As Bitcoin broke through the psychologically important $95,000 mark, a new positive atmosphere was injected into the market. At least among miners, this is the case.

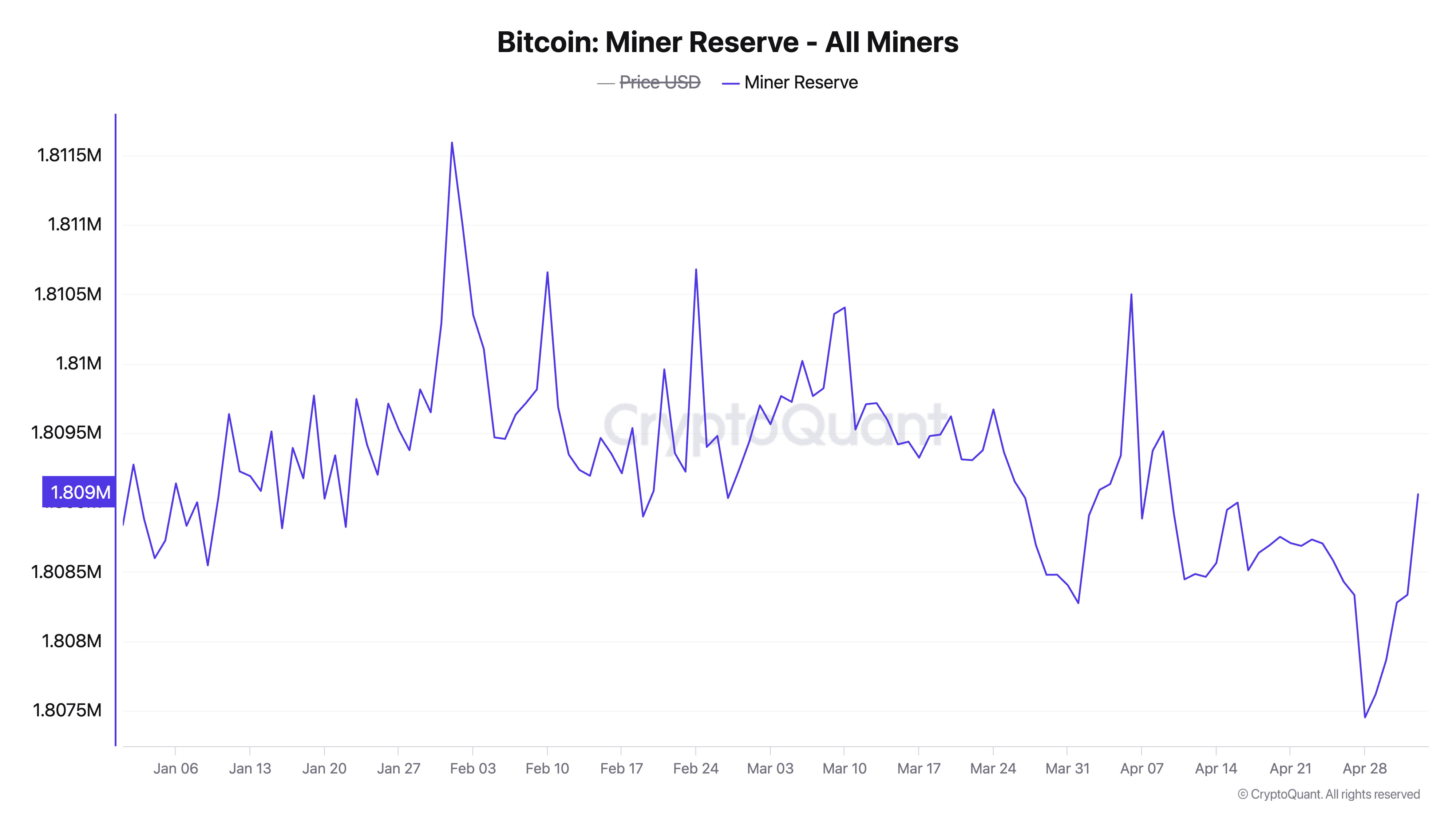

This important milestone triggered a change in miners' psychology. According to on-chain data, BTC miners' reserves have noticeably increased over the past few days.

Miners Betting on BTC Rise... Increasing Reserves from Annual Lowest Point

According to the crypto on-chain platform Crypto.com, Bitcoin's miner reserves had been continuously declining but started to increase from April 29th, right after BTC surpassed $95,000.

Notably, the reserves had dropped to the annual lowest point of 1.8 million BTC just a day before, but then changed direction and showed signs of accumulation.

Bitcoin's miner reserves track the number of coins held in miner wallets. This indicates the number of coins miners have not yet sold. When reserves decrease, it often means miners are moving coins out of their wallets to sell, confirming a bearish sentiment towards BTC.

Conversely, when this indicator rises, it suggests miners are holding more of the coins they mine, reflecting confidence in BTC's future price increase.

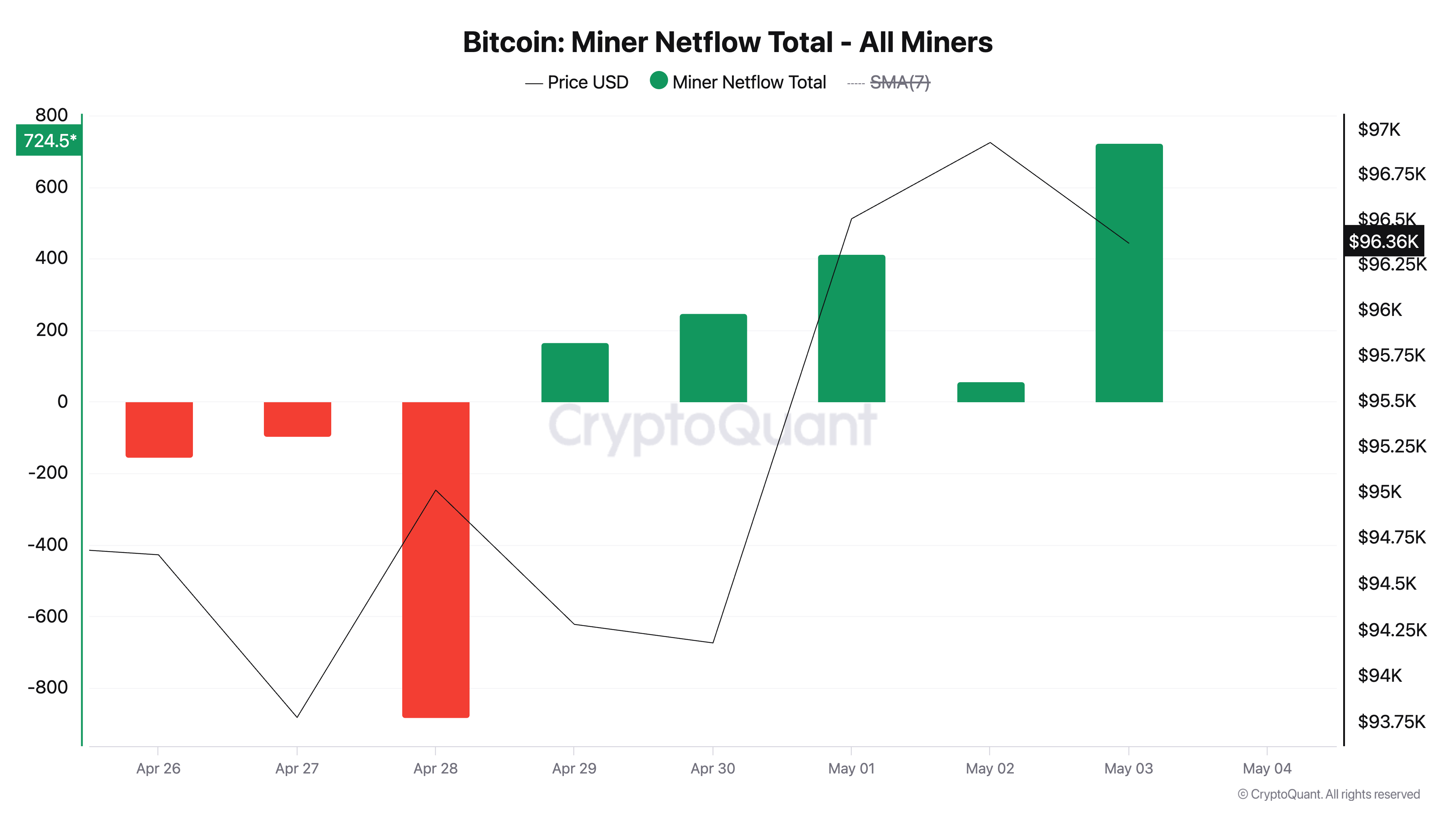

Moreover, the positive change in miner psychology is further supported by the positive miner net inflow recorded from April 29th. This indicates more coins are being kept in miner wallets rather than moving to exchanges.

This behavior reflects confidence in further increases. Miners are considered long-term holders and are choosing accumulation over liquidation.

There's a Catch

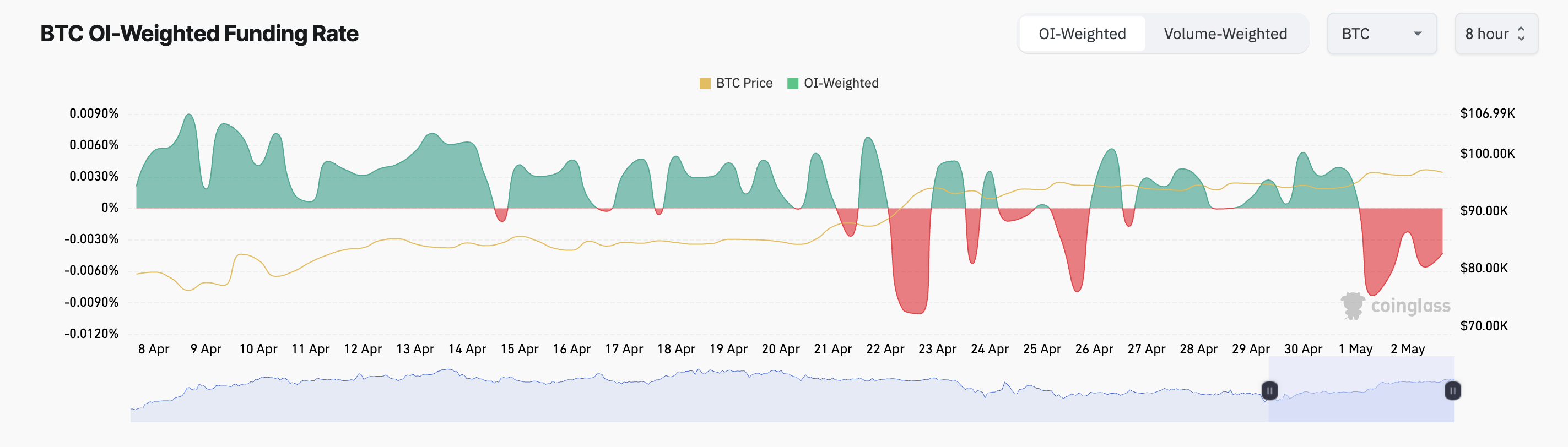

However, not all sentiment is positive. While BTC miners are reducing sales, derivatives data tells a different story.

The funding rate for BTC in the futures market has remained negative since early May. This indicates that many traders are anticipating a short-term price correction. Currently, the coin's funding rate is -0.0056%.

The funding rate is a periodic payment exchanged between long and short traders in perpetual futures contracts. This is to align the contract price with the spot price.

When the funding rate is positive, it means long position traders are paying short position traders, indicating a predominantly positive market sentiment.

In contrast, such a negative funding rate suggests that short bets are more numerous than long bets, implying bearish pressure on BTC price.

Traders and Miners at a Crossroads... Breakout or Decline?

While miners' actions may indicate new confidence, the persistent bearish sentiment in derivatives suggests traders are wary of a potential retreat.

If coin accumulation is strengthened, BTC could continue its upward trend, attempting to break through the $98,515 resistance and recover to the $102,080 price range.

However, if major coin bearish bets win and demand is lacking, the price could fall below $95,000, reaching $92,910.