Over 50% of all cryptocurrencies launched since 2021 are no longer active. A more worrying trend is emerging in 2025, with the rate of failed token launches reaching similar levels in just the first five months.

This rate will naturally increase with more than half a year remaining. Representatives from Binance and dune analytics told BeInCrypto that these failures are just another reminder of the need to launch viable projects, supported by solid tokenomics and a strong community.

Ghost tokens surge

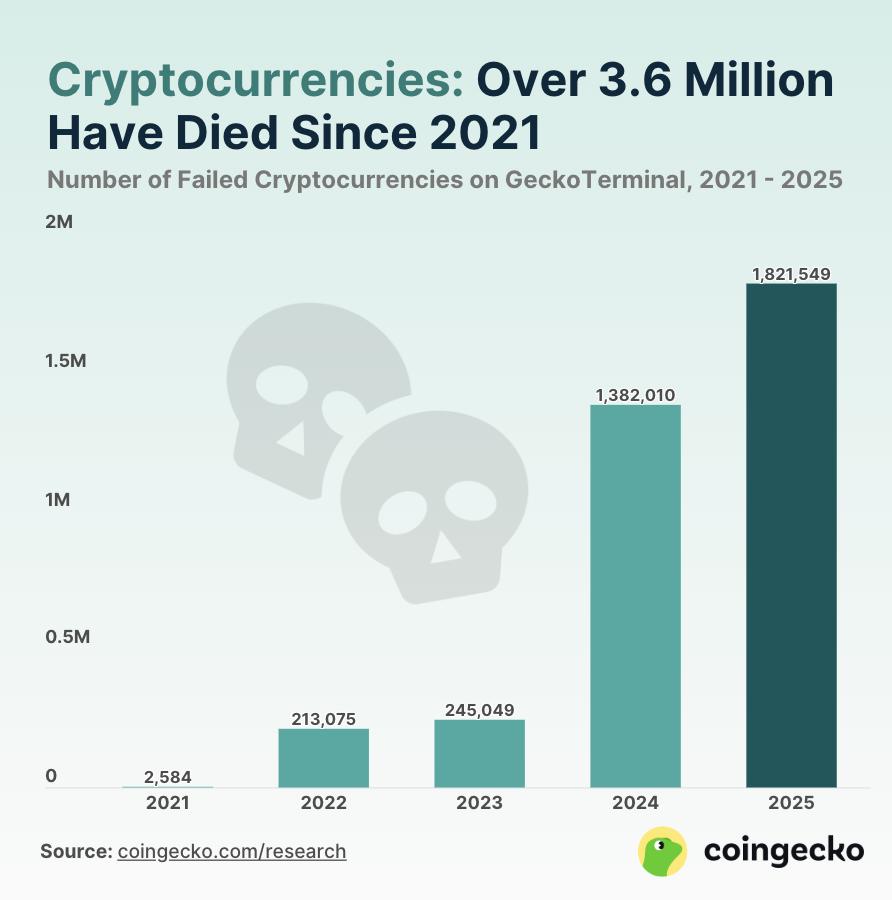

A recent CoinGecko report revealed some astonishing data. Among approximately 7 million cryptocurrencies listed on GeckoTerminal since 2021, 3.7 million have died.

Many factors are considered when assessing whether a coin has reached its end.

"A coin is considered 'dead' when it loses all utility, liquidation, and community participation. Key indicators include trading volume near zero, abandoned development (no GitHub commits in over 6 months), and price dropping 99%+ from ATH. Teams often disappear without warning—social media accounts become silent, domains expire," Alsie Liu, Content Manager at dune analytics, told BeInCrypto.

Half of the tokens launched since 2021 have died. Source: CoinGecko.

Half of the tokens launched since 2021 have died. Source: CoinGecko.A significant 53% of listed cryptocurrencies have failed, with most collapses concentrated in 2024 and 2025. Notably, over 1.82 million tokens stopped trading in 2025, far exceeding the approximately 1.38 million failures recorded throughout 2024.

With seven months remaining in the year, the trend of failures in the current year will continue to develop.

Why do many crypto projects fail?

Experts suggest that the high failure rate of cryptocurrency projects, often called "ghost coins", is due to multiple factors, including broader macroeconomic conditions affecting the crypto market.

CoinGecko specifically suggested a potential link between economic concerns like tariffs and recession fears, noting the increase in meme coin launches after a certain election, with subsequent market volatility likely contributing to their decline.

However, not all responsibility can be placed on a larger economic recession. Other aspects may also contribute to these project failures.

"Common factors include failing to find product market fit leading to insignificant user or investor interest, or project teams focusing too much on short-term speculation without a long-term roadmap, and sometimes abandoned by developers (rug pulls). Broader issues like fraudulent intent, weak user attraction, hype due to novelty, financial shortages, poor implementation, strong competition, or security failures also contribute to project failure," a Binance spokesperson told BeInCrypto.

The rapid surge of ghost tokens also coincides with massive project launches, especially from early 2024.

Survival-death rate analysis

Last year was unique in its own way after the meme coins explosion. This new story emerged especially after the launch of Pump.fun, a Solana platform allowing anyone to launch a token at minimal cost.

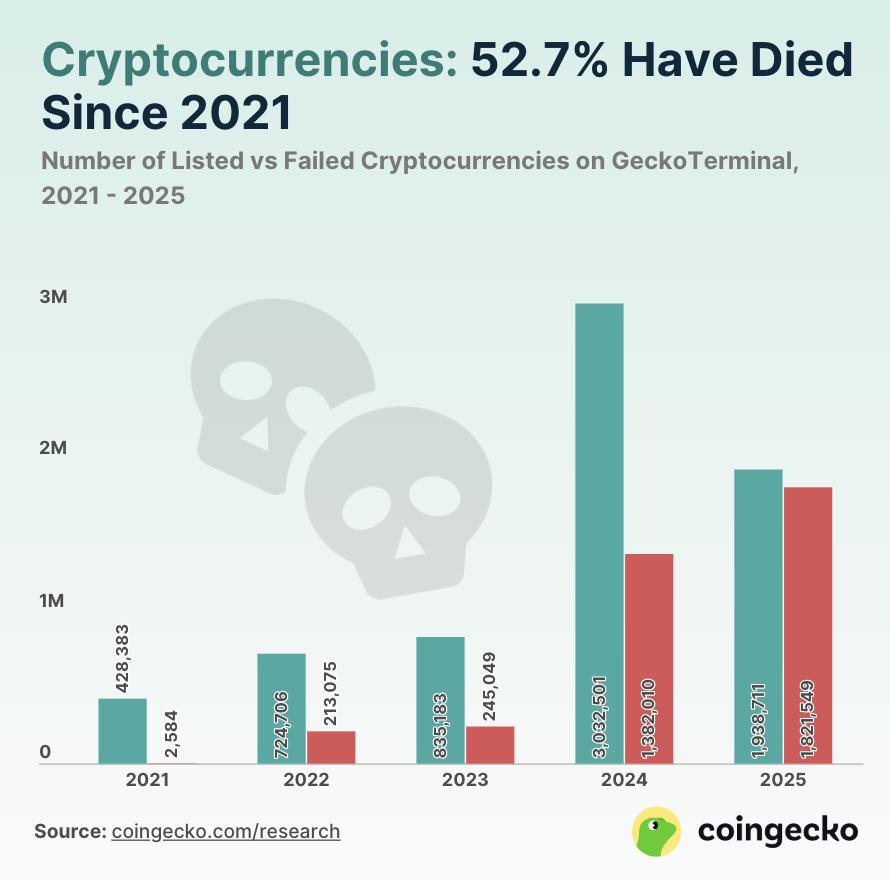

According to CoinGecko data, 3 million new tokens were listed on CoinGecko in 2024 alone. Half of these projects have died, but the other half still exist. However, the situation in 2025 seems less stable.

The difference between token launches and failures in 2025 is very small. Source: CoinGecko.

The difference between token launches and failures in 2025 is very small. Source: CoinGecko.Although the number of new tokens remains high, the number of failures is almost equivalent, with the number of launches just barely exceeding the number of deaths by about a thousand.

"Ecosystems with low barriers to token creation see the highest number of ghost coins. Generally, platforms that make launching new tokens very easy and cheap see the most abandoned coins. In this cycle, Solana's meme coin boom (for example, through token launchpads like Pump.fun) drove a wave of new tokens, many of which lost user attraction and daily activity as initial hype faded," the Binance spokesperson explained.

The larger meme market has also taken a particular hit in popularity.

As of 03/05, the meme coin market capital has sharply dropped to 54 billion USD, marking a 56.8% decrease from the peak of 125 billion USD on 12/05/2024. This decline is accompanied by a significant drop in trading activity, with volume decreasing 26.2% just in the previous month.

Some tokens have been more heavily affected than others.

Music and video tokens among the most heavily impacted categories

A BitKE report in 2024 indicated that video and music are prominent categories with many failed cryptocurrency projects, reaching a failure rate of 75%. This rate suggests that cryptocurrency projects focused on niche areas often struggle to achieve long-term viability.

"These niches face challenges in acceptance and utility. Music tokens struggle to compete with Spotify/YouTube, while 'listen-to-earn' models often lack demand. As more mainstream celebrities join this space without much blockchain technology knowledge, tokens have become a quick money-making business," Liu explained.

A Binance spokesperson noted that legal and technical barriers, such as music licensing and significant resources required for video distribution, have complicated the expansion of decentralized alternatives.

They further explained that many projects struggle to maintain sustainability without significant user acceptance or strong network effects.

"This emphasizes that a good idea is not enough; cryptocurrency projects must compete with established Web2 platforms, overcome complex industry challenges, and provide real utility to succeed. If not aligned with user behavior and market needs, even well-intentioned initiatives risk becoming ghost tokens," Binance told BeInCrypto.

Despite the alarming number of failed tokens, this situation provides important insights into building sustainable projects that can withstand unfavorable market conditions.

What Can We Learn from Token Collapses?

Potential token creators can learn important lessons from previously popular but ultimately failed projects. The negative outcomes these projects experienced, especially in severe cases, can drive the development of new projects more responsibly and help avoid similar mistakes.

Binance referenced famous ghost coin cases like BitConnect and OneCoin.

"BitConnect, once among the top 10 coins, collapsed in 2018 after being exposed as a Ponzi scheme promising daily returns of around 1%. Investors lost nearly $2 billion. OneCoin, which raised around $4 billion, never had a real blockchain and relied on aggressive multi-level marketing before collapsing. Both cases highlight the risks of projects built on exaggeration, unrealistic promises, and unverifiable technology," the Binance spokesperson explained.

These examples also provide valuable lessons for small retail investors trading tokens, regardless of whether the token is new or established.

Important Lessons from Ghost Tokens

Although concerning, the increasing number of ghost coins is an important reminder that clear warning signs often appear before the collapse of these cryptocurrencies.

These cases emphasize the necessity of thorough research, verifying fundamental principles, and maintaining a cautious perspective, especially when investment returns seem unrealistic. Prioritizing risk management and long-term sustainability factors should be placed above short-term speculative trading.

Binance specifically emphasized the importance of "Do Your Own Research" (DYOR) when evaluating cryptocurrency projects.

"In reality, this means examining the whitepaper, assessing whether the project solves a real problem, verifying team credibility, checking tokenomics and supply distribution, and examining community and development activity," Binance said, adding that "Fundamentally, DYOR is about empowerment and protection. It helps investors identify solid projects and avoid scams or ghost tokens by detecting early red flags. With the fast-moving cryptocurrency market, self-research remains essential to navigate this space safely and successfully."

Ultimately, the prevalence of ghost tokens underscores an important truth for cryptocurrency participants: thorough research and fundamental value are crucial in identifying sustainable projects.