Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies centered on stablecoins (and their derivative tokens) in the current market, helping users who wish to gradually expand their capital through USDT-based financial management find ideal income opportunities.

Previous Records

Lazy Financial Strategy | Focus on Berachain, Raise Reslov Airdrop Expectations (March 31)

New Opportunities

Falcon Publicly Released, Points Program Details Confirmed

On April 30, the stablecoin protocol Falcon Finance (portal: https://app.falcon.finance), incubated by DWF Labs, officially announced its public release, allowing users to directly mint or exchange USDf without whitelist application.

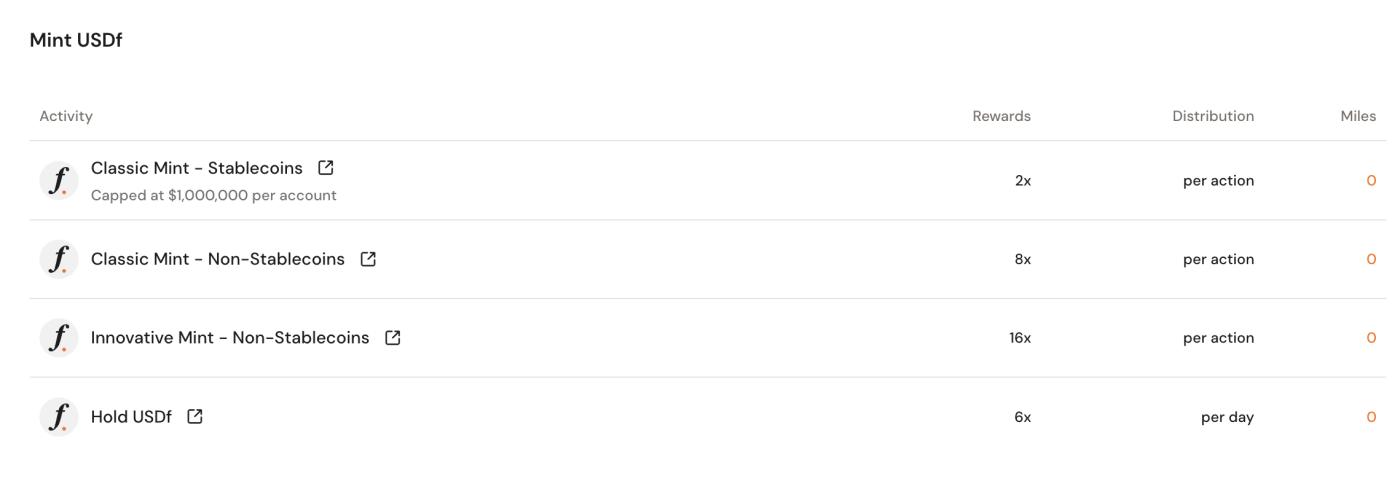

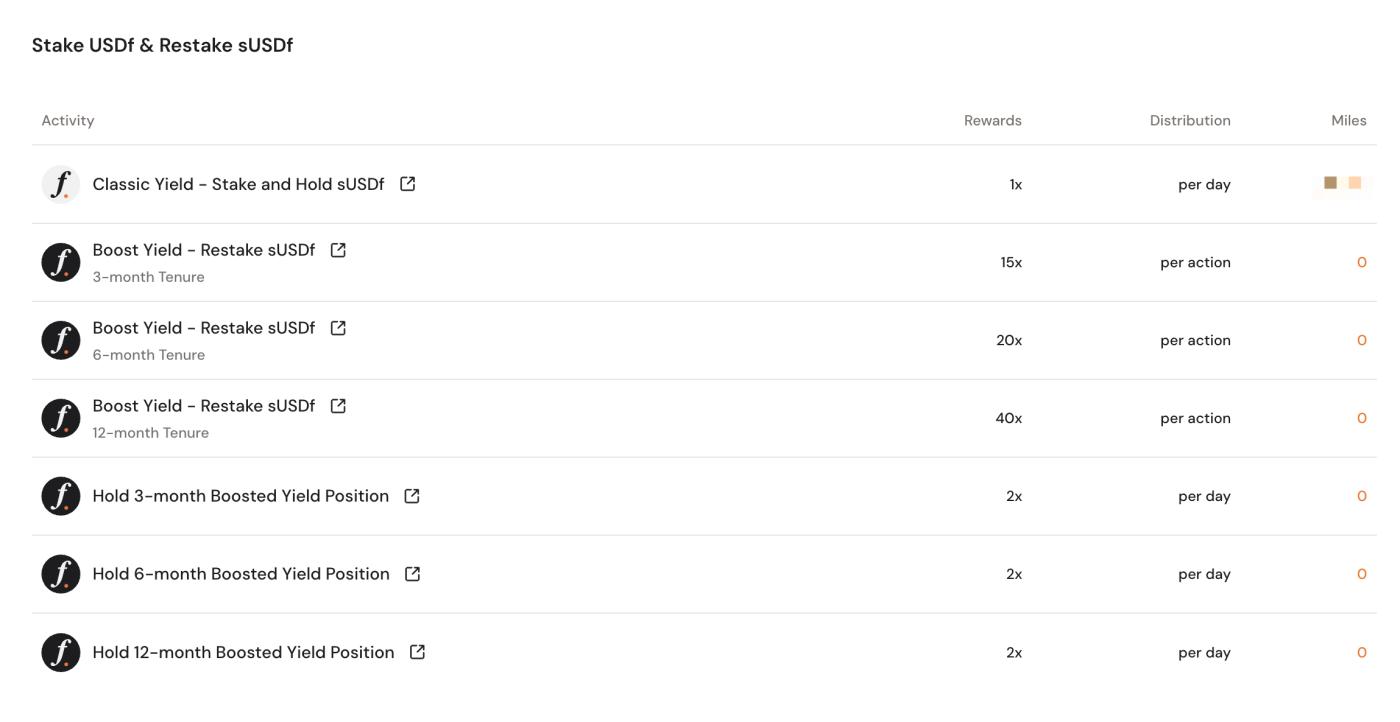

Simultaneously, Falcon Finance officially confirmed the details of its points program (Falcon Miles), where minting, holding, and staking USDf can accumulate points. The point multipliers for various operations are as follows - choosing 3, 6, or 12-month lockups will have corresponding APY increases (up to 19.83%) and point acceleration, which can be selected based on individual risk preferences.

Coinshift Points Program

In late April, the asset management platform Coinshift, which has received investments from Tiger Global, Sequoia Capital India, Polygon Studios, and other renowned institutions, announced that its stablecoin csUSDL has been integrated with Pendle.

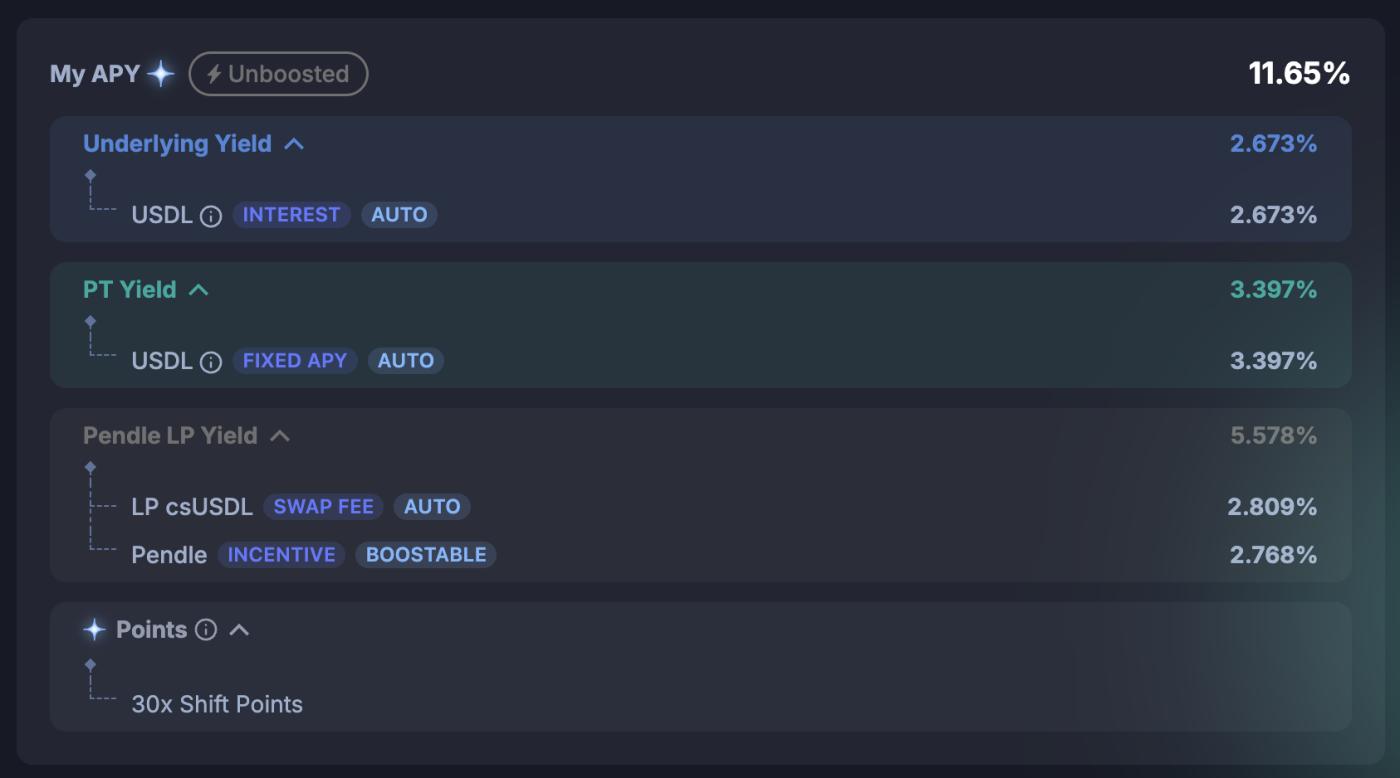

Currently, users can directly purchase PTs expiring on July 31 on Pendle, with an APY of 11.5%; LP market-making APY is 11.65% (can increase to 17.76% with sufficient PENDLE staking), while also earning 30x Shift points.

After reviewing Coinshift's historical updates, this seems to be the first time the project has mentioned points-related matters. Although the specific plan and utility are not yet clear, given the base yield rate, it may be worth considering.

Midas TVL Grows Significantly

On April 26, my colleague wrote an participation strategy article about the RWA protocol Midas (see 《TVL Exceeds $60 Million, Analyzing Hidden Wealth Opportunities Behind Midas》).

Just a few days later, Midas's TVL broke through $75 million on May 1, showing clear signs of capital inflow. Users can participate accordingly based on the previous strategy.

Ethena's Third Season Harvest

Last week, the most exciting thing for stablecoin miners was undoubtedly Ethena opening its third season airdrop claim, ultimately allocating 3.5% of ENA as this season's airdrop amount.

Due to multiple portfolio adjustments in my personal address, it's difficult to calculate the exact yield rate, but some experts on X have calculated that the APR performance of the Pendle USDe pool (50x points boost) is around 11%.

Currently, Ethena's fourth season (portal: https://app.ethena.fi/join/r0p2g) is ongoing and will continue until September 24. Large-capital users with liquidity requirements can consider participating.