Author: Kevin, the Researcher at Movemaker

The Failure of Binance Alpha1.0 and the Strategic Shift of Alpha2.0

Due to the failure on the Binance wallet, Binance Alpha1.0, as a liquidity bridge connecting Binance's chain, was declared unsuccessful. Before the upgrade, trading volume and user numbers dropped to historical lows, with the total daily trading volume of all tokens on Alpha not exceeding $10 million and daily trading times below 10,000, which is undoubtedly far from the scale of the Binance exchange. It not only failed to attract on-chain users and corresponding liquidity for the exchange but also demonstrated a negative impact in market marketing.

Therefore, Binance Alpha was upgraded to Binance Alpha2.0 in late March. Unlike version 1.0, which could only be accessed through the Binance Web3 wallet, Alpha is now directly integrated into the Binance APP, allowing users to purchase Alpha tokens using funds from the exchange.

The inability to expand wallet user scale means that Binance's strategy of using Binance Alpha as a bridge to compete for on-chain liquidity has failed, unable to attract liquidity while enhancing BSC's attention. In other words, when Binance's growth on the chain cannot form a natural positive cycle, it can only take the opposite approach by injecting exchange traffic into Alpha, allowing Binance Alpha to attract market attention through quantitative changes and ultimately become a forward base for attracting on-chain liquidity and amplifying the presence of the BSC chain under sufficient wealth effect.

Waiting Period Without Consensus Confirmation: The Low Point of Alpha2.0 Before the "Gunshot"

This idea is reasonable, but it requires a premise: in a market without sufficient liquidity, providing a consensus for observing funds to enter, thereby triggering market attention for Binance Alpha2.0. Without such a trigger, even with the Alpha upgrade to 2.0, from late March to mid-April, whether in order book depth or wealth effect promotion, it could only briefly spark market discussion for less than a week before quickly returning to silence, falling into a low point again in early April.

This is not a failure of the Alpha2.0 upgrade or a strategic error, because to expand Alpha's scale, or total trading volume, besides introducing liquidity from DEX, the only option is to inject liquidity from Binance's own exchange. The reason 1.0 chose the former approach is that this is a ready-made strategy for second-tier exchanges, which the market can quickly accept; on the other hand, Binance's approach differs from second-tier exchanges due to its absolute confidence as a leading exchange. For second-tier exchanges, introducing on-chain liquidity is seen as a fundamental basis, allowing agile responses in user experience and marketing. For Binance, introducing on-chain liquidity is more of a precautionary measure, not an urgent necessity. Therefore, the poor wallet experience and the sharp downturn in Q1 market trends made it difficult for Binance to quickly adjust, leading to the mid-way collapse of Alpha1.0.

Thus, it can be said that reverse injection of liquidity from the exchange is Binance's last resort and strongest upgrade. However, looking at Alpha2.0 data from 3.20-4.20, it can still be described as bleak. Why? Because even though the liquidity injection pipeline has been successfully built, the simultaneous liquidity inflow still requires a signal, a gunshot. In the current desperate atmosphere where all crypto market narratives have been declared dead, only Bitcoin can play the role of this starting gun.

Bitcoin Signal Starts, Alpha2.0 Trading Ecosystem Ushers in Turning Point

Bitcoin's price is now closely linked to the US macroeconomic trend, and Bitcoin needs market confidence from the macro level to break out of a new trend. In the previous article, Bitcoin's week-long hovering around 85,000 was waiting for macroeconomic confidence confirmation. Therefore, when the market is deeply immersed in the fear of tariffs and recession, and stimulated by the 90-day tariff cooling period, strong US economic performance, and progress in US-China negotiations, a brief market relaxation cycle appears. Currently, there's no need to consider further tariff escalation risks or fund hedging due to recession. In the not-too-long future of several dozen days, the source of negative factors is tightly suppressed, which for Bitcoin is sufficient confidence confirmation. The market began to launch on 4.21, with large funds rushing in as seen in Ethereum's three-day strong breakthrough, entering the second stage of the trend.

Therefore, when Bitcoin sends a signal, thirsty liquidity will first flow into high-risk assets, and the pipeline built by Alpha2.0 will begin to show its effect.

Points Incentives and Token Bubble: Alpha2.0's Dual-Wheel Drive Strategy

Returning to Alpha2.0 itself, besides attracting on-chain liquidity as mentioned earlier, its main function is to become Binance's reservoir, weakening Binance's token listing effect by pre-diverting liquidity when new tokens are listed while ensuring this liquidity remains within Binance and does not overflow to other exchanges. Therefore, when Bitcoin sends a signal and market short-term consensus is strong, the direction for Alpha2.0 becomes simple: how to create bubbles in the reservoir through market makers' narrative in each cycle. Alpha2.0 chooses two ways to create bubbles:

Bottom-up points promotion

Alpha points are direct incentives to increase trading volume and liquidity, calculated by adding balance points and trading volume points within 15 days.

Balance points: Different points earned daily based on asset balances in exchange and wallet, e.g., $10,000 to <$100,000 = 3 points/day.

Trading volume points: Scored based on Alpha token purchase volume, e.g., 1 point per $2 purchased, with bonus points for doubled purchase amounts.

Alpha points relate to airdrop qualification, e.g., 142 Alpha points can earn 50 ZKJ token airdrop.

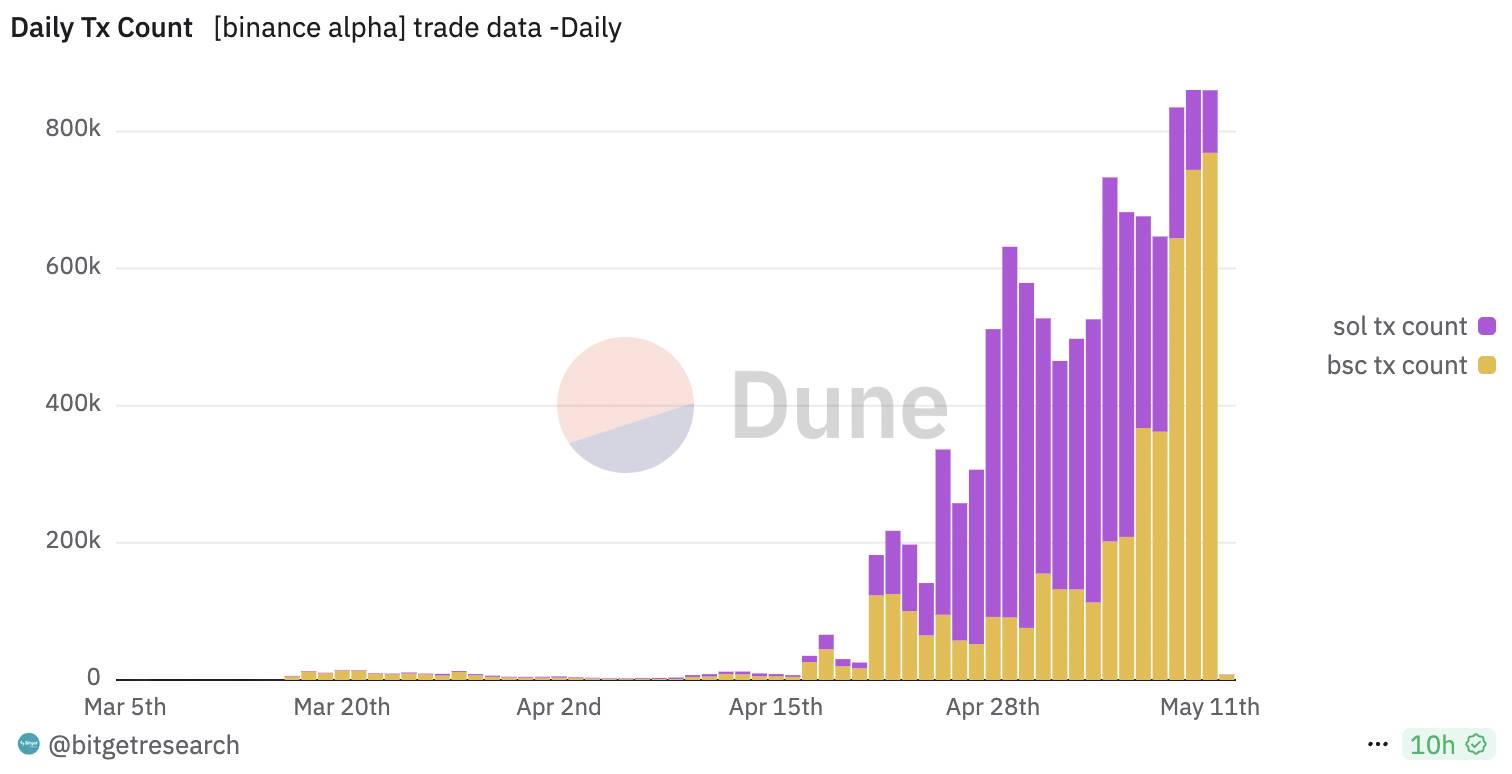

Point difficulty increases with balance and trading volume. Alpha2.0 aims to provide incentives to the broadest user range, encouraging asset balance maintenance and active Alpha token trading through carefully designed incentive mechanisms. The double trading volume points activity starting April 30 mobilized more long-tail user enthusiasm, offering 2x points for BSC token orders or direct purchases. Binance uses double points to enable more users' airdrop qualifications, creating market heat and activity, providing main forces with more comprehensive pulling power.

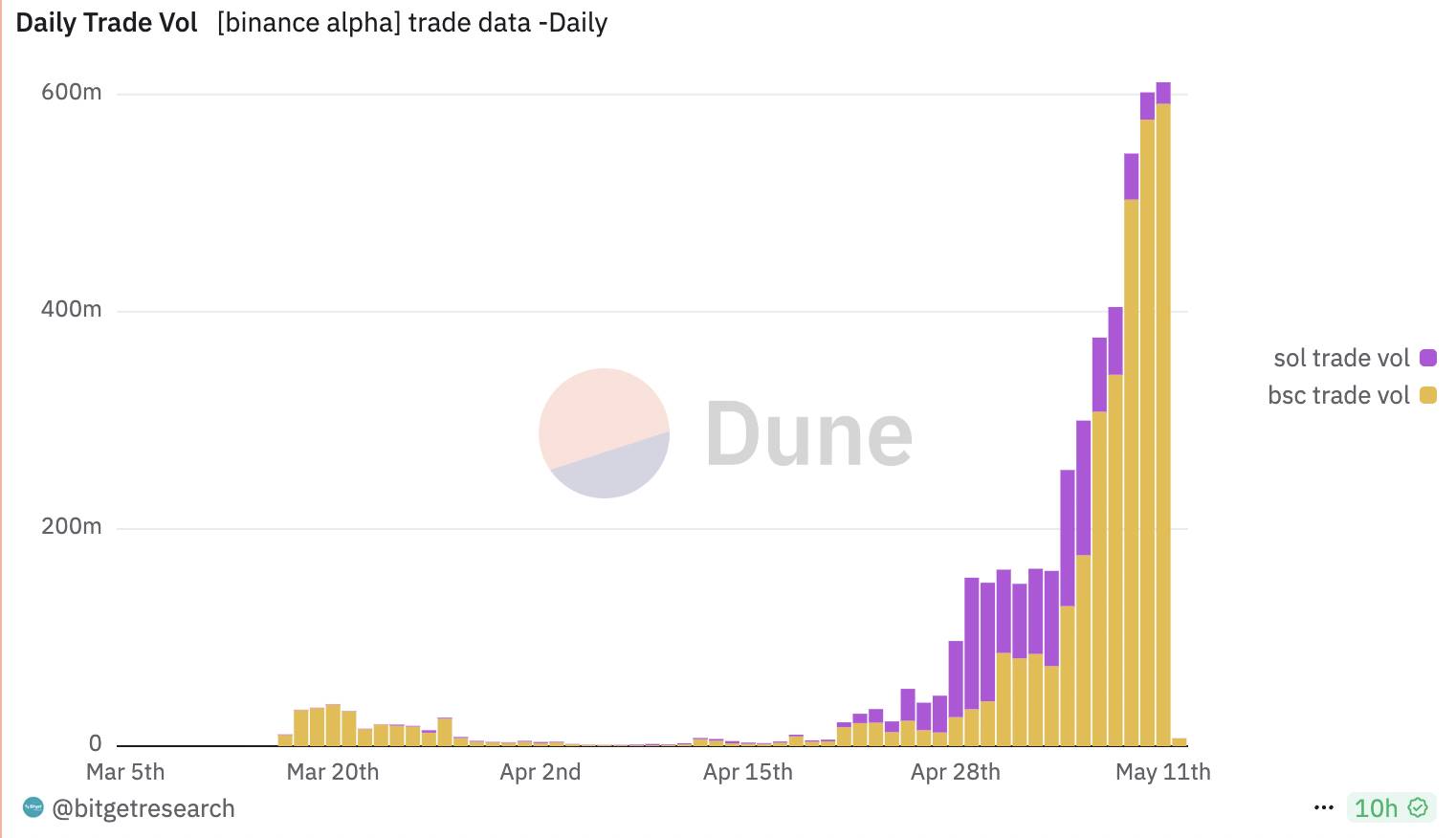

Since April 20, Alpha2.0's trading volume shows Binance can effectively increase platform asset holdings and trading volume, further enhancing overall market activity and depth. As more users actively participate, Alpha token market liquidity will significantly strengthen, and this virtuous cycle will be key to Binance's future market competition.

Liquidity convergence forming leader effect

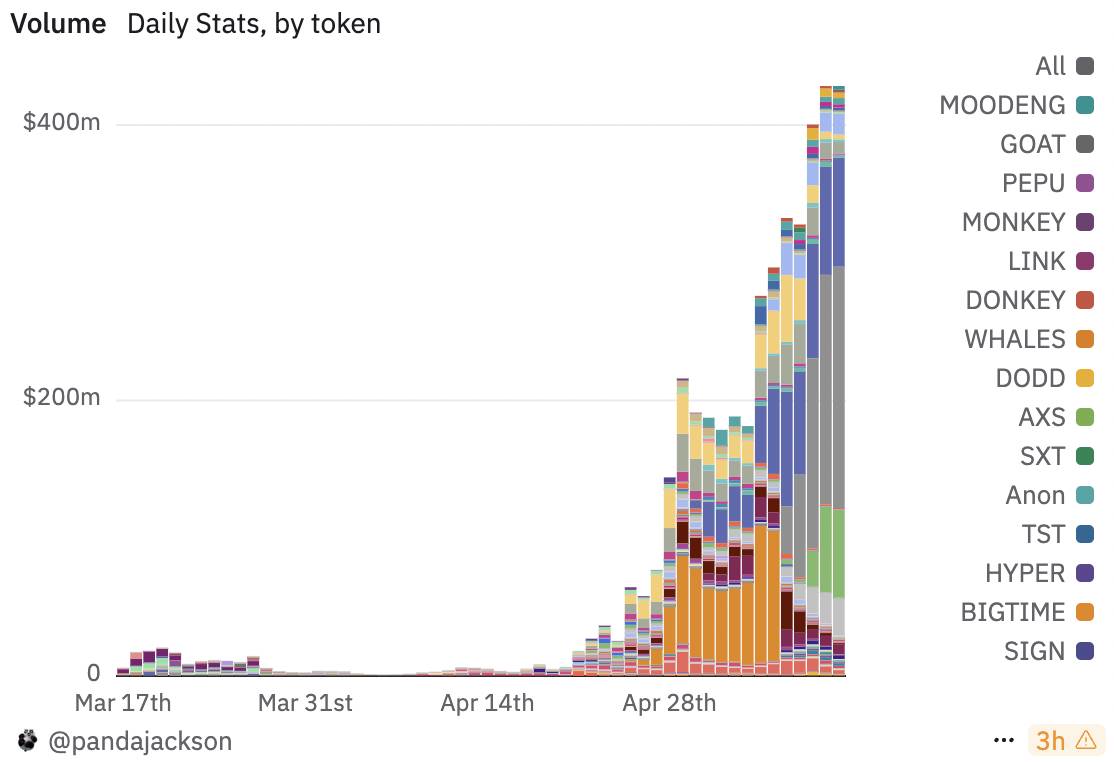

Observing the daily trading volume trend of Alpha tokens after Alpha2.0's shift, the rule changes themselves did not create sufficient stimulation or generate interest among internal funds. However, Bitcoin's signal represents a strong consensus. Observing the main tokens constituting Alpha token daily trading volume: $KMNO, $B2, $ZKJ.

$KMNO: Kamino Finance, a DeFi protocol on Solana, began a unilateral decline after entering Binance Alpha on February 13th. From April 28th, trading volume started to expand, growing 40 times compared to two weeks prior, with price fluctuating between 0.065-0.085. Until May 6th when it was listed on Binance spot market, trading volume returned to normal levels.

$B2: A Bitcoin ecosystem Layer 2 protocol, launched tokens and entered Binance Alpha on April 30th. Market cap peaked at only $30 million, currently at $27 million. Trading volume gradually increased after token launch, with a clear pattern of volume expanding during Asian daytime and weakening at night.

$ZKJ: ZK protocol Polyhedra Network, launched tokens and entered Binance Alpha on May 6th. Market cap of $130 million. Trading volume fluctuations similar to $B2, with volume expanding during Asian daytime and weakening at night.

In terms of transaction volume, Solana was particularly outstanding in the early stage (especially in mid-to-late April), with significantly higher transaction numbers compared to BSC, indicating that the main liquidity of Alpha2.0 was on Solana during this period. However, by early May, BSC's transaction volume quickly caught up and even surpassed Solana, showing that Alpha2.0's activity on BSC rapidly increased, possibly related to market-making strategy adjustments. While Solana maintained stable transaction volume, its growth rate slightly slowed down.

Opportunities and Concerns during the Sentiment Recovery Period: Next Challenges for Alpha2.0

In the current recession and post-tariff impact recovery period, the crypto market has fallen into a narrative stalemate: without a new main storyline, it is impossible to form market synergy, and the typical leading effect in the main narrative is difficult to manifest, naturally making it challenging to generate true wealth effects. Although USDT is abundantly supplied in the market, overall liquidity remains relatively tight in comparative terms. At this moment, no other narrative can take on the task of driving the broader market, with Ethereum being the only one capable of playing the dual roles of "narrative core" and "liquidity reservoir" in the fleeting market trend. While it is difficult to definitively say that network upgrade expectations or actual ETF staking brought buying pressure to Ethereum, from another perspective, the current market has deteriorated to the point where Ethereum needs to become the primary carrier of market sentiment and capital flow, a role typically assumed by leading projects in past bull markets.

When Ethereum or some meme coins or other hot assets experience short-term explosive price increases, strong project parties and top exchanges (such as Binance) must unhesitatingly follow this wave of enthusiasm, absolutely avoiding staying on the sidelines or missing opportunities due to hesitation. Because the current small-cycle bull market catalyzed by sentiment recovery still has uncertainty about further evolving into a larger-scale bull market. Once strong project parties fail to respond promptly in price K-lines or exchanges in trading volume, they can easily be judged by the market as "lacking energy" and consequently abandoned. Even if the current small bull market ultimately fails to upgrade, numerous potential positive factors (such as liquidity recovery) may still trigger market movements. In this context, strong project parties and exchanges should use every upward cycle to cultivate market confidence and consolidate wealth consensus: by continuously injecting liquidity and actively generating transactions before market pullbacks, they can establish a positive image of "robust funds and keen market sensitivity" in investors' minds. Conversely, choosing inaction at critical moments makes them easily perceived as lacking continuous driving force, making it difficult to gather sufficient market synergy when larger market trends arrive.

For Alpha2.0, the current sentiment recovery period brings both opportunities and concerns. From real on-chain traffic perspectives, activity on BSC is almost negligible—clearly not the ideal outcome expected by Binance and its ecosystem. The current Alpha2.0's bustling appearance relies more on concentrated operations by market makers and project parties rather than spontaneous participation from global retail investors. This "artificially constructed" apparent trading volume is highly likely to experience a cliff-like decline once external stimulation disappears. How many small or large bull market cycles will it take to gradually cultivate a truly spontaneous and positive liquidity ecosystem? This is the core variable we most need to focus on when observing Alpha2.0's subsequent development.

About Movemaker: Movemaker is the first official community organization authorized by the Aptos Foundation, jointly initiated by Ankaa and BlockBooster, focusing on promoting the construction and development of the Aptos Chinese ecosystem. As Aptos's official representative in the Chinese region, Movemaker is committed to creating a diverse, open, and prosperous Aptos ecosystem by connecting developers, users, capital, and numerous ecosystem partners.

Disclaimer: This article/blog is for reference only, representing the author's personal views and not Movemaker's stance. This article does not intend to provide: (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and Non-Fungible Tokens, carries extremely high risks with significant price volatility, potentially becoming worthless. You should carefully consider whether trading or holding digital assets is suitable based on your financial situation. For specific situation inquiries, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general reference. Reasonable care has been taken in compiling these data and charts, but no responsibility is accepted for any factual errors or omissions.