The U.S. Securities and Exchange Commission (SEC) is set to make a decision on the proposed spot Litecoin (LTC) Exchange Traded Fund (ETF) by Canary Capital on May 5th.

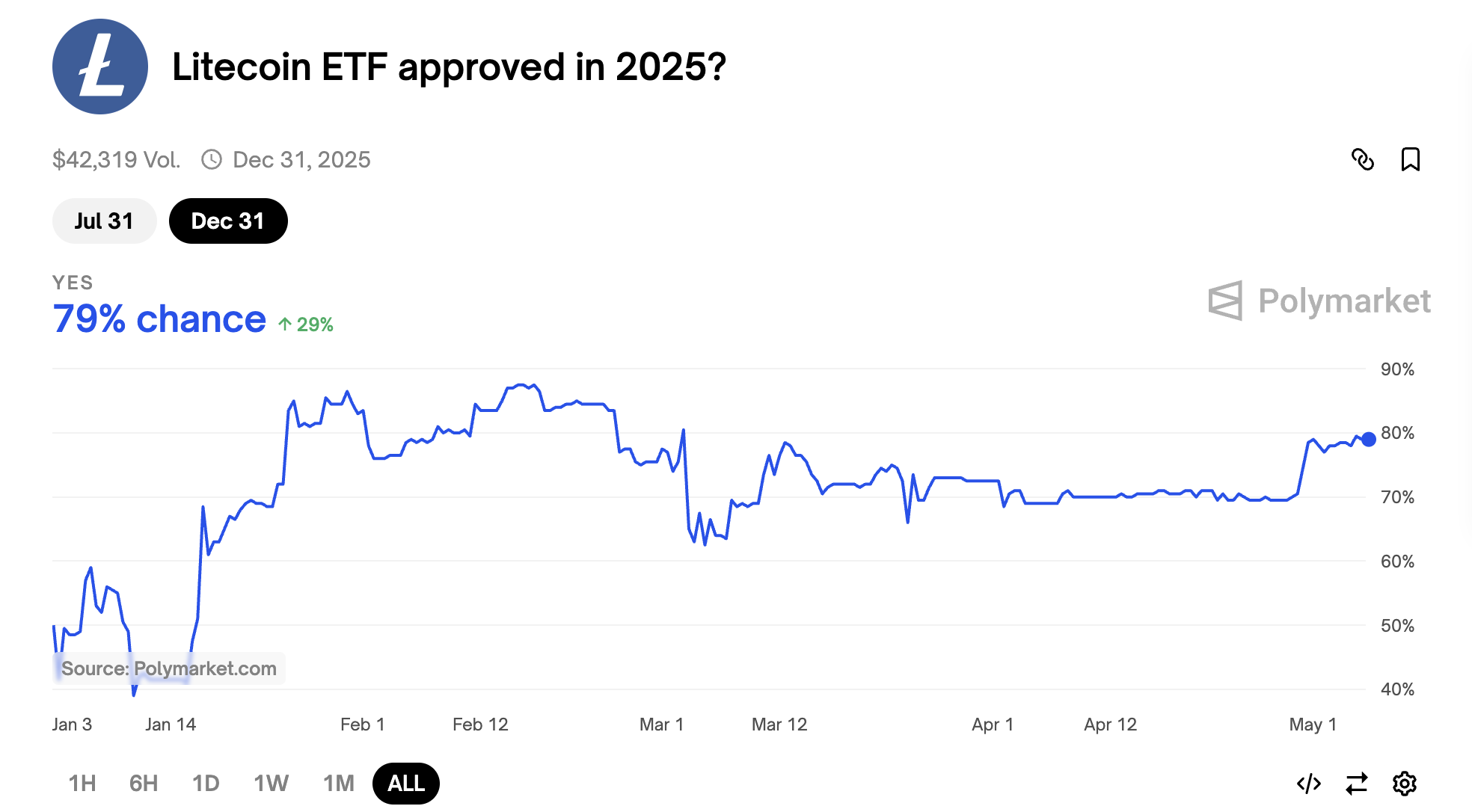

Meanwhile, market observers are becoming increasingly optimistic. The approval probability has reached its peak on Polymarket since mid-March.

Will the SEC Approve the Litecoin ETF?

BeInCrypto reported in January that Nasdaq submitted a proposed rule change (Form 19b-4) to list and trade shares of the Canary Litecoin ETF. This proposal was published in the Federal Register on February 4th, initiating an initial 45-day review period that ended on March 21st.

However, the SEC decided to extend this period by 45 days, setting May 5th as the new 90-day deadline.

"Therefore, the Commission designates May 5, 2025, as the date by which it shall approve or disapprove, or institute proceedings to determine whether to approve or disapprove, the proposed rule change (SR-NASDAQ-2025-005) pursuant to Section 19(b)(2) of the Act," as stated in the statement.

The regulatory authority has taken similar actions on other cryptocurrency ETF applications. On April 29th, the SEC deferred the decision on Franklin Templeton's spot XRP (XRP) ETF until June 17th, and Bitwise's Dogecoin (DOGE) proposal until June 15th. Grayscale's Ethereum (ETH) staking ETF met the same fate.

Previously, on April 24th, the regulatory authority deferred decisions on Bitwise's Bitcoin (BTC) and Ethereum ETF and Canary Capital's Hedera (HBAR) ETF. The new deadlines are June 10th and 11th, respectively.

Similarly, Grayscale's application to convert its Polkadot (DOT) Trust into an ETF was also deferred. The new decision deadline is June 11th.

However, the SEC's decision not to defer the Litecoin ETF beyond the 90-day deadline has drawn significant community attention. Bloomberg's ETF analyst James Seyffart highlighted this in a recent post on X (formerly Twitter).

"SEC has come out early and deferred several applications, but not this one," Seyffart wrote.

Nevertheless, he emphasized that Litecoin could be approved faster, but a deferral is more likely.

"If any asset could have a chance of early approval, I think it's Litecoin. Personally, I think a deferral is more likely, but it's certainly noteworthy," he added.

Previously, analysts estimated that the Litecoin ETF has the highest approval possibility of 90% among all altcoin ETFs. This prediction seems to align with market sentiment.

On the prediction platform Polymarket, the approval probability has surged to 79%, its highest since mid-March. Additionally, the probability of approval by July has risen to 49%.

A positive decision on the ETF could pave the way for broader Litecoin adoption. Conversely, approval denial or further delay could indicate regulatory hesitation in the cryptocurrency space. As time passes, all eyes are focused on the SEC's next move.