the just-reached $96,000 NPOC [Naked Point of Control] and $94,400 rolling VWAP [Volume-Weighted Average Price]. However, some express concerns about May selling and exit seasonality." – Greeks.live

Due to low volatility, traders are seeing opportunities for long positions. According to Greeks.live, market makers are selling calls at 30% implied volatility (IV) to collect gamma, with leverage remaining low. This suggests potential upside as traders anticipate more interest rate cuts.

Collecting gamma means selling options at stable prices to profit, managing small price movements, and gaining premiums in low volatility markets.

With ETH underperforming compared to BTC, some traders are short-selling it. Meanwhile, others are noting BTC's steady rise and considering July volatility positions for vega gains, reflecting a strategic market focus split.

Vega gains occur when market volatility increases, causing option prices to rise, benefiting traders holding options with high vega sensitivity.

Meanwhile, Deribit analysts agree that some traders are focusing on Bitcoin's steady rise. In this context, BTC accumulation above $95,000 is significant.

"The market shows strong BTC call accumulation above $95,000. What impact will the expiration have?" – Deribit Analysts

At the time of writing, Bitcoin is trading at $97,108, recording an almost 3% increase over the past 24 hours.

Therefore, Bitcoin call option accumulation above $95,000 indicates traders' optimistic outlook on price increase.

Nevertheless, it should be noted that option expiration can cause volatility. Last week, the $8.05 billion option expiration caused a short-term price adjustment. However, volatility around option expiration tends to ease when contracts are settled at 8:00 UTC on Deribit.