According to the latest market analysis, if current macroeconomic conditions persist, Bitcoin's price is expected to break through $135,000 within the next 100 days, setting a new historical record.

Core Predictions:

- As the market volatility index (VIX) remains below 18, it will create a risk-appetite environment that may drive Bitcoin to rise to $135,000 within 100 days

- The total market value of stablecoins has exceeded $220 billion, injecting strong liquidity into the cryptocurrency market, which is favorable for Bitcoin's price trend

- The negative Bitcoin financing rate suggests a potential short squeeze, with prices possibly challenging the $100,000 mark

Bitcoin network economist Timothy Peterson recently published an analysis on social platform X, pointing out the significant correlation between Bitcoin's price and the Chicago Board Options Exchange Volatility Index (VIX). Data shows that the VIX index has significantly dropped from 55 to 25 in the past 50 trading days. Peterson emphasized that when the VIX index falls below 18, it often signals a market entering a risk-appetite phase, which will create a favorable environment for high-risk assets like Bitcoin.

It is worth noting that Peterson's prediction model has a historical accuracy rate of 95%. The model indicates that as long as the VIX index remains low, Bitcoin's target price within the next 100 days will reach $135,000. This prediction aligns with Bitcoin's high sensitivity to market sentiment - a lower volatility index means reduced market uncertainty, making investors more inclined to allocate high-risk assets.

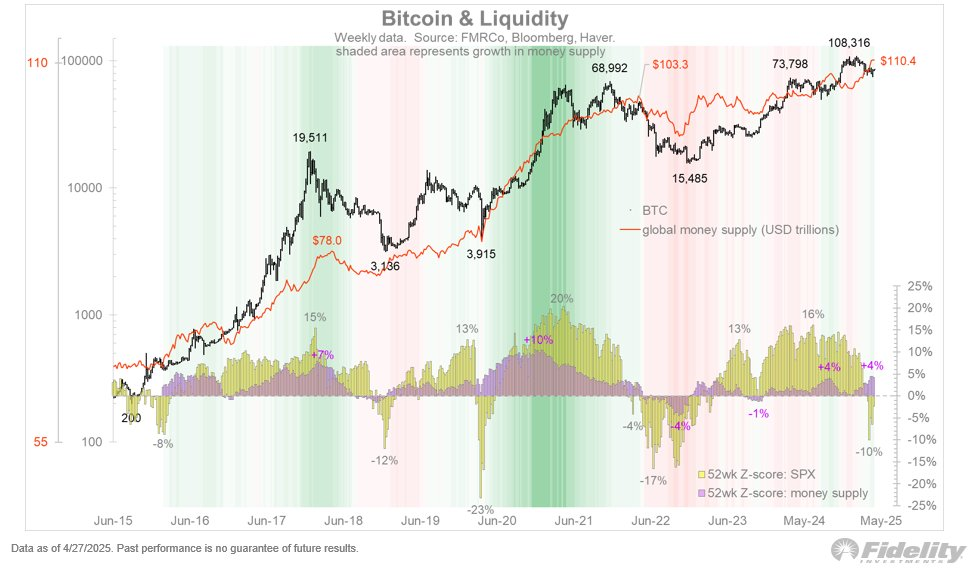

Jurrien Timmer, Fidelity's Global Macro Director, used the "Dr. Jekyll and Mr. Hyde" metaphor to vividly describe Bitcoin's dual nature. Timmer pointed out that Bitcoin possesses both a value storage function (Dr. Jekyll) and strong speculative characteristics (Mr. Hyde), which sharply contrasts with gold's consistent "hard currency" attribute.

The relationship between Bitcoin price and global money supply. Source: X.com

He particularly emphasized the dynamic relationship between Bitcoin's price and global money supply (M2):

"When M2 growth accompanies stock market rises, Bitcoin tends to perform strongly due to its dual attributes. However, when M2 growth meets a stock market pullback, Bitcoin's performance becomes relatively lackluster."

This analysis reveals Bitcoin's high sensitivity to macroeconomic environments and explains why its price trend is less stable and predictable compared to gold.

In terms of market liquidity, the latest data from CryptoQuant shows that the total market value of stablecoins has exceeded $220 billion, a historical new high, marking an unprecedented level of liquidity in the cryptocurrency market. This data indicates that as funds continue to flow in, Bitcoin has clearly emerged from the bear market shadow. Given that stablecoins directly reflect market liquidity conditions, analysts expect Bitcoin's price to potentially reach new highs in the coming weeks.

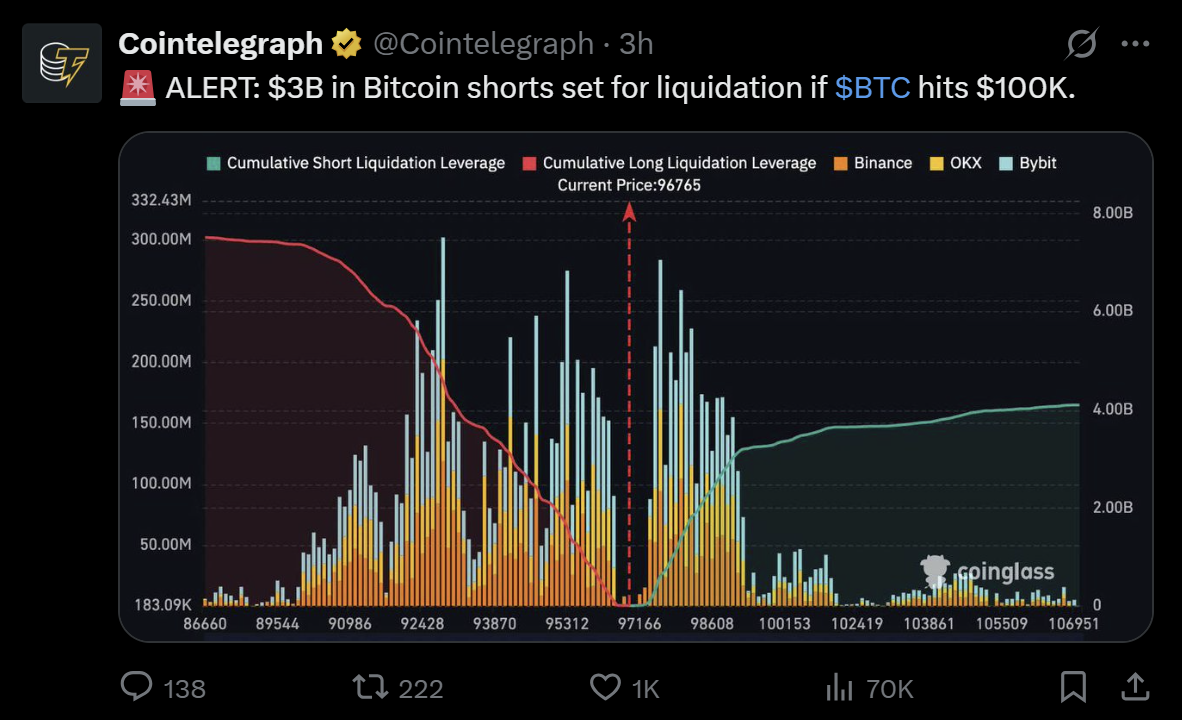

Bitcoin 4-hour chart and financing rate. Source: Velo.chart

Despite Bitcoin's overall upward trend, subtle changes have occurred in the short-term market structure. The latest data shows that Bitcoin futures financing rates have again turned negative, indicating that short positions are increasing, and traders generally expect prices to continue rising.

Notably, the 4-hour chart's funding rate has dropped to the lowest negative value since 2025, showing that short-side liquidity significantly overwhelms long positions. This extreme imbalance sets the stage for a potential short squeeze, which could drive Bitcoin's price to break through the psychological $100,000 mark.

Currently, over $3 billion in short positions face liquidation risk. Once the upward price trend is established, it may trigger a chain reaction, forcing shorts to close positions and further amplifying upward momentum.