𝐓𝐡𝐞 𝐄𝐜𝐨𝐧𝐨𝐦𝐢𝐜𝐬 𝐨𝐟 𝐒𝐜𝐚𝐥𝐞 𝐆𝐨𝐯𝐞𝐫𝐧𝐢𝐧𝐠 𝐭𝐡𝐞 𝐑𝐢𝐬𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐈𝐒𝐂-𝐕 𝐌𝐨𝐝𝐞𝐥

𝐖𝐡𝐚𝐭 𝐈𝐬 𝐑𝐞𝐚𝐥𝐥𝐲 𝐃𝐫𝐢𝐯𝐢𝐧𝐠 𝐑𝐈𝐒𝐂-𝐕 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧?

The conversation around RISC-V centers on the openness and freedom from licensing costs. However, the real story is more complex.

RISC-V is gaining ground because it reshapes scale, how costs fall,

𝐖𝐡𝐚𝐭 𝐃𝐨𝐞𝐬 𝐑𝐈𝐒𝐂-𝐕 𝐑𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭?

RISC-V is an open instruction set architecture (ISA). Unlike Arm or Intel’s x86, it is owned by anyone. You can use, modify, and produce chips without paying royalties. That alone changes the economic model.

It gives startups,

𝐓𝐫𝐚𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐒𝐜𝐚𝐥𝐞 𝐯𝐬. 𝐑𝐈𝐒𝐂-𝐕’𝐬 𝐄𝐜𝐨𝐧𝐨𝐦𝐢𝐜 𝐒𝐡𝐢𝐟𝐭

Historically, designing hardware at scale meant dealing with two main cost pressures:

☑️ High licensing fees. E.g., Arm’s per-chip royalties or Intel’s exclusivity.

☑️ Huge upfront design and

📌 Zero Royalties

Once the architecture is set up, adding more devices costs almost nothing in terms of licensing. That’s a direct cost advantage.

📌 Shared Tools and Infrastructure

The compiler ecosystem (LLVM, GCC), verification tools, and even chip design libraries are

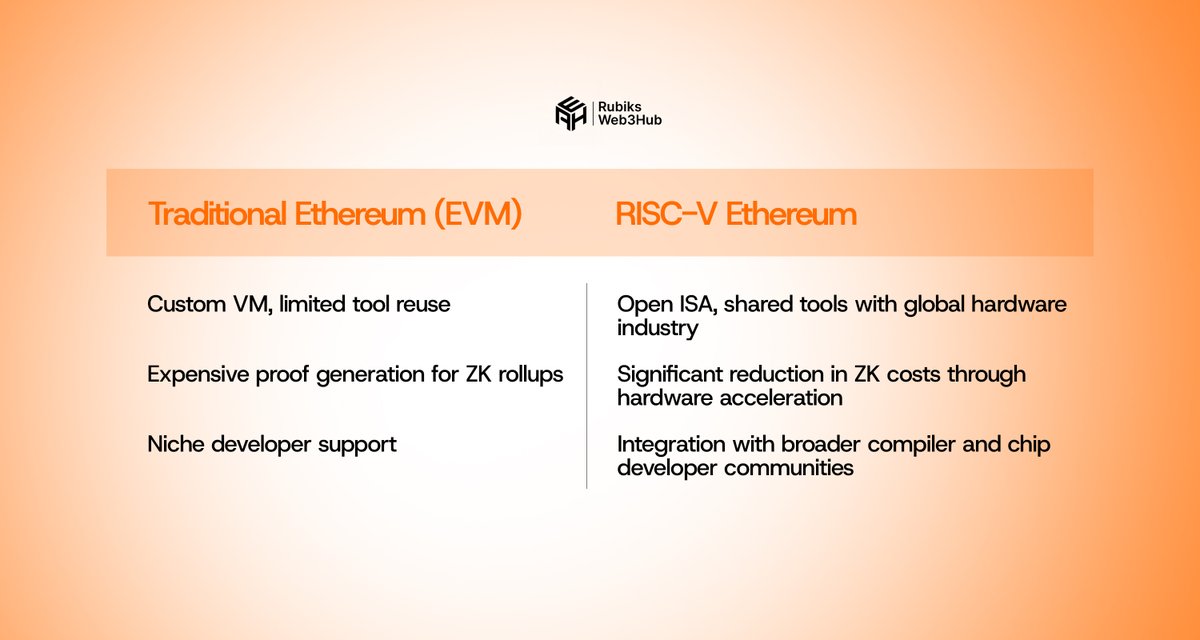

𝐕𝐢𝐭𝐚𝐥𝐢𝐤’𝐬 𝐄𝐭𝐡𝐞𝐫𝐞𝐮𝐦 𝐑𝐈𝐒𝐂-𝐕 𝐏𝐫𝐨𝐩𝐨𝐬𝐚𝐥

Vitalik's suggestion to shift Ethereum’s execution layer to RISC-V is a practical application of this economic model. His focus is on long-term efficiency while maintaining performance.

Instead of continuing to pay the hidden tax of maintaining a virtual machine, Ethereum should integrate with a larger system that is already enjoying scale benefits.

𝐓𝐡𝐞 𝐅𝐞𝐞𝐝𝐛𝐚𝐜𝐤 𝐋𝐨𝐨𝐩𝐬 𝐃𝐫𝐢𝐯𝐢𝐧𝐠 𝐑𝐈𝐒𝐂-𝐕 𝐆𝐫𝐨𝐰𝐭𝐡

RISC-V reduces cost. It also compounds the benefit with every new participant. The structure is self-reinforcing:

☑️ More adoption leads to better toolchains.

☑️ Better tools attract more developers.

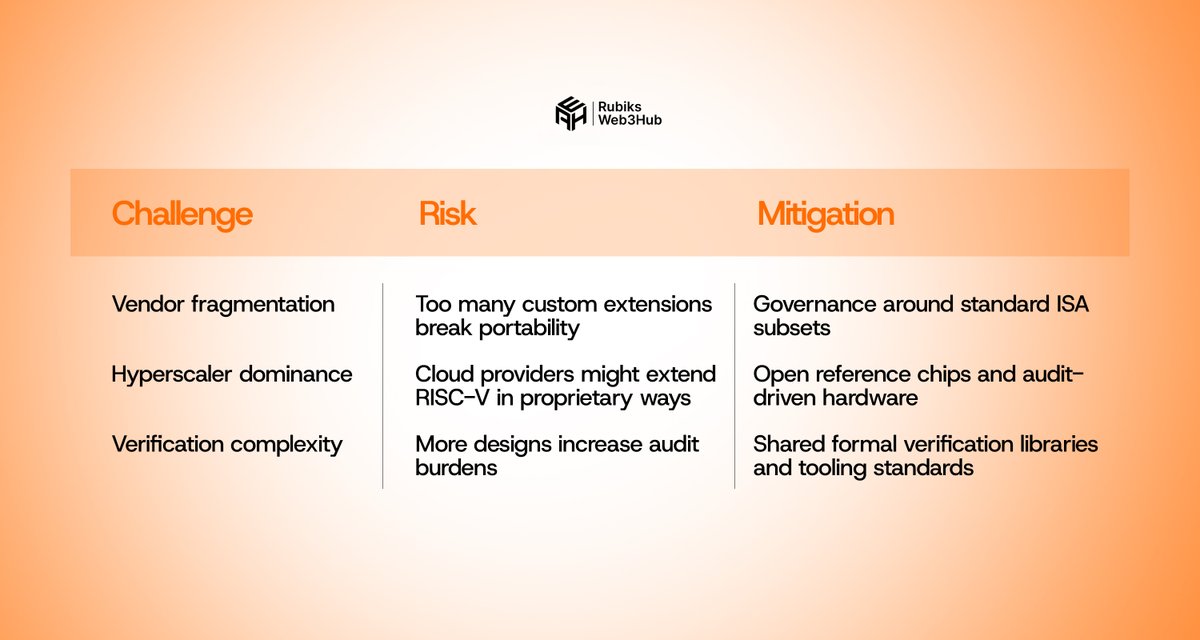

𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐑𝐢𝐬𝐤𝐬

As scale increases, new problems emerge. RISC-V is no exception.

In rollup-heavy ecosystems, reducing the cost of verification is critical. If RISC-V-based accelerators can cut the cost of generating zero-knowledge proofs by 50–100×, then savings directly impact scalability, user fees, and validator incentives.

The same principle applies to

Tagging Chads to check this out:

@TheDeFISaint @poopmandefi @eli5_defi @stacy_muur @DefiIgnas

@DOLAK1NG @hmalviya9 @Louround_ @CryptoGirlNova @chilla_ct @Route2FI @Only1temmy @Dynamo_Patrick @milesdeutscher @Adebiyi_Diamond @0xkhan_ @DeFiMinty @rektdiomedes @ViktorDefi

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content