This week, many interesting events took place in the cryptocurrency field, spanning various ecosystems. However, the main highlights focused on the Bitcoin (BTC) and XRP ecosystems.

If you missed it, here is a compilation of the week's notable stories in the cryptocurrency field.

Bitcoin Tests $97,000

Starting the list of this week's cryptocurrency events, Bitcoin tested the $97,000 mark for the first time since February 2025. However, at the time of writing, this pioneering cryptocurrency had slightly decreased and was trading at $96,731.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCryptoThis pioneering cryptocurrency has shown significant volatility in recent weeks and months, influenced by most of President Trump's tax policies. The trade chaos, from temporary pauses to retaliatory commitments and rumors of reduced tensions, has increased volatility.

However, amid these uncertainties, Bitcoin has emerged as a hedge against traditional financial (TradFi) risks and U.S. Treasury risks. Institutional interest in BTC has also increased, with Bitcoin ETFs recording increased inflows while Gold ETPs have slowed down.

Sui and Pokémon Collaboration Discussion

Another highlight this week in the cryptocurrency field is speculation about a potential collaboration between Sui blockchain and Pokémon. Amid these discussions, the price of SUI increased by over 60% during the week.

These rumors erupted after the Pokémon HOME privacy policy update, which featured Parasol Technologies, LLC as a new developer. Parasol Technologies is a Web3 gaming infrastructure company that Sui's developer, Mysten Labs, acquired in March 2025.

However, changes in one of the circulating documents dampened the speculation, clarifying what was the main driver for SUI's price this week.

"The official Sui Foundation blog confirmed (and removed) Pokémon NFTs. They seem to be developing a cloud infrastructure using blockchain technology to address bugs, hacks, and fraud while allowing transfers between compatible games," another user emphasized.

However, this adjustment did not diminish speculation that Parasol might be involved in developing new features for Pokémon.

SUI Price Performance. Source: BeInCrypto

SUI Price Performance. Source: BeInCryptoThe SUI price has dropped nearly 3% in the past 24 hours. At the time of writing, it was trading at $3.47.

ProShares XRP ETF Rumors

Added to the list of cryptocurrency speculations this week is a rumor that the SEC (U.S. Securities and Exchange Commission) approved a ProShares XRP ETF.

However, BeInCrypto refuted these claims, explaining that the approval was for ProShares' Leveraged and Short-Term XRP Futures ETFs. ETF analyst James Seyffart also provided further clarity, stating that the allegations were incorrect.

"UPDATE: Many are posting/reporting that ProShares will launch XRP ETFs on 04/30. We have confirmed this is not true. We do not have an official launch date but believe they will launch — and likely in the short or medium term," Seyffart explained.

ProShares has launched three futures-based ETFs: Ultra XRP ETF, Short XRP ETF, and Ultra Short XRP ETF. This development occurred after Teucrium launched the 2x Long Daily XRP ETF in early April.

ProShares XRP Futures ETF Sparks Optimism

Meanwhile, the approval of ProShares XRP futures ETF has sparked optimism, creating a sense that a spot XRP ETF would be the next step.

According to industry expert Armando Pantoja's forecast, this move could lead to significant capital inflow into the altcoin.

"A spot XRP ETF could be the next step, unlocking real demand and driving prices higher. Over $100 billion could soon flow into XRP," he wrote.

Pantoja noted that the approval marks a crucial turning point for the industry, expanding XRP's investor base.

This optimism emerges as the ProShares XRP futures ETF has attracted significant attention from Wall Street and institutional investors.

The approval has paved the way for the XRP ETF, providing Ripple's token with a managed and accessible channel for major financial participants.

"Futures ETF = first domino piece. Spot ETF = explosion point. XRP's long-term setup has just become much stronger," Pantoja commented.

Another analyst was more cautious amid rising optimism, noting that futures ETFs are not the game-changing factor many might expect.

"It's not the silver bullet that will trigger widespread acceptance or significant price action. The real momentum will come when a Spot XRP ETF is approved. Real token. Real demand. Real market impact," John Squire posted.

SEC Delays Decision on XRP ETF

To add to the list of developments in the XRP ecosystem this week in the cryptocurrency field, the US SEC has delayed its decision on a potential XRP ETF until June 17.

Before this news was announced, cryptocurrency market participants were waiting for the final decision on XRP, Dogecoin (DOGE), and Ethereum Staking ETFs. However, all have been postponed.

"These are intermediate days and we may see the final decision on many crypto ETPs in the fourth quarter. For the spot XRP ETF, [I am] targeting mid-October, around the 18th, as the deadline for the final decision. The SEC may not take much time to make a decision, but many things will depend on their level of active engagement with the applications," Seyffart explained.

Currently, over 70 ETF proposals are awaiting the securities regulator's judgment. The June deadline for the XRP ETF is not final, but the committee may continue to delay until mid-October.

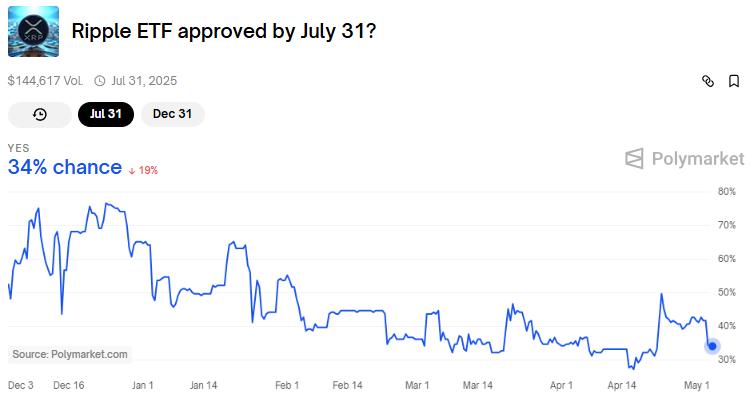

Meanwhile, data from Polymarket shows that bettors see a 34% chance that this financial instrument will be approved before July 31.

XRP ETF approval probability. Source: Polymarket

At the same time, they see a 79% chance that this financial instrument will be approved before December 31 at the time of writing.