Author: Mr. Beggar, On-chain Data Analyst

I. The Principle of RUP Divergence as a Top Signal

The introduction of the RUP indicator has been detailed in the following two articles:

1. 'On-chain Data School (IX): Market Barometer RUPL(I) Data Introduction & Buy the Dips Application'

2. 'On-chain Data School (X): Market Barometer RUPL (II) Strongest Top Signal & Detailed Analysis of Historical Cycle Tops'

Today's article will cite an even more obvious example to help everyone understand the RUP indicator. Simply put, RUP measures the "current overall unrealized profit status of the market".

From the perspective of chip holders, the higher the price, the more floating profits, so this indicator is highly positively correlated with $BTC's price trend in most cases. Once a "non-highly positively correlated" trend appears, it is a signal worth paying attention to.

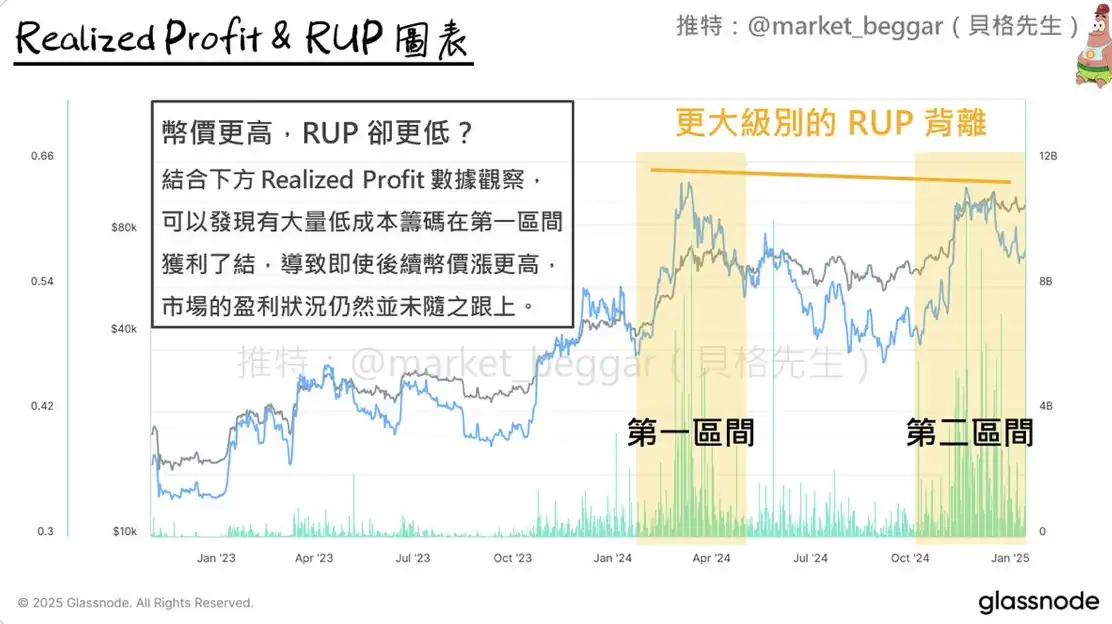

In previous articles, I analyzed historical cyclical tops from the RUP perspective. Today, we'll observe the "current cycle's" RUP from a more macro perspective. As shown in the image: I marked two main upward waves in this cycle, the first when the price rose and broke through 70,000, and the second when it broke through 100,000.

You'll notice: The RUP at 70,000 is actually higher than at 100,000? Why doesn't RUP keep up when the price is higher? The reasons are as follows:

1. The main profitable group in the market is often low-cost chips

2. Low-cost chips have massive profits and occupy a large proportion of unrealized profits

3. If these low-cost chips are cashed out, it will greatly impact RUP

At this point, some readers should have fully understood: As shown in the image, when the price broke through 70,000, a large amount of Realized Profit occurred, indicating that many low-cost chips were liquidated at that time. This led to: When the price subsequently rose to a higher level, RUP did not rise synchronously. Related reading: The significance of Realized Profit: 'On-chain Data School (III): Have the bottom-accumulating market makers realized their profits?'

You might ask: "Okay, what does it have to do with me that those low-cost chips were liquidated?" I have detailed this in the first paragraph of my previous article. Interested readers can refer to this article: 'Detailed On-chain Data Analysis: You Might Need to Prepare to Escape the Top at Any Time'

II. Post-market Scenario & Planning

From the RUP perspective, during the market downturn, I previously published an article: 'Market Update: Did the Bull Run Leave?'

Some content mentioned at that time is now updated as follows:

As the price began to show a bottom signal two days ago (I immediately posted about it), $BTC experienced a decent "rebound".

"Rebound"? Yes, I will define the current rise as a "rebound", not a trend reversal signal. If you've read my previous articles, you should know that I'm not optimistic about 2025. After the price first broke 100,000, a RUP divergence signal occurred; the current market is in the orange box in the image, and careful readers should notice:

In the current market, RUP (blue line) is rising slower than the price (black line). Therefore, if the price rebounds to around 103k, the price will create a wave new high, but RUP will likely not create a new high, forming a second divergence similar to 2017. What if the price continues to rise and creates a historical new high? It might create a top divergence structure similar to 2013 and 2021.

Regardless of which scenario occurs, when the price turns and forms a wave turning point, I will definitely update the RUP status here first.

III. Conclusion

Today, I explained the principle of RUP divergence again and sorted out several possible subsequent $BTC trends, hoping to help all readers!