After surging by almost 70% in recent weeks, SUI has experienced a quick correction, losing 10% of its value over the past three days. While the strong upward momentum had drawn attention to the altcoin, the sudden retreat did not shake investors.

The overall outlook for SUI remains solid. On-chain and market indicators suggest that this decline could be a simple correction.

SUI Investors Rejoice

The 50-day moving average is expected to soon cross above the 200-day moving average. This imminent crossover suggests that SUI may soon witness a golden cross. This is a powerful technical signal indicating a change in long-term momentum.

Once the crossover is complete, the death cross of SUI that began 7 weeks ago will end.

This change is likely to induce new buying pressure. The golden cross often precedes a significant rise, and considering that SUI's price had risen almost 70% before the recent decline, the upward trend still appears to be intact.

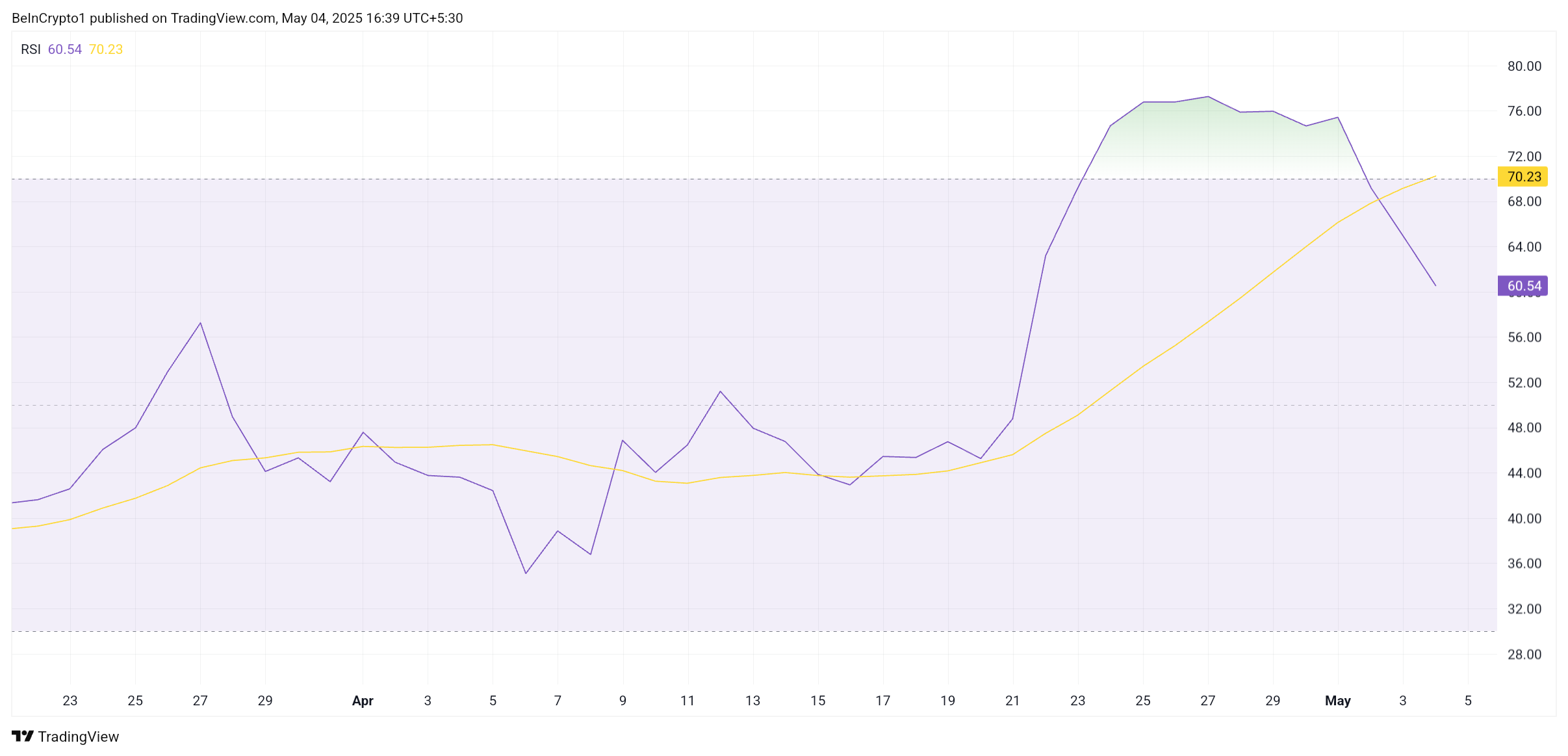

SUI's Relative Strength Index (RSI) recently crossed above the overbought threshold, causing traders to take profits and triggering a correction. This RSI decline coincides with the 10% price drop, indicating that the asset was temporarily overheated and needed stabilization.

Despite the retreat, the RSI remains in the upward trend area, hovering just below the overbought zone. This suggests that while the rally has paused, the overall trend remains robust, and additional increases may occur if buying volume increases again.

SUI Price, What's the Rebound Target?

At the time of reporting, SUI is trading at $3.16, having fallen below a major support level in the past 24 hours. The 10.77% decline stems from the altcoin failing to break through the $3.59 resistance level, compounded by a general market correction. However, many traders view this correction as temporary.

Overall indicators continue to reflect an upward trend. The upcoming golden cross, solid RSI, and strong upward momentum suggest that SUI may soon recover above the $3.16 support level. If momentum returns, the asset could retest $3.59 and potentially break through, resuming its previous recovery path.

However, the situation could change if recovery is delayed. If SUI fails to recover above $3.16 soon, the altcoin risks further decline. If it fails to break through $3.39 or secure support at $3.18, the price could drop to $2.77, which could invalidate the bullish logic and signal a trend reversal.