Author: Marcel Pechman, CoinTelegraph; Translated by: Deng Tong, Jinse Finance

Summary

Returning to the $2,200 level remains the primary price challenge for ETH.

If the Pectra upgrade can drive a surge in DApp and Ethereum network activity, ETH price may rebound.

Ethereum successfully implemented a key network upgrade on May 7th, but the Ethereum price and its derivative indicators showed a muted response to this upgrade. This lackluster market reaction surprised traders and raised analysts' doubts about the real possibility of ETH rising 22% and returning to the $2,200 level.

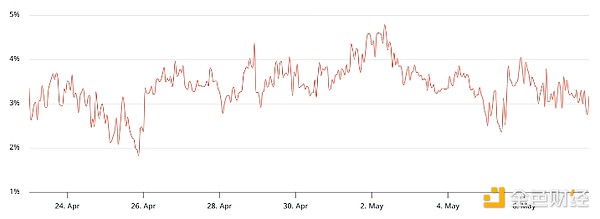

Ethereum 30-day futures annualized premium. Source: Laevitas.ch

ETH futures premium has remained below the neutral threshold of 5%, indicating a lack of interest from leveraged long positions. More importantly, the indicator remained unchanged at 3% after the Pectra upgrade, suggesting that traders did not adjust their positions despite the successful deployment.

The muted market response is partly due to investors focusing on macroeconomic issues, as uncertainties in global trade disputes have increased the risk of economic recession. However, traders' lack of interest in ETH predates the recent deterioration of risk aversion. In fact, ETH has underperformed the broader cryptocurrency market cap by 28% in the first three months of 2025.

The flat price performance after the Pectra upgrade reflects a general market dissatisfaction, as competing L1 chains have gained momentum.

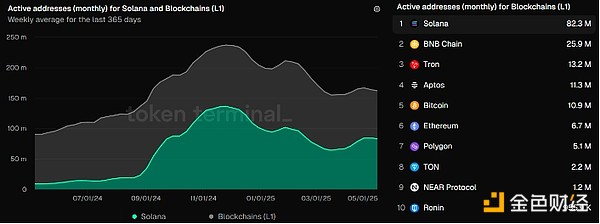

Solana's monthly active addresses compared to other Layer-1 competitors. Source: Token Terminal

Historically, high Ethereum base layer fees could limit network activity, but these fees have dropped below $1 since mid-February. Moreover, according to Token Terminal, Ethereum's leading Layer-2 solution Base currently has 10.3 million monthly active users, far lower than Solana's 82.2 million and BNB Chain's 25.9 million.

Ethereum Lags in DApp Interoperability - Will This Harm ETH's Price?

Solana dominates the decentralized exchange sector, especially in token issuance, by providing an integrated user experience. Similarly, Hyperliquid's performance in perpetual contract trading has exceeded expectations, indicating that traders' primary focus is not limited to Ethereum's decentralization and security. Meanwhile, Tron has made significant progress in the stablecoin market.

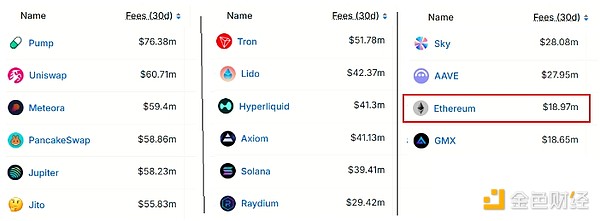

Blockchain and DApp 30-day fees (USD). Source: defillama

Ethereum undoubtedly leads in total locked value (TVL), reaching $53.7 billion. However, according to defillama, this hasn't brought much benefit to ETH holders, as the network fees for the past 30 days were relatively low at $19 million. In comparison, Tron accumulated $51.8 million in fees during the same period, while Solana collected $39.4 million.

Noam Hurwitz, Engineering Director at Alchemy, noted that Ethereum's blob transaction fees have dropped to their lowest level since the Pectra upgrade. For Hurwitz, Ethereum's success depends on underlying scalability, including further improvements to Rollup mechanisms and ultimately a more seamless user experience.

Connecting assets and data in the Ethereum Layer-2 ecosystem has always been a challenge, while users on Solana and BNB Chain can easily switch between multiple decentralized applications (DApps). The Pectra upgrade took a step in the right direction but did not solve this issue, which explains why ETH has failed to return to the $2,200 level from early March.

To raise ETH's price by 22% from its current $1,810 level, investors may need to ensure that the network's progress (whether through deposits or Layer-2 growth) translates into tangible gains. Ultimately, improving staking yields or providing stronger incentives to drive broader DApp adoption would stimulate ecosystem demand for ETH.