This article is machine translated

Show original

Hash Your Way To Success

Hashwei is considered an in-depth analysis tool that addresses issues related to latency, noise, fragmentation, and cost. From there, users can easily access data

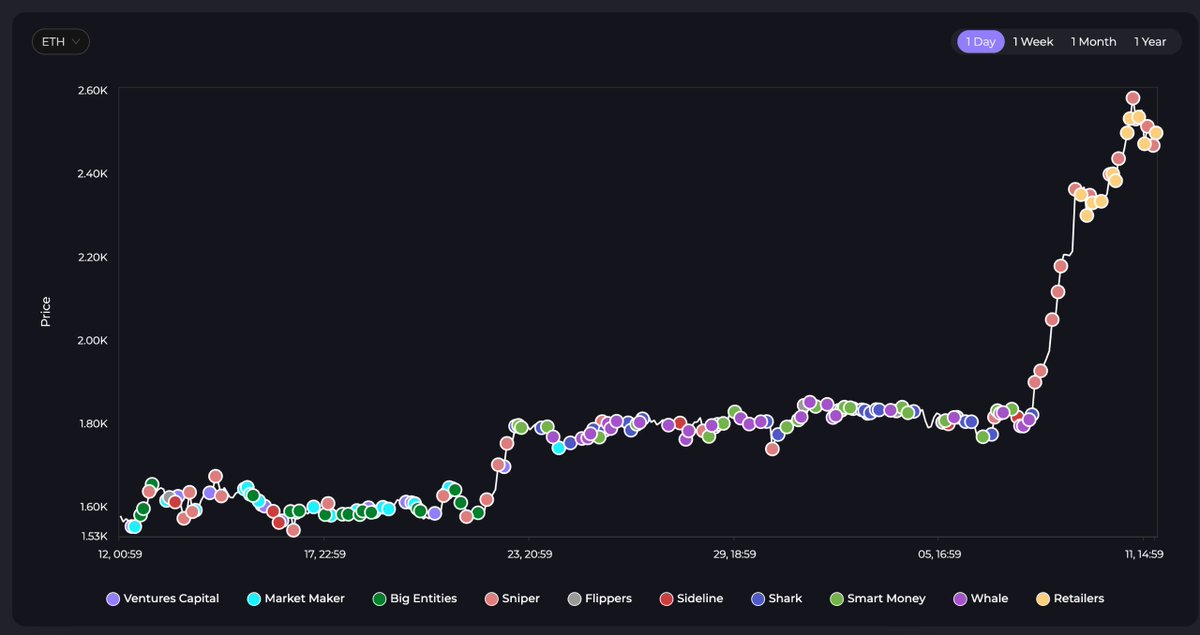

(a) Tracking Flow (USP)

(b) Smart Money

Goal

Beta Version: Dashboard/Leaderboard

- Tracking Flow (USP)

- Smart Money Active

- Alert

- Money Flow

- On-Chain Heatmap

- Onchain Leverage Analytics

- Stablecoin Flow Analytics

- Orderflow Heatmap (USP)

- Off-Chain Heatmap

- Leverage Liquidation

- Open Interest Futures

(a) Tracking Flow (USP)

Provides a comprehensive view of the on-chain cash flow of each Token, with detailed classification by bubble type: Retailers, Smart Money, Sidelines, Flippers, Snipers, Whales, Venture Capital and Market Makers. This analysis

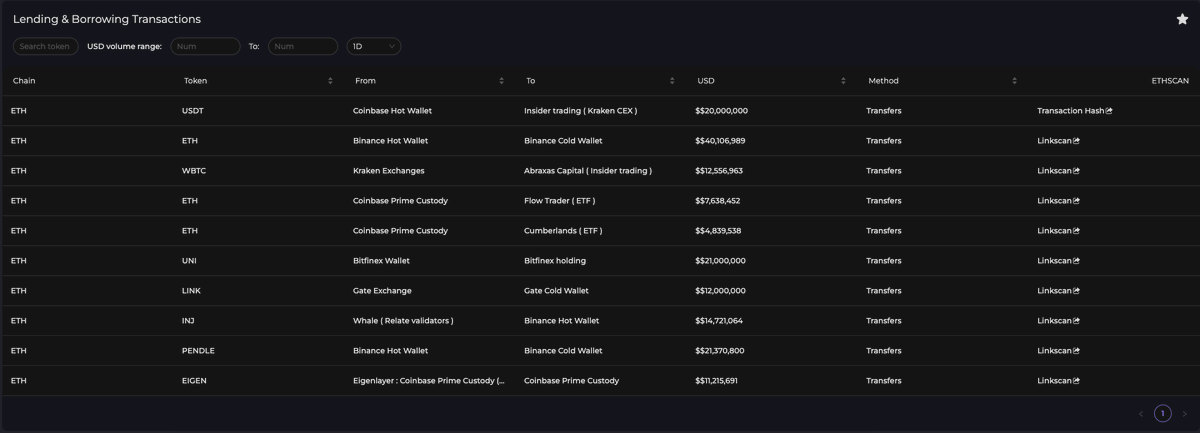

(b) Smart Money Active

- Smart Money Transactions

- Top Holder Transactions

- Smart Contract Transactions

- Exchange Transactions ( cold/hot )

- Market Marker Transactions

- Lending & Borrowing Transactions

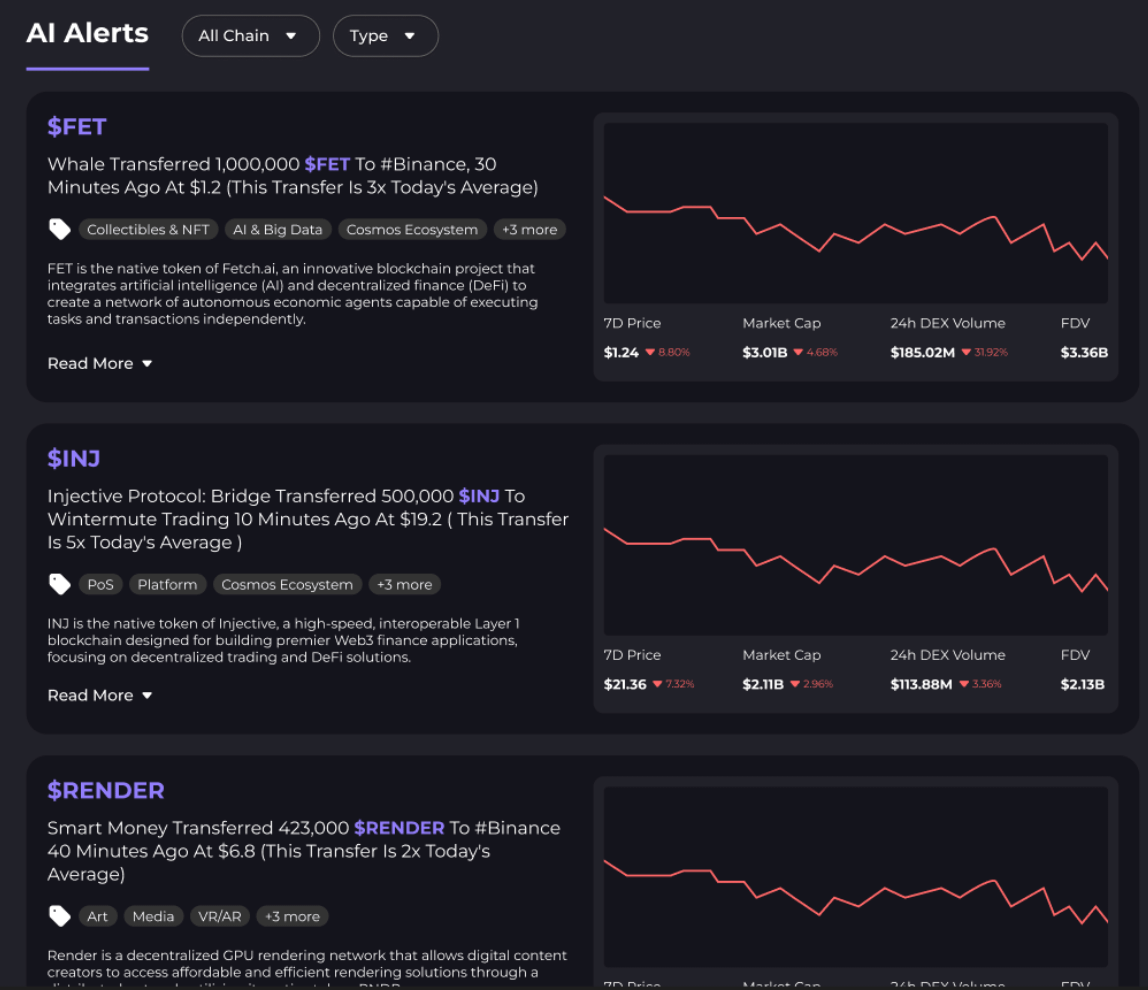

(c) Alert (testing)

Alert alerts unusual transactions based on volume or large fluctuations and provides basic information accompanying each alert

=> In the process of building logic to complete AI Agent integration to reduce

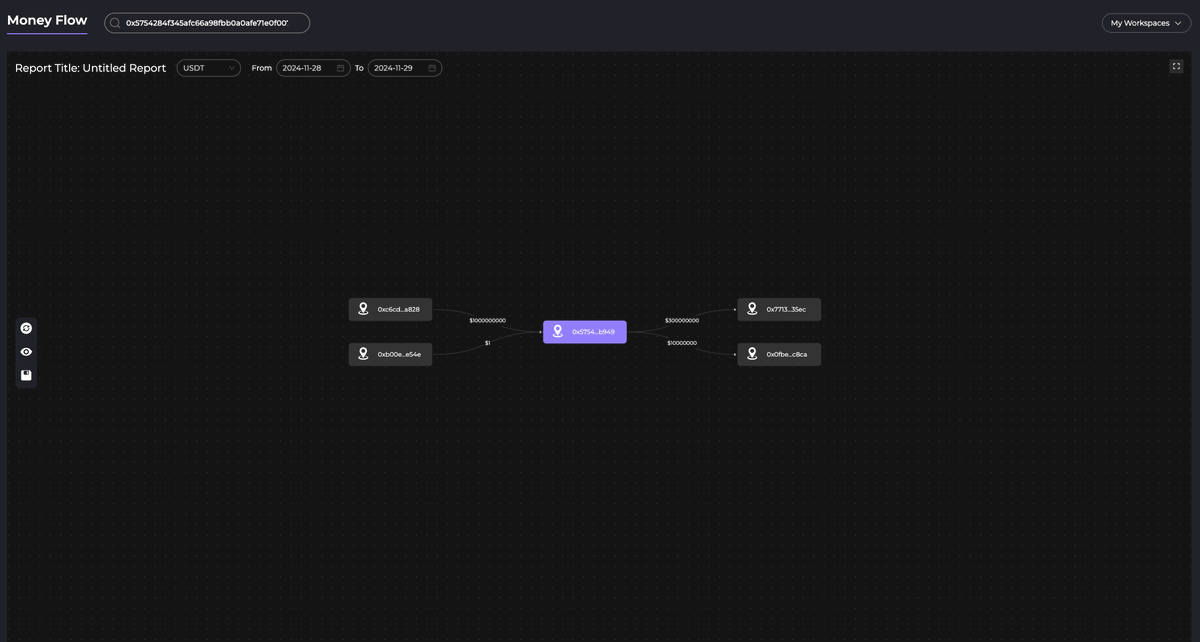

(d) Money Flow

Users can use the wallet address attached to Money Flow to access and trace the wallet address data through Layers wallet, txhash Incoming, outgoing, and balance value

Or Money Flow can also be considered as a tool to reduce the

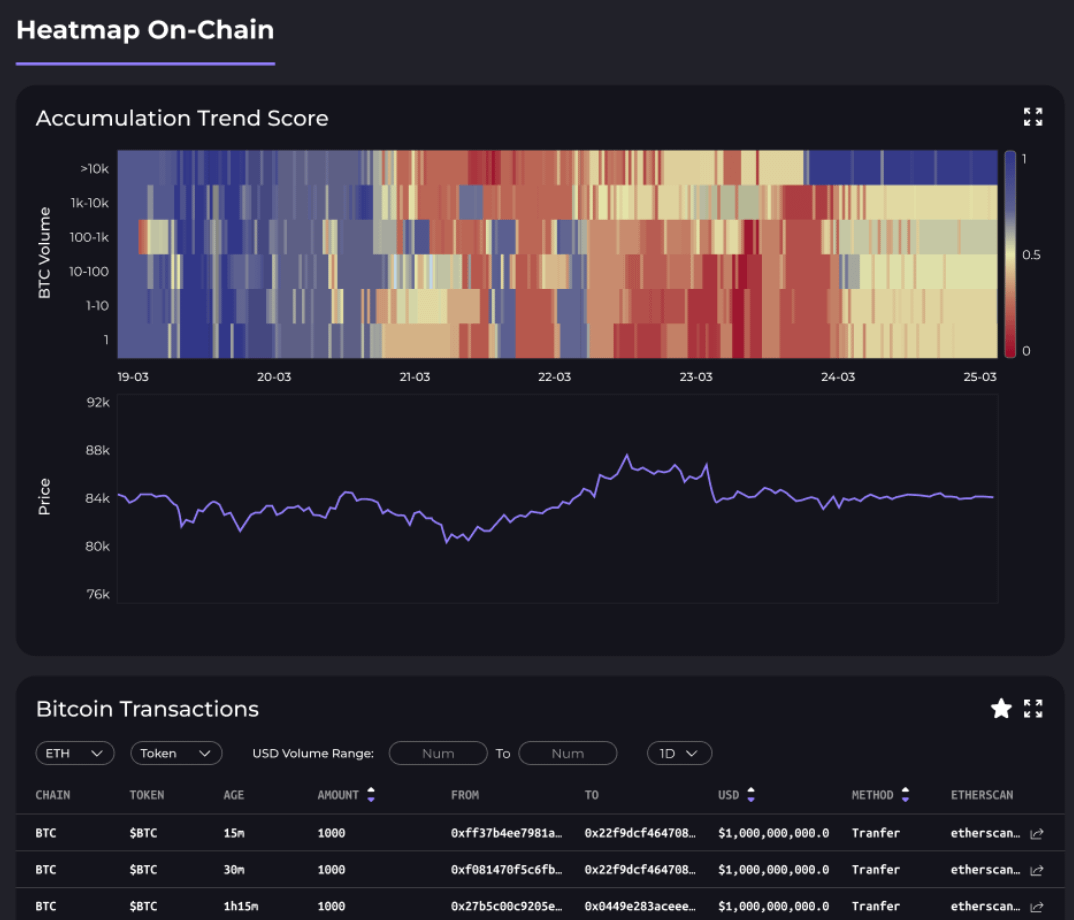

(e) On-Chain Heatmap

Users observe the accumulation or distribution rate through various forms of $BTC or $ETH and Balance value. Hashwei provides additional data along with $BTC transactions to increase data transparency

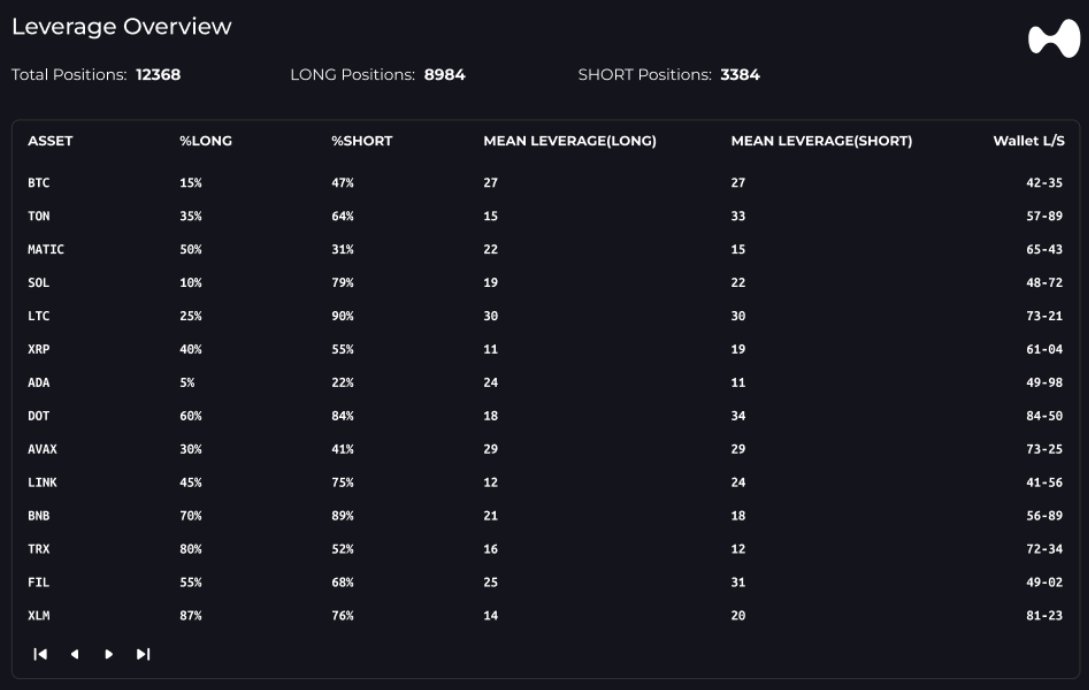

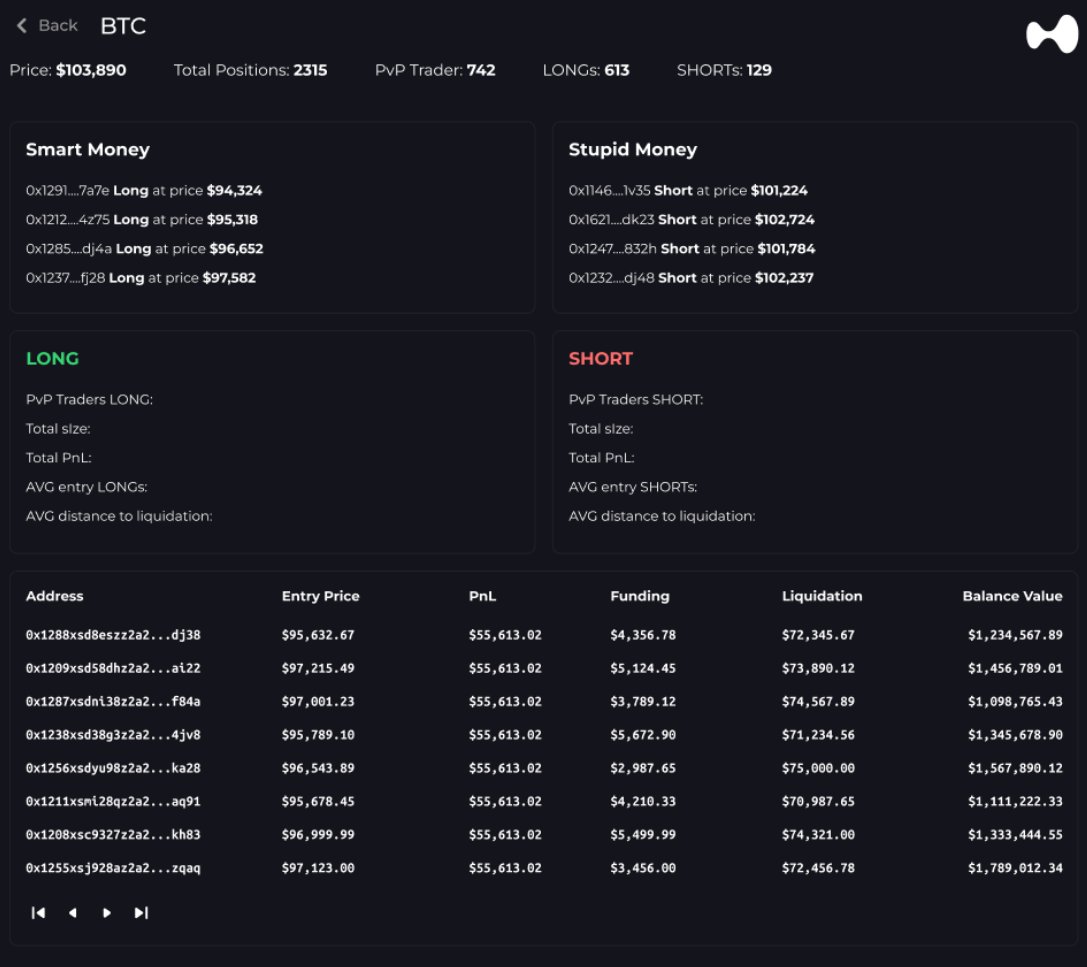

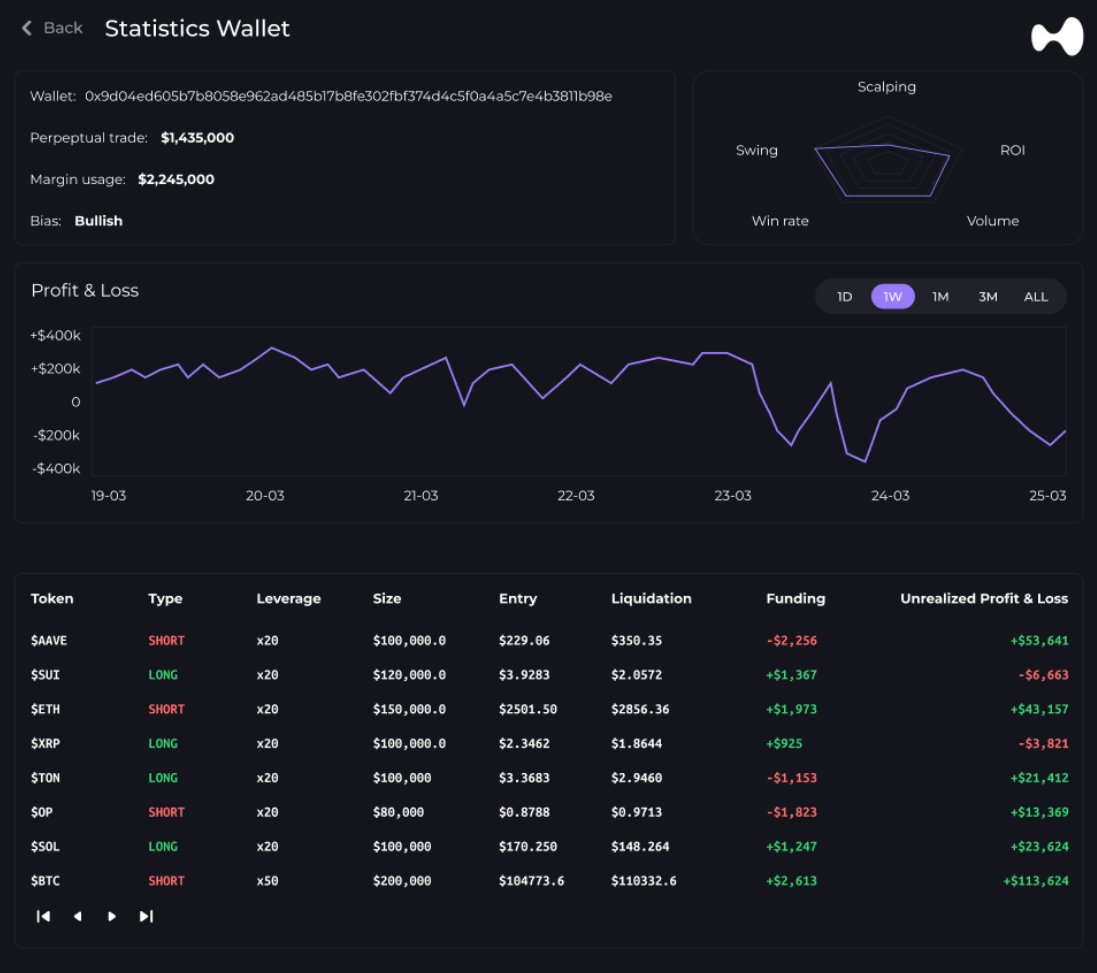

(f) Onchain Leverage Analytics

Data collected through Perp Dex data provides data

- Leverage Overview: Asset, % Longing, % Short, Mean Leverage(Longing), Mean Leverage(Short)

- Leaderboard: Smart Money, Stupid Money, deepdive Longing position, deepdive Short position,

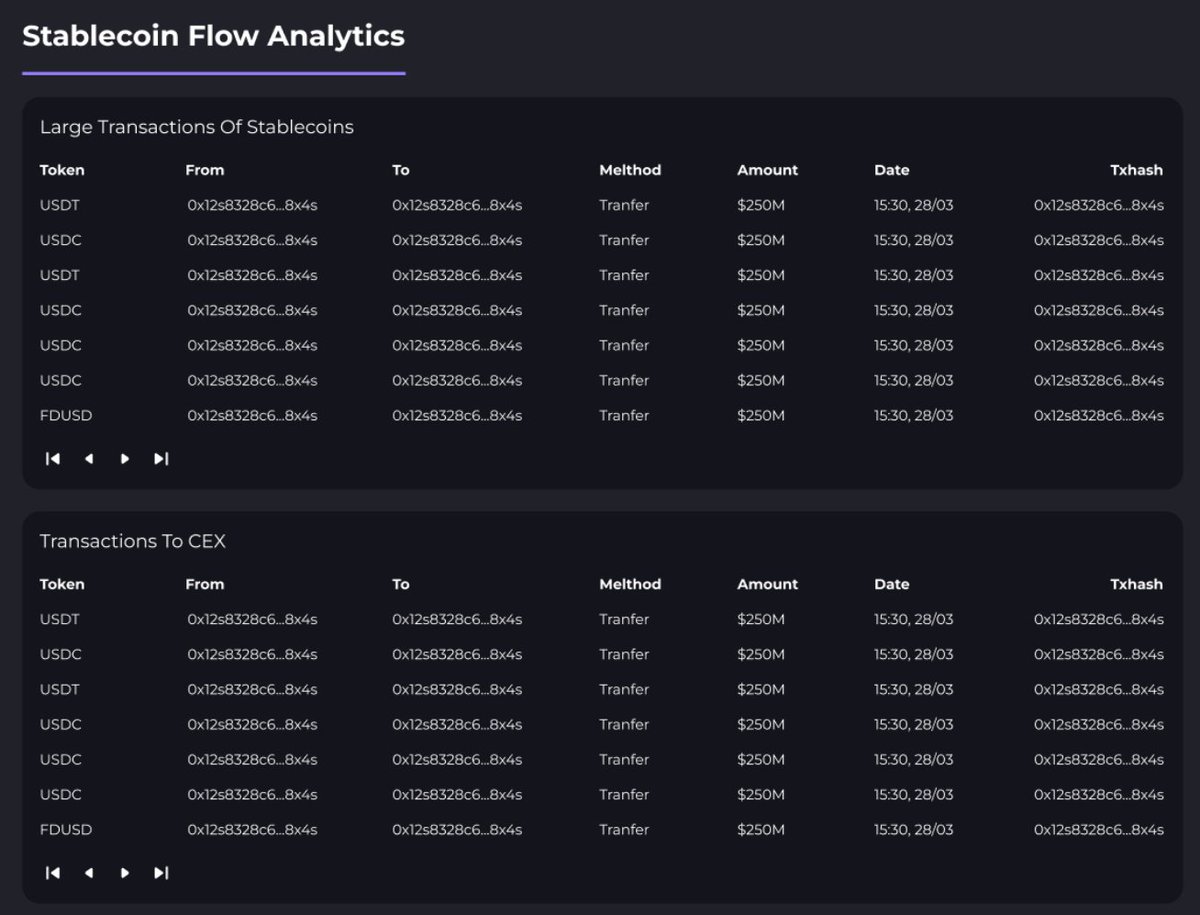

(g) Stablecoin Flow Analytics

Deploy 3 stablecoins $ USDT, $ USDC, and $FDUSD via Large Transactions, Transactions to Exchange, Minted/Burned based on timeframe

Additionally, provides a correlation chart between $BTC and 3 stablecoins via Marketcap and Dom

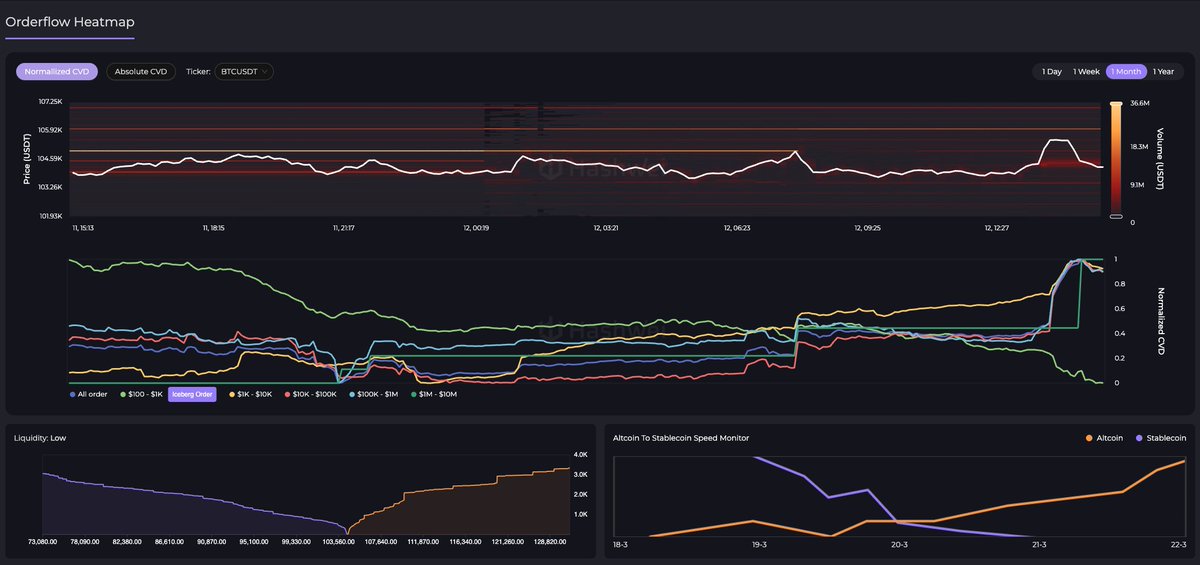

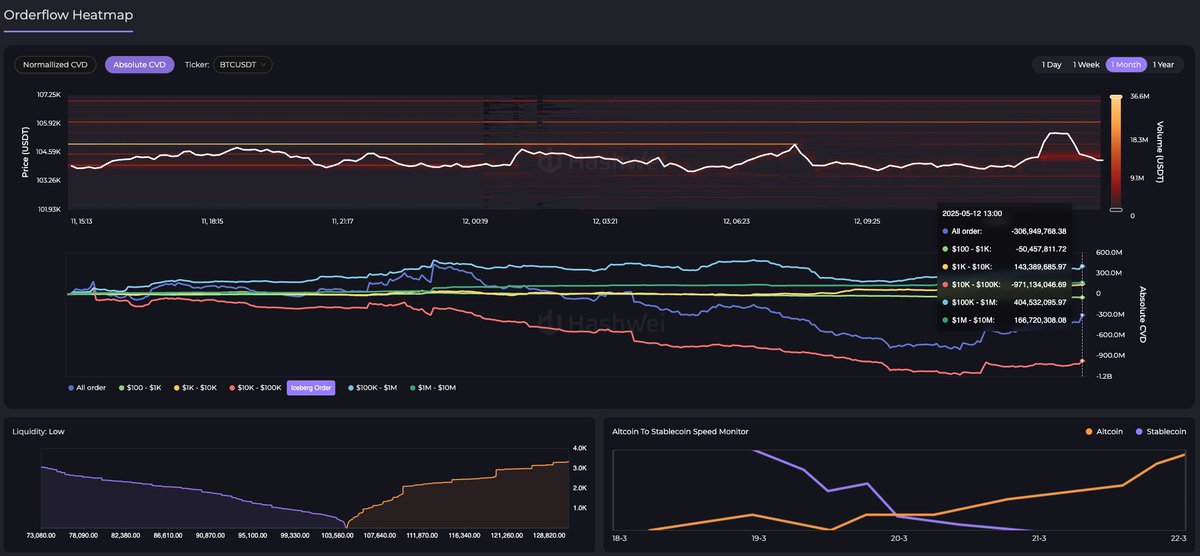

(h) Orderflow Heatmap (USP)

- Orderlfow collects data through the order range from $100 to $10M through basic color forms, helping users observe the accumulation or distribution dynamics through Normalized cvd for the purpose of calculating fluctuations. To optimize data

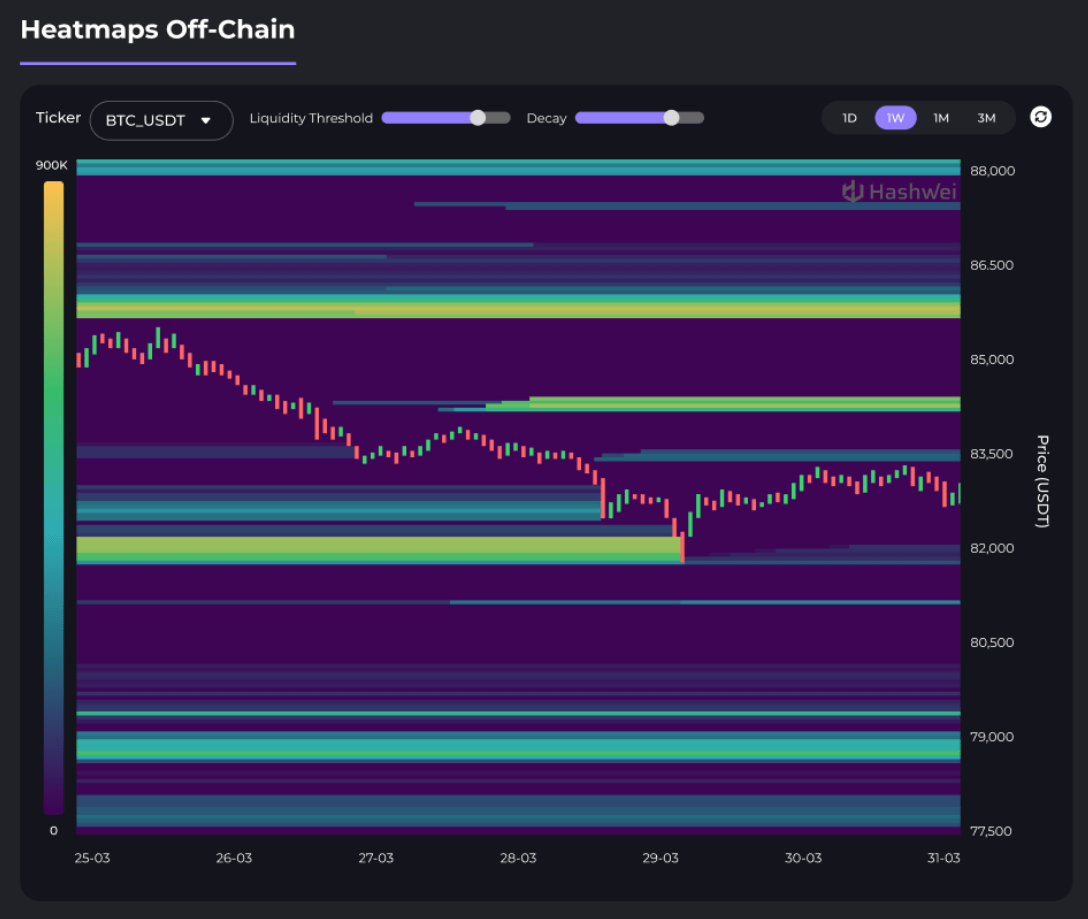

(i) Off-Chain Heatmap

Users can observe leverage patterns from lowest leverage to highest leverage, and combine decay rate and Volume to eliminate and reduce the noise of small liquidations.

(j) Leverage Liquidation

- Flow 1: Users can observe the entire liquidated in multiple timeframes, and especially observe real-time liquidation

- Flow 2: Leverage Liquidation has a panoramic view through Longing/ Short delta and liquidation zones through bubbles

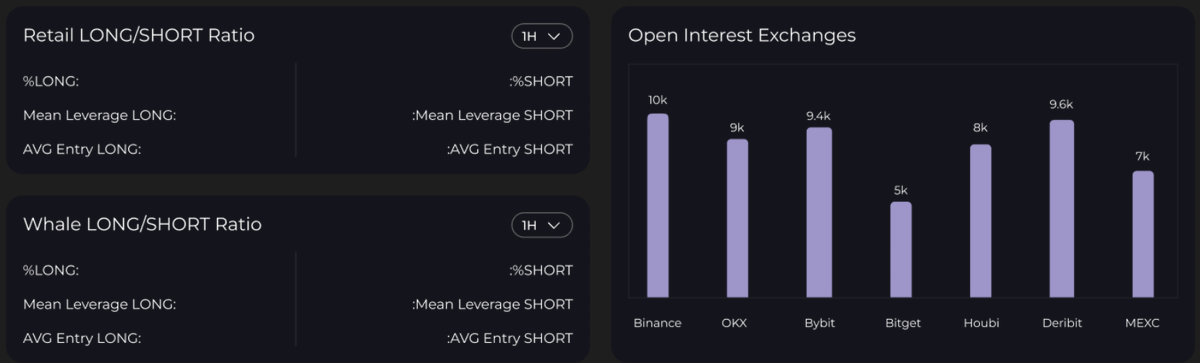

(k) Open Interest Futures

Aggregate open orders of Exchanges with high %OI and use charts to observe the fluctuations of Open Interest and market sentiment. Provide additional data Retail Longing/ Short ratio and Whale Longing/ Short ratio

Data researched by Hashwei Lab expected beta version Q3/Q4 2025

Direct for work (telegram): @mai1909_xyz

In addition, everyone can ask how to use or think to optimize when using in the upcoming beta version, everyone leaves feedback and will solve

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content