Solana has seen an impressive price increase recently, reaching a two-month high and nearly touching $180.

However, Solana is facing an important resistance level that prevents this altcoin from breaking through the $200 mark. Given the market conditions and investor behavior, the journey to $200 may be challenging for Solana.

Solana Investors Shift to Selling

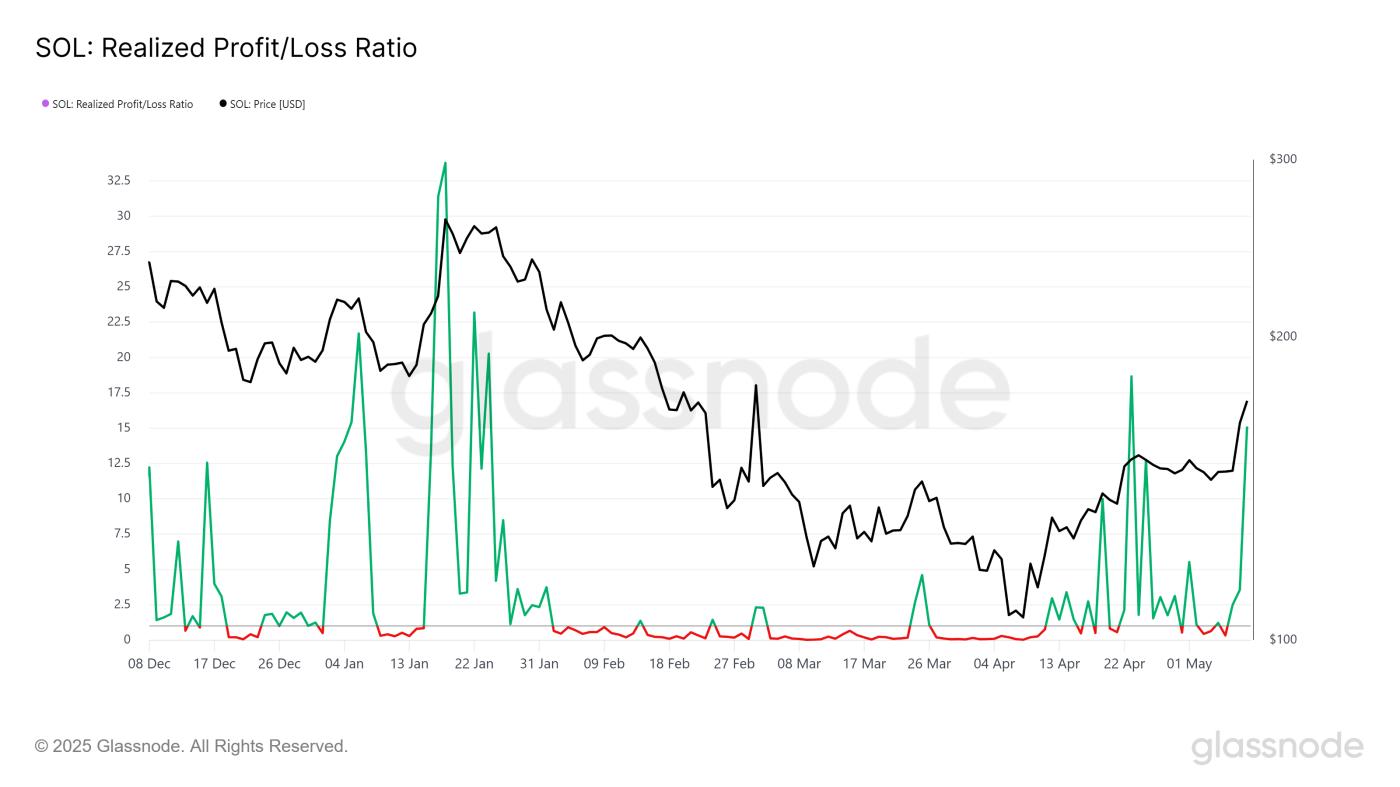

Many Solana (SOL) holders are choosing to take profits, contributing to an increase in the Realized Profit/Loss Ratio. This index has risen to 15.0, indicating that excessive selling could be a concerning issue. History shows that when this ratio exceeds 10.0, it typically leads to short-term price corrections.

This profit-taking behavior can also increase market volatility, potentially delaying or preventing Solana's upward momentum. Large sell-offs can impact the price, even as Solana has achieved significant gains over the past month.

As a result, SOL may be facing a potential reversal.

Solana's Realized Profit/Loss Ratio. Source: Glassnode

Solana's Realized Profit/Loss Ratio. Source: GlassnodeSolana's technical indicators also suggest that the price momentum may be near its peak. The Relative Strength Index (RSI) is currently above 70.0, placing Solana in the overbought zone.

This indicates that the altcoin's upward trend may be reaching its peak, similar to what occurred in mid-January 2025, when Solana's price dropped after reaching a similar level. The RSI, combined with investor behavior, suggests that Solana's price may be close to a short-term decline.

Solana RSI. Source: TradingView

Solana RSI. Source: TradingViewSOL Price Faces an Old Enemy

Solana's price has increased by 61% over the past month, trading at $170 at the time of writing. The altcoin is just below the $180 resistance level, not far from the long-anticipated $200 mark.

If the current momentum continues, Solana could break through this resistance and move towards $200, stimulating further interest and investment.

However, the factors discussed above may cause concern for Solana's price. The combination of increasing selling pressure and overbought technical indicators could lead to a reversal.

In this case, Solana's price could drop to $161 or lower, with $148 potentially becoming the next important support level. This would maintain the three-month barrier at $180, delaying the long-awaited breakthrough.

Solana price analysis. Source: TradingView

Solana price analysis. Source: TradingViewOn the other hand, if the SOL sell-off is absorbed by new investors, and the price can maintain its gains, Solana could break through the $180 resistance. This would pave the way to $200, nullifying the price decline prospects and continuing the upward trend. Such a move would require sustained market confidence and demand to overcome the current barriers.