Written by: TechFlow

Welcome to the first day after the May Day holiday, where the crypto market is still full of gossip and hot topics.

During the May Day holiday, the native token $BOOP of the new token launchpad Boop.fun was obviously one of the most eye-catching performers, with its market value briefly exceeding $500 million. With Binance Alpha launching $BOOP yesterday, the community's focus on this token has become even more intense.

But in the midst of the new token hype, a "subtle post" by CZ quickly sparked community discussions about Boop.fun founder dingaling.

On May 5th, CZ replied on X, implying that a former employee was fired for "rat trading" (insider trading), and claimed to have been a "Binance CXO", a position that Binance never had.

Although CZ emphasized not to take it personally, the description in his reply's original post - "a founder recently launched a platform project on Solana claiming to revolutionize meme gameplay" - was actually quite direct.

If you've been observing market trends recently, you can easily infer that this is referring to Boop.fun and dingaling.

The most interesting part is that in dingaling's personal profile (250,000 followers), besides stating he is a PancakeSwap founder, he indeed has a former Binance "CRO" title. Combined with CZ's statement that Binance never had a certain CXO title, the implication becomes quite specific.

When facts are connected, the verbal request not to take it personally seems more like a protective color and armor; although both parties haven't directly confronted each other, the community has already erupted in discussion.

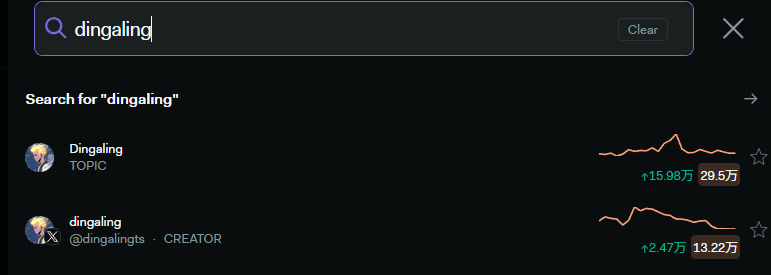

If you search for dingaling on crypto social media sentiment websites, you'll find that international discussions about him have rapidly increased in a short time, with many people passionately debating this matter.

In these discussions, beyond the defensive arguments driven by having some Boop positions, more informative discussions focus on dingaling's past and Boop's future development.

Ambiguous CRO, Real Non-Fungible Token Diamond Hands

Who exactly is dingaling?

The CRO title is quite ambiguous, with some guessing it means Chief Risk Officer, others saying Chief Revenue Officer, and some suggesting Chief Research Officer.

Dingaling himself seems to have not responded to what the CRO abbreviation actually refers to. With CZ's subtle post, some netizens jokingly suggested CRO might mean Chief Rat Officer (hinting at being fired for insider trading).

But jokes aside, there are some traces of the past in the ambiguous job title.

Crypto blogger NFT Ethics revealed that dingaling's early Twitter name was @DinghuaXiao, seemingly corresponding to his full name. Although most of his associations with Binance have been deleted from the internet, some community screenshots show that you could directly chat with him on Telegram to get help with Binance-related issues.

This seems more like a customer service or customer relationship handling role.

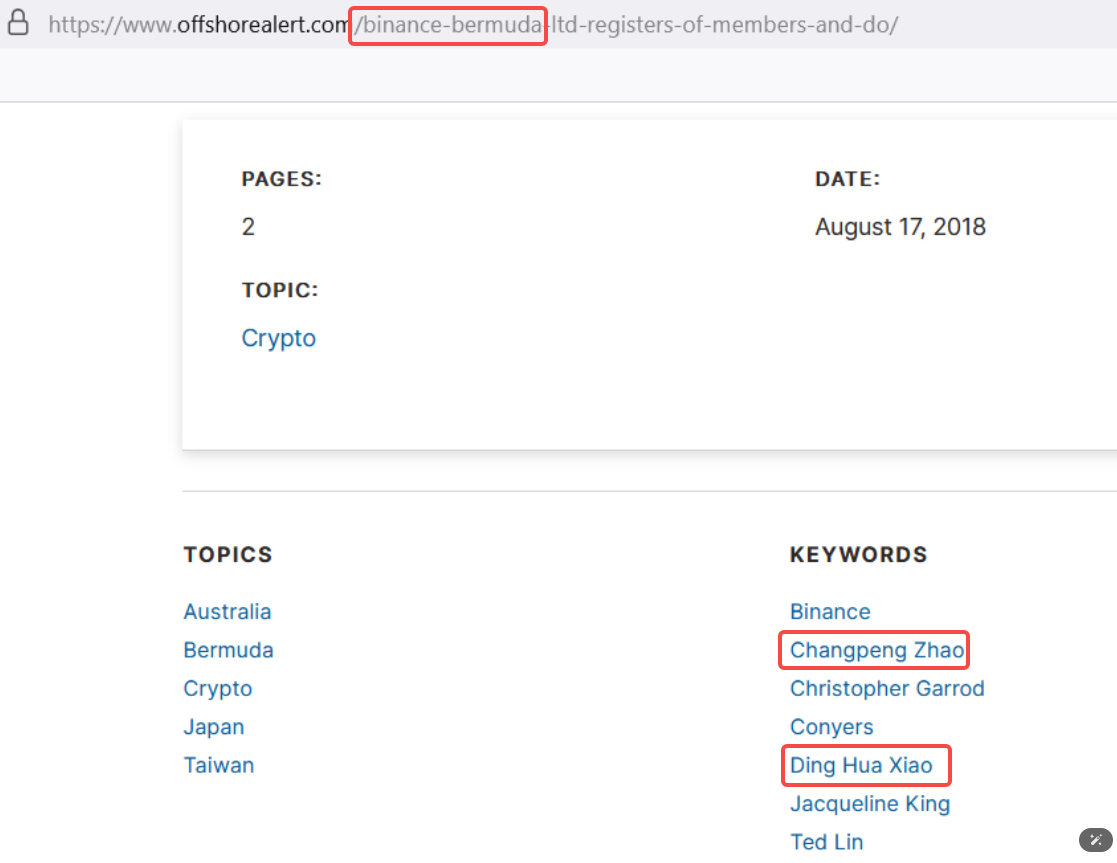

Beyond the surface of facing customers, NFT Ethics pointed out that dingaling's lesser-known connection with Binance was that he was one of the heads of Binance's offshore entity (Bermuda), with a screenshot of the company website (now possibly taken down) showing CZ and Ding Hua Xiao listed together.

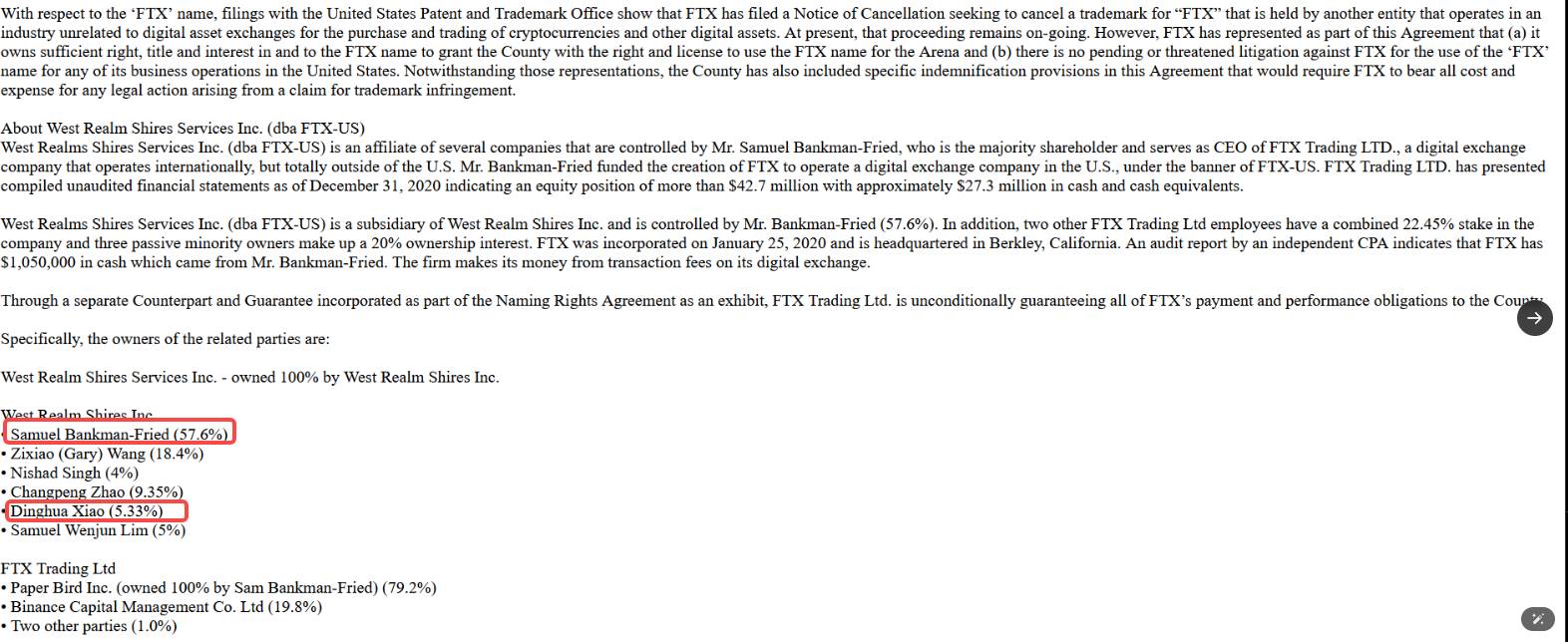

Additionally, more information shows that Ding Hua Xiao was also a member of West Realm Shires Inc, a joint venture between Binance and FTX, which was a key entity controlling FTX's US operations (FTX-US).

Documents also showed the ownership proportions of SBF, CZ, and himself, with Ding holding 5.33%; although the percentage is not high, it sufficiently demonstrates his relationship with the FTX core team and CZ.

Most of the content exposed by NFT Ethics was released in 2022, and the survival and validity of the content cannot be accurately verified. Ding's exact position at Binance cannot be precisely determined, and we can only glimpse a bit from these compiled information.

However, one thing can be confirmed: Dingaling was definitely not just an ordinary employee.

Despite the ambiguous title, dingaling's behavior in the crypto market is traceable, which is why the community is discussing him so passionately:

An OG player in the NFT circle, a well-known diamond hands investor.

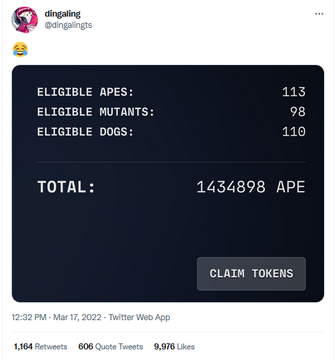

He is considered one of the most successful "NFT investors", having early held 113 Bored Ape Yacht Club (BAYC), over 70 Azuki NFTs, and accumulated 1.4 million Ape airdrops, worth over $10 million at the time.

He was also an early CryptoKitties investor and one of the largest NBA Top Shots investors.

The community calls him an "NFT OG" and "diamond hands" because he rarely "pump-and-dump", but instead habitually adopts a floor-sweeping strategy, buying large quantities of floor-priced NFTs and holding long-term.

In that NFT era, players often used whether dingaling bought in as a standard for determining if an NFT was blue-chip quality. His floor-sweeping strategy could easily raise NFT prices, benefiting other holders of the same NFT, thus winning broad community trust.

LooksRare's Lesson, Can Boop Succeed?

As an NFT trader, dingaling is undoubtedly successful, even worthy of being called a big shot; but in terms of product development or creation, his record is not so brilliant.

In 2022, dingaling entered LooksRare as an advisor and investor. At that time, OpenSea was firmly dominant in the NFT field, and LooksRare's goal was to subvert this NFT market leader and carve out a place in the competition.

During the same period, LooksRare launched the $LOOKS reward mechanism to incentivize trading, with initial trading volume nearly matching OpenSea. But the good times didn't last long. As the overall market weakened and wash trading became prevalent, the NFT market collapsed, and LooksRare couldn't take off.

Looking at the token price, $LOOKS peaked around $7, but is now around $0.01, essentially zeroed out, a tear in the era.

And the historical rhythm is so similar. In this cycle, Pump.fun has been in the spotlight, and the market has seen a batch of challengers and innovators trying to dethrone it; Boop.fun is one of them.

Again with a similar launch mechanism, plus a slightly different reward mechanism, will this replicate the script of LooksRare challenging OpenSea?

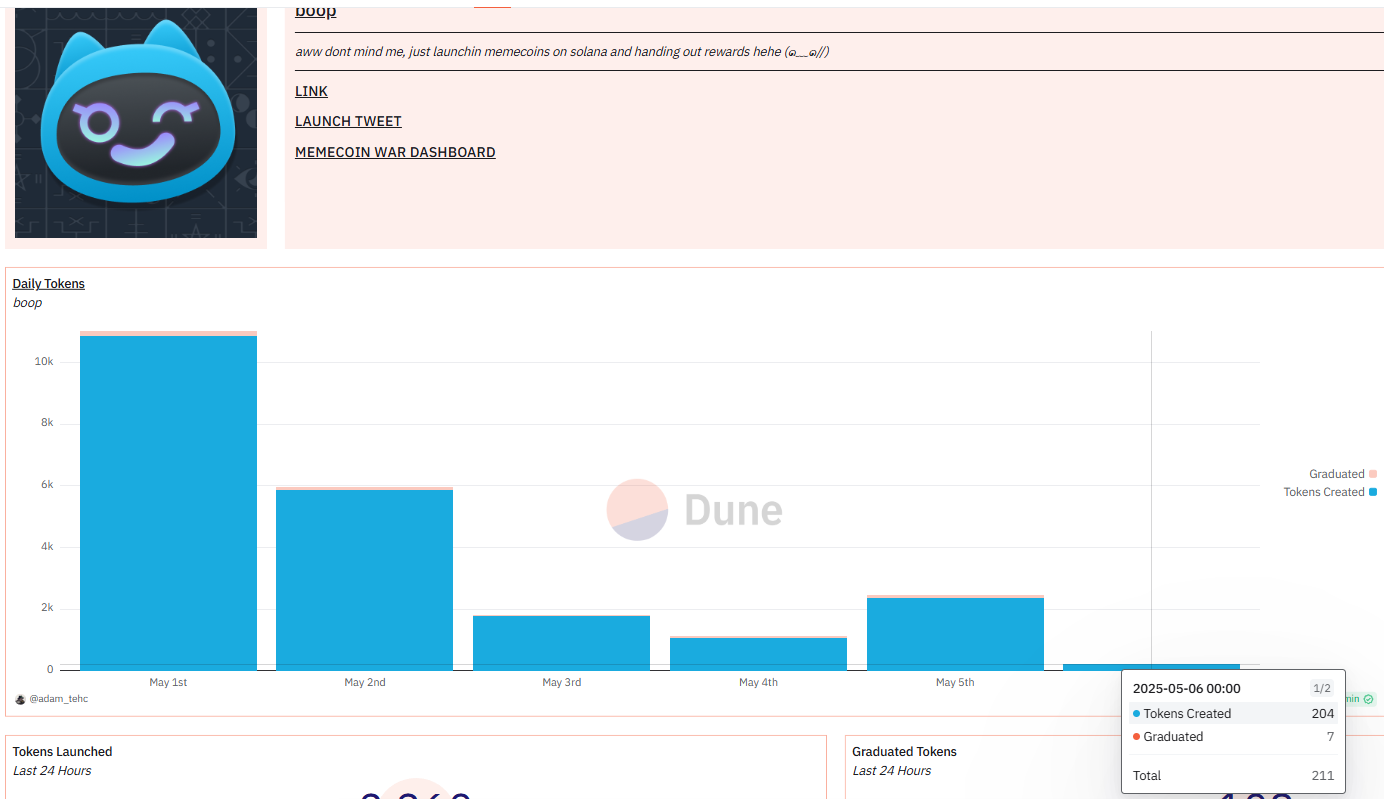

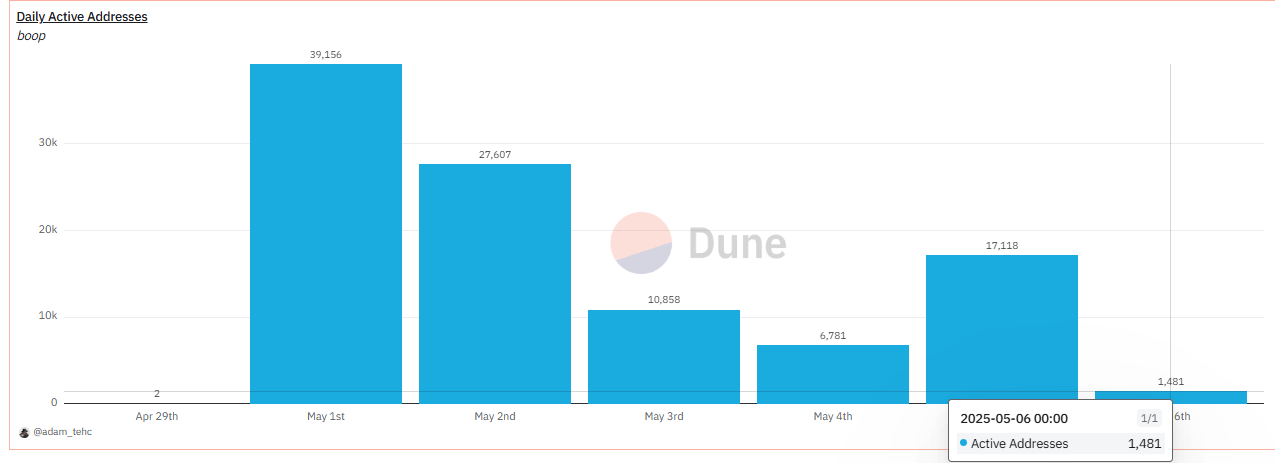

Dune's data panel for Boop.fun shows that within 5 days of platform launch, daily token launches have noticeably declined; before this article's publication, daily Boop token launches had fallen from 10,000 initially to 1-2,000, with active addresses also showing a daily decreasing trend.

In a market with insufficient liquidity and severe PVP, whether Boop.fun is viable remains to be seen.

Community Fermentation, Mantis Trying to Stop a Chariot

The future of Boop.fun is indeed unknown, but some are already defending dingaling, pointing the finger at CZ.

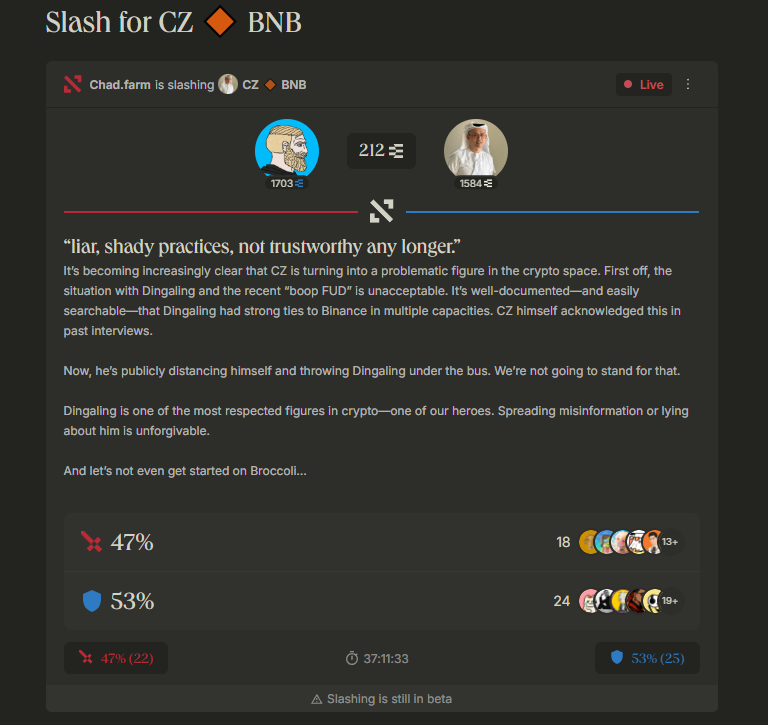

On Ethos Network, a small user with only 215 followers, @chadstrdaumus0, initiated a "Slash" proposal, attempting to punish CZ's FUD about Boop through decentralized governance.

The mechanism is that Ethos Network is a decentralized social platform aimed at building a reputation system for the crypto economy. Users generate reputation scores by staking Ethereum, can review others (positively or negatively), or initiate "Slash" proposals to punish misconduct, such as spreading FUD or fraud. Slashing requires community voting, and if successful, the slashed party's staked assets may be confiscated, and their reputation score damaged.

@chadstrdaumus0's proposal directly targets CZ, arguing that his "implicit post" makes false accusations against Boop and dingaling, harming the project's prospects.

This is very Web3, where everyone can challenge others' statements according to their own logic and judgment, even if the other person is CZ.

However, currently few people are participating in the discussion and commenting, and some point out that such accusations require clear evidence to stand, with the attacker needing to provide very explicit, detailed proof, such as whether the CRO position actually exists, or whether dingaling truly held the CRO role; rather than using fragmentary remarks to label CZ with a "fabricated" crime.

But for the proposer, perhaps the truth is not as important as the position.

Corporate Brands VS Crypto OG Reputation

Looking back, CZ's virtual confrontation is almost tantamount to naming names, and dingaling has not yet removed the "former Binance CRO" title, so what are their motivations?

CZ's "implicit post" seems casual, but a deeper look might reveal a related interest-driven separation.

If dingaling claims to be a "former Binance CRO", especially after Boop's launch on Binance Alpha, any price crash or negative associated events could damage Binance's credibility, making the market wonder about potential insider trading or so-called "rat trading".

As the world's largest exchange, Binance has faced controversy due to regulatory pressure (2022 US investigation), making CZ's sensitivity to brand image self-evident.

Unless dingaling is unaware of CZ's remarks and related hot discussions, the fact that his personal profile remains unchanged might already express an attitude.

Although not actively leveraging the "CXO" title to hype Boop, all publicly available information, including the NFT OG's past and even this ambiguous CRO position, can be considered a form of reputation - silently endorsing the new project and letting Boop go further is perhaps a clever choice.

We cannot know the private grievances behind this, but we can be certain of one thing:

There are no groundless expressions; in the crypto market, every voice is defending the interests they deem worthwhile.