For the first time since April, Bitcoin price in South Korea is lower than the global medium price, recording a discount of up to 0.76% during the price surge.

Bitcoin just went through a notable trading week when it exceeded the $100,000 threshold for the first time since February 2025, fluctuating between $103,133 and $104,841 in the past 24 hours. However, the most notable point is the reversal of the price difference in South Korea - also known as Kimchi Premium - when transitioning from a premium state to a discount.

Unusual Reversal Phenomenon in the South Korean Market

Data from cryptoquant.com shows the reversal phenomenon began on May 2nd, with Bitcoin prices on South Korean exchanges 0.43% lower than the global medium price. By May 10th, the discount had deepened to -0.76%. This marks a notable turning point, especially considering that just a few days earlier, on May 6th, the premium had reached 3%.

Cases where Bitcoin prices in South Korea are lower than the global medium price are rare in cryptocurrency market history. The most recent reversal occurred in April 2025, when the discount reached 1.19% - deeper than the current situation. Prior to that, a similar phenomenon was last seen in December 2024.

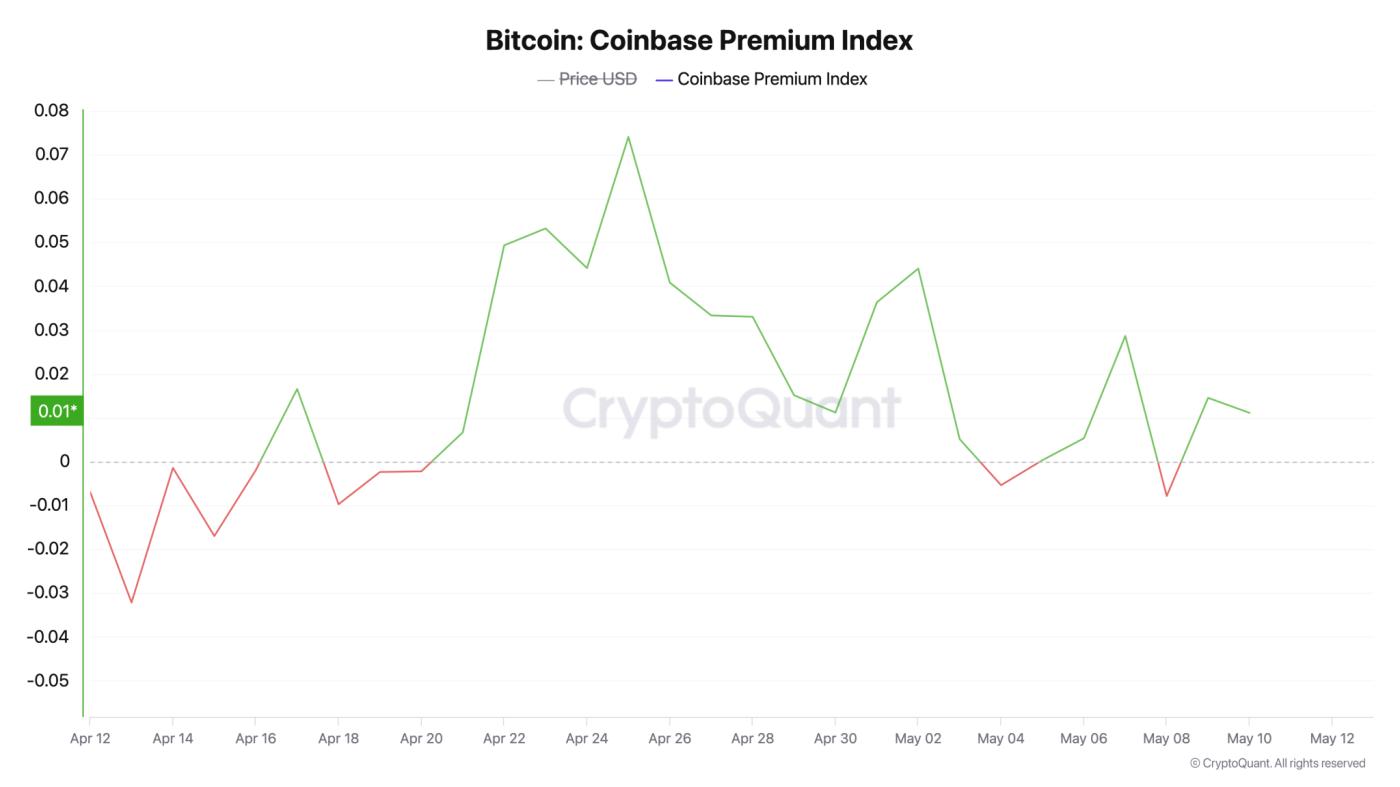

While Kimchi Premium is reversing, Coinbase's Premium Index has maintained a positive level since April 20th, with only two brief and light reversals on May 4th and 8th. This index measures the percentage price difference between Coinbase Pro and Binance, where a high premium typically reflects strong buying pressure from US investors.

The South Korean won falling into a discount state could be a signal of declining demand, excess supply, or increasing instability in the domestic South Korean market. Analysts are closely monitoring this phenomenon, especially as Bitcoin maintains its position above the $100,000 threshold.

At major South Korean exchanges like Bithumb and Upbit, Bitcoin prices are now almost equivalent to international exchanges, marking a significant change from the market's historical trend.